Heritage Insurance Holdings, Inc.

1401 N Westshore Blvd,

Tampa, Florida 33607

April 25, 2025

To Our Stockholders:

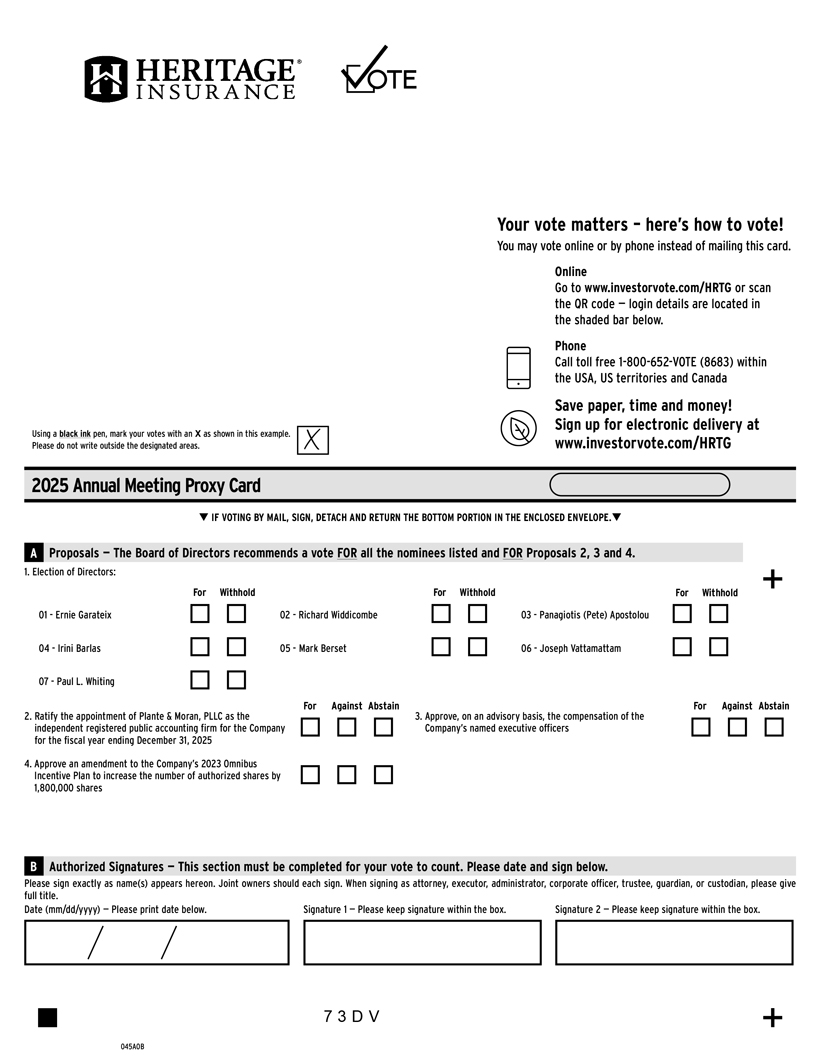

On behalf of the Board of Directors and management of Heritage Insurance Holdings, Inc., we cordially invite you to attend the annual meeting of stockholders to be held on Tuesday, June 10, 2025 at 10:00 a.m. (ET). Our annual meeting will be held as a “hybrid meeting” which means that we will host the meeting in person at The Westshore Grand, 4860 W Kennedy Blvd, Tampa, FL 33609 and also enable remote participation, including voting, via the Internet. Accordingly, you will be able to attend the annual meeting virtually and vote and submit questions by visiting meetnow.global/MJJHJNV.

The following pages contain the formal notice of the annual meeting, the proxy statement and the proxy card. Please review this material for information concerning the business to be conducted at the meeting including the nominees for election as directors. You may also find electronic copies of these documents online at http://www.edocumentview.com/HRTG.

The purpose of the meeting is to consider and vote upon proposals to (i) elect seven directors, (ii) ratify the appointment of our independent registered public accounting firm for 2025, (iii) approve, on an advisory basis, the compensation of our named executive officers, (iv) approve an amendment to the Company’s 2023 Omnibus Incentive Plan to increase the number of authorized shares by 1,800,000 shares, and (v) transact such other business as may properly come before the meeting.

Whether or not you plan to attend the meeting, your vote is important. We encourage you to vote in advance of the meeting by telephone, by Internet or by signing, dating and returning your proxy card by mail. You may also vote by attending the meeting in person or virtually at meetnow.global/MJJHJNV. Full instructions for attending the meeting are contained in the proxy statement and in the enclosed proxy card.

Sincerely yours,

Richard Widdicombe

Chairman

We mailed a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement and annual report on or about April 25, 2025.

This proxy statement and our 2025 Annual Report are available online at

http://www.edocumentview.com/HRTG