false2024FY00016908200.80.80.80.8P2YP4Y0.800.80P1YP2YP4Yhttp://fasb.org/us-gaap/2024#NotesPayableCurrent393748748458iso4217:USDxbrli:sharesiso4217:USDxbrli:sharescvna:classxbrli:purecvna:segmentcvna:siteutr:sqftutr:acrecvna:centercvna:renewal_optioncvna:aircraftcvna:agreement_typecvna:votecvna:milecvna:casecvna:tranchecvna:interestRateCap00016908202024-01-012024-12-310001690820us-gaap:CommonStockMember2024-01-012024-12-3100016908202024-06-300001690820us-gaap:CommonClassAMember2025-02-140001690820us-gaap:CommonClassBMember2025-02-1400016908202024-12-3100016908202023-12-310001690820us-gaap:RelatedPartyMember2024-12-310001690820us-gaap:RelatedPartyMember2023-12-310001690820us-gaap:CommonClassAMember2023-12-310001690820us-gaap:CommonClassAMember2024-12-310001690820us-gaap:CommonClassBMember2024-12-310001690820us-gaap:CommonClassBMember2023-12-310001690820cvna:UsedVehicleSalesMember2024-01-012024-12-310001690820cvna:UsedVehicleSalesMember2023-01-012023-12-310001690820cvna:UsedVehicleSalesMember2022-01-012022-12-310001690820us-gaap:RelatedPartyMembercvna:WholesaleSalesAndRevenuesMember2024-01-012024-12-310001690820us-gaap:RelatedPartyMembercvna:WholesaleSalesAndRevenuesMember2023-01-012023-12-310001690820us-gaap:RelatedPartyMembercvna:WholesaleSalesAndRevenuesMember2022-01-012022-12-310001690820cvna:WholesaleSalesAndRevenuesMember2024-01-012024-12-310001690820cvna:WholesaleSalesAndRevenuesMember2023-01-012023-12-310001690820cvna:WholesaleSalesAndRevenuesMember2022-01-012022-12-310001690820us-gaap:RelatedPartyMemberus-gaap:ProductAndServiceOtherMember2024-01-012024-12-310001690820us-gaap:RelatedPartyMemberus-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001690820us-gaap:RelatedPartyMemberus-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001690820us-gaap:ProductAndServiceOtherMember2024-01-012024-12-310001690820us-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001690820us-gaap:ProductAndServiceOtherMember2022-01-012022-12-3100016908202023-01-012023-12-3100016908202022-01-012022-12-310001690820us-gaap:RelatedPartyMember2024-01-012024-12-310001690820us-gaap:RelatedPartyMember2023-01-012023-12-310001690820us-gaap:RelatedPartyMember2022-01-012022-12-310001690820us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-12-310001690820us-gaap:CommonStockMemberus-gaap:CommonClassBMember2021-12-310001690820us-gaap:AdditionalPaidInCapitalMember2021-12-310001690820us-gaap:RetainedEarningsMember2021-12-310001690820us-gaap:NoncontrollingInterestMember2021-12-3100016908202021-12-310001690820us-gaap:RetainedEarningsMember2022-01-012022-12-310001690820us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001690820us-gaap:CommonStockMemberus-gaap:CommonClassAMembercvna:FollowOnPublicOfferingMember2022-01-012022-12-310001690820us-gaap:AdditionalPaidInCapitalMembercvna:FollowOnPublicOfferingMember2022-01-012022-12-310001690820cvna:FollowOnPublicOfferingMember2022-01-012022-12-310001690820us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001690820us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-01-012022-12-310001690820us-gaap:AdditionalPaidInCapitalMembercvna:CarvanaGroupMember2022-01-012022-12-310001690820cvna:CarvanaGroupMember2022-01-012022-12-310001690820us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001690820us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310001690820us-gaap:AdditionalPaidInCapitalMember2022-12-310001690820us-gaap:RetainedEarningsMember2022-12-310001690820us-gaap:NoncontrollingInterestMember2022-12-3100016908202022-12-310001690820us-gaap:RetainedEarningsMember2023-01-012023-12-310001690820us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001690820us-gaap:CommonStockMemberus-gaap:CommonClassAMembercvna:FollowOnPublicOfferingMember2023-01-012023-12-310001690820us-gaap:AdditionalPaidInCapitalMembercvna:FollowOnPublicOfferingMember2023-01-012023-12-310001690820cvna:FollowOnPublicOfferingMember2023-01-012023-12-310001690820us-gaap:CommonStockMembercvna:ClassBCommonStockLLCUnitsMember2023-01-012023-12-310001690820us-gaap:NoncontrollingInterestMembercvna:ClassBCommonStockLLCUnitsMember2023-01-012023-12-310001690820cvna:ClassBCommonStockLLCUnitsMember2023-01-012023-12-310001690820us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001690820us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-12-310001690820us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-01-012023-12-310001690820us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001690820us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-12-310001690820us-gaap:AdditionalPaidInCapitalMember2023-12-310001690820us-gaap:RetainedEarningsMember2023-12-310001690820us-gaap:NoncontrollingInterestMember2023-12-310001690820us-gaap:RetainedEarningsMember2024-01-012024-12-310001690820us-gaap:NoncontrollingInterestMember2024-01-012024-12-310001690820us-gaap:CommonStockMemberus-gaap:CommonClassAMembercvna:FollowOnPublicOfferingMember2024-01-012024-12-310001690820us-gaap:AdditionalPaidInCapitalMembercvna:FollowOnPublicOfferingMember2024-01-012024-12-310001690820cvna:FollowOnPublicOfferingMember2024-01-012024-12-310001690820us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001690820us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-12-310001690820us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-01-012024-12-310001690820us-gaap:AdditionalPaidInCapitalMembercvna:CarvanaGroupMember2024-01-012024-12-310001690820cvna:CarvanaGroupMember2024-01-012024-12-310001690820us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-12-310001690820us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-12-310001690820us-gaap:AdditionalPaidInCapitalMember2024-12-310001690820us-gaap:RetainedEarningsMember2024-12-310001690820us-gaap:NoncontrollingInterestMember2024-12-310001690820cvna:CarvanaGroupMember2024-12-310001690820cvna:A2028SeniorSecuredNotesMemberus-gaap:SeniorNotesMember2024-01-012024-12-310001690820cvna:AtTheMarketOfferingATMOfferingMember2024-01-012024-12-310001690820cvna:PurchaseAndSaleAgreementMemberus-gaap:SubsequentEventMemberus-gaap:ConsumerLoanMember2025-01-030001690820srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2024-12-310001690820srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2024-12-310001690820srt:MinimumMemberus-gaap:TransportationEquipmentMember2024-12-310001690820us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-12-310001690820srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2024-12-310001690820srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2024-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:MasterDealerAgreementMember2023-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:MasterDealerAgreementMember2024-12-310001690820us-gaap:ShippingAndHandlingMember2024-01-012024-12-310001690820us-gaap:ShippingAndHandlingMember2023-01-012023-12-310001690820us-gaap:ShippingAndHandlingMember2022-01-012022-12-3100016908202022-01-012022-01-010001690820cvna:ReportableSegmentMember2024-01-012024-12-310001690820cvna:ReportableSegmentMember2023-01-012023-12-310001690820cvna:ReportableSegmentMember2022-01-012022-12-310001690820cvna:ADESAUSPhysicalAuctionAcquisitionMember2022-05-090001690820cvna:ADESAUSPhysicalAuctionAcquisitionMember2022-05-092022-05-0900016908202022-05-090001690820cvna:ADESAUSPhysicalAuctionAcquisitionMemberus-gaap:CustomerRelationshipsMember2022-12-310001690820cvna:ADESAUSPhysicalAuctionAcquisitionMemberus-gaap:CustomerRelationshipsMember2022-01-012022-12-310001690820cvna:ADESAUSPhysicalAuctionAcquisitionMemberus-gaap:DevelopedTechnologyRightsMember2022-12-310001690820cvna:ADESAUSPhysicalAuctionAcquisitionMemberus-gaap:DevelopedTechnologyRightsMember2022-01-012022-12-310001690820cvna:ADESAUSPhysicalAuctionAcquisitionMember2024-01-012024-12-310001690820cvna:ADESAUSPhysicalAuctionAcquisitionMembercvna:WholesaleSalesAndRevenuesMember2023-01-012023-12-310001690820cvna:ADESAUSPhysicalAuctionAcquisitionMembercvna:WholesaleSalesAndRevenuesMember2022-01-012022-12-310001690820cvna:ADESAUSPhysicalAuctionAcquisitionMember2023-01-012023-12-310001690820cvna:ADESAUSPhysicalAuctionAcquisitionMember2022-01-012022-12-310001690820us-gaap:LandAndLandImprovementsMember2024-12-310001690820us-gaap:LandAndLandImprovementsMember2023-12-310001690820us-gaap:BuildingAndBuildingImprovementsMember2024-12-310001690820us-gaap:BuildingAndBuildingImprovementsMember2023-12-310001690820us-gaap:TransportationEquipmentMember2024-12-310001690820us-gaap:TransportationEquipmentMember2023-12-310001690820us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-310001690820us-gaap:FurnitureAndFixturesMember2024-12-310001690820us-gaap:FurnitureAndFixturesMember2023-12-310001690820cvna:ExcludingConstructionInProgressMember2024-12-310001690820cvna:ExcludingConstructionInProgressMember2023-12-310001690820us-gaap:ConstructionInProgressMember2024-12-310001690820us-gaap:ConstructionInProgressMember2023-12-310001690820us-gaap:CostOfSalesMemberus-gaap:PropertyPlantAndEquipmentMember2024-01-012024-12-310001690820us-gaap:CostOfSalesMemberus-gaap:PropertyPlantAndEquipmentMember2023-01-012023-12-310001690820us-gaap:CostOfSalesMemberus-gaap:PropertyPlantAndEquipmentMember2022-01-012022-12-310001690820us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:PropertyPlantAndEquipmentMember2024-01-012024-12-310001690820us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:PropertyPlantAndEquipmentMember2023-01-012023-12-310001690820us-gaap:SellingGeneralAndAdministrativeExpensesMemberus-gaap:PropertyPlantAndEquipmentMember2022-01-012022-12-310001690820us-gaap:CustomerRelationshipsMember2024-12-310001690820us-gaap:CustomerRelationshipsMember2023-12-310001690820us-gaap:DevelopedTechnologyRightsMember2024-12-310001690820us-gaap:DevelopedTechnologyRightsMember2023-12-3100016908202014-11-300001690820us-gaap:RelatedPartyMembercvna:BlueMoundTexasDelancoNewJerseyMembercvna:DriveTimeAutomotiveGroupInc.Memberus-gaap:BuildingMembercvna:LeaseAgreementForFullyOperationalInspectionAndReconditioningCenterMember2014-11-012014-11-300001690820us-gaap:RelatedPartyMembercvna:BlueMoundTexasDelancoNewJerseyMembercvna:DriveTimeAutomotiveGroupInc.Memberus-gaap:BuildingMembercvna:LeaseAgreementForFullyOperationalInspectionAndReconditioningCenterMember2014-11-300001690820us-gaap:RelatedPartyMembercvna:WinderGeorgiaMembercvna:DriveTimeAutomotiveGroupInc.Memberus-gaap:BuildingMembercvna:LeaseAgreementForFullyOperationalInspectionAndReconditioningCenterMember2017-02-012017-02-280001690820us-gaap:RelatedPartyMembercvna:WinderGeorgiaMembercvna:DriveTimeAutomotiveGroupInc.Memberus-gaap:BuildingMembercvna:LeaseAgreementForFullyOperationalInspectionAndReconditioningCenterMember2017-02-280001690820us-gaap:RelatedPartyMembercvna:VerdeInvestmentsInc.andDriveTimeAutomotiveGroupInc.Membercvna:LeaseAgreementForFullyOperationalInspectionAndReconditioningCenterMember2024-01-012024-12-310001690820us-gaap:RelatedPartyMembercvna:VerdeInvestmentsInc.andDriveTimeAutomotiveGroupInc.Membercvna:LeaseAgreementForFullyOperationalInspectionAndReconditioningCenterMember2023-01-012023-12-310001690820us-gaap:RelatedPartyMembercvna:VerdeInvestmentsInc.andDriveTimeAutomotiveGroupInc.Membercvna:LeaseAgreementForFullyOperationalInspectionAndReconditioningCenterMember2022-01-012022-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:CorporateHeadquartersOfficeLeaseAndSubleasedOfficeSpaceFirstFloorMember2016-09-300001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:CorporateHeadquartersOfficeLeaseAndSubleasedOfficeSpaceFirstFloorMember2016-09-012016-09-300001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:SubleasedOfficeSpaceFirstFloorMember2024-01-012024-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:SubleasedOfficeSpaceFirstFloorMember2023-01-012023-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:SubleasedOfficeSpaceFirstFloorMember2022-01-012022-12-310001690820cvna:TempeArizonaMemberus-gaap:RelatedPartyMembercvna:VerdeInvestmentsInc.Membercvna:OfficeBuildingLeaseMember2019-12-310001690820cvna:TempeArizonaMemberus-gaap:RelatedPartyMembercvna:VerdeInvestmentsInc.Membercvna:OfficeBuildingLeaseMember2019-12-012019-12-310001690820cvna:TempeArizonaMemberus-gaap:RelatedPartyMembercvna:VerdeInvestmentsInc.Membercvna:OfficeBuildingLeaseMember2024-01-012024-12-310001690820cvna:TempeArizonaMemberus-gaap:RelatedPartyMembercvna:VerdeInvestmentsInc.Membercvna:OfficeBuildingLeaseMember2023-01-012023-12-310001690820cvna:TempeArizonaMemberus-gaap:RelatedPartyMembercvna:VerdeInvestmentsInc.Membercvna:OfficeBuildingLeaseMember2022-01-012022-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:WholesaleSalesAndRevenuesMember2024-01-012024-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:WholesaleSalesAndRevenuesMember2023-01-012023-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:WholesaleSalesAndRevenuesMember2022-01-012022-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:WholesaleMarketplaceRevenuesMember2024-01-012024-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:WholesaleMarketplaceRevenuesMember2023-01-012023-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:WholesaleMarketplaceRevenuesMember2022-01-012022-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:UsedVehiclesMember2024-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:UsedVehiclesMember2023-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:UsedVehicleSalesMember2024-01-012024-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:UsedVehicleSalesMember2023-01-012023-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:UsedVehicleSalesMember2022-01-012022-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:MasterDealerAgreementMember2024-01-012024-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:MasterDealerAgreementMember2023-01-012023-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:MasterDealerAgreementMember2022-01-012022-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Memberus-gaap:ProductAndServiceOtherMember2024-01-012024-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Memberus-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Memberus-gaap:ProductAndServiceOtherMember2022-01-012022-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:ServicingandAdministrativeFeesMember2024-01-012024-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:ServicingandAdministrativeFeesMember2023-01-012023-12-310001690820us-gaap:RelatedPartyMembercvna:DriveTimeAutomotiveGroupInc.Membercvna:ServicingandAdministrativeFeesMember2022-01-012022-12-310001690820cvna:VerdeInvestmentsInc.Memberus-gaap:RelatedPartyMemberus-gaap:AirTransportationEquipmentMembercvna:AircraftTimeSharingAgreementMember2015-10-220001690820cvna:VerdeInvestmentsInc.Memberus-gaap:RelatedPartyMemberus-gaap:AirTransportationEquipmentMembercvna:AircraftTimeSharingAgreementAmended2017Member2018-12-310001690820cvna:VerdeInvestmentsInc.Memberus-gaap:RelatedPartyMemberus-gaap:AirTransportationEquipmentMembercvna:AircraftTimeSharingAgreementMember2015-10-222015-10-220001690820cvna:VerdeInvestmentsInc.Memberus-gaap:RelatedPartyMemberus-gaap:AirTransportationEquipmentMembercvna:AircraftTimeSharingAgreementMember2023-01-012023-12-310001690820cvna:VerdeInvestmentsInc.Memberus-gaap:RelatedPartyMemberus-gaap:AirTransportationEquipmentMembercvna:AircraftTimeSharingAgreementMember2022-01-012022-12-310001690820cvna:VerdeInvestmentsInc.Memberus-gaap:RelatedPartyMemberus-gaap:AirTransportationEquipmentMembercvna:AircraftTimeSharingAgreementMember2024-01-012024-12-310001690820srt:ChiefExecutiveOfficerMemberus-gaap:RelatedPartyMemberus-gaap:CommonClassAMembercvna:ContributionAgreementMember2022-01-052022-01-050001690820srt:ChiefExecutiveOfficerMemberus-gaap:RelatedPartyMembercvna:ContributionAgreementMember2022-01-052022-01-050001690820us-gaap:RestrictedStockUnitsRSUMembersrt:ChiefExecutiveOfficerMemberus-gaap:RelatedPartyMembercvna:ContributionAgreementMember2022-01-012022-03-310001690820us-gaap:RestrictedStockUnitsRSUMembersrt:ChiefExecutiveOfficerMemberus-gaap:RelatedPartyMembercvna:ContributionAgreementMember2022-01-052022-01-050001690820us-gaap:RestrictedStockUnitsRSUMemberus-gaap:RelatedPartyMembercvna:ContributionAgreementMember2022-02-222022-02-220001690820us-gaap:RestrictedStockUnitsRSUMembersrt:ChiefExecutiveOfficerMemberus-gaap:RelatedPartyMembercvna:ContributionAgreementMember2024-01-012024-12-310001690820us-gaap:RestrictedStockUnitsRSUMembersrt:ChiefExecutiveOfficerMemberus-gaap:RelatedPartyMembercvna:ContributionAgreementMember2023-01-012023-12-310001690820us-gaap:RelatedPartyMembercvna:ConditionalSaleOfEquityToRelatedPartyMember2023-07-172023-07-170001690820us-gaap:RelatedPartyMembercvna:ClassALLCUnitsMember2023-08-182023-08-180001690820us-gaap:RelatedPartyMemberus-gaap:CommonClassBMember2023-08-182023-08-180001690820us-gaap:RelatedPartyMemberus-gaap:CommonClassAMember2023-08-180001690820us-gaap:RelatedPartyMembercvna:ClassALLCUnitsMember2023-08-180001690820cvna:PurchaseAndSaleAgreementMemberus-gaap:ConsumerLoanMember2024-01-110001690820cvna:PurchaseAndSaleAgreementMemberus-gaap:ConsumerLoanMember2024-12-310001690820cvna:PurchaseAndSaleAgreementMemberus-gaap:ConsumerLoanMember2023-12-310001690820cvna:PurchaseAndSaleAgreementMemberus-gaap:ConsumerLoanMember2022-12-310001690820cvna:SecuritizationTransactionMember2024-12-310001690820cvna:SecuritizationTransactionMember2023-12-310001690820cvna:SecuritizationTransactionMember2022-12-310001690820cvna:FixedPoolLoanSaleMemberus-gaap:ConsumerLoanMember2024-01-012024-12-310001690820cvna:FixedPoolLoanSaleMemberus-gaap:ConsumerLoanMember2022-01-012022-12-310001690820cvna:FixedPoolLoanSaleMemberus-gaap:ConsumerLoanMember2023-01-012023-12-310001690820cvna:MasterPurchaseAndSaleAgreementAndMasterTransferAgreementsMemberus-gaap:ConsumerLoanMember2024-01-012024-12-310001690820cvna:MasterPurchaseAndSaleAgreementAndMasterTransferAgreementsMemberus-gaap:ConsumerLoanMember2023-01-012023-12-310001690820cvna:MasterPurchaseAndSaleAgreementAndMasterTransferAgreementsMemberus-gaap:ConsumerLoanMember2022-01-012022-12-310001690820us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-12-310001690820us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001690820us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMembercvna:RatedNotesMember2024-12-310001690820us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMembercvna:RatedNotesMember2023-12-310001690820us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMembercvna:CertificatesAndOtherAssetsMember2024-12-310001690820us-gaap:VariableInterestEntityNotPrimaryBeneficiaryMembercvna:CertificatesAndOtherAssetsMember2023-12-310001690820cvna:FloorPlanFacilityMemberus-gaap:LineOfCreditMember2024-12-310001690820cvna:FloorPlanFacilityMemberus-gaap:LineOfCreditMember2023-12-310001690820cvna:FinanceReceivableFacilitiesMemberus-gaap:LineOfCreditMember2024-12-310001690820cvna:FinanceReceivableFacilitiesMemberus-gaap:LineOfCreditMember2023-12-310001690820cvna:FinancingOfBeneficialInterestsInSecuritizationsMember2024-12-310001690820cvna:FinancingOfBeneficialInterestsInSecuritizationsMember2023-12-310001690820cvna:RealEstateFinancingMember2024-12-310001690820cvna:RealEstateFinancingMember2023-12-310001690820cvna:SeniorSecuredNotesMemberus-gaap:SeniorNotesMember2024-12-310001690820cvna:SeniorSecuredNotesMemberus-gaap:SeniorNotesMember2023-12-310001690820cvna:SeniorUnsecuredNotesEffectiveSeptember2018Memberus-gaap:SeniorNotesMember2024-12-310001690820cvna:SeniorUnsecuredNotesEffectiveSeptember2018Memberus-gaap:SeniorNotesMember2023-12-310001690820cvna:FloorPlanFacility18MonthMemberus-gaap:LineOfCreditMember2023-11-010001690820cvna:FloorPlanFacility18MonthMemberus-gaap:LineOfCreditMembercvna:Under50CurrentInventoryMember2023-11-012023-11-010001690820cvna:FloorPlanFacility18MonthMemberus-gaap:LineOfCreditMembercvna:Under50CurrentInventoryMember2023-11-010001690820cvna:FloorPlanFacility18MonthMemberus-gaap:LineOfCreditMembercvna:Over50CurrentInventoryMember2023-11-012023-11-010001690820cvna:FloorPlanFacility18MonthMemberus-gaap:LineOfCreditMembercvna:Over50CurrentInventoryMember2023-11-010001690820cvna:FloorPlanFacilityMemberus-gaap:LineOfCreditMember2023-11-012023-11-010001690820cvna:FloorPlanFacilityMemberus-gaap:LineOfCreditMember2023-11-010001690820cvna:Under50CurrentInventoryMemberus-gaap:LineOfCreditMember2023-11-010001690820cvna:Between505999CurrentInventoryMemberus-gaap:LineOfCreditMember2023-11-010001690820cvna:FloorPlanFacility18MonthMemberus-gaap:LineOfCreditMembercvna:Between505999CurrentInventoryMembersrt:MinimumMember2023-11-010001690820cvna:FloorPlanFacility18MonthMemberus-gaap:LineOfCreditMembercvna:Between505999CurrentInventoryMembersrt:MaximumMember2023-11-010001690820cvna:Between606099CurrentInventoryMemberus-gaap:LineOfCreditMember2023-11-010001690820cvna:FloorPlanFacility18MonthMemberus-gaap:LineOfCreditMembercvna:Between606099CurrentInventoryMembersrt:MinimumMember2023-11-010001690820cvna:FloorPlanFacility18MonthMemberus-gaap:LineOfCreditMembercvna:Between606099CurrentInventoryMembersrt:MaximumMember2023-11-010001690820cvna:Over70CurrentInventoryMemberus-gaap:LineOfCreditMember2023-11-010001690820cvna:FloorPlanFacility18MonthMemberus-gaap:LineOfCreditMembercvna:Over70CurrentInventoryMember2023-11-010001690820cvna:FloorPlanFacility12MonthMemberus-gaap:LineOfCreditMember2024-12-310001690820cvna:SPVANAIICreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2020-02-290001690820cvna:SPVANAIICreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2021-12-310001690820cvna:SPVANAIIICreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2021-04-300001690820cvna:SPVANAIIICreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2021-12-310001690820cvna:SPVANAIVCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2022-03-310001690820cvna:SPVANAVICreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2023-05-310001690820cvna:SPVANAIVCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2024-12-310001690820cvna:SPVANAIVCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2023-12-310001690820cvna:FinanceReceivableFacilitiesMemberus-gaap:RevolvingCreditFacilityMember2023-12-310001690820cvna:SeniorSecuredNotesDue2028Memberus-gaap:SeniorNotesMember2024-12-310001690820cvna:SeniorSecuredNotesDue2028Memberus-gaap:SeniorNotesMember2023-12-310001690820cvna:SeniorSecuredNotesDue2030Memberus-gaap:SeniorNotesMember2024-12-310001690820cvna:SeniorSecuredNotesDue2030Memberus-gaap:SeniorNotesMember2023-12-310001690820cvna:SeniorSecuredNotesDue2031Memberus-gaap:SeniorNotesMember2024-12-310001690820cvna:SeniorSecuredNotesDue2031Memberus-gaap:SeniorNotesMember2023-12-310001690820us-gaap:SeniorNotesMember2024-01-012024-12-310001690820us-gaap:SeniorNotesMember2023-01-012023-12-310001690820us-gaap:SeniorNotesMember2024-12-310001690820us-gaap:SeniorNotesMember2023-12-310001690820cvna:SeniorSecuredNotesDue2028Memberus-gaap:SeniorNotesMember2024-02-152024-02-150001690820cvna:SeniorSecuredNotesDue2030Memberus-gaap:SeniorNotesMember2024-02-152024-02-150001690820cvna:SeniorSecuredNotesDue2031Memberus-gaap:SeniorNotesMember2024-02-152024-02-150001690820cvna:SeniorSecuredNotesDue2028Memberus-gaap:SeniorNotesMember2024-08-152024-08-150001690820cvna:SeniorSecuredNotesDue2030Memberus-gaap:SeniorNotesMember2024-08-152024-08-150001690820cvna:SeniorSecuredNotesDue2031Memberus-gaap:SeniorNotesMember2024-08-152024-08-150001690820cvna:SeniorSecuredNotesMemberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorSecuredNotesMemberus-gaap:SeniorNotesMember2023-09-012023-09-010001690820cvna:SeniorUnsecuredNotesMemberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveSeptember2018Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveOctober20205625Member2023-09-012023-09-0100016908202023-09-012023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveOctober20205625Memberus-gaap:SeniorNotesMember2022-12-310001690820cvna:SeniorUnsecuredNotesEffectiveOctober20205625Membercvna:SeniorSecuredNotesDue2028Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveOctober20205625Membercvna:SeniorSecuredNotesDue2030Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveOctober20205625Membercvna:SeniorSecuredNotesDue2031Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveOctober20205625Membercvna:SeniorSecuredNotesMemberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveMarch20215500Memberus-gaap:SeniorNotesMember2022-12-310001690820cvna:SeniorUnsecuredNotesEffectiveMarch20215500Member2023-09-012023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveMarch20215500Membercvna:SeniorSecuredNotesDue2028Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveMarch20215500Membercvna:SeniorSecuredNotesDue2030Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveMarch20215500Membercvna:SeniorSecuredNotesDue2031Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveMarch20215500Membercvna:SeniorSecuredNotesMemberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveOctober20205875Memberus-gaap:SeniorNotesMember2022-12-310001690820cvna:SeniorUnsecuredNotesEffectiveOctober20205875Member2023-09-012023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveOctober20205875Membercvna:SeniorSecuredNotesDue2028Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveOctober20205875Membercvna:SeniorSecuredNotesDue2030Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveOctober20205875Membercvna:SeniorSecuredNotesDue2031Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveOctober20205875Membercvna:SeniorSecuredNotesMemberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveAugust20214875Memberus-gaap:SeniorNotesMember2022-12-310001690820cvna:SeniorUnsecuredNotesEffectiveAugust20214875Member2023-09-012023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveAugust20214875Membercvna:SeniorSecuredNotesDue2028Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveAugust20214875Membercvna:SeniorSecuredNotesDue2030Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveAugust20214875Membercvna:SeniorSecuredNotesDue2031Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveAugust20214875Membercvna:SeniorSecuredNotesMemberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveMay202210250Memberus-gaap:SeniorNotesMember2022-12-310001690820cvna:SeniorUnsecuredNotesEffectiveMay202210250Member2023-09-012023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveMay202210250Membercvna:SeniorSecuredNotesDue2028Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveMay202210250Membercvna:SeniorSecuredNotesDue2030Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveMay202210250Membercvna:SeniorSecuredNotesDue2031Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveMay202210250Membercvna:SeniorSecuredNotesMemberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesMemberus-gaap:SeniorNotesMember2022-12-310001690820cvna:SeniorUnsecuredNotesMember2023-09-012023-09-010001690820cvna:SeniorSecuredNotesDue2028Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorSecuredNotesDue2030Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorSecuredNotesDue2031Memberus-gaap:SeniorNotesMember2023-09-010001690820cvna:SeniorUnsecuredNotesEffectiveOctober20205625Memberus-gaap:SeniorNotesMember2024-12-310001690820cvna:SeniorUnsecuredNotesEffectiveOctober20205625Memberus-gaap:SeniorNotesMember2023-12-310001690820cvna:SeniorUnsecuredNotesEffectiveMarch20215500Memberus-gaap:SeniorNotesMember2024-12-310001690820cvna:SeniorUnsecuredNotesEffectiveMarch20215500Memberus-gaap:SeniorNotesMember2023-12-310001690820cvna:SeniorUnsecuredNotesEffectiveOctober20205875Memberus-gaap:SeniorNotesMember2024-12-310001690820cvna:SeniorUnsecuredNotesEffectiveOctober20205875Memberus-gaap:SeniorNotesMember2023-12-310001690820cvna:SeniorUnsecuredNotesEffectiveAugust20214875Memberus-gaap:SeniorNotesMember2024-12-310001690820cvna:SeniorUnsecuredNotesEffectiveAugust20214875Memberus-gaap:SeniorNotesMember2023-12-310001690820cvna:SeniorUnsecuredNotesEffectiveMay202210250Memberus-gaap:SeniorNotesMember2024-12-310001690820cvna:SeniorUnsecuredNotesEffectiveMay202210250Memberus-gaap:SeniorNotesMember2023-12-310001690820cvna:SeniorUnsecuredNotesMemberus-gaap:SeniorNotesMember2024-12-310001690820cvna:SeniorUnsecuredNotesMemberus-gaap:SeniorNotesMember2023-12-310001690820cvna:SeniorUnsecuredNotesEffectiveAugust20214875Memberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2024-01-012024-12-310001690820cvna:SeniorUnsecuredNotesMemberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2024-01-012024-12-310001690820cvna:SeniorUnsecuredNotesEffectiveMay202210250Memberus-gaap:SeniorNotesMemberus-gaap:DebtInstrumentRedemptionPeriodOneMember2024-01-012024-12-310001690820srt:MinimumMember2024-01-012024-12-310001690820srt:MaximumMember2024-01-012024-12-310001690820us-gaap:AssetPledgedAsCollateralMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-12-310001690820us-gaap:AssetPledgedAsCollateralMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001690820us-gaap:CommonClassAMember2024-01-012024-12-310001690820us-gaap:CommonClassBMembercvna:GarciaPartiesMember2024-01-012024-12-310001690820cvna:GarciaPartiesMember2024-01-012024-12-310001690820us-gaap:CommonClassBMember2024-01-012024-12-310001690820cvna:CarvanaSubMember2024-01-012024-12-310001690820cvna:CarvanaGroupMembercvna:ClassACommonUnitsMember2024-12-310001690820cvna:CarvanaGroupMembercvna:ClassACommonUnitsMember2023-12-310001690820cvna:CarvanaGroupMembercvna:ClassBCommonUnitsMember2024-12-310001690820cvna:CarvanaGroupMembercvna:ClassBCommonUnitsMember2023-12-310001690820us-gaap:CommonClassAMembercvna:AtTheMarketOfferingATMOfferingMember2023-07-192023-07-190001690820us-gaap:CommonClassAMembercvna:AtTheMarketOfferingATMOfferingMember2024-01-012024-12-310001690820us-gaap:CommonClassAMembercvna:AtTheMarketOfferingATMOfferingMember2023-01-012023-12-310001690820us-gaap:CommonClassAMembercvna:AtTheMarketOfferingATMOfferingMember2024-12-310001690820us-gaap:CommonClassAMembercvna:AtTheMarketOfferingATMOfferingMember2023-12-310001690820cvna:AtTheMarketOfferingATMOfferingMember2023-01-012023-12-310001690820cvna:LLCUnitsMembercvna:ExchangeAgreementMember2024-01-012024-12-310001690820cvna:LLCUnitsMembercvna:ExchangeAgreementMember2023-01-012023-12-310001690820us-gaap:CommonClassBMembercvna:ExchangeAgreementMember2024-01-012024-12-310001690820us-gaap:CommonClassBMembercvna:ExchangeAgreementMember2023-01-012023-12-310001690820us-gaap:CommonClassAMembercvna:ExchangeAgreementMember2024-01-012024-12-310001690820us-gaap:CommonClassAMembercvna:ExchangeAgreementMember2023-01-012023-12-310001690820cvna:ClassANonConvertiblePreferredUnitsMember2024-12-310001690820cvna:ClassANonConvertiblePreferredUnitsMember2023-12-310001690820cvna:SeniorUnsecuredNotesEffectiveSeptember2018Memberus-gaap:SeniorNotesMember2018-10-022018-10-020001690820cvna:CarvanaGroupMembercvna:ClassANonConvertiblePreferredUnitsMember2018-10-020001690820cvna:ClassANonConvertiblePreferredUnitsMember2024-01-012024-12-310001690820cvna:CarvanaGroupMembercvna:ClassANonConvertiblePreferredUnitsMember2023-12-310001690820us-gaap:CommonClassAMember2017-05-032017-05-030001690820us-gaap:CommonClassBMember2017-05-032017-05-030001690820us-gaap:CommonClassAMembercvna:ExchangeAgreementMember2017-05-032017-05-030001690820cvna:RestrictedStockUnitsAndRestrictedStockExcludingMilestoneGiftMember2024-01-012024-12-310001690820cvna:RestrictedStockUnitsAndRestrictedStockExcludingMilestoneGiftMember2023-01-012023-12-310001690820cvna:RestrictedStockUnitsAndRestrictedStockExcludingMilestoneGiftMember2022-01-012022-12-310001690820us-gaap:EmployeeStockOptionMember2024-01-012024-12-310001690820us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001690820us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001690820cvna:PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationMember2024-01-012024-12-310001690820cvna:PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationMember2023-01-012023-12-310001690820cvna:PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationMember2022-01-012022-12-310001690820cvna:InventoryNetMember2024-01-012024-12-310001690820cvna:InventoryNetMember2023-01-012023-12-310001690820cvna:InventoryNetMember2022-01-012022-12-310001690820cvna:RestrictedStockUnitsAndRestrictedStockMember2024-12-310001690820cvna:RestrictedStockUnitsAndRestrictedStockMember2024-01-012024-12-310001690820us-gaap:EmployeeStockOptionMember2024-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMemberus-gaap:CommonClassAMember2023-05-010001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMemberus-gaap:CommonClassAMember2024-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMemberus-gaap:CommonClassAMember2024-01-012024-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMemberus-gaap:RestrictedStockMembersrt:MinimumMember2024-01-012024-12-310001690820us-gaap:RestrictedStockMembercvna:TwoThousandSeventeenOmnibusIncentivePlanMember2022-01-012022-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMemberus-gaap:RestrictedStockMemberus-gaap:CommonClassAMember2022-01-012022-12-310001690820us-gaap:RestrictedStockMembercvna:TwoThousandSeventeenOmnibusIncentivePlanMember2023-01-012023-12-310001690820us-gaap:RestrictedStockMembercvna:TwoThousandSeventeenOmnibusIncentivePlanMember2024-01-012024-12-310001690820us-gaap:RestrictedStockUnitsRSUMembercvna:TwoThousandSeventeenOmnibusIncentivePlanMember2024-01-012024-12-310001690820cvna:RSAsRSUsMembercvna:TwoThousandSeventeenOmnibusIncentivePlanMember2024-01-012024-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2023-01-012023-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2022-01-012022-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMemberus-gaap:RestrictedStockUnitsRSUMemberus-gaap:CommonClassAMember2024-01-012024-12-310001690820cvna:RSAsRSUsMembercvna:TwoThousandSeventeenOmnibusIncentivePlanMember2021-12-310001690820cvna:RSAsRSUsMembercvna:TwoThousandSeventeenOmnibusIncentivePlanMember2022-01-012022-12-310001690820cvna:RSAsRSUsMembercvna:TwoThousandSeventeenOmnibusIncentivePlanMember2022-12-310001690820cvna:RSAsRSUsMembercvna:TwoThousandSeventeenOmnibusIncentivePlanMember2023-01-012023-12-310001690820cvna:RSAsRSUsMembercvna:TwoThousandSeventeenOmnibusIncentivePlanMember2023-12-310001690820cvna:RSAsRSUsMembercvna:TwoThousandSeventeenOmnibusIncentivePlanMember2024-12-310001690820cvna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMemberus-gaap:CommonClassAMember2021-07-012021-07-010001690820cvna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMemberus-gaap:CommonClassAMembersrt:MinimumMember2021-07-012021-07-010001690820cvna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMemberus-gaap:CommonClassAMembersrt:MaximumMember2021-07-012021-07-010001690820cvna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMemberus-gaap:CommonClassAMember2021-07-010001690820cvna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMemberus-gaap:CommonClassAMember2024-01-012024-12-310001690820cvna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMemberus-gaap:CommonClassAMember2023-01-012023-12-310001690820cvna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMemberus-gaap:CommonClassAMember2022-01-012022-12-310001690820cvna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMemberus-gaap:EmployeeStockMemberus-gaap:CommonClassAMember2024-12-310001690820us-gaap:EmployeeStockMembercvna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMember2023-01-012023-12-310001690820us-gaap:EmployeeStockMembercvna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMember2022-01-012022-12-310001690820us-gaap:EmployeeStockMembercvna:TwoThousandAndTwentyOneEmployeeStockPurchasePlanMember2024-01-012024-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMemberus-gaap:EmployeeStockOptionMembercvna:SharebasedCompensationAwardTrancheFourMember2024-01-012024-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMemberus-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-01-012024-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMemberus-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2024-01-012024-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMemberus-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-01-012024-12-310001690820us-gaap:EmployeeStockOptionMembercvna:TwoThousandSeventeenOmnibusIncentivePlanMember2024-01-012024-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMember2021-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMember2021-01-012021-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMember2022-01-012022-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMember2022-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMember2023-01-012023-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMember2023-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMember2024-01-012024-12-310001690820cvna:TwoThousandSeventeenOmnibusIncentivePlanMember2024-12-310001690820us-gaap:EmployeeStockOptionMembercvna:TwoThousandSeventeenOmnibusIncentivePlanMember2023-01-012023-12-310001690820us-gaap:EmployeeStockOptionMembercvna:TwoThousandSeventeenOmnibusIncentivePlanMember2022-01-012022-12-310001690820srt:MinimumMembercvna:ClassACommonUnitsMember2019-01-012019-12-310001690820srt:MaximumMembercvna:ClassACommonUnitsMember2019-01-012019-12-310001690820cvna:ClassACommonUnitsMember2019-01-012019-12-310001690820cvna:ClassACommonUnitsMember2024-01-012024-12-310001690820cvna:ClassACommonUnitsMember2021-12-310001690820cvna:ClassACommonUnitsMember2022-01-012022-12-310001690820cvna:ClassACommonUnitsMember2022-12-310001690820cvna:ClassACommonUnitsMember2023-01-012023-12-310001690820cvna:ClassACommonUnitsMember2023-12-310001690820cvna:ClassACommonUnitsMember2024-12-310001690820srt:MinimumMembercvna:ClassBCommonUnitsMember2015-03-012015-03-310001690820srt:MaximumMembercvna:ClassBCommonUnitsMember2015-03-012015-03-310001690820cvna:ClassBCommonUnitsMember2024-01-012024-12-310001690820cvna:ClassBCommonUnitsMember2023-01-012023-12-310001690820cvna:ClassBCommonUnitsMember2022-01-012022-12-310001690820srt:MinimumMembercvna:ClassBCommonUnitsMember2024-01-012024-12-310001690820srt:MaximumMembercvna:ClassBCommonUnitsMember2024-01-012024-12-310001690820cvna:ClassBCommonUnitsMember2021-12-310001690820cvna:ClassBCommonUnitsMember2022-12-310001690820cvna:ClassBCommonUnitsMember2023-12-310001690820cvna:ClassBCommonUnitsMember2024-12-310001690820cvna:ClassACommonUnitsMember2021-01-012021-12-310001690820cvna:ClassBCommonUnitsMember2021-01-012021-12-310001690820us-gaap:CommonClassAMember2023-01-012023-12-310001690820us-gaap:CommonClassAMember2022-01-012022-12-310001690820us-gaap:EmployeeStockOptionMemberus-gaap:CommonClassAMember2024-01-012024-12-310001690820us-gaap:EmployeeStockOptionMemberus-gaap:CommonClassAMember2023-01-012023-12-310001690820us-gaap:EmployeeStockOptionMemberus-gaap:CommonClassAMember2022-01-012022-12-310001690820cvna:RestrictedStockUnitsAndRestrictedStockMemberus-gaap:CommonClassAMember2024-01-012024-12-310001690820cvna:RestrictedStockUnitsAndRestrictedStockMemberus-gaap:CommonClassAMember2023-01-012023-12-310001690820cvna:RestrictedStockUnitsAndRestrictedStockMemberus-gaap:CommonClassAMember2022-01-012022-12-310001690820cvna:ClassACommonUnitsMemberus-gaap:CommonClassAMember2024-01-012024-12-310001690820cvna:ClassACommonUnitsMemberus-gaap:CommonClassAMember2023-01-012023-12-310001690820cvna:ClassACommonUnitsMemberus-gaap:CommonClassAMember2022-01-012022-12-310001690820cvna:ClassBCommonUnitsMemberus-gaap:CommonClassAMember2024-01-012024-12-310001690820cvna:ClassBCommonUnitsMemberus-gaap:CommonClassAMember2023-01-012023-12-310001690820cvna:ClassBCommonUnitsMemberus-gaap:CommonClassAMember2022-01-012022-12-310001690820us-gaap:EmployeeStockOptionMember2024-01-012024-12-310001690820us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001690820us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001690820cvna:RestrictedStockUnitsAndRestrictedStockMember2024-01-012024-12-310001690820cvna:RestrictedStockUnitsAndRestrictedStockMember2023-01-012023-12-310001690820cvna:RestrictedStockUnitsAndRestrictedStockMember2022-01-012022-12-310001690820cvna:ClassACommonUnitsMember2024-01-012024-12-310001690820cvna:ClassACommonUnitsMember2023-01-012023-12-310001690820cvna:ClassACommonUnitsMember2022-01-012022-12-310001690820cvna:ClassBCommonUnitsMember2024-01-012024-12-310001690820cvna:ClassBCommonUnitsMember2023-01-012023-12-310001690820cvna:ClassBCommonUnitsMember2022-01-012022-12-310001690820cvna:CarvanaGroupMemberus-gaap:AdditionalPaidInCapitalMembercvna:LLCUnitExchangesMember2024-01-012024-12-310001690820cvna:CarvanaGroupMemberus-gaap:AdditionalPaidInCapitalMembercvna:LLCUnitExchangesMember2023-01-012023-12-310001690820cvna:CarvanaGroupMemberus-gaap:AdditionalPaidInCapitalMembercvna:AtTheMarketOfferingATMOfferingMember2024-01-012024-12-310001690820cvna:CarvanaGroupMemberus-gaap:AdditionalPaidInCapitalMembercvna:AtTheMarketOfferingATMOfferingMember2023-01-012023-12-310001690820srt:MinimumMember2024-12-310001690820srt:MaximumMember2024-12-310001690820srt:MinimumMemberus-gaap:EquipmentMember2024-12-310001690820srt:MaximumMemberus-gaap:EquipmentMember2024-12-310001690820us-gaap:EquipmentMember2024-01-012024-12-310001690820us-gaap:NonrelatedPartyMember2024-01-012024-12-310001690820us-gaap:NonrelatedPartyMember2023-01-012023-12-310001690820us-gaap:NonrelatedPartyMember2022-01-012022-12-310001690820us-gaap:NonrelatedPartyMember2024-12-3100016908202022-11-022022-11-020001690820us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001690820us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001690820us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001690820us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001690820us-gaap:FairValueMeasurementsRecurringMember2024-12-310001690820us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001690820us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001690820us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001690820us-gaap:FairValueMeasurementsRecurringMemberus-gaap:WarrantMember2024-12-310001690820us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:WarrantMember2024-12-310001690820us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:WarrantMember2024-12-310001690820us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:WarrantMember2024-12-310001690820us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001690820us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001690820us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001690820us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001690820us-gaap:FairValueMeasurementsRecurringMember2023-12-310001690820us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001690820us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001690820us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001690820us-gaap:FairValueMeasurementsRecurringMemberus-gaap:WarrantMember2023-12-310001690820us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:WarrantMember2023-12-310001690820us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:WarrantMember2023-12-310001690820us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:WarrantMember2023-12-310001690820us-gaap:FairValueMeasurementsRecurringMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-12-310001690820us-gaap:FairValueMeasurementsRecurringMembersrt:MaximumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-12-310001690820us-gaap:FairValueMeasurementsRecurringMembersrt:MinimumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001690820us-gaap:FairValueMeasurementsRecurringMembersrt:MaximumMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001690820us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Membercvna:MeasurementInputWeightedAverageDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-12-310001690820us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Membercvna:MeasurementInputWeightedAverageDiscountRateMemberus-gaap:ValuationTechniqueDiscountedCashFlowMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001690820us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2024-01-012024-12-310001690820us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-01-012023-12-310001690820us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2023-12-310001690820us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:VariableInterestEntityNotPrimaryBeneficiaryMember2022-12-310001690820us-gaap:FairValueMeasurementsRecurringMember2024-01-012024-12-310001690820us-gaap:FairValueMeasurementsRecurringMember2023-01-012023-12-310001690820cvna:RootIncMember2021-10-310001690820cvna:RootIncMemberus-gaap:WarrantMember2021-10-310001690820cvna:Tranche1Member2022-09-010001690820cvna:Tranche2Member2022-09-010001690820cvna:Tranche3Member2022-09-010001690820us-gaap:MeasurementInputPriceVolatilityMember2024-12-310001690820us-gaap:MeasurementInputPriceVolatilityMember2023-12-310001690820us-gaap:FairValueInputsLevel3Membercvna:RootIncMemberus-gaap:WarrantMember2024-12-310001690820us-gaap:FairValueInputsLevel3Membercvna:RootIncMemberus-gaap:WarrantMember2023-01-012023-12-310001690820cvna:RootIncMemberus-gaap:WarrantMember2024-12-310001690820cvna:RootIncMemberus-gaap:WarrantMember2023-12-310001690820cvna:RootIncMemberus-gaap:WarrantMember2024-01-012024-12-310001690820cvna:RootIncMemberus-gaap:WarrantMember2023-01-012023-12-310001690820cvna:RootIncMemberus-gaap:WarrantMember2022-01-012022-12-310001690820us-gaap:FairValueInputsLevel3Membercvna:RootIncMemberus-gaap:WarrantMember2023-12-310001690820us-gaap:FairValueInputsLevel3Membercvna:RootIncMemberus-gaap:WarrantMember2022-12-310001690820us-gaap:FairValueInputsLevel3Membercvna:RootIncMemberus-gaap:WarrantMember2024-01-012024-12-310001690820us-gaap:InterestRateCapMember2023-12-310001690820us-gaap:FairValueInputsLevel2Membercvna:InterestRateCapExpiresJuly2027Member2023-12-310001690820us-gaap:FairValueInputsLevel2Membercvna:InterestRateCapExpiresApril2027Member2023-12-310001690820us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-12-310001690820us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310001690820us-gaap:FairValueInputsLevel2Membercvna:SeniorUnsecuredNotesEffectiveSeptember2018Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2024-12-310001690820us-gaap:FairValueInputsLevel2Membercvna:SeniorUnsecuredNotesEffectiveSeptember2018Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-12-310001690820us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2024-12-310001690820us-gaap:FairValueInputsLevel2Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001690820us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2024-12-310001690820us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001690820us-gaap:CommonClassAMemberus-gaap:SubsequentEventMembercvna:SecondARDistributionAgreementMember2025-02-192025-02-1900016908202024-10-012024-12-310001690820cvna:TomTairaMember2024-01-012024-12-310001690820cvna:TomTairaMember2024-10-012024-12-310001690820cvna:TomTairaMember2024-12-310001690820cvna:DanielGillMember2024-01-012024-12-310001690820cvna:DanielGillTradingArrangementJune2023PlanMembercvna:DanielGillMember2024-10-012024-12-310001690820cvna:DanielGillTradingArrangementDecember2024PlanMembercvna:DanielGillMember2024-10-012024-12-310001690820cvna:DanielGillTradingArrangementDecember2024PlanMembercvna:DanielGillMember2024-12-310001690820cvna:BenjaminHustonMember2024-01-012024-12-310001690820cvna:BenjaminHustonTradingArrangementDecember2024PlanMembercvna:BenjaminHustonMember2024-10-012024-12-310001690820cvna:BenjaminHustonTradingArrangementMarch2021PlanMembercvna:BenjaminHustonMember2024-10-012024-12-310001690820cvna:BenjaminHustonTradingArrangementMarch2021PlanMembercvna:BenjaminHustonMember2024-12-310001690820cvna:BenjaminHustonTradingArrangementDecember2024PlanMembercvna:BenjaminHustonMember2024-12-310001690820cvna:ErnestGarciaIIIMember2024-01-012024-12-310001690820cvna:ErnestGarciaIIIMember2024-10-012024-12-310001690820cvna:ErnestGarciaIIIMember2024-12-310001690820us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-12-310001690820us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-01-012024-12-310001690820us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-12-310001690820us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310001690820us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-01-012023-12-310001690820us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310001690820us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____ to ______

Commission File Number: 001-38073

CARVANA CO.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Delaware | 81-4549921 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

| 300 E. Rio Salado Parkway | Tempe | Arizona | 85281 |

| (Address of principal executive offices) | (Zip Code) |

(602) 922-9866

(Registrant's telephone number, including area code)

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, Par Value $0.001 Per Share | CVNA | New York Stock Exchange |

| | |

| | |

Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☒ Yes q No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. q Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes q No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). ☒ Yes q No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ | |

Emerging growth company | ☐ | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ¨ |

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. | ☒ |

| If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. | ☐ |

| Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

As of June 30, 2024, the aggregate market value of the common stock of the registrant held by non-affiliates was $14.7 billion based on the closing price of the common stock on the New York Stock Exchange on June 28, 2024.

As of February 14, 2025, the registrant had 134,046,880 shares of Class A common stock outstanding and 79,119,471 shares of Class B common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's Definitive Proxy Statement for its 2025 Annual Meeting of Shareholders are incorporated by reference into Part III of this Form 10-K.

CARVANA CO.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2024

INDEX | | | | | | | | |

| | Page |

PART I |

Item 1. | Business | |

Item 1A. | Risk Factors | |

Item 1B. | Unresolved Staff Comments | |

Item 1C. | Cybersecurity | |

Item 2. | Properties | |

Item 3. | Legal Proceedings | |

Item 4. | Mine Safety Disclosures | |

| | |

PART II |

Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities | |

Item 6. | [Reserved] | |

Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | |

Item 8. | Financial Statements and Supplementary Data | |

Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

Item 9A. | Controls and Procedures | |

Item 9B. | Other Information | |

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections | |

| | |

PART III |

Item 10. | Directors, Executive Officers and Corporate Governance | |

Item 11. | Executive Compensation | |

Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | |

Item 13. | Certain Relationships and Related Transactions, and Director Independence | |

Item 14. | Principal Accountant Fees and Services | |

| | |

PART IV |

Item 15. | Exhibit and Financial Statement Schedules | |

| Item 16. | Form 10-K Summary | |

| Signatures | |

PART I

In this Annual Report on Form 10-K, "we," "our," "us," "Carvana," and "the Company" refer to Carvana Co. and its consolidated subsidiaries, unless the context requires otherwise.

Forward-Looking and Cautionary Statements

This Annual Report on Form 10-K, as well as information included in oral statements or other written statements made or to be made by us, contain statements that constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations, and assumptions regarding the future of our business, future plans and strategies, and other future conditions. Forward-looking statements can be identified by words such as "anticipate," "believe," "contemplate," "continue," "could," "envision," "estimate," "expect," "intend," "may," "ongoing," "plan," "potential," "predict," "project," "should," "target," "will," "would," and other similar expressions or variations or negatives of these words, although not all forward-looking statements contain these identifying words. Examples of forward-looking statements include, among others, statements we make regarding:

•expectations relating to the used car market and our industry;

•macroeconomic conditions, economic slowdown or recessions;

•future financial position;

•expectations and plans regarding our business strategy;

•budgets, projected costs, and plans;

•future industry growth;

•financing sources;

•short-and long-term liquidity;

•the impact and outcome of litigation, government inquiries, and investigations; and

•all other statements regarding our intent, plans, beliefs, or expectations or those of our directors or officers.

We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions, and expectations disclosed in the forward-looking statements we make. Important factors that could cause actual results and events to differ materially from those indicated in the forward-looking statements include, among others, those discussed under Part I, Item 1A —"Risk Factors" in this Annual Report on Form 10-K. The forward-looking statements in this Annual Report on Form 10-K represent our views as of the date hereof. We undertake no obligation to publicly update any forward-looking statements whether as a result of new information, future developments or otherwise.

Market and Industry Data

Some of the market and industry data contained in this Annual Report on Form 10-K is based on industry publications or other publicly available information. Although we believe that these third-party sources are relevant and reliable, we have not independently verified and cannot assure you as to the accuracy or completeness of this information. As a result, you should be aware that the market and industry data contained herein, and our beliefs and estimates based on such data, may not be reliable.

ITEM 1. BUSINESS.

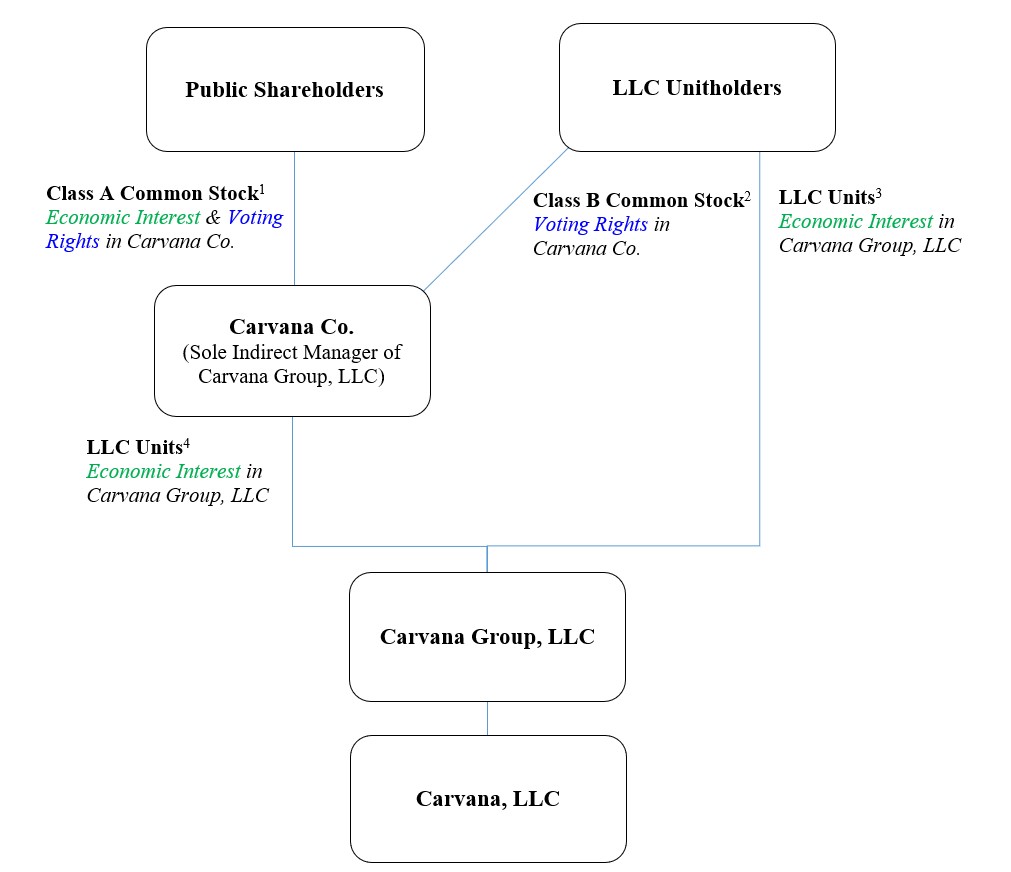

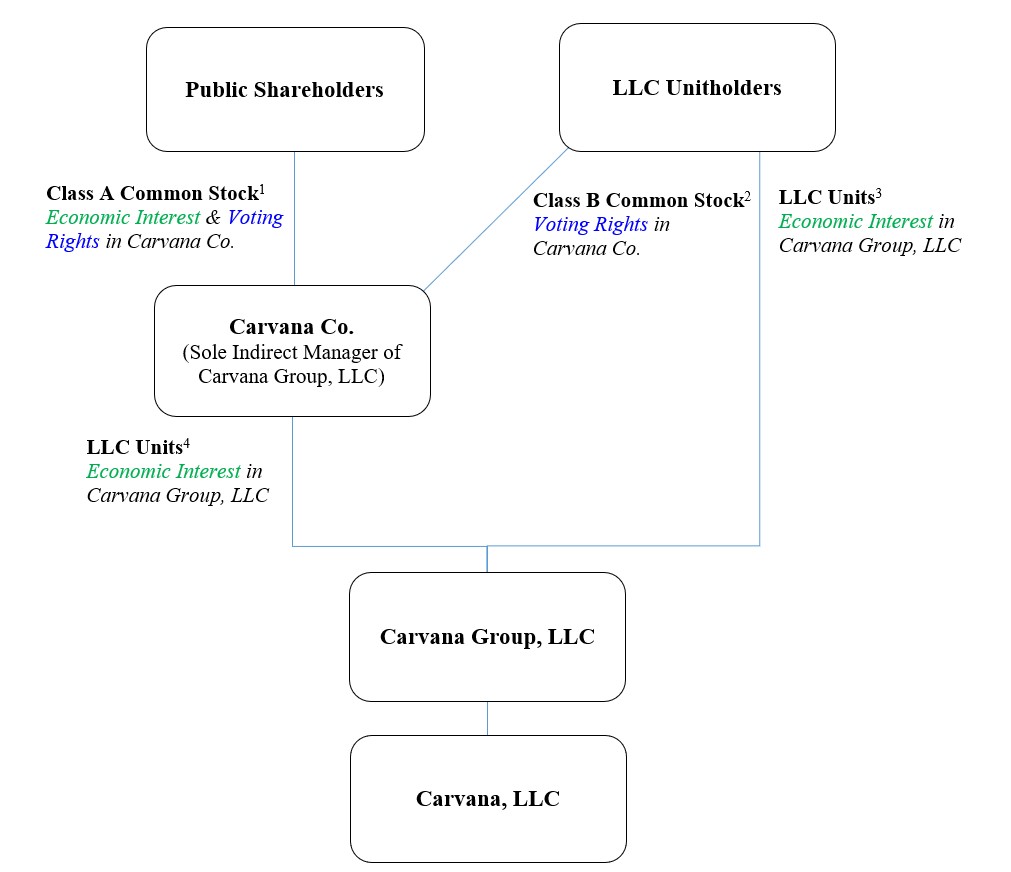

Carvana Co. is a holding company that was formed as a Delaware corporation in 2016 in order to operate the business of Carvana Group, LLC and its subsidiaries (collectively, "Carvana Group"). Carvana Co. Class A common stock trades on the New York Stock Exchange ("NYSE") under the symbol "CVNA."

Our Company

Carvana is the leading e-commerce platform for buying and selling used cars. We are transforming the used car buying and selling experience by giving consumers what they want - a wide selection, great value and quality, transparent pricing, and a simple, no pressure transaction. Our differentiated business model combines a comprehensive online sales experience with a vertically integrated supply chain, designed to sell high-quality vehicles to our customers transparently and efficiently at a low

price. The automotive retail industry is large – with approximately 36 million used auto retail transactions in the United States (“U.S.”) in 2023 according to Cox Automotive – and highly fragmented – with the top 10 used auto retailers in the U.S. accounting for less than 10% of the market share in 2023 according to Automotive News. These dynamics create an exceptional opportunity for disruption that our custom-built business model can capitalize on to remain well-positioned for long term growth. Over the years we have leveraged our growing logistics network, which spans 316 metropolitan statistical areas, and our in-house distribution network, servicing over 80% of the U.S. population as of December 31, 2024, to sell 2.2 million retail vehicles, generating $63.7 billion in total revenue since inception in 2012 through December 31, 2024.

Vehicle Acquisition. We primarily acquire our used vehicle inventory directly from customers, used car auctions, and wholesale used vehicle suppliers, including retail marketplace partners. Acquiring inventory directly from customers when they trade in or sell us their vehicles in a one-way transaction eliminates auction fees and provides for a more diverse set of vehicles. After answering a few questions about the vehicle condition and features, our online tool provides customers with an automated, conditional offer for their existing vehicle that can be applied to any vehicle purchase or paid directly without an associated vehicle purchase. Our online tool then allows customers to schedule a time to have their existing vehicle picked up at their home, and receive payment. We designed this process to be convenient, seamless, and to eliminate the need for a customer to visit a dealership or negotiate a private sale.

Inspection and Reconditioning. Once we acquire a vehicle, we leverage our in-house logistics network or a vendor to transport the vehicle to one of our inspection and reconditioning centers ("IRC") or auction locations with reconditioning capabilities (together with IRCs "Reconditioning Sites"), at which point the vehicle enters our inventory management system. We then begin an inspection process covering controls, features, brakes, tires, and cosmetics. Each Reconditioning Site leverages proprietary inventory management technology and includes trained technicians, vehicle lifts, paintless dent repair, and paint capabilities and receives on-site support from vendors with whom we have integrated systems to expedite ready access to parts and materials. We have a uniform set of cosmetic standards across all Reconditioning Sites to provide a consistent customer experience. When an inspection is complete, we estimate the necessary reconditioning cost for the vehicle to meet our standards and expected timing for that vehicle to be made available for sale on our website. Vehicles that do not meet Carvana standards are sold wholesale, either through our wholesale marketplace platform or through third party auctions.

Online Search and Shopping Experience. We offer a mobile-optimized website, where prospective retail car buyers can immediately begin browsing, researching, filtering, and identifying their vehicle of choice from an inventory of over 53,000 total website units that we offer for sale as of December 31, 2024. We leverage our patented, automated photo technology to offer an annotated virtual vehicle tour, which includes a 360-degree view of the interior and exterior of the actual vehicle and allows customers to view vehicle imperfections through high-definition photography. Our website also features integrations with various vehicle data providers for vehicle feature and option information to assist customers with purchase decisions.

Financing. We offer integrated financing using our proprietary loan origination platform. Customers who choose to apply for our in-house financing fill out a short prequalification form, and, if approved, are nearly instantaneously presented with an interactive set of conditional financing terms generated by our proprietary credit scoring and deal structuring algorithms for every vehicle in our inventory. Our financing tool intuitively and transparently shows the relationship between down payment, monthly payment and loan term to assist the customer in selecting the best payment plan tailored to their specific needs. This pre-approval involves a short process that does not impact customers’ credit unless they pursue a purchase and finance the transaction. For customers who choose not to utilize our financing, we also accept payment in cash or financing from third party lenders, such as banks or credit unions.

Complementary Products. As part of the integrated purchasing process, customers have the option to protect their vehicle with a vehicle service contract (“VSC”). VSCs provide customers with protection against the costs of certain mechanical repairs after the expiration of their vehicle’s original manufacturer warranty. In most states, customers financing their purchase with us are also offered guaranteed asset protection ("GAP") waiver coverage during checkout to provide customers with protection for the value of the loan. We have also partnered with Root, Inc. ("Root"), an online car insurance company, to offer an integrated auto insurance solution, through which customers in most states may conveniently access auto insurance directly from the Carvana e-commerce platform. We collectively refer to VSC, GAP, and auto insurance as complementary products.

Nationwide Logistics Network and Distinctive Fulfillment Experience. We have developed proprietary logistics software and an in-house nationwide delivery network which is aimed at allowing us to predictably and efficiently transport cars while providing customers with a distinctive fulfillment experience. Our logistics network and technologies that support it are based on a "hub and spoke" model, which connects Reconditioning Sites to vending machines and hubs via our fleet of multi-car and single-car haulers. This allows us to efficiently manage locations, routes, route capacities, trucks, and drivers while also dynamically optimizing for speed and cost. This proprietary logistics infrastructure enables us to offer our customers and

operations team highly accurate predictions of vehicle availability, to minimize delays, and promote a seamless and reliable customer experience. We offer customers in our markets a home delivery option that is typically conducted by a Carvana employee on a branded hauler. Customers in certain markets can also pick up their vehicles at one of our patented car vending machines, which are multi-story glass towers that store purchased vehicles, or at other customer-facing locations. As of December 31, 2024, we estimate that 75% of the U.S. population is within 100 miles of an IRC or auction site, which shortens the distance from our inventory pools to our customers to reduce delivery times.

Post-sale customer support. After purchase, our customer advocates handle post-sale coordination and assistance, including facilitating returns or exchanges under our seven-day return policy. As of December 31, 2024, customers rated us an average of 4.7 out of 5.0 from over 215,000 surveys on our website since inception, fostering repeat business and a strong referral network.

Strengths and Competitive Advantages

We aim to deliver the best selection, the best value, and the best experience for used car buyers and sellers. Since our inception, we have been developing and leveraging the following key strengths, which we believe provide for significant competitive advantages.

Purpose-Built Vertically Integrated E-commerce Platform

We believe our proprietary technology and vertically integrated business model allow us to enjoy a significantly lower variable cost structure versus traditional dealerships and to provide substantial value to our customers by providing a seamless, best-in-class car buying and selling experience. Our vertically integrated platform gives us control of all critical operations and transaction elements to allow us to facilitate a fast, simple, and consistent user experience. We control the algorithms that help determine the vehicles we make available to our customers, the prices of those vehicles, the financing terms offered to customers, complementary products, and the purchase prices and trade-in values we offer. Additionally, we control the logistics infrastructure that enables us to offer customers fast, specific, and reliable delivery and pick-up times. We have invested heavily in our customer-facing website to provide an intuitive user interface and have built a team of in-house customer advocates that is dedicated to providing first-rate customer service.

Differentiated Shopping Experience

We have developed technology that makes the online vehicle purchasing process intuitive, transparent and fun. Our patented photo technology, paired with custom photo processing and display technology, provides an interactive way for consumers to search for vehicles and take a virtual tour of the interior and exterior of a vehicle using annotated, high-definition photography. We believe this technology, coupled with our inspection process, uniform cosmetic standard, and seven-day return policy, generates the confidence and trust in our platform needed to buy a car online.

Proprietary Financing Technology

Our differentiated financing solutions provide customers with nearly instantaneous credit terms as well as flexibility and transparency in financing their vehicle purchase. We preapprove thousands of down payment and monthly payment combinations that allow customers to choose their preferred financing. We preapprove these terms utilizing "soft credit checks" which do not impact a customer’s credit unless they complete a purchase and financing transaction. Our proprietary credit and underwriting platform is trained on over ten years of Carvana-originated loans, giving us information to make credit decisions aimed to optimize risk, vehicle characteristics, deal structure, and customer credit. We believe this significantly enhances the quality of the loans that we generate and the value we can capture when we sell them through securitization transactions or to our financing partners.

Efficient Logistics Network and Distinctive Fulfillment Experience

We have developed proprietary logistics software and an in-house delivery network that differentiates us from competitors, and which is designed to predictably and efficiently transport cars while providing customers with a distinctive fulfillment experience. Our home delivery and pickup is typically conducted by a Carvana employee on a branded hauler, as soon as the same day in certain markets. Customers in certain markets can also pick up or drop off their vehicles at one of our patented car vending machines, or at another customer-facing location. Our vending machines provide an attractive and unique pickup experience for our customers and develop brand awareness while lowering our variable fulfillment expenses. Following the

opening of a vending machine in one of our markets, our market penetration has typically seen a meaningful increase while our variable operating costs per vehicle sold have typically decreased.

Scaled Used Vehicle Infrastructure

As of December 31, 2024, we leverage a network of Reconditioning Sites throughout the U.S. and proprietary software for our vehicle reconditioning and logistics activities that required significant investment in time and capital to develop. This infrastructure gives us capacity to inspect and recondition more than 1 million cars per year at full utilization.

Scale Driving Powerful Network Effects

Our business benefits from powerful network effects. As of December 31, 2024, we offer all customers a nationally pooled inventory of over 53,000 high-quality used vehicles on our website. Our customer research indicates that size and breadth of selection are primary determinants of a customer's choice of retailer. We use proprietary algorithms to optimize our inventory acquisition based on extensive used vehicle market and customer behavior data. Furthermore, our nationally pooled inventory system maximizes the scope of vehicle selection for our customers in any given location, increasing the likelihood that customers are able to find the make, model, year, and color combination that they desire.

Business and Growth Strategies

The foundation of our business is retail vehicle unit sales, which drives the majority of our revenue and allows us to capture additional revenue streams associated with financing, complementary products offerings, as well as trade-in vehicles. As we evolve, we believe we will continue to improve profitability associated with these revenues and expand our offering of complementary products. However, all of these additional revenue opportunities are derived from retail vehicle unit sales and, as a result, our business strategies are primarily focused on this metric.

Our ability to generate retail vehicle sales is a function of our market penetration in existing markets, the number of markets we operate in, and our ability to build and maintain our brand by offering great value, transparency, and outstanding customer service.

Since the launch of our first market twelve years ago, our vertically integrated, customer-centered offering has enabled us to become one of the largest and fastest growing used automotive retailers in the U.S. as of December 31, 2024. In 2022 and 2023, as a result of changes in the economy, the market, and the industry, we shifted our focus to driving profitability through fundamental operating efficiency. We believe these profitability initiatives allowed us to deliver substantial cost efficiency improvements and build a strong operational foundation for future growth. Throughout 2024, we remained focused on driving operational efficiency and profitability while also shifting towards the long-term phase of driving profitable growth. In this early stage, we are pursuing growth at a rate that seeks to balance the long-term benefits of scale with the continued opportunities we see to further enhance customer experiences. We have physical infrastructure for continued growth, which gives us capacity to recondition over approximately 1 million vehicles per year.

Further, the acquisition of ADESA US Auction, LLC in 2022 provided us with 56 additional locations that could be built out to increase our reconditioning capacity. Six of these ADESA auction sites have been built out to provide IRC capabilities, and the remaining sites provide continued potential for further growth.

With more than 36 million transactions in 2023, according to Cox Automotive, the used vehicle retail market represents a massive, highly fragmented industry, of which Carvana currently holds only approximately 1% of the market share. We believe we are well positioned to benefit from secular e-commerce trends. According to Federal Reserve Economic Data (FRED), e-commerce as a share of non-automotive retail has risen steadily for over 20 years and made up approximately 18% of all non-automotive retail transactions as of 2023. Within the automotive retail industry, e-commerce adoption has lagged behind that of other retail segments, but we believe that as customers continue becoming more accustomed to making larger purchases online, e-commerce will make up an increasing share of automotive retail as it has in other retail segments. The large scale and fragmentation of the used retail vehicle market, coupled with the ongoing adoption of e-commerce more broadly, presents a differentiated opportunity for continued growth. Carvana intends to take advantage of this market opportunity by executing the following key elements of our growth strategy:

Increase Sales Through Further Penetration of Our Existing Markets

Our growth has historically been driven by opening new markets and increasing market penetration in our existing markets. Our long-term plan includes marketing and actively building our brand image and awareness in existing markets by improving the speed and efficiency of our operations and increasing our inventory size.

Optimize Our Inventory Selection