FALSE2024FY0000721371http://fasb.org/us-gaap/2024#GainLossOnSalesOfAssetsAndAssetImpairmentChargeshttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#DeferredTaxAndOtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#DeferredTaxAndOtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2024#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2024#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2024#LongTermDebtAndCapitalLeaseObligationsCurrenthttp://fasb.org/us-gaap/2024#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2024#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2024#InterestExpensehttp://fasb.org/us-gaap/2024#InterestExpensehttp://fasb.org/us-gaap/2024#InterestExpensehttp://fasb.org/us-gaap/2024#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2024#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2024#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2024#InterestExpensehttp://fasb.org/us-gaap/2024#InterestExpensehttp://fasb.org/us-gaap/2024#InterestExpenseiso4217:USDxbrli:sharesxbrli:pureiso4217:USDxbrli:sharescah:organizationutr:Ratecah:statescah:numberOfUSTerritoriescah:lawsuitcah:plaintiffiso4217:JPYiso4217:EURcah:segmentcah:Segmentscah:granteescah:vestingPeriods00007213712023-07-012024-06-3000007213712023-12-3100007213712024-07-310000721371cah:CVSHealthCorporationMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercah:PharmaceuticalAndSpecialtySolutionsMember2023-07-012024-06-300000721371cah:OptumRxMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercah:PharmaceuticalAndSpecialtySolutionsMember2023-07-012024-06-300000721371cah:GroupPurchasingOrganizationsMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-07-012024-06-3000007213712024-04-012024-06-3000007213712024-06-3000007213712022-07-012023-06-3000007213712021-07-012022-06-3000007213712023-06-300000721371us-gaap:CommonStockMember2021-06-300000721371us-gaap:RetainedEarningsMember2021-06-300000721371us-gaap:TreasuryStockCommonMember2021-06-300000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-300000721371us-gaap:NoncontrollingInterestMember2021-06-3000007213712021-06-300000721371us-gaap:RetainedEarningsMember2021-07-012022-06-300000721371us-gaap:NoncontrollingInterestMember2021-07-012022-06-300000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-012022-06-300000721371us-gaap:CommonStockMember2021-07-012022-06-300000721371us-gaap:TreasuryStockCommonMember2021-07-012022-06-300000721371us-gaap:CommonStockMember2022-06-300000721371us-gaap:RetainedEarningsMember2022-06-300000721371us-gaap:TreasuryStockCommonMember2022-06-300000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300000721371us-gaap:NoncontrollingInterestMember2022-06-3000007213712022-06-300000721371us-gaap:RetainedEarningsMember2022-07-012023-06-300000721371us-gaap:NoncontrollingInterestMember2022-07-012023-06-300000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012023-06-300000721371us-gaap:CommonStockMember2022-07-012023-06-300000721371us-gaap:TreasuryStockCommonMember2022-07-012023-06-300000721371us-gaap:CommonStockMember2023-06-300000721371us-gaap:RetainedEarningsMember2023-06-300000721371us-gaap:TreasuryStockCommonMember2023-06-300000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000721371us-gaap:NoncontrollingInterestMember2023-06-300000721371us-gaap:RetainedEarningsMember2023-07-012024-06-300000721371us-gaap:NoncontrollingInterestMember2023-07-012024-06-300000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012024-06-300000721371us-gaap:CommonStockMember2023-07-012024-06-300000721371us-gaap:TreasuryStockCommonMember2023-07-012024-06-300000721371us-gaap:CommonStockMember2024-06-300000721371us-gaap:RetainedEarningsMember2024-06-300000721371us-gaap:TreasuryStockCommonMember2024-06-300000721371us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300000721371us-gaap:NoncontrollingInterestMember2024-06-300000721371srt:ScenarioPreviouslyReportedMember2022-07-012023-06-300000721371srt:RestatementAdjustmentMember2022-07-012023-06-300000721371srt:ScenarioPreviouslyReportedMember2021-07-012022-06-300000721371srt:RestatementAdjustmentMember2021-07-012022-06-300000721371srt:ScenarioPreviouslyReportedMember2023-06-300000721371srt:RestatementAdjustmentMember2023-06-300000721371srt:ScenarioPreviouslyReportedMemberus-gaap:CommonStockMember2021-06-300000721371srt:RestatementAdjustmentMemberus-gaap:CommonStockMember2021-06-300000721371srt:ScenarioPreviouslyReportedMemberus-gaap:RetainedEarningsMember2021-06-300000721371srt:RestatementAdjustmentMemberus-gaap:RetainedEarningsMember2021-06-300000721371srt:ScenarioPreviouslyReportedMemberus-gaap:TreasuryStockCommonMember2021-06-300000721371srt:RestatementAdjustmentMemberus-gaap:TreasuryStockCommonMember2021-06-300000721371srt:ScenarioPreviouslyReportedMember2021-06-300000721371srt:RestatementAdjustmentMember2021-06-300000721371srt:ScenarioPreviouslyReportedMemberus-gaap:CommonStockMember2021-07-012022-06-300000721371srt:RestatementAdjustmentMemberus-gaap:CommonStockMember2021-07-012022-06-300000721371srt:ScenarioPreviouslyReportedMemberus-gaap:RetainedEarningsMember2021-07-012022-06-300000721371srt:RestatementAdjustmentMemberus-gaap:RetainedEarningsMember2021-07-012022-06-300000721371srt:ScenarioPreviouslyReportedMemberus-gaap:TreasuryStockCommonMember2021-07-012022-06-300000721371srt:RestatementAdjustmentMemberus-gaap:TreasuryStockCommonMember2021-07-012022-06-300000721371srt:ScenarioPreviouslyReportedMemberus-gaap:CommonStockMember2022-06-300000721371srt:RestatementAdjustmentMemberus-gaap:CommonStockMember2022-06-300000721371srt:ScenarioPreviouslyReportedMemberus-gaap:RetainedEarningsMember2022-06-300000721371srt:RestatementAdjustmentMemberus-gaap:RetainedEarningsMember2022-06-300000721371srt:ScenarioPreviouslyReportedMemberus-gaap:TreasuryStockCommonMember2022-06-300000721371srt:RestatementAdjustmentMemberus-gaap:TreasuryStockCommonMember2022-06-300000721371srt:ScenarioPreviouslyReportedMember2022-06-300000721371srt:RestatementAdjustmentMember2022-06-300000721371srt:ScenarioPreviouslyReportedMemberus-gaap:CommonStockMember2022-07-012023-06-300000721371srt:RestatementAdjustmentMemberus-gaap:CommonStockMember2022-07-012023-06-300000721371srt:ScenarioPreviouslyReportedMemberus-gaap:RetainedEarningsMember2022-07-012023-06-300000721371srt:RestatementAdjustmentMemberus-gaap:RetainedEarningsMember2022-07-012023-06-300000721371srt:ScenarioPreviouslyReportedMemberus-gaap:TreasuryStockCommonMember2022-07-012023-06-300000721371srt:RestatementAdjustmentMemberus-gaap:TreasuryStockCommonMember2022-07-012023-06-300000721371srt:ScenarioPreviouslyReportedMemberus-gaap:CommonStockMember2023-06-300000721371srt:RestatementAdjustmentMemberus-gaap:CommonStockMember2023-06-300000721371srt:ScenarioPreviouslyReportedMemberus-gaap:RetainedEarningsMember2023-06-300000721371srt:RestatementAdjustmentMemberus-gaap:RetainedEarningsMember2023-06-300000721371srt:ScenarioPreviouslyReportedMemberus-gaap:TreasuryStockCommonMember2023-06-300000721371srt:RestatementAdjustmentMemberus-gaap:TreasuryStockCommonMember2023-06-300000721371us-gaap:AllowanceForCreditLossMember2024-06-300000721371us-gaap:AllowanceForCreditLossMember2023-06-300000721371srt:MinimumMember2023-07-012024-06-300000721371srt:MaximumMember2023-07-012024-06-300000721371us-gaap:AllowanceForLossesOnFinanceReceivablesMember2024-06-300000721371us-gaap:AllowanceForLossesOnFinanceReceivablesMember2023-06-300000721371cah:CVSHealthCorporationMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercah:PharmaceuticalAndSpecialtySolutionsMember2022-07-012023-06-300000721371cah:CVSHealthCorporationMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercah:PharmaceuticalAndSpecialtySolutionsMember2021-07-012022-06-300000721371cah:CVSHealthCorporationMembercah:PharmaceuticalAndSpecialtySolutionsMember2024-06-300000721371cah:CVSHealthCorporationMembercah:PharmaceuticalAndSpecialtySolutionsMember2023-06-300000721371cah:OptumRxMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercah:PharmaceuticalAndSpecialtySolutionsMember2022-07-012023-06-300000721371cah:OptumRxMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMembercah:PharmaceuticalAndSpecialtySolutionsMember2021-07-012022-06-300000721371cah:OptumRxMembercah:PharmaceuticalAndSpecialtySolutionsMember2024-06-300000721371cah:OptumRxMembercah:PharmaceuticalAndSpecialtySolutionsMember2023-06-300000721371cah:GroupPurchasingOrganizationsMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2022-07-012023-06-300000721371cah:GroupPurchasingOrganizationsMemberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2021-07-012022-06-300000721371cah:InventoryReserveExcessAndObsoleteMember2024-06-300000721371cah:InventoryReserveExcessAndObsoleteMember2023-06-300000721371srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2024-06-300000721371srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2024-06-300000721371srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2024-06-300000721371srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2024-06-300000721371srt:MinimumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-06-300000721371srt:MaximumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-06-300000721371srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2024-06-300000721371srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2024-06-300000721371us-gaap:LandBuildingsAndImprovementsMember2024-06-300000721371us-gaap:LandBuildingsAndImprovementsMember2023-06-300000721371us-gaap:MachineryAndEquipmentMember2024-06-300000721371us-gaap:MachineryAndEquipmentMember2023-06-300000721371us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2024-06-300000721371us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-06-300000721371us-gaap:FurnitureAndFixturesMember2024-06-300000721371us-gaap:FurnitureAndFixturesMember2023-06-300000721371us-gaap:ConstructionInProgressMember2024-06-300000721371us-gaap:ConstructionInProgressMember2023-06-300000721371srt:MinimumMember2024-06-300000721371srt:MaximumMember2024-06-300000721371cah:GMPDMember2023-07-012024-06-300000721371cah:GMPDMember2022-07-012023-06-300000721371cah:GMPDMember2021-07-012022-06-300000721371cah:TransactionDataSystemInvestmentMember2024-06-300000721371cah:TotalOpioidLitigationMember2021-07-012022-06-300000721371cah:ThirdPartyPayorsAcuteCareHospitalsAndCityOfBaltimoreMember2024-06-300000721371us-gaap:PerformanceSharesMembercah:August2021Member2023-07-012024-06-300000721371us-gaap:PerformanceSharesMembercah:August2022Member2023-07-012024-06-300000721371us-gaap:PerformanceSharesMembercah:September2023Member2023-07-012024-06-300000721371us-gaap:PerformanceSharesMembercah:August2023Member2023-07-012024-06-300000721371us-gaap:PerformanceSharesMembersrt:MinimumMember2023-07-012024-06-300000721371us-gaap:PerformanceSharesMembersrt:MaximumMember2023-07-012024-06-300000721371us-gaap:ShippingAndHandlingMember2023-07-012024-06-300000721371us-gaap:ShippingAndHandlingMember2022-07-012023-06-300000721371us-gaap:ShippingAndHandlingMember2021-07-012022-06-300000721371cah:SpecialtyNetworksMember2023-07-012024-06-300000721371cah:SpecialtyNetworksMemberus-gaap:CustomerRelationshipsMember2024-06-300000721371cah:SpecialtyNetworksMembercah:TrademarksAndPatentsMember2024-06-300000721371cah:SpecialtyNetworksMemberus-gaap:DevelopedTechnologyRightsMember2024-06-300000721371cah:SpecialtyNetworksMember2024-06-300000721371cah:OutcomesDivestitureMember2023-07-012024-06-300000721371us-gaap:FairValueInputsLevel3Membercah:TransactionDataSystemInvestmentMemberus-gaap:FairValueMeasurementsNonrecurringMember2023-07-100000721371cah:CordisDivestitureMember2021-08-022021-08-020000721371cah:CordisDivestitureMember2020-07-012021-06-300000721371us-gaap:EmployeeSeveranceMember2022-06-300000721371us-gaap:FacilityClosingMember2022-06-300000721371us-gaap:EmployeeSeveranceMember2022-07-012023-06-300000721371us-gaap:FacilityClosingMember2022-07-012023-06-300000721371us-gaap:EmployeeSeveranceMember2023-06-300000721371us-gaap:FacilityClosingMember2023-06-300000721371us-gaap:EmployeeSeveranceMember2023-07-012024-06-300000721371us-gaap:FacilityClosingMember2023-07-012024-06-300000721371us-gaap:EmployeeSeveranceMember2024-06-300000721371us-gaap:FacilityClosingMember2024-06-300000721371cah:PharmaceuticalAndSpecialtySolutionsMember2022-06-300000721371cah:GMPDMember2022-06-300000721371us-gaap:AllOtherSegmentsMember2022-06-300000721371cah:PharmaceuticalAndSpecialtySolutionsMember2022-07-012023-06-300000721371us-gaap:AllOtherSegmentsMember2022-07-012023-06-300000721371cah:PharmaceuticalAndSpecialtySolutionsMember2023-06-300000721371cah:GMPDMember2023-06-300000721371us-gaap:AllOtherSegmentsMember2023-06-300000721371cah:PharmaceuticalAndSpecialtySolutionsMember2023-07-012024-06-300000721371us-gaap:AllOtherSegmentsMember2023-07-012024-06-300000721371cah:PharmaceuticalAndSpecialtySolutionsMember2024-06-300000721371cah:GMPDMember2024-06-300000721371us-gaap:AllOtherSegmentsMember2024-06-300000721371cah:OptiFreightLogisticsMember2024-06-300000721371cah:GMPDMember2024-01-010000721371cah:OptiFreightLogisticsMemberus-gaap:AllOtherSegmentsMember2024-01-010000721371cah:GMPDMember2024-01-012024-03-310000721371cah:GMPDMember2024-03-310000721371cah:GMPDMember2023-07-012023-09-300000721371cah:OutcomesDivestitureMembercah:PharmaceuticalAndSpecialtySolutionsMember2023-06-300000721371cah:IPRDTrademarksandOtherMember2024-06-300000721371us-gaap:CustomerRelationshipsMember2024-06-300000721371cah:TrademarksAndPatentsMember2024-06-300000721371us-gaap:DevelopedTechnologyRightsMember2024-06-300000721371cah:IPRDTrademarksandOtherMember2023-06-300000721371us-gaap:CustomerRelationshipsMember2023-06-300000721371cah:TrademarksAndPatentsMember2023-06-300000721371us-gaap:DevelopedTechnologyRightsMember2023-06-300000721371cah:OperatingLeaseMember2024-06-300000721371cah:FinanceLeaseMember2024-06-300000721371cah:A3.079Notesdue2024Member2024-06-300000721371cah:A3.079Notesdue2024Member2023-06-300000721371cah:A3.5Notesdue2025Member2024-06-300000721371cah:A3.5Notesdue2025Member2023-06-300000721371cah:A3.75Notesdue2026Member2024-06-300000721371cah:A3.75Notesdue2026Member2023-06-300000721371cah:A3.41Notesdue2027Member2024-06-300000721371cah:A3.41Notesdue2027Member2023-06-300000721371cah:A5.125NotesDue2029Member2024-06-300000721371cah:A5.125NotesDue2029Member2023-06-300000721371cah:A5.45NotesDue2034Member2024-06-300000721371cah:A5.45NotesDue2034Member2023-06-300000721371cah:A4.6Notesdue2043Member2024-06-300000721371cah:A4.6Notesdue2043Member2023-06-300000721371cah:A4.5Notesdue2044Member2024-06-300000721371cah:A4.5Notesdue2044Member2023-06-300000721371cah:A4.9Notesdue2045Member2024-06-300000721371cah:A4.9Notesdue2045Member2023-06-300000721371cah:A4.368Notesdue2047Member2024-06-300000721371cah:A4.368Notesdue2047Member2023-06-300000721371cah:A7.0Debenturesduefiscal2027Member2024-06-300000721371cah:A7.0Debenturesduefiscal2027Member2023-06-300000721371cah:A3.079Notesdue2024Member2023-07-012024-06-300000721371cah:A5.125NotesDue2029Member2023-07-012024-06-300000721371cah:A5.45NotesDue2034Member2023-07-012024-06-300000721371cah:A3.2Notesdue2023Member2022-07-012023-06-300000721371cah:A2.616Notesdue2022Member2021-07-012022-06-300000721371cah:FloatingRateNotesdue2022Member2021-07-012022-06-300000721371us-gaap:CommercialPaperMember2024-06-300000721371us-gaap:RevolvingCreditFacilityMember2024-06-300000721371cah:CommittedReceivablesSalesFacilityProgramMembercah:ShortTermCreditFacilitiesMember2024-06-300000721371us-gaap:LetterOfCreditMember2024-06-300000721371us-gaap:LetterOfCreditMember2023-06-300000721371cah:CommittedReceivablesSalesFacilityProgramMember2023-07-012024-06-300000721371cah:CommittedReceivablesSalesFacilityProgramMember2024-06-300000721371cah:CommittedReceivablesSalesFacilityProgramMemberus-gaap:LetterOfCreditMember2024-06-300000721371cah:CommittedReceivablesSalesFacilityProgramMemberus-gaap:LetterOfCreditMember2023-06-300000721371us-gaap:CommercialPaperMember2023-06-300000721371cah:CVSHealthCorporationMember2014-07-312014-07-310000721371cah:NewYorkOpioidStewardshipActMember2018-04-300000721371cah:NewYorkOpioidStewardshipActMember2021-06-300000721371cah:NewYorkOpioidStewardshipActMember2021-10-012021-12-310000721371cah:NewYorkOpioidStewardshipActMember2022-06-300000721371cah:NewYorkOpioidStewardshipActMember2022-07-012023-06-300000721371cah:NewYorkOpioidStewardshipActMember2023-06-300000721371cah:PharmaceuticalAndSpecialtySolutionsMember2021-10-012021-12-310000721371cah:TotalOpioidLitigationMember2024-06-300000721371cah:TotalOpioidLitigationMember2023-07-012024-06-300000721371cah:OpioidLawsuitsMember2022-06-300000721371cah:OpioidLawsuitsMember2024-06-300000721371cah:OpioidLawsuitsMemberstpr:AL2023-11-300000721371cah:OpioidLawsuitsMemberstpr:AL2023-07-012024-06-300000721371cah:OpioidLawsuitsMemberus-gaap:SubsequentEventMember2021-07-012024-07-310000721371cah:OpioidLawsuitsMemberus-gaap:SubsequentEventMember2023-08-012038-06-300000721371cah:OpioidLawsuitsMemberstpr:WV2022-07-310000721371cah:OpioidLawsuitsMembernaics:ZZ9211502022-10-310000721371cah:OpioidLawsuitsMember2024-01-012024-03-310000721371cah:TotalOpioidLitigationMember2024-01-012024-03-310000721371cah:OpioidLawsuitsMembercah:PrivatePartiesMemberus-gaap:SubsequentEventMember2024-08-080000721371cah:ClassActionLawsuitsMembercah:OpioidLawsuitsMembercah:PrivatePartiesMemberus-gaap:SubsequentEventMember2024-08-080000721371cah:ClassActionLawsuitsMembercah:OpioidLawsuitsMembercah:PrivatePartiesMember2024-06-300000721371stpr:GAcah:OpioidLawsuitsMembercah:PrivatePartiesMember2023-01-012023-03-310000721371cah:OpioidLawsuitsMember2023-07-012024-06-300000721371cah:ProductLiabilityLawsuitsMembercah:IVCApril2023AgreementMember2023-04-302023-04-300000721371cah:ProductLiabilityLawsuitsMembercah:IVCApril2023AgreementMember2023-04-300000721371cah:ProductLiabilityLawsuitsMembercah:IVCApril2023AgreementMember2023-05-012023-09-300000721371cah:ProductLiabilityLawsuitsMember2022-07-012023-06-300000721371cah:ProductLiabilityLawsuitsMembersrt:MinimumMember2024-06-300000721371cah:GMPDMember2023-07-012024-06-300000721371cah:GMPDMember2022-07-012023-06-300000721371cah:GMPDMember2021-07-012022-06-300000721371us-gaap:InternalRevenueServiceIRSMember2024-06-300000721371us-gaap:StateAndLocalJurisdictionMember2024-06-300000721371us-gaap:ForeignCountryMember2024-06-300000721371us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300000721371us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300000721371us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-06-300000721371us-gaap:FairValueMeasurementsRecurringMember2024-06-300000721371us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300000721371us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300000721371us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-06-300000721371us-gaap:FairValueMeasurementsRecurringMember2023-06-300000721371us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:FairValueHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-06-300000721371us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:FairValueHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-06-300000721371us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:FairValueHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMember2024-06-300000721371us-gaap:CrossCurrencyInterestRateContractMemberus-gaap:FairValueHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMember2023-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMember2024-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMember2023-06-300000721371us-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMember2024-06-300000721371us-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMember2023-06-300000721371us-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300000721371us-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-06-300000721371us-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-06-300000721371us-gaap:FairValueHedgingMember2023-07-012024-06-300000721371us-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2024-06-300000721371us-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2023-06-300000721371us-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2023-07-012024-06-300000721371us-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2022-07-012023-06-300000721371us-gaap:InterestRateSwapMemberus-gaap:FairValueHedgingMember2021-07-012022-06-300000721371cah:FixedRateDebtMemberus-gaap:FairValueHedgingMember2023-07-012024-06-300000721371cah:FixedRateDebtMemberus-gaap:FairValueHedgingMember2022-07-012023-06-300000721371cah:FixedRateDebtMemberus-gaap:FairValueHedgingMember2021-07-012022-06-300000721371us-gaap:CashFlowHedgingMember2023-07-012024-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2024-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2023-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2023-07-012024-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2022-07-012023-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMember2021-07-012022-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:SalesMember2023-07-012024-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:SalesMember2022-07-012023-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:SalesMember2021-07-012022-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:CostOfSalesMember2023-07-012024-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:CostOfSalesMember2022-07-012023-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:CostOfSalesMember2021-07-012022-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2023-07-012024-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2022-07-012023-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:CashFlowHedgingMemberus-gaap:SellingGeneralAndAdministrativeExpensesMember2021-07-012022-06-300000721371us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMember2023-07-012024-06-300000721371us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMember2022-07-012023-06-300000721371us-gaap:ForwardContractsMemberus-gaap:CashFlowHedgingMember2021-07-012022-06-300000721371us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-07-012024-06-300000721371us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-07-012022-06-300000721371us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-07-012023-06-300000721371us-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMembercah:June2027Member2024-06-300000721371cah:June2027Member2023-07-012024-06-300000721371cah:September2025Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300000721371cah:June2027Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2024-06-300000721371us-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMembercah:January2023Member2024-06-300000721371cah:January2023Member2023-07-012024-06-300000721371cah:September2025Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-06-300000721371cah:June2027Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-06-300000721371cah:March2025Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-06-300000721371cah:March2026Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-06-300000721371us-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMembercah:March2022Member2023-06-300000721371us-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMembercah:September2018Member2023-06-300000721371cah:March2022Member2023-04-012023-06-300000721371cah:September2018Member2023-04-012023-06-300000721371cah:September2025Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-06-300000721371cah:June2027Memberus-gaap:CurrencySwapMemberus-gaap:NetInvestmentHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-06-300000721371us-gaap:CurrencySwapMember2022-06-300000721371us-gaap:ForeignExchangeContractMember2023-07-012024-06-300000721371us-gaap:ForeignExchangeContractMember2022-07-012023-06-300000721371us-gaap:NondesignatedMember2023-07-012024-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2024-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2023-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2023-07-012024-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2022-07-012023-06-300000721371us-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMemberus-gaap:OtherNonoperatingIncomeExpenseMember2021-07-012022-06-300000721371us-gaap:FairValueInputsLevel2Member2024-06-300000721371us-gaap:FairValueInputsLevel2Member2023-06-300000721371us-gaap:CurrencySwapMemberus-gaap:CashFlowHedgingMember2024-06-300000721371us-gaap:CurrencySwapMemberus-gaap:CashFlowHedgingMember2023-06-300000721371us-gaap:CommonClassAMember2024-06-300000721371us-gaap:CommonClassAMember2023-06-300000721371us-gaap:CommonClassBMember2024-06-300000721371us-gaap:CommonClassBMember2023-06-300000721371us-gaap:CommonClassAMember2023-07-012024-06-300000721371us-gaap:TreasuryStockCommonMember2020-07-012023-06-300000721371cah:A500MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2023-07-012023-09-300000721371cah:A500MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2023-07-012024-06-300000721371cah:A250MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2023-07-012024-06-300000721371cah:A1BillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2023-07-012024-06-300000721371cah:A1BillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2022-07-012023-06-300000721371cah:A250MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2022-07-012023-06-300000721371cah:Second250MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2022-07-012023-06-300000721371cah:A500MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2022-07-012023-06-300000721371cah:A500MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2021-07-012022-06-300000721371cah:A300MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2021-07-012022-06-300000721371cah:A200MillionShareRepurchaseProgramMemberus-gaap:TreasuryStockCommonMember2021-07-012022-06-300000721371us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-06-300000721371us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2022-06-300000721371us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2022-07-012023-06-300000721371us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2022-07-012023-06-300000721371us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-06-300000721371us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2023-06-300000721371us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2023-07-012024-06-300000721371us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2023-07-012024-06-300000721371us-gaap:AccumulatedForeignCurrencyAdjustmentIncludingPortionAttributableToNoncontrollingInterestMember2024-06-300000721371us-gaap:AccumulatedNetGainLossFromCashFlowHedgesIncludingPortionAttributableToNoncontrollingInterestMember2024-06-300000721371us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2024-06-300000721371us-gaap:OperatingSegmentsMembercah:PharmaceuticalAndSpecialtySolutionsMember2023-07-012024-06-300000721371us-gaap:OperatingSegmentsMembercah:PharmaceuticalAndSpecialtySolutionsMember2022-07-012023-06-300000721371us-gaap:OperatingSegmentsMembercah:PharmaceuticalAndSpecialtySolutionsMember2021-07-012022-06-300000721371us-gaap:OperatingSegmentsMembercah:GMPDMember2023-07-012024-06-300000721371us-gaap:OperatingSegmentsMembercah:GMPDMember2022-07-012023-06-300000721371us-gaap:OperatingSegmentsMembercah:GMPDMember2021-07-012022-06-300000721371us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2023-07-012024-06-300000721371us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2022-07-012023-06-300000721371us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2021-07-012022-06-300000721371us-gaap:OperatingSegmentsMember2023-07-012024-06-300000721371us-gaap:OperatingSegmentsMember2022-07-012023-06-300000721371us-gaap:OperatingSegmentsMember2021-07-012022-06-300000721371us-gaap:CorporateNonSegmentMember2023-07-012024-06-300000721371us-gaap:CorporateNonSegmentMember2022-07-012023-06-300000721371us-gaap:CorporateNonSegmentMember2021-07-012022-06-300000721371us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMembercah:NuclearAndPrecisionHealthSolutionsMember2023-07-012024-06-300000721371us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMembercah:NuclearAndPrecisionHealthSolutionsMember2022-07-012023-06-300000721371us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMembercah:NuclearAndPrecisionHealthSolutionsMember2021-07-012022-06-300000721371us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMembercah:AtHomeSolutionsMember2023-07-012024-06-300000721371us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMembercah:AtHomeSolutionsMember2022-07-012023-06-300000721371us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMembercah:AtHomeSolutionsMember2021-07-012022-06-300000721371us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMembercah:OptiFreightLogisticsMember2023-07-012024-06-300000721371us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMembercah:OptiFreightLogisticsMember2022-07-012023-06-300000721371us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMembercah:OptiFreightLogisticsMember2021-07-012022-06-300000721371country:US2023-07-012024-06-300000721371country:US2022-07-012023-06-300000721371country:US2021-07-012022-06-300000721371us-gaap:NonUsMember2023-07-012024-06-300000721371us-gaap:NonUsMember2022-07-012023-06-300000721371us-gaap:NonUsMember2021-07-012022-06-300000721371us-gaap:OperatingSegmentsMembercah:PharmaceuticalAndSpecialtySolutionsMember2024-06-300000721371us-gaap:OperatingSegmentsMembercah:PharmaceuticalAndSpecialtySolutionsMember2023-06-300000721371us-gaap:OperatingSegmentsMembercah:GMPDMember2024-06-300000721371us-gaap:OperatingSegmentsMembercah:GMPDMember2023-06-300000721371us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2024-06-300000721371us-gaap:OperatingSegmentsMemberus-gaap:AllOtherSegmentsMember2023-06-300000721371us-gaap:CorporateNonSegmentMember2024-06-300000721371us-gaap:CorporateNonSegmentMember2023-06-300000721371country:US2024-06-300000721371country:US2023-06-300000721371us-gaap:NonUsMember2024-06-300000721371us-gaap:NonUsMember2023-06-300000721371cah:A2021LTIPMember2024-06-300000721371cah:AwardsOtherThanStockOptionsMembercah:A2021LTIPMember2024-06-300000721371us-gaap:EmployeeStockOptionMembercah:A2021LTIPMember2024-06-300000721371us-gaap:EmployeeStockOptionMember2021-07-012022-06-300000721371us-gaap:EmployeeStockOptionMember2022-07-012023-06-300000721371us-gaap:EmployeeStockOptionMember2023-07-012024-06-300000721371us-gaap:RestrictedStockUnitsRSUMember2023-07-012024-06-300000721371us-gaap:RestrictedStockUnitsRSUMember2022-07-012023-06-300000721371us-gaap:RestrictedStockUnitsRSUMember2021-07-012022-06-300000721371us-gaap:PerformanceSharesMember2023-07-012024-06-300000721371us-gaap:PerformanceSharesMember2022-07-012023-06-300000721371us-gaap:PerformanceSharesMember2021-07-012022-06-300000721371us-gaap:RestrictedStockUnitsRSUMember2022-06-300000721371us-gaap:RestrictedStockUnitsRSUMember2023-06-300000721371us-gaap:RestrictedStockUnitsRSUMember2024-06-300000721371us-gaap:PerformanceSharesMember2022-06-300000721371us-gaap:PerformanceSharesMember2023-06-300000721371us-gaap:PerformanceSharesMember2024-06-3000007213712022-07-012023-03-3100007213712023-07-012024-03-310000721371srt:ScenarioPreviouslyReportedMember2023-07-012023-09-300000721371srt:RestatementAdjustmentMember2023-07-012023-09-3000007213712023-07-012023-09-300000721371srt:ScenarioPreviouslyReportedMember2023-10-012023-12-310000721371srt:RestatementAdjustmentMember2023-10-012023-12-3100007213712023-10-012023-12-310000721371srt:ScenarioPreviouslyReportedMember2024-01-012024-03-310000721371srt:RestatementAdjustmentMember2024-01-012024-03-3100007213712024-01-012024-03-310000721371srt:ScenarioPreviouslyReportedMember2022-07-012022-09-300000721371srt:RestatementAdjustmentMember2022-07-012022-09-3000007213712022-07-012022-09-300000721371srt:ScenarioPreviouslyReportedMember2022-10-012022-12-310000721371srt:RestatementAdjustmentMember2022-10-012022-12-3100007213712022-10-012022-12-310000721371srt:ScenarioPreviouslyReportedMember2023-01-012023-03-310000721371srt:RestatementAdjustmentMember2023-01-012023-03-3100007213712023-01-012023-03-310000721371us-gaap:AllowanceForCreditLossMember2023-07-012024-06-300000721371us-gaap:AllowanceForLossesOnFinanceReceivablesMember2023-07-012024-06-300000721371us-gaap:SalesReturnsAndAllowancesMember2023-06-300000721371us-gaap:SalesReturnsAndAllowancesMember2023-07-012024-06-300000721371us-gaap:SalesReturnsAndAllowancesMember2024-06-300000721371us-gaap:AllowanceForCreditLossMember2022-06-300000721371us-gaap:AllowanceForCreditLossMember2022-07-012023-06-300000721371us-gaap:AllowanceForLossesOnFinanceReceivablesMember2022-06-300000721371us-gaap:AllowanceForLossesOnFinanceReceivablesMember2022-07-012023-06-300000721371us-gaap:SalesReturnsAndAllowancesMember2022-06-300000721371us-gaap:SalesReturnsAndAllowancesMember2022-07-012023-06-300000721371us-gaap:AllowanceForCreditLossMember2021-06-300000721371us-gaap:AllowanceForCreditLossMember2021-07-012022-06-300000721371us-gaap:AllowanceForLossesOnFinanceReceivablesMember2021-06-300000721371us-gaap:AllowanceForLossesOnFinanceReceivablesMember2021-07-012022-06-300000721371us-gaap:SalesReturnsAndAllowancesMember2021-06-300000721371us-gaap:SalesReturnsAndAllowancesMember2021-07-012022-06-300000721371cah:PricingDisputesMember2023-07-012024-06-300000721371cah:PricingDisputesMember2022-07-012023-06-300000721371us-gaap:DisputesMember2021-07-012022-06-300000721371cah:PriorYearRecoveriesMember2021-07-012022-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2024

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission File Number: 1-11373

Cardinal Health, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

| Ohio | | | | | | 31-0958666 |

(State or other jurisdiction of

incorporation or organization) | | (IRS Employer

Identification No.) |

| | | | | | |

| 7000 Cardinal Place | | Dublin | , | Ohio | | 43017 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | | |

| | | | (614) | | 757-5000 |

| (Registrant’s telephone number, including area code) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common shares (without par value) | CAH | New York Stock Exchange |

| | |

| Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | þ | | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ | |

| | | Emerging growth company | ☐ | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

|

| þ | | | | | |

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. þ |

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The aggregate market value of voting stock held by non-affiliates on December 31, 2023, was the following: $24,413,491,673.

The number of the registrant’s common shares, without par value, outstanding as of July 31, 2024, was the following: 243,845,343.

Documents Incorporated by Reference:

Portions of the registrant’s Definitive Proxy Statement to be filed for its 2024 Annual Meeting of Shareholders are incorporated by reference into the sections of this Form 10-K addressing the requirements of Part III of Form 10-K.

| | |

Cardinal Health Fiscal 2024 Form 10-K |

Table of Contents

| | | | | | | | |

1 | Cardinal Health | Fiscal 2024 Form 10-K | |

Introduction

References to Cardinal Health and Fiscal Years

As used in this report, "we," "our," "us," "Cardinal Health" and similar pronouns refer to Cardinal Health, Inc. and its majority-owned and consolidated subsidiaries, unless the context requires otherwise. Our fiscal year ends on June 30. References to fiscal 2025, 2024, 2023, 2022, 2021 and 2020 are to the fiscal years ended June 30, 2025, 2024, 2023, 2022, 2021 and 2020, respectively. Except as otherwise specified, information in this report is provided as of June 30, 2024.

Non-GAAP Financial Measures

In this report, we use financial measures that are derived from consolidated financial data but are not presented in our financial statements that are prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). These measures are considered “non-GAAP financial measures” under the Securities and Exchange Commission (“SEC”) rules. The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are included in the “Explanation and Reconciliation of Non-GAAP Financial Measures” section following MD&A in this report.

Management's Discussion and Analysis ("MD&A") of Financial Condition and Results of Operations

Our MD&A within this Form 10-K generally discusses fiscal 2024 and fiscal 2023 items and year-over-year comparisons between fiscal 2024 and fiscal 2023. This Form 10-K also includes fiscal 2022 items and discussions of year-over-year comparisons between fiscal 2023 and fiscal 2022. The periods discussed in this Form 10-K have been revised herein to correct an error identified during the preparation of this Form 10-K, as well as to correct other unrelated immaterial errors. The revisions ensure comparability across all periods reflected herein. Please refer to Note 1 of the “Notes to the Consolidated Financial Statements” for additional information about these corrections. Important Information Regarding Forward-Looking Statements

This report (including information incorporated by reference) includes forward-looking statements addressing expectations, prospects, estimates and other matters that are dependent upon future events or developments. Many forward-looking statements appear in MD&A and Risk Factors, but there are others throughout this report, which may be identified by words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “will,” “should,” “could,” “would,” “project,” “continue,” “likely,” and similar expressions, and include statements reflecting future results or guidance, statements of outlook and expense accruals. These matters are subject to risks and uncertainties that could cause actual results to differ materially from those projected, anticipated or implied. The most significant of these risks and uncertainties are described in “Risk Factors” in this report and in Exhibit 99.1 to the Form 10-K included in this report. Forward-looking statements in this report speak only as of the date of this document. Except to the extent required by applicable law, we undertake no obligation to update or revise any forward-looking statement.

Available Information

Our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports are available free of charge on our website (www.cardinalhealth.com), under the “Investor Relations — Financial Reporting — SEC Filings” caption, as soon as reasonably practicable after we electronically file them with, or furnish them to, the SEC. The SEC also maintains a website (www.sec.gov) where you can search for annual, quarterly and current reports, proxy and information statements and other information regarding us and other public companies.

| | | | | | | | |

| Cardinal Health | Fiscal 2024 Form 10-K | 2 |

Management's Discussion and Analysis of Financial Condition and Results of Operations

About Cardinal Health

Cardinal Health, Inc., an Ohio corporation formed in 1979, is a global healthcare services and products company providing customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, physician offices and patients in the home. We provide pharmaceuticals and medical products and cost-effective solutions that enhance supply chain efficiency. We connect patients, providers, payers, pharmacists and manufacturers for integrated care coordination.

Effective January 1, 2024, we began operating under an updated organizational structure and re-aligned our financial reporting structure under two reportable segments: Pharmaceutical and Specialty Solutions ("Pharma") segment and Global Medical Products and Distribution ("GMPD") segment. All remaining operating segments that are not significant enough to require separate reportable segment disclosures are included in Other, which is comprised of Nuclear and Precision Health Solutions, at-Home Solutions and OptiFreight® Logistics.

Pharmaceutical and Specialty Solutions Segment

Our Pharmaceutical and Specialty Solutions segment distributes branded and generic pharmaceutical, specialty pharmaceutical and over-the-counter healthcare and consumer products in the United States. This segment also provides services to pharmaceutical manufacturers and healthcare providers for specialty pharmaceutical products; provides pharmacy management services to hospitals and operates a limited number of pharmacies, including pharmacies in community health centers; and repackages generic pharmaceuticals and over-the-counter healthcare products.

Global Medical Products and Distribution Segment

Our GMPD segment manufactures, sources and distributes Cardinal Health brand medical, surgical and laboratory products, which are sold in the United States, Canada, Europe, Asia and other markets. In addition to distributing Cardinal Health brand products, this segment also distributes a broad range of medical, surgical and laboratory products known as national brand products to hospitals, ambulatory surgery centers, clinical laboratories and other healthcare providers in the United States and Canada.

| | | | | | | | |

| Cardinal Health | Fiscal 2024 Form 10-K | 3 |

Consolidated Results

In connection with the preparation of our Consolidated Financial Statements for fiscal 2024, we identified an accounting error related to revenue recognition from third party payors within the at-Home Solutions operating segment. We evaluated the materiality of the error and determined that the impacts were not material, individually or in the aggregate, to our previously issued Consolidated Financial Statements for any of the prior quarters or annual periods in which they occurred. In this report, we present revised prior period financial statements to correct this error, as well as other unrelated immaterial errors, including an adjustment to an uncertain tax position. These other immaterial errors were previously corrected in the periods they were identified; however, they are now reflected in the periods they originated. The revisions ensure comparability across all periods reflected herein. Refer to Note 1 of the "Notes to Consolidated Financial Statements" for additional information regarding the immaterial corrections to our results of prior periods.

Overview

Revenue

Revenue increased 11 percent to $226.8 billion for fiscal 2024 and 13 percent to $205.0 billion for fiscal 2023 compared to their respective prior-year periods, primarily due to branded and specialty pharmaceutical sales growth from existing customers.

GAAP and Non-GAAP Operating Earnings/(Loss)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP and Non-GAAP Operating Earnings/(Loss) | | Change |

| (in millions) | 2024 | | 2023 | | 2022 | | 2024 | | 2023 |

GAAP operating earnings/(loss) | $ | 1,243 | | | $ | 752 | | | $ | (607) | | | 65 | % | | N.M. |

| | | | | | | | | |

| | | | | | | | | |

| State opioid assessment related to prior fiscal years | — | | | (6) | | | — | | | | | |

| Shareholder cooperation agreement costs | 1 | | | 8 | | | — | | | | | |

| Restructuring and employee severance | 175 | | | 95 | | | 101 | | | | | |

| Amortization and other acquisition-related costs | 284 | | | 285 | | | 324 | | | | | |

| Impairments and (gain)/loss on disposal of assets, net | 634 | | | 1,246 | | | 2,060 | | | | | |

| Litigation (recoveries)/charges, net | 78 | | | (304) | | | 94 | | | | | |

| Non-GAAP operating earnings | $ | 2,414 | | | $ | 2,076 | | | $ | 1,973 | | | 16 | % | | 5 | % |

The sum of the components and certain computations may reflect rounding adjustments.

We had GAAP operating earnings of $1.2 billion and $752 million during fiscal 2024 and 2023, respectively, which included $675 million and $1.2 billion pre-tax non-cash goodwill impairment charges related to the GMPD segment. See the "Critical Accounting Policies and Sensitive Accounting Estimates" section of this MD&A and Note 5 of the "Notes to Consolidated Financial Statements" for additional detail. GAAP operating earnings during fiscal 2023 were favorably impacted by litigation recoveries as described further in the "Results of Operations" section of this MD&A and Note 8 of the "Notes to Consolidated Financial Statements." We had a GAAP operating loss of $607 million during fiscal 2022, which included $2.1 billion pre-tax non-cash goodwill impairment charges related to the GMPD segment. See the "Critical Accounting Policies and Sensitive Accounting Estimates" section of this MD&A and Note 5 of the "Notes to Consolidated Financial Statements" for additional detail. GAAP and Non-GAAP operating earnings increased during fiscal 2024, driven by increases in GMPD and Pharmaceutical and Specialty Solutions segment profit as described further in the "Results of Operations" section of this MD&A.

Non-GAAP operating earnings increased during fiscal 2023, driven by an increase in Pharmaceutical and Specialty Solutions segment profit, partially offset by a decrease in GMPD segment profit as described further in the "Results of Operations" section of this MD&A.

| | | | | | | | |

4 | Cardinal Health | Fiscal 2024 Form 10-K | |

GAAP and Non-GAAP Diluted EPS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP and Non-GAAP diluted EPS | | Change |

| ($ per share) | 2024 (2) | | 2023 (2) | | 2022 (2)(3) | | 2024 | | 2023 |

GAAP diluted EPS (1) | $ | 3.45 | | | $ | 1.26 | | | $ | (3.37) | | | N.M. | | N.M. |

| | | | | | | | | |

| | | | | | | | | |

| State opioid assessment related to prior fiscal years | — | | | (0.02) | | | — | | | | | |

| Shareholder cooperation agreement costs | — | | | 0.02 | | | — | | | | | |

| Restructuring and employee severance | 0.54 | | | 0.28 | | | 0.27 | | | | | |

| Amortization and other acquisition-related costs | 0.85 | | | 0.80 | | | 0.87 | | | | | |

Impairments and (gain)/loss on disposal of assets, net (4) | 2.38 | | | 4.35 | | | 7.03 | | | | | |

| Litigation (recoveries)/charges, net | 0.30 | | | (0.84) | | | 0.28 | | | | | |

| Loss on early extinguishment of debt | — | | | — | | | 0.03 | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Non-GAAP diluted EPS (1) | $ | 7.53 | | | $ | 5.85 | | | $ | 5.07 | | | 29 | % | | 15 | % |

The sum of the components and certain computations may reflect rounding adjustments.

(1)Diluted earnings/(loss) per share attributable to Cardinal Health, Inc. ("diluted EPS" or "diluted loss per share").

(2)The reconciling items are presented within this table net of tax. See quantification of tax effect of each reconciling item in our GAAP to Non-GAAP Reconciliations in the section titled "Explanation and Reconciliation of Non-GAAP Financial Measures."

(3)For fiscal 2022, GAAP diluted loss per share attributable to Cardinal Health, Inc. and the EPS impact from the GAAP to non-GAAP per share reconciling items are calculated using a weighted average of 279 million common shares, which excludes potentially dilutive securities from the denominator due to their anti-dilutive effects resulting from our GAAP net loss for the period. Fiscal 2022 non-GAAP diluted EPS is calculated using a weighted average of 280 million common shares, which includes potentially dilutive shares.

(4)For fiscal 2024, 2023 and 2022, impairments and (gain)/loss on disposals of assets, net includes pre-tax goodwill impairment charges of $675 million, $1.2 billion and $2.1 billion related to the GMPD segment, respectively. For fiscal 2024, 2023 and 2022, the net tax benefit related to these charges was $58 million, $92 million and $140 million, respectively, and were included in the annual effective tax rate.

The increases in fiscal 2024 and 2023 GAAP diluted EPS were primarily due to the factors impacting GAAP operating earnings. During fiscal 2024, 2023 and 2022, GAAP diluted EPS was adversely impacted by the goodwill impairment charges related to the GMPD segment, which had $(2.50), $(4.33) and $(6.97) per share after-tax impacts, respectively. See the "Critical Accounting Policies and Sensitive Accounting Estimates" section of this MD&A and Note 5 and Note 9 of the "Notes to Consolidated Financial Statements" for additional detail. During fiscal 2024, non-GAAP diluted EPS increased 29 percent to $7.53 due to the factors impacting non-GAAP operating earnings described above and a lower share count.

During fiscal 2023, non-GAAP diluted EPS increased 15 percent to $5.85 due to a lower share count, the factors impacting non-GAAP operating earnings described above and lower interest expense, net.

Cash and Equivalents

Our cash and equivalents balance was $5.1 billion at June 30, 2024 compared to $4.1 billion at June 30, 2023. During fiscal 2024, net cash provided by operating activities was $3.8 billion, which includes the impact of our annual payment of $378 million and prepayments of $239 million primarily related to the agreement to settle the vast majority of the opioid lawsuits filed by states and local governmental entities (the "National Opioid Settlement Agreement"). During fiscal 2024, we issued additional long-term debt and received net proceeds of $1.14 billion, of which $200 million is invested in short-term time deposits with initial effective maturities of more than three months and classified as prepaid expenses and other in our consolidated balance sheet as of June 30, 2024. In addition, during fiscal 2024 we deployed $1.2 billion for the Specialty Networks acquisition, $783 million for debt repayments, $750 million for share repurchases, $511 million for capital expenditures and $499 million for cash dividends.

Our cash and equivalents balance was $4.1 billion at June 30, 2023 compared to $4.7 billion at June 30, 2022. During fiscal 2023, net cash provided by operating activities was $2.8 billion, which was offset by $2.0 billion for share repurchases, $579 million for debt repayments, $525 million for cash dividends and $481 million for capital expenditures.

| | | | | | | | |

| Cardinal Health | Fiscal 2024 Form 10-K | 5 |

Significant Developments in Fiscal 2024 and Trends

Operating and Segment Reporting Structure Changes Effective January 1, 2024, we began operating under an updated organizational structure and re-aligned our financial reporting structure under two reportable segments: Pharmaceutical and Specialty Solutions segment and GMPD segment. All remaining operating segments that are not significant enough to require separate reportable segment disclosures are included in Other. The following indicates the changes from the second quarter of fiscal 2024 to the new reporting structure:

•Pharmaceutical and Specialty Solutions segment: This reportable segment is comprised of all businesses formerly within our Pharmaceutical segment except Nuclear and Precision Health Solutions.

•GMPD segment: This reportable segment is comprised of all businesses formerly within our Medical segment except at-Home Solutions and OptiFreight® Logistics.

•Other: This is comprised of the remaining operating segments, Nuclear and Precision Health Solutions, at-Home Solutions and OptiFreight® Logistics.

Our previously reported segment results have been recast to conform to our new reporting structure and reflect changes in the elimination of inter-segment revenue and allocated corporate technology and shared function expenses, which are driven by the reporting structure change.

Pharmaceutical and Specialty Solutions Segment OptumRx Contracts

On April 22, 2024, we announced that our pharmaceutical distribution contracts with OptumRx would expire at the end of June 2024. Sales to OptumRx generated 17 percent of our consolidated revenue in fiscal 2024; however, due to the class of trade, sales to OptumRx generated a meaningfully lower operating margin than the overall Pharmaceutical and Specialty Solutions segment. We expect the expiration of the OptumRx contracts to adversely impact our results of operations, including segment profit, financial condition and cash flows in fiscal 2025. In particular, we expect the unwinding of the negative net working capital associated with the contract to negatively impact operating cash flow in fiscal 2025.

Specialty Networks Acquisition

On March 18, 2024, we completed the acquisition of Specialty Networks for a purchase price of $1.2 billion in cash, subject to certain adjustments. Specialty Networks creates clinical and economic value for independent specialty providers and partners across multiple specialty group purchasing organizations ("GPOs"): UroGPO, Gastrologix and GastroGPO, and United Rheumatology. Specialty Networks’ PPS Analytics platform analyzes data from electronic medical records, practice management, imaging, and dispensing systems and transforms it into meaningful and actionable insights for providers and other stakeholders by using artificial intelligence and modern data analytics capabilities. The acquisition further expands our offerings in key therapeutic areas, accelerates our upstream data and research opportunities with biopharma manufacturers, and creates a platform for our expansion across therapeutic areas. We expect the Specialty Networks acquisition to positively impact Pharmaceutical and Specialty Solutions segment revenue and profit while increasing amortization and other acquisition-related costs during fiscal 2025 and beyond.

Branded Pharmaceuticals

During fiscal 2024, we saw increased demand for GLP-1 pharmaceuticals, and our sales increased significantly, despite periodic supply shortages. These increased sales positively impacted our Pharmaceutical segment and consolidated revenue for the year; however, GLP-1 sales did not meaningfully contribute to segment profit. Future demand for these medications is unpredictable and our ability to meet demand may be impacted by additional supply constraints.

During fiscal 2024, we began distributing commercially available COVID-19 vaccines following U.S. Food and Drug Administration (“FDA”) approval. Distribution of these vaccines had a greater than anticipated benefit to Pharmaceutical and Specialty Solutions segment profit in fiscal year 2024. Updated COVID-19 vaccines for 2025 also require FDA approval. We expect COVID-19 vaccine distribution to favorably impact Pharmaceutical and Specialty Solutions segment profit in fiscal 2025, but to a lesser extent.

Generics Program

The performance of our Pharmaceutical and Specialty Solutions segment generics program positively impacted the year-over-year comparison of Pharmaceutical and Specialty Solutions segment profit. The Pharmaceutical and Specialty Solutions segment generics program includes, among other things, the impact of generic pharmaceutical product launches, customer volumes, pricing changes, the Red Oak Sourcing, LLC venture ("Red Oak Sourcing") with CVS Health Corporation ("CVS Health") and generic pharmaceutical contract manufacturing and sourcing costs.

| | | | | | | | |

6 | Cardinal Health | Fiscal 2024 Form 10-K | |

The frequency, timing, magnitude and profit impact of generic pharmaceutical customer volumes, pricing changes, customer contract renewals, generic pharmaceutical manufacturer pricing changes and generic pharmaceutical contract manufacturing and sourcing costs all impact Pharmaceutical and Specialty Solutions segment profit and are subject to risks and uncertainties. These risks and uncertainties may impact Pharmaceutical and Specialty Solutions segment profit and consolidated operating earnings during fiscal 2025 and beyond.

Global Medical Products and Distribution Segment

Inflationary Impacts

Beginning in fiscal 2022, GMPD segment profit was negatively affected by incremental inflationary impacts, primarily related to transportation (including ocean and domestic freight), commodities and labor, and global supply chain constraints. Since that time, we have taken actions to partially mitigate these impacts, including implementing certain price increases and evolving our pricing and commercial contracting processes to provide us with greater pricing flexibility. In addition, decreases in some product-related costs have been recognized as the higher-cost inventory moved through our supply chain and was replaced by lower-cost inventory. These net inflationary impacts negatively affected GMPD segment profit during fiscal 2023. The net inflationary impacts were less significant during fiscal 2024 and had a favorable impact on GMPD segment profit on a year-over-year basis.

We expect these inflationary impacts to continue to affect GMPD segment profit in fiscal 2025 and beyond, but we expect that they will be substantially offset due to our mitigation actions. However, these inflationary costs are difficult to predict and may be greater than we expect or continue longer than our current expectations. Our actions to increase prices and evolve our contracting strategies are subject to contingencies and uncertainties and it is possible that our results of operations will be adversely impacted to a greater extent than we currently anticipate or that we may not be able to mitigate the negative impact to the extent or on the timeline we anticipate.

Volumes

GMPD segment profit was adversely impacted during fiscal 2023 in part due to lower volumes, which included our Cardinal Health brand medical products. We experienced Cardinal Health brand medical products sales growth during fiscal 2024 and expect further growth in fiscal 2025 and beyond. The timing, magnitude and profit impact of this anticipated sales growth is subject to risks and uncertainties, which may impact GMPD segment profit.

Goodwill

The change in segment structure as discussed above resulted in changes to the composition of our reporting units. Accordingly, we were required to reallocate the goodwill in reporting units affected by the change using a relative fair value approach and assess goodwill for impairment both before and after the reallocation. During the three months ended March 31, 2024, we allocated $90 million and $48 million of goodwill from the former Medical segment excluding our at-Home Solutions division (the "Medical Unit") to the GMPD reporting unit and the OptiFreight® Logistics reporting unit, respectively. We also assessed GMPD's goodwill for impairment and determined there was an impairment of GMPD’s remaining goodwill balance of $90 million, resulting in GMPD goodwill being fully impaired. See the "Critical Accounting Policies and Sensitive Accounting Estimates" section of this MD&A and Note 5 of the "Notes to Consolidated Financial Statements" for additional detail.

Shareholder Cooperation Agreement In September 2022, we entered into a Cooperation Agreement (the "Cooperation Agreement") with Elliott Associates, L.P. and Elliott International, L.P. (together, "Elliott") under which our Board of Directors (the "Board"), among other things, (1) appointed four new independent directors, including a representative from Elliott, and (2) formed an advisory Business Review Committee of the Board tasked with undertaking a comprehensive review of our strategy, portfolio, capital-allocation framework and operations. In May 2023, we extended the term of the Cooperation Agreement until the later of July 15, 2024 or until Elliott's representative ceases to serve on, or resigns from, the Board. In connection with this extension, the Board extended the term of the Business Review Committee until July 15, 2024. On that date, the Business Review Committee disbanded in accordance with its charter. The Cooperation Agreement remains in effect.

The evaluation and implementation of actions recommended by the Business Review Committee and the Board have impacted and may continue to impact our business, financial position and results of operations during fiscal 2025 and beyond. During fiscal 2024 and 2023, we incurred $1 million and $8 million of expenses related to the negotiation and finalization of the Cooperation Agreement and other consulting expenses, respectively. We have incurred, and may incur additional legal, consulting and other expenses related to the Cooperation Agreement.

| | | | | | | | |

| Cardinal Health | Fiscal 2024 Form 10-K | 7 |

| | | | | | | | |

| MD&A | Results of Operations | |

Results of Operations

Revenue

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenue | | Change |

| (in millions) | 2024 | | 2023 | | 2022 | | 2024 | | 2023 |

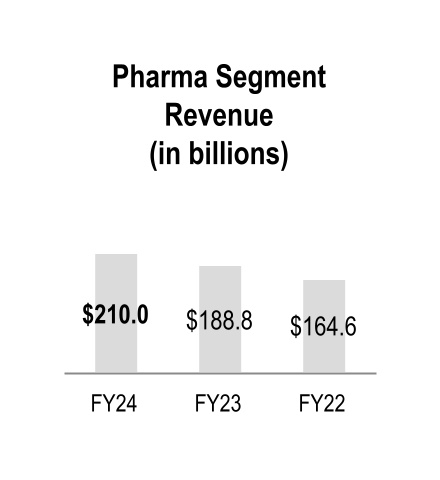

| Pharmaceutical and Specialty Solutions | $ | 210,019 | | | $ | 188,814 | | | $ | 164,596 | | | 11 | % | | 15 | % |

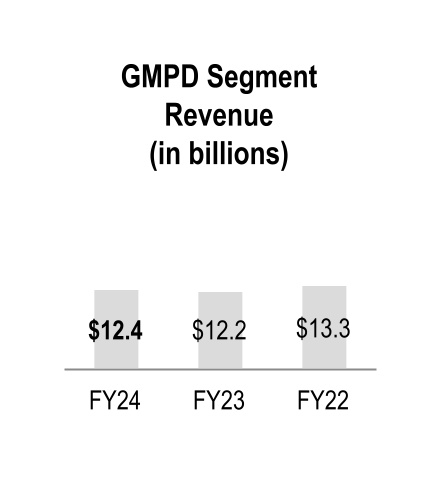

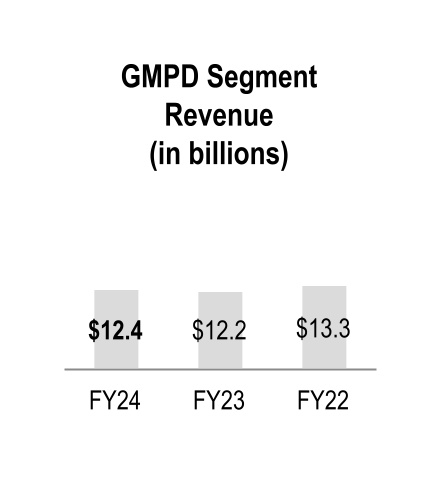

| Global Medical Products and Distribution | 12,381 | | | 12,222 | | | 13,280 | | | 1 | % | | (8) | % |

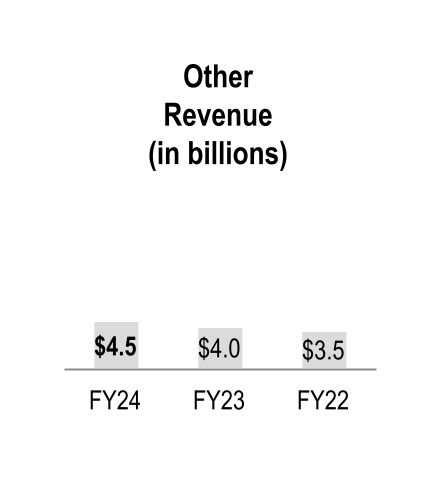

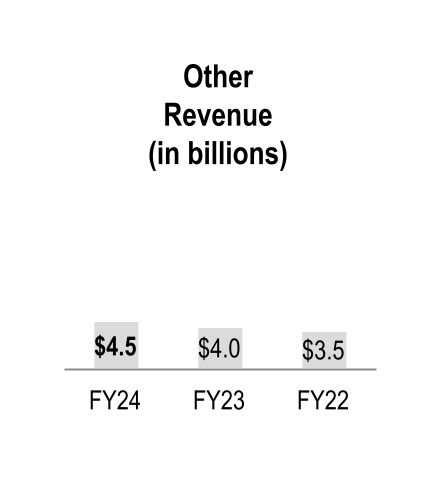

| Other | 4,512 | | | 4,021 | | | 3,518 | | | 12 | % | | 14 | % |

| Total segment revenue | 226,912 | | | 205,057 | | | 181,394 | | | 11 | % | | 13 | % |

Corporate (1) | (85) | | | (78) | | | (68) | | | N.M. | | N.M. |

| Total revenue | $ | 226,827 | | | $ | 204,979 | | | $ | 181,326 | | | 11 | % | | 13 | % |

(1)Corporate revenue consists of the elimination of inter-segment revenue and other revenue not allocated to the segments.

Fiscal 2024 Compared to Fiscal 2023

Pharmaceutical and Specialty Solutions

Fiscal 2024 Pharmaceutical and Specialty Solutions segment revenue grew by 11 percent primarily due to branded and specialty pharmaceutical sales growth largely from existing customers, which increased revenue by $20.1 billion.

Global Medical Products and Distribution

Fiscal 2024 GMPD segment revenue increased primarily due to higher volumes from existing customers, which increased revenue by $275 million. The increase was partially offset by the adverse impact of personal protective equipment ("PPE") pricing.

Other

Fiscal 2024 Other revenue increased due to growth across the at-Home Solutions, Nuclear and Precision Health Solutions and OptiFreight® Logistics operating segments.

Fiscal 2023 Compared to Fiscal 2022

Pharmaceutical and Specialty Solutions

Fiscal 2023 Pharmaceutical and Specialty Solutions segment revenue grew by 15 percent primarily due to branded and specialty pharmaceutical sales growth from existing and net new customers, which increased revenue by $24.2 billion.

Global Medical Products and Distribution

Fiscal 2023 GMPD segment revenue decreased primarily due to lower sales, largely due to an adverse impact of PPE pricing and volumes.

Other

Fiscal 2023 Other revenue increased due to growth across the Nuclear and Precision Health Solutions, at-Home Solutions and OptiFreight® Logistics operating segments.

| | | | | | | | |

8 | Cardinal Health | Fiscal 2024 Form 10-K | |

| | | | | | | | |

| MD&A | Results of Operations | |

Cost of Products Sold

Cost of products sold for fiscal 2024 and 2023 increased $21.3 billion (11 percent) and $23.3 billion (13 percent) compared to their respective prior-year periods as a result of the same factors affecting the changes in revenue and gross margin.

Gross Margin

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated Gross Margin | | Change |

| (in millions) | 2024 | | 2023 | | 2022 | | 2024 | | 2023 |

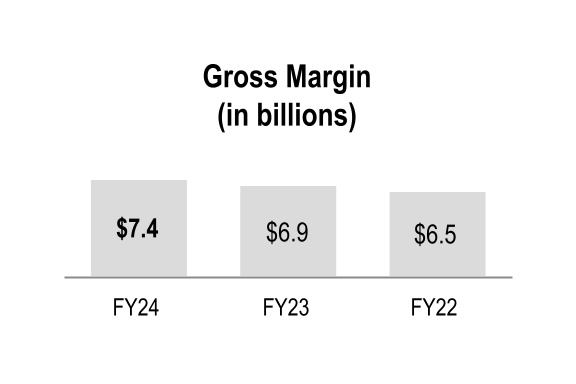

| Gross margin | $ | 7,414 | | | $ | 6,874 | | | $ | 6,484 | | | 8 | % | | 6 | % |

Fiscal 2024 Compared to Fiscal 2023

Fiscal 2024 consolidated gross margin increased primarily due to the beneficial comparison of the prior-year net inflationary impacts in the GMPD segment and the positive performance of our generics program in the Pharmaceutical and Specialty Solutions segment.

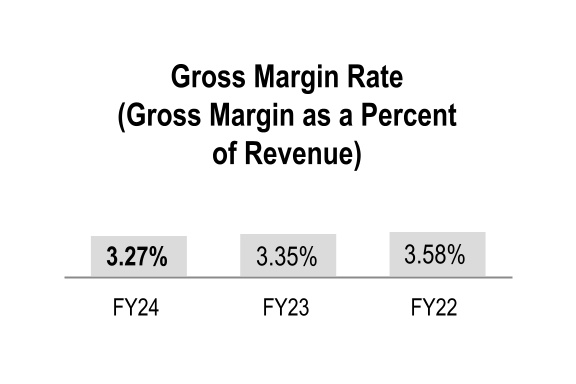

Gross margin rate declined 8 basis points during fiscal 2024 mainly due to changes in overall product mix, primarily driven by increased pharmaceutical distribution branded sales, which have a dilutive impact on our overall gross margin rate. This decline in gross margin rate was partially offset by the beneficial comparison to the prior-year net inflationary impacts in the GMPD segment.

`

Fiscal 2023 Compared to Fiscal 2022

Fiscal 2023 consolidated gross margin increased primarily due to the Pharmaceutical and Specialty Solutions segment, which reflected the positive performance of our generics program and a higher contribution from branded and specialty pharmaceutical products. This increase was partially offset by the GMPD segment, primarily driven by lower volumes and unfavorable product sales mix, partially offset by a net positive contribution from PPE.

Gross margin rate declined 23 basis points during fiscal 2023 mainly due to changes in overall product mix, primarily driven by increased pharmaceutical distribution branded sales, which have a dilutive impact on our overall gross margin rate. This decline in gross margin rate was partially offset by a net positive contribution from PPE.

| | | | | | | | |

| Cardinal Health | Fiscal 2024 Form 10-K | 9 |

| | | | | | | | |

| MD&A | Results of Operations | |

Distribution, Selling, General and Administrative ("SG&A") Expenses

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| SG&A Expenses | | Change |

| (in millions) | 2024 | | 2023 | | 2022 | | 2024 | | 2023 |

| SG&A expenses | $ | 5,000 | | | $ | 4,800 | | | $ | 4,512 | | | 4 | % | | 6 | % |

Fiscal 2024 Compared to Fiscal 2023

Fiscal 2024 SG&A expenses increased primarily due to compensation related costs, investment projects and higher costs to support sales growth. These increases were partially offset by the beneficial impact of enterprise-wide cost-savings measures.

Fiscal 2023 Compared to Fiscal 2022

Fiscal 2023 SG&A expenses increased primarily due to higher costs to support sales growth, compensation related costs and inflationary impacts. These increases were partially offset by the beneficial impact of enterprise-wide cost-savings measures.

| | | | | | | | |

10 | Cardinal Health | Fiscal 2024 Form 10-K | |

| | | | | | | | |

| MD&A | Results of Operations | |

We evaluate segment performance based on segment profit, among other measures. See Note 14 of the "Notes to Consolidated Financial Statements" for additional information on segment profit. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Segment Profit and Operating Earnings/(Loss) | | Change |

| (in millions) | 2024 | | 2023 | | 2022 | | 2024 | | 2023 |

| Pharmaceutical and Specialty Solutions | $ | 2,015 | | | $ | 1,881 | | | $ | 1,643 | | | 7 | % | | 14 | % |

| Global Medical Products and Distribution | 92 | | | (147) | | | (64) | | | N.M. | | N.M. |

| Other | 423 | | | 396 | | | 390 | | | 7 | % | | 2 | % |

| Total segment profit | 2,530 | | | 2,130 | | | 1,969 | | | 19 | % | | 8 | % |

| Corporate | (1,287) | | | (1,378) | | | (2,576) | | | N.M. | | N.M. |

| Total consolidated operating earnings/(loss) | $ | 1,243 | | | $ | 752 | | | $ | (607) | | | 65 | % | | N.M. |

Fiscal 2024 Compared to Fiscal 2023

Pharmaceutical and Specialty Solutions

Fiscal 2024 Pharmaceutical and Specialty Solutions segment profit increased primarily due to the positive performance of our generics program.

Global Medical Products and Distribution

Fiscal 2024 GMPD segment profit increased primarily due to the beneficial comparison to the prior-year inflationary impacts, net of the effects of mitigation actions.

Other

Fiscal 2024 Other segment profit increased primarily due to the performance of OptiFreight® Logistics.

Corporate

The changes in Corporate during fiscal 2024 are due to the factors discussed in the "Other Components of Consolidated Operating Earnings/(Loss)" section that follows.

Fiscal 2023 Compared to Fiscal 2022

Pharmaceutical and Specialty Solutions

Fiscal 2023 Pharmaceutical and Specialty Solutions segment profit increased primarily due to the positive performance of our generics program and an increased contribution from branded and specialty pharmaceutical products, partially offset by inflationary impacts, primarily related to increased transportation and labor costs.

Global Medical Products and Distribution

Fiscal 2023 GMPD segment profit decreased primarily due to net inflationary impacts, lower volumes and unfavorable product sales mix, partially offset by a net positive contribution from PPE.

Other

Fiscal 2023 Other segment profit increased primarily due to the performance of OptiFreight® Logistics.

Corporate

The changes in Corporate during fiscal 2023 are due to the factors discussed in the "Other Components of Consolidated Operating Earnings/(Loss)" section that follows.

| | | | | | | | |

| Cardinal Health | Fiscal 2024 Form 10-K | 11 |

| | | | | | | | |

| MD&A | Results of Operations | |

Other Components of Consolidated Operating Earnings/(Loss) In addition to revenue, gross margin and SG&A expenses discussed previously, consolidated operating earnings/(loss) were impacted by the following:

| | | | | | | | | | | | | | | | | |

| (in millions) | 2024 | | 2023 | | 2022 |

| Restructuring and employee severance | $ | 175 | | | $ | 95 | | | $ | 101 | |

| Amortization and other acquisition-related costs | 284 | | | 285 | | | 324 | |

| Impairments and (gain)/loss on disposal of assets, net | 634 | | | 1,246 | | | 2,060 | |

| Litigation (recoveries)/charges, net | 78 | | | (304) | | | 94 | |

Restructuring and Employee Severance

Restructuring and employee severance costs in fiscal 2024, 2023 and 2022 include costs related to the implementation of certain enterprise-wide cost-savings measures, which include certain initiatives to rationalize our manufacturing operations. The increase in fiscal 2024 restructuring costs are primarily due to estimated severance costs related to these cost-savings measures and costs related to certain projects resulting from the reviews of our strategy, portfolio, capital-allocation framework and operations. During fiscal 2023 and 2022, restructuring and employee severance included costs related to the divestiture of the Cordis business. During fiscal 2022, restructuring also included facility-exit costs related to decreasing our overall office space.

Amortization and Other Acquisition-Related Costs

Amortization of acquisition-related intangible assets was $264 million, $281 million and $311 million for fiscal 2024, 2023 and 2022, respectively.

Impairments and (Gain)/Loss on Disposal of Assets, Net

During fiscal 2024, 2023 and 2022, we recognized $675 million, $1.2 billion and $2.1 billion of pre-tax non-cash goodwill impairment charges, respectively, related to our GMPD segment, as discussed further in the "Critical Accounting Policies and Sensitive Accounting Estimates" section of this MD&A and Note 5 of the "Notes to Consolidated Financial Statements." Litigation (Recoveries)/Charges, Net

During fiscal 2024, we recognized expense of $340 million in connection with opioid-related matters, including agreements in principle with counsel representing classes of third-party payors and acute care hospitals, the case brought by the City of Baltimore, and a settlement with the State of Alabama. This expense was partially offset by a benefit of $105 million related to certain prepayments and $34 million in insurance recoveries. We also recognized income of $117 million for net recoveries in class action lawsuits in which we were a class member or plaintiff.

During fiscal 2023, we recognized income of $130 million for net recoveries in class action lawsuits in which we were a class member or plaintiff. We recognized income of $103 million primarily related to a reduction of the reserve for the estimated settlement and defense costs for the Cordis OptEase and TrapEase inferior vena cava ("IVC") product liability due to the execution of certain settlement agreements. We also recognized income of $93 million due to net proceeds from the settlement of a shareholder derivative litigation matter.