UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For

the quarterly period ended

OR

For the transition period _______________

Commission

File Number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification Number) |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s

telephone number, including area code:

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Date File required to be submitted pursuant to Rule

405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definitions of “large accelerated filer”, “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | ||

| Non-accelerated filer ☐ | Smaller

reporting company | |

| Emerging

growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The

|

As of May 7, 2024, there were shares of the Company’s common stock issued and outstanding.

TABLE OF CONTENTS

| PART I. | FINANCIAL INFORMATION | 1 |

| ITEM 1. | FINANCIAL STATEMENTS | 1 |

| Condensed Consolidated Balance Sheets | 1 | |

| Condensed Consolidated Statements of Operations and Comprehensive (Loss) Income | 2 | |

| Condensed Consolidated Statement of Stockholders’ Deficit | 3 | |

| Condensed Consolidated Statements of Cash Flows | 5 | |

| Notes to Condensed Consolidated Financial Statements | 6 | |

| ITEM 2. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 14 |

| ITEM 3. | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | 33 |

| ITEM 4. | CONTROLS AND PROCEDURES | 34 |

| PART II. | OTHER INFORMATION | 35 |

| ITEM 1. | LEGAL PROCEEDINGS | 35 |

| ITEM 1A. | RISK FACTORS | 35 |

| ITEM 2. | UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS | 35 |

| ITEM 3. | DEFAULTS UPON SENIOR SECURITIES | 35 |

| ITEM 4. | MINE SAFETY DISCLOSURES | 35 |

| ITEM 5. | OTHER INFORMATION | 35 |

| ITEM 6. | EXHIBITS | 35 |

| SIGNATURES | 36 | |

| i |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

References in this report to “we,” “us,” “our,” the “Company” and “Inspired” refer to Inspired Entertainment, Inc. and its subsidiaries unless the context suggests otherwise.

Certain statements and other information set forth in this report, including in Item 2, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere herein, may relate to future events and expectations, and as such constitute “forward-looking statements” within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 27A of the Securities Act of 1933, as amended (the “Securities Act”). Our forward-looking statements include, but are not limited to, statements regarding our business strategy, plans and objectives and our expected or contemplated future operations, results, financial condition, beliefs and intentions. In addition, any statements that refer to projections, forecasts or other characterizations or predictions of future events or circumstances, including any underlying assumptions on which such statements are expressly or implicitly based, are forward-looking statements. The words “anticipate”, “believe”, “continue”, “can”, “could”, “estimate”, “expect”, “intend”, “may”, “might”, “plan”, “possible”, “potential”, “predict”, “project”, “scheduled”, “seek”, “should”, “would” and similar expressions, among others, and negatives expressions including such words, may identify forward-looking statements.

Our forward-looking statements reflect our current expectations about our future results, performance, liquidity, financial condition, prospects and opportunities, and are based upon information currently available to us, our interpretation of what we believe to be significant factors affecting our business and many assumptions regarding future events. Actual results, performance, liquidity, financial condition, prospects and opportunities could differ materially from those expressed in, or implied by, our forward-looking statements. This could occur as a result of various risks and uncertainties, including the following:

| ● | government regulation of our industries; | |

| ● | our ability to compete effectively in our industries; | |

| ● | the effect of evolving technology on our business; | |

| ● | our ability to renew long-term contracts and retain customers, and secure new contracts and customers; | |

| ● | our ability to maintain relationships with suppliers; | |

| ● | our ability to protect our intellectual property; | |

| ● | our ability to protect our business against cybersecurity threats; | |

| ● | our ability to successfully grow by acquisition as well as organically; | |

| ● | fluctuations due to seasonality; | |

| ● | our ability to attract and retain key members of our management team; | |

| ● | our need for working capital; | |

| ● | our ability to secure capital for growth and expansion; | |

| ● | changing consumer, technology and other trends in our industries; | |

| ● | our ability to successfully operate across multiple jurisdictions and markets around the world; | |

| ● | changes in local, regional and global economic and political conditions; and | |

| ● | other factors described in the reports and documents we file from time to time with the U.S. Securities and Exchange Commission (the “SEC”). |

In light of these risks and uncertainties, and others discussed in this report, there can be no assurance that any matters covered by our forward-looking statements will develop as predicted, expected or implied. Readers should not place undue reliance on any forward-looking statements. Except as expressly required by the federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason. We advise you to carefully review the reports and documents we file from time to time with the SEC.

| ii |

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

INSPIRED ENTERTAINMENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions, except share data)

| March 31, 2024 | December 31, 2023 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Cash | $ | $ | ||||||

| Accounts receivable, net | ||||||||

| Inventory, net | ||||||||

| Prepaid expenses and other current assets | ||||||||

| Total current assets | ||||||||

| Property and equipment, net | ||||||||

| Software development costs, net | ||||||||

| Other acquired intangible assets subject to amortization, net | ||||||||

| Goodwill | ||||||||

| Operating lease right of use asset | ||||||||

| Costs of obtaining and fulfilling customer contracts, net | ||||||||

| Other assets | ||||||||

| Total assets | $ | $ | ||||||

| Liabilities and Stockholders’ Deficit | ||||||||

| Current liabilities | ||||||||

| Accounts payable and accrued expenses | $ | $ | ||||||

| Corporate tax and other current taxes payable | ||||||||

| Deferred revenue, current | ||||||||

| Operating lease liabilities | ||||||||

| Current portion of long-term debt | ||||||||

| Other current liabilities | ||||||||

| Total current liabilities | ||||||||

| Long-term debt | ||||||||

| Finance lease liabilities, net of current portion | ||||||||

| Deferred revenue, net of current portion | ||||||||

| Operating lease liabilities | ||||||||

| Other long-term liabilities | ||||||||

| Total liabilities | ||||||||

| Commitments and contingencies | ||||||||

| Stockholders’ deficit | ||||||||

| Preferred stock; $ par value; shares authorized, shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively. | ||||||||

| Common stock; $ par value; shares authorized; shares and shares issued and outstanding at March 31, 2024 and December 31, 2023, respectively | ||||||||

| Additional paid in capital | ||||||||

| Accumulated other comprehensive income | ||||||||

| Accumulated deficit | ( |

) | ( |

) | ||||

| Total stockholders’ deficit | ( |

) | ( |

) | ||||

| Total liabilities and stockholders’ deficit | $ | $ | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 1 |

INSPIRED ENTERTAINMENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(in millions, except share and per share data)

(Unaudited)

Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| Revenue: | ||||||||

| Service | $ | $ | ||||||

| Product sales | ||||||||

| Total revenue | ||||||||

| Cost of sales: | ||||||||

| Cost of service (1) | ( | ) | ( | ) | ||||

| Cost of product sales | ( | ) | ( | ) | ||||

| Selling, general and administrative expenses | ( | ) | ( | ) | ||||

| Depreciation and amortization | ( | ) | ( | ) | ||||

| Net operating (loss) income | ( | ) | ||||||

| Other expense | ||||||||

| Interest expense, net | ( | ) | ( | ) | ||||

| Other finance income | ||||||||

| Total other expense, net | ( | ) | ( | ) | ||||

| Loss before income taxes | ( | ) | ( | ) | ||||

| Income tax benefit | ||||||||

| Net loss | ( | ) | ( | ) | ||||

| Other comprehensive income (loss): | ||||||||

| Foreign currency translation gain (loss) | ( | ) | ||||||

| Reclassification of loss on hedging instrument to comprehensive income | ||||||||

| Actuarial gains on pension plan | ||||||||

| Other comprehensive income (loss) | ( | ) | ||||||

| Comprehensive loss | $ | ( | ) | $ | ( | ) | ||

| Net loss per common share – basic and diluted | $ | ) | $ | ) | ||||

| Weighted average number of shares outstanding during the period – basic and diluted | ||||||||

| Supplemental disclosure of stock-based compensation expense | ||||||||

| Stock-based compensation included in: | ||||||||

| Selling, general and administrative expenses | $ | ( | ) | $ | ( | ) | ||

| (1) |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 2 |

INSPIRED ENTERTAINMENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT

THREE MONTHS ENDED MARCH 31, 2024

(in millions, except share data)

(Unaudited)

| Common stock | Additional paid in | Accumulated other comprehensive | Accumulated | Total stockholders’ | ||||||||||||||||||||

| Shares | Amount | capital | income | deficit | deficit | |||||||||||||||||||

| Balance as of December 31, 2023 | ( | ) | ( | ) | ||||||||||||||||||||

| Foreign currency translation adjustments | — | |||||||||||||||||||||||

| Actuarial gains on pension plan | — | |||||||||||||||||||||||

| Issuances under stock plans | ( | ) | ( | ) | ||||||||||||||||||||

| Stock-based compensation expense | — | |||||||||||||||||||||||

| Net loss | — | ( | ) | ( | ) | |||||||||||||||||||

| Balance as of March 31, 2024 | $ | $ | $ | $ | ( | ) | $ | ( | ) | |||||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 3 |

INSPIRED ENTERTAINMENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT

THREE MONTHS ENDED MARCH 31, 2023

(in millions, except share data)

(Unaudited)

| Common stock | Additional paid in | Accumulated other comprehensive | Accumulated | Total stockholders’ | ||||||||||||||||||||

| Shares | Amount | capital | income | deficit | deficit | |||||||||||||||||||

| Balance as of December 31, 2022 | ( | ) | ( | ) | ||||||||||||||||||||

| Foreign currency translation adjustments | — | ( | ) | ( | ) | |||||||||||||||||||

| Actuarial gains on pension plan | — | |||||||||||||||||||||||

| Reclassification of loss on hedging instrument to comprehensive income | — | |||||||||||||||||||||||

| Issuances under stock plans | ||||||||||||||||||||||||

| Stock-based compensation expense | — | |||||||||||||||||||||||

| Net loss | — | ( | ) | ( | ) | |||||||||||||||||||

| Balance as of March 31, 2023 | $ | $ | $ | $ | ( | ) | $ | ( | ) | |||||||||||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 4 |

INSPIRED ENTERTAINMENT, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(Unaudited)

Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| Cash flows from operating activities: | ||||||||

| Net loss | $ | ( | ) | $ | ( | ) | ||

| Adjustments to reconcile net loss to net cash provided by operating activities: | ||||||||

| Depreciation and amortization | ||||||||

| Amortization of right of use asset | ||||||||

| Stock-based compensation expense | ||||||||

| Contract cost expense | ( | ) | ( | ) | ||||

| Reclassification of loss on hedging instrument to comprehensive income | ||||||||

| Non-cash interest expense relating to senior debt | ||||||||

| Changes in assets and liabilities: | ||||||||

| Accounts receivable | ||||||||

| Inventory | ( | ) | ||||||

| Prepaid expenses and other assets | ||||||||

| Corporate tax and other current taxes payable | ( | ) | ( | ) | ||||

| Accounts payable and accrued expenses | ( | ) | ||||||

| Deferred revenues and customer prepayment | ( | ) | ||||||

| Operating lease liabilities | ( | ) | ( | ) | ||||

| Other long-term liabilities | ||||||||

| Net cash provided by operating activities | ||||||||

| Cash flows from investing activities: | ||||||||

| Purchases of property and equipment | ( | ) | ( | ) | ||||

| Acquisition of third-party company trade and assets | ( | ) | ||||||

| Purchases of capital software | ( | ) | ( | ) | ||||

| Net cash used in investing activities | ( | ) | ( | ) | ||||

| Cash flows from financing activities: | ||||||||

| Repayments of finance leases | ( | ) | ( | ) | ||||

| Net cash used in financing activities | ( | ) | ( | ) | ||||

| Effect of exchange rate changes on cash | ( | ) | ||||||

| Net (decrease) increase in cash | ( | ) | ||||||

| Cash, beginning of period | ||||||||

| Cash, end of period | $ | $ | ||||||

| Supplemental cash flow disclosures | ||||||||

| Cash paid during the period for interest | $ | $ | ||||||

| Cash paid during the period for income taxes | $ | $ | ||||||

| Cash paid during the period for operating leases | $ | $ | ||||||

| Supplemental disclosure of noncash investing and financing activities | ||||||||

| Additional paid in capital from net settlement of RSUs | $ | ( | ) | $ | ||||

| Lease liabilities arising from obtaining right of use assets | $ | ( | ) | $ | ( | ) | ||

| Property and equipment acquired through finance lease | $ | $ | ||||||

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

| 5 |

1. Nature of Operations, Management’s Plans and Summary of Significant Accounting Policies

Company Description and Nature of Operations

We are a global gaming technology company, supplying content, platform, gaming terminals and other products and services to online and land-based regulated lottery, betting and gaming operators worldwide through a broad range of distribution channels, predominantly on a business-to-business basis. We provide end-to-end digital gaming solutions (i) on our own proprietary and secure network, which accommodates a wide range of devices, including land-based gaming machine terminals, mobile devices and online computer applications and (ii) through third party networks. Our content and other products can be found through the consumer-facing portals of our interactive customers and, through our land-based customers, in licensed betting offices, adult gaming centers, pubs, bingo halls, airports, motorway service areas and leisure parks.

Liquidity Discussions

As

of March 31, 2024, the Company’s cash on hand was $

Management currently believes that the Company’s cash balances on hand, cash flows expected to be generated from operations, ability to control and defer capital projects and amounts available from the Company’s external borrowings will be sufficient to fund the Company’s net cash requirements through May 2025.

Basis of Presentation

The accompanying unaudited interim condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) for interim financial information and pursuant to the applicable rules and regulations of the SEC. Certain information or footnote disclosures normally included in financial statements prepared in accordance with U.S. GAAP have been condensed or omitted, pursuant to the rules and regulations of the SEC for interim financial reporting. Accordingly, they do not include all the information and footnotes necessary for a comprehensive presentation of financial position, results of operations, or cash flows. It is management’s opinion, however, that the accompanying unaudited interim condensed consolidated financial statements include all adjustments, consisting of a normal recurring nature, which are necessary for a fair presentation of the financial position, operating results and cash flows for the periods presented.

The accompanying unaudited interim condensed consolidated financial statements should be read in conjunction with the Company’s consolidated financial statements and notes thereto for the years ended December 31, 2023 and 2022. The financial information as of December 31, 2023 is derived from the audited consolidated financial statements presented in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on April 15, 2024. The financial information for the three months ended March 31, 2023 is derived from the unaudited consolidated financial statements presented in the Company’s Annual Report on Form 10-Q/A for the three months ended March 31, 2023 filed with the SEC on February 27, 2024. The interim results for the three months ended March 31, 2024 are not necessarily indicative of the results to be expected for the year ending December 31, 2024 or for any future interim periods.

| 6 |

2. Allowance for Credit Losses

Changes in the allowance for credit losses are as follows:

| March 31, 2024 | December 31, 2023 | |||||||

| (in millions) | ||||||||

| Beginning balance | $ | ( | ) | $ | ( | ) | ||

| Additional allowance for credit losses | ( | ) | ||||||

| Recoveries | ||||||||

| Write offs | ||||||||

| Foreign currency translation adjustments | ( | ) | ||||||

| Ending balance | $ | ( | ) | $ | ( | ) | ||

3. Inventory

Inventory consists of the following:

| March 31, 2024 | December 31, 2023 | |||||||

| (in millions) | ||||||||

| Component parts | $ | $ | ||||||

| Work in progress | ||||||||

| Finished goods | ||||||||

| Total inventories | $ | $ | ||||||

Component parts include parts for gaming terminals. Our finished goods inventory primarily consists of gaming terminals which are ready for sale.

4. Accounts Payable and Accrued Expenses

Accounts payable and accrued expenses consist of the following:

March 31, 2024 | December 31, 2023 | |||||||

| (in millions) | ||||||||

| Accounts payable | $ | $ | ||||||

| Interest payable | ||||||||

| Payroll and related costs | ||||||||

| Cost of sales including inventory | ||||||||

| Other creditors | ||||||||

| $ | $ | |||||||

5. Contract Related Disclosures

The following table summarizes contract related balances:

Accounts Receivable | Unbilled Accounts Receivable | Right to recover asset | Deferred Income | Customer Prepayments and Deposits | ||||||||||||||||

| (in millions) | ||||||||||||||||||||

| At March 31, 2024 | $ | $ | $ | $ | ( | ) | $ | ( | ) | |||||||||||

| At December 31, 2023 | $ | $ | $ | $ | ( | ) | $ | ( | ) | |||||||||||

Revenue

recognized that was included in the deferred income balance at the beginning of the period amounted to $

For the periods ended March 31, 2024 and 2023 respectively, there was no significant amounts of revenue recognized as a result of changes in contract transaction price related to performance obligations that were satisfied in the respective prior periods.

Transaction Price Allocated to Remaining Performance Obligations

At

March 31, 2024, the transaction price allocated to unsatisfied performance obligations for contracts expected to be greater than one

year, or performance obligations for which we do not have a right to consideration from the customer in the amount that corresponds to

the value to the customer for our performance completed to date, variable consideration which is not accounted for in accordance with

the sales-based or usage-based royalties guidance, or contracts which are not wholly unperformed, is approximately $

| 7 |

Number of Shares | ||||

| Unvested Outstanding at January 1, 2024 (1) | ||||

| Granted (2) | ||||

| Forfeited | ( | ) | ||

| Vested | ( | ) | ||

| Unvested Outstanding at March 31, 2024 | ||||

| (1) |

|

| (2) |

The Company issued a total of shares during the three months ended March 31, 2024, in connection with the Company’s equity-based plans, which included an aggregate of shares issued in connection with the net settlement of RSUs that vested during the prior year (on December 29, 2023).

7. Accumulated Other Comprehensive Loss (Income)

The accumulated balances for each classification of comprehensive loss (income) are presented below:

Foreign Currency Translation Adjustments | Change in Fair Value of Hedging Instrument | Unrecognized Pension Benefit Costs | Accumulated Other Comprehensive (Income) | |||||||||||||

| (in millions) | ||||||||||||||||

| Balance at January 1, 2024 | $ | ( | ) | $ | $ | $ | ( | ) | ||||||||

| Change during the period | ( | ) | ( | ) | ( | ) | ||||||||||

| Balance at March 31, 2024 | $ | ( | ) | $ | $ | $ | ( | ) | ||||||||

Foreign Currency Translation Adjustments | Change in Fair Value of Hedging Instrument | Unrecognized Pension Benefit Costs | Accumulated Other Comprehensive (Income) | |||||||||||||

| (in millions) | ||||||||||||||||

| Balance at January 1, 2023 | $ | ( | ) | $ | $ | $ | ( | ) | ||||||||

| Change during the period | ( | ) | ( | ) | ||||||||||||

| Balance at March 31, 2023 | $ | ( | ) | $ | $ | $ | ( | ) | ||||||||

In

connection with the issuance of Senior Secured Notes and the entry into a Revolving Credit Facility (“RCF”) Agreement

(the “RCF Agreement”), on May 19, 2021, the Company terminated all of its interest rate swaps. Accordingly, hedge accounting is no longer applicable. The

amounts previously recorded in Accumulated Other Comprehensive Income are amortized into Interest expense over the terms of the

hedged forecasted interest payments. Losses reclassified from Accumulated Other Comprehensive Income into Interest expense in the

Consolidated Statements of Operations and Income for the three months ended March 31, 2024 and March 31, 2023 amounted to $

| 8 |

Basic income/loss per share (“EPS”) is computed by dividing net income/loss attributable to common stockholders by the weighted-average number of common shares outstanding during the period, excluding the effects of any potentially dilutive securities. Diluted EPS gives effect to all dilutive potential shares of common stock outstanding during the period, including stock options and RSUs, unless the inclusion would be anti-dilutive.

Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| RSUs | $ | $ | ||||||

There were no reconciling items for the three months ended March 31, 2024 or March 31, 2023.

The calculation of Basic EPS includes the effects of and shares for the three months ended March 31, 2024 and 2023, respectively, with respect to RSU awards that have vested but have not yet been issued.

9. Other Finance Income (Expense)

Other finance income (expense) consisted of the following:

Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| (in millions) | ||||||||

| Pension interest cost | $ | ( | ) | $ | ( | ) | ||

| Expected return on pension plan assets | ||||||||

| $ | $ | |||||||

10. Income Taxes

The

effective income tax rate for the three months ended March 31, 2024 and 2023 was

The effective tax rate reported in any given year will continue to be influenced by a variety of factors, including the level of pre-tax income or loss, the income mix between jurisdictions, and any discrete items that may occur.

The Company recorded a valuation allowance against all of our deferred tax assets as of both March 31, 2024 and 2023. We intend to continue maintaining a full valuation allowance on our deferred tax assets until there is sufficient evidence to support the reversal of all or some portion of these allowances. However, given our current earnings and anticipated future earnings, we believe that there is a reasonable possibility that within the next 12 months, sufficient positive evidence may become available to allow us to reach a conclusion that a significant portion of the valuation allowance will no longer be needed. Release of the valuation allowance would result in the recognition of certain deferred tax assets and a decrease to income tax expense for the period the release is recorded. However, the exact timing and amount of the valuation allowance release are subject to change on the basis of the level of profitability that we are able to actually achieve.

| 9 |

11. Related Parties

Macquarie

Corporate Holdings Pty Limited (UK Branch) (“Macquarie UK”) (an arranger and lending party under our RCF Agreement) is

an affiliate of MIHI LLC, which beneficially owned approximately

On

December 31, 2021, the Company entered into a consultancy agreement with Richard Weil, the brother of A. Lorne Weil, our Executive

Chairman, under which Richard Weil received a success fee for services provided in connection with our acquisition of Sportech

Lotteries, LLC. The success fee was paid during the year ended December 31, 2022. Under the agreement, as extended in November 2022

and in July 2023 and December 2023, he will provide consulting services to the Company relating to the lottery in the Dominican

Republic through December 31, 2024, for which he was compensated at a rate of $

12. Leases

Certain of our arrangements include leases for equipment installed at customer locations. As the lessor, we combine lease and non-lease components for all classes of underlying assets in arrangements that involve operating leases. The single combined component is accounted for under ASC 606, Revenue from Contracts with Customers based on the consideration that the non-lease components are the predominant items in the arrangements. If a component cannot be combined, the consideration is allocated between the lease component and the non-lease component based on relative standalone selling price. The lease component is accounted for under ASC 842, Leases and the non-lease component is accounted for under ASC 606.

Lease income from operating leases and from sales type leases is not material for any of the periods presented.

13. Commitments and Contingencies

Employment Agreements

We are party to employment agreements with our executive officers and other employees of the Company and our subsidiaries which contain, among other terms, provisions relating to severance and notice requirements.

Legal Matters

From time to time, the Company may become involved in lawsuits and legal matters arising in the ordinary course of business. While the Company believes that, currently, it has no such matters that are material, there can be no assurance that existing or new matters arising in the ordinary course of business will not have a material adverse effect on the Company’s business, financial condition or results of operations.

| 10 |

14. Pension Plan

We operate a defined contribution plan in the US, and both defined benefit and defined contribution pension schemes in the UK. The defined contribution scheme assets are held separately from those of the Company in independently administered funds.

Defined Benefit Pension Scheme

The defined benefit scheme has been closed to new entrants since April 1, 1999 and closed to future accruals for services rendered to the Company for the entire financial statement periods presented. The Actuarial Valuation of the scheme as at March 31, 2021, determined that the statutory funding objective was not met, i.e., there were insufficient assets to cover the scheme’s technical provisions and there was a funding shortfall.

In June 2022, a recovery plan was put in place to eliminate the funding shortfall. The plan expects the shortfall to be eliminated by October 31, 2026.

The following table presents the components of our net periodic pension cost:

Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| (in millions) | ||||||||

| Components of net periodic pension cost: | ||||||||

| Interest cost | $ | $ | ||||||

| Expected return on plan assets | ( | ) | ( | ) | ||||

| Amortization of net loss | ||||||||

| Net periodic cost | $ | $ | ||||||

| 11 |

15. Segment Reporting and Geographic Information

The Company operates its business along four operating segments, which are segregated on the basis of revenue stream: Gaming, Virtual Sports, Interactive and Leisure. The Company believes this method of segment reporting reflects both the way its business segments are managed and the way the performance of each segment is evaluated.

The following tables present revenue, cost of sales, excluding depreciation and amortization, selling, general and administrative expenses, depreciation and amortization, stock-based compensation expense and acquisition related transaction expenses, operating profit/(loss), and total capital expenditures for the periods ended March 31, 2024 and March 31, 2023, respectively, by business segment. Certain unallocated corporate function costs have not been allocated to the Company’s reportable operating segments because these costs are not allocable and to do so would not be practical. Corporate function costs consist primarily of selling, general and administrative expenses, depreciation and amortization and capital expenditures relating to corporate/shared functions.

Segment Information

Three Months Ended March 31, 2024

| Gaming | Virtual Sports | Interactive | Leisure | Corporate Functions | Total | |||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||

| Revenue: | ||||||||||||||||||||||||

| Service | $ | $ | $ | $ | $ | $ | ||||||||||||||||||

| Product sales | ||||||||||||||||||||||||

| Total revenue | ||||||||||||||||||||||||

| Cost of sales, excluding depreciation and amortization: | ||||||||||||||||||||||||

| Cost of service | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||

| Cost of product sales | ( | ) | ( | ) | ( | ) | ||||||||||||||||||

| Selling, general and administrative expenses | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||

| Stock-based compensation expense | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||

| Depreciation and amortization | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||

| Segment operating income (loss) | ( | ) | ( | ) | ( | ) | ||||||||||||||||||

| Net operating loss | $ | ( | ) | |||||||||||||||||||||

| Total capital expenditures for the three months ended March 31, 2024 | $ | $ | $ | $ | $ | $ | ||||||||||||||||||

| 12 |

Three Months Ended March 31, 2023

| Gaming | Virtual Sports | Interactive | Leisure | Corporate Functions | Total | |||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||

| Revenue: | ||||||||||||||||||||||||

| Service | $ | $ | $ | $ | $ | $ | ||||||||||||||||||

| Product sales | ||||||||||||||||||||||||

| Total revenue | ||||||||||||||||||||||||

| Cost of sales, excluding depreciation and amortization: | ||||||||||||||||||||||||

| Cost of service | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||||

| Cost of product sales | ( | ) | ( | ) | ( | ) | ||||||||||||||||||

| Selling, general and administrative expenses | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||

| Stock-based compensation expense | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||

| Acquisition and integration related transaction expenses | ||||||||||||||||||||||||

| Depreciation and amortization | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ( | ) | ||||||||||||

| Segment operating income (loss) | ( | ) | ( | ) | ||||||||||||||||||||

| Net operating income | $ | |||||||||||||||||||||||

| Total capital expenditures for the three months ended March 31, 2023 | $ | $ | $ | $ | $ | $ | ||||||||||||||||||

Geographic Information

Geographic information for revenue is set forth below:

Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| (in millions) | ||||||||

| Total revenue | ||||||||

| UK | $ | $ | ||||||

| Greece | ||||||||

| Rest of world | ||||||||

| Total | $ | $ | ||||||

UK revenue includes revenue from customers headquartered in the UK, but whose revenue is generated globally.

Geographic information of our non-current assets excluding goodwill is set forth below:

| March 31, 2024 | December 31, 2023 | |||||||

| (in millions) | ||||||||

| UK | $ | $ | ||||||

| Greece | ||||||||

| Rest of world | ||||||||

| Total | $ | $ | ||||||

Software development costs are included as attributable to the market in which they are utilized.

16. Customer Concentration

During

the three months ended March 31, 2024, there was one customer that represented at least 10% of the Company’s revenues,

accounting for approximately

At

March 31, 2024 no customers represented at least 10% of the Company’s accounts receivable. At December 31, 2023, there was one

customer that represented at least 10% of the Company’s accounts receivable, accounting for approximately

17. Subsequent Events

The Company evaluates subsequent events and transactions that occur after the balance sheet date up to the date that the financial statements were issued. The Company did not identify subsequent events that would have required adjustment or disclosure in the consolidated financial statements.

| 13 |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the financial statements and related notes thereto included elsewhere in this report. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual future results could differ materially from the historical results discussed below. Factors that could cause or contribute to such differences include, but are not limited to, those identified below and those referenced in the section titled “Risk Factors” included elsewhere in this report.

Forward-Looking Statements

We make forward-looking statements in this Management’s Discussion and Analysis of Financial Condition and Results of Operations. For definitions of the term “forward-looking statements”, see the definitions provided in the Cautionary Note Regarding Forward-Looking Statements at the forepart of this report.

Seasonality

Our results of operations can fluctuate due to seasonal trends and other factors. Sales of our gaming machines can vary quarter-on-quarter due to both supply and demand factors. Player activity for our holiday parks is generally higher in the second and third quarters of the year, particularly during the summer months and slower during the first and fourth quarters of the year.

Revenue

We generate revenue in four principal ways: (i) on a participation basis, (ii) on a fixed rental fee basis, (iii) through product sales, (iv) by services provided and (v) through software license fees. Participation revenue generally includes a right to receive a share of our customers’ gaming revenue, typically as a share of net win but sometimes as a share of the handle or “coin in” which represents the total amount wagered.

Geographic Range

Geographically, the majority of our revenue is derived from, and the majority of our non-current assets are attributable to, our UK operations. The remainder of our revenue is derived from, and non-current assets attributable to, Greece and the rest of the world (including North America).

For the three months ended March 31, 2024 we derived approximately 75% of our revenue from the UK (including customers headquartered in the UK but whose revenue is generated globally), 10% from Greece, and the remaining 15% across the rest of the world. In the three-months ended March 31, 2023 we derived approximately 76% of our revenue from the UK (including customers headquartered in the UK but whose revenue is generated globally), 9% from Greece, and the remaining 15% across the rest of the world.

As of March 31, 2024, our non-current assets (excluding goodwill) were attributable as follows: 70% to the UK, 12% to Greece and 18% across the rest of the world. As of March 31, 2023 our non-current assets (excluding goodwill) were attributable as follows: 80% to the UK, 5% to Greece and 15% across the rest of the world.

Foreign Exchange

Our results are affected by changes in foreign currency exchange rates as a result of the translation of foreign functional currencies into our reporting currency and the re-measurement of foreign currency transactions and balances. The impact of foreign currency exchange rate fluctuations represents the difference between current rates and prior-period rates applied to current activity. The geographic region in which the largest portion of our business is operated is the UK and the British pound sterling (“GBP”) is considered to be our functional currency. Our reporting currency is the U.S. dollar (“USD”). Our results are translated from our functional currency of GBP into the reporting currency of USD using average rates for profit and loss transactions and applicable spot rates for period-end balances. The effect of translating our functional currency into our reporting currency, as well as translating the results of foreign subsidiaries that have a different functional currency into our functional currency, is reported separately in Accumulated Other Comprehensive Income.

During the three months ended March 31, 2024 we derived approximately 25% of our revenue from sales to customers outside the UK. In the thee months ended March 31, 2023 we derived approximately 24% of our revenue from sales to customers outside the UK.

In the section “Results of Operations” below, currency impacts shown have been calculated as the current-period average GBP:USD rate less the equivalent average rate in the prior period, multiplied by the current period amount in our functional currency (GBP). The remaining difference, referred to as functional currency at constant rate, is calculated as the difference in our functional currency, multiplied by the prior-period average GBP:USD rate. This is not a U.S. GAAP measure, but is one which management believes gives a clearer indication of results. In the tables below, variances in particular line items from period to period exclude currency translation movements, and currency translation impacts are shown independently.

Non-GAAP Financial Measures

We use certain financial measures that are not compliant with U.S. GAAP (“Non-GAAP financial measures”), including EBITDA and Adjusted EBITDA, to analyze our operating performance. In this discussion and analysis, we present certain non-GAAP financial measures, define and explain these measures and provide reconciliations to the most comparable U.S. GAAP measures. See “Non-GAAP Financial Measures” below.

Results of Operations

Our results are affected by changes in foreign currency exchange rates, primarily between our functional currency (GBP) and our reporting currency (USD). During the three months ended March 31, 2024 and March 31, 2023, the average GBP:USD rates for the periods 1.27 and 1.21, respectively.

| 14 |

The following discussion and analysis of our results of operations has been organized in the following manner:

| ● | a discussion and analysis of the Company’s results of operations for the three-month period ended March 31, 2024, compared to the same period in 2023; and | |

| ● | a discussion and analysis of the results of operations for each of the Company’s segments (Gaming, Virtual Sports, Interactive and Leisure) for the three-month periods ended March 31, 2024, compared to the same period in 2023, including key performance indicator (“KPI”) analysis. |

In the discussion and analysis below, certain data may vary from the amounts presented in our consolidated financial statements due to rounding.

For all reported variances, refer to the overall company and segment tables shown below. All variances discussed in the overall company and segment results are on a functional currency (at constant rate) basis, which excludes the impact of any changes in foreign currency exchange rates.

Key Events

During the three-month period ended March 31, 2024 in the Gaming segment, we completed over 240 B3 / Category C installations of Inspired’s new Vantage terminal into the Gaming estate.

During the three-month period ended March 31, 2024 the Interactive segment went live with four new operators including Winmasters, Midnite, Favbet, and OLG and bet365 in New Jersey.

Key agreements signed in the three-month period ended March 31, 2024 include a new contract with Kambi Group to integrate Inspired Virtual Sports products into the Kambi sportsbook platform, a new multi-year contract with Parkdean resorts for the sole supply of amusement and gaming machines to their holiday park estate of 64 sites nationwide in the UK and a new multi-year contract with Away Resorts for sole supply to 19 sites nationwide in the UK. We also secured an early contract extension with Hydes in the pubs business.

Overall Company Results

Three Months ended March 31, 2024, compared to Three Months ended March 31, 2023

| For the Three-Month | Variance | |||||||||||||||||||||||

| (In millions) | Period ended | 2024 vs 2023 | ||||||||||||||||||||||

| March 31, 2024 | March 31, 2023 | Variance Attributable to Currency Movement | Variance on a Functional currency basis | Total Functional Currency Variance % | Total Reported Variance % | |||||||||||||||||||

| Revenue: | ||||||||||||||||||||||||

| Service | $ | 57.1 | $ | 57.5 | $ | 2.4 | $ | (2.8 | ) | (5 | )% | (1 | )% | |||||||||||

| Product | 6.0 | 7.4 | 0.2 | (1.6 | ) | (22 | )% | (19 | )% | |||||||||||||||

| Total revenue | 63.1 | 64.9 | 2.6 | (4.4 | ) | (7 | )% | (3 | )% | |||||||||||||||

| Cost of Sales, excluding depreciation and amortization: | ||||||||||||||||||||||||

| Cost of Service | (15.9 | ) | (15.0 | ) | (0.6 | ) | (0.3 | ) | 2 | % | 6 | % | ||||||||||||

| Cost of Product | (4.5 | ) | (6.7 | ) | (0.3 | ) | 2.5 | (37 | )% | (33 | )% | |||||||||||||

| Selling, general and administrative expenses | (31.9 | ) | (26.3 | ) | (1.5 | ) | (4.1 | ) | 16 | % | 21 | % | ||||||||||||

| Stock-based compensation | (2.3 | ) | (2.9 | ) | (0.1 | ) | 0.7 | (24 | )% | (21 | )% | |||||||||||||

| Depreciation and amortization | (9.9 | ) | (9.4 | ) | (0.4 | ) | (0.1 | ) | 1 | % | 5 | % | ||||||||||||

| Net operating (loss) income | (1.4 | ) | 4.6 | (0.3 | ) | (5.7 | ) | (124 | )% | (130 | )% | |||||||||||||

| Other expense | ||||||||||||||||||||||||

| Interest expense, net | (6.6 | ) | (6.3 | ) | (0.3 | ) | - | 0 | % | 5 | % | |||||||||||||

| Other finance income | 0.1 | 0.1 | (0.0 | ) | - | 0 | % | 0 | % | |||||||||||||||

| Total other expense, net | (6.5 | ) | (6.2 | ) | (0.3 | ) | - | 0 | % | 5 | % | |||||||||||||

| Loss before income taxes | (7.9 | ) | (1.6 | ) | (0.6 | ) | (5.7 | ) | 356 | % | 394 | % | ||||||||||||

| Income tax expense | 2.2 | 0.2 | 0.1 | 1.9 | 950 | % | 1000 | % | ||||||||||||||||

| Net loss | $ | (5.7 | ) | $ | (1.4 | ) | $ | (0.5 | ) | $ | (3.8 | ) | 271 | % | 307 | % | ||||||||

| Exchange Rate - $ to £ | 1.27 | 1.21 | ||||||||||||||||||||||

See “Segments Results” below for a more detailed explanation of the significant changes in our components of revenue within the individual segment results of operations.

| 15 |

Revenue (for the three months ended March 31, 2024, compared to the three months ended March 31, 2023)

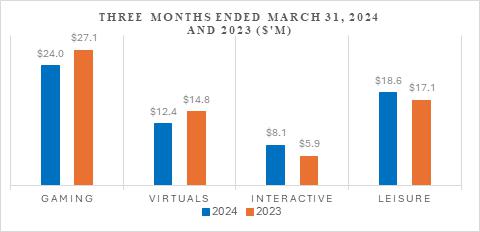

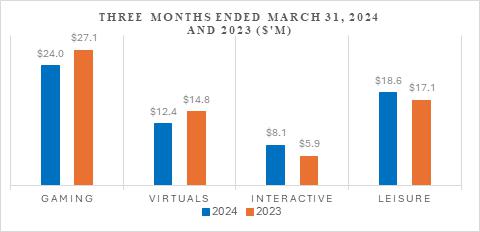

Consolidated Reported Revenue by Segment

For the three months ended March 31, 2024, revenue on a functional currency (at constant rate) basis decreased by $4.4 million, or 7%.

For the three-month period, Gaming revenue declined by $4.1 million and Gaming service revenue declined by $2.4 million predominantly due to a decrease in the UK and Greek markets. Gaming Product revenue decreased by $1.7 million predominately due to UK and mainland Europe product sales. Virtual Sports declined by $3.0 million predominately due to reduced Online revenues. Interactive grew by $1.8 million, driven primarily by revenue growth in the UK, mainland Europe and Latin America. Leisure grew by $0.8 million, driven primarily by the increase in the revenue generated per machine in the Pubs and increased revenues in Holiday Parks.

Cost of sales, excluding depreciation and amortization

Cost of sales, excluding depreciation and amortization, for the three months ended March 31, 2024, decreased by $2.2 million, or 10% compared to the three-month period ended March 31, 2023. The decrease was mainly driven by $2.5 million in cost of product related to the reduction in Gaming Product sales.

Selling, general and administrative expenses

Selling, general and administrative (“SG&A”) expenses for the three months ended March 31, 2024 increased by $4.1 million, or 16% compared to the three-month period March 31,2024.

The increase was driven primarily by the cost of restatement work of $5.0 million (excluded from Adjusted EBITDA) as well as an increase in non-staff costs of $2.1 million, of which the largest proportion was driven by audit and accountancy costs of $0.7 million that were not incurred in the prior period. This was partially offset by $3.0 million for restructuring costs incurred in the prior year period that were not repeated in this period (removed from Adjusted EBITDA).

Stock-based compensation

During the three months ended March 31, 2024, the Company recorded expenses of $2.3 million compared to expenses of $2.9 million for the three months ended March 31, 2023. All expenses were related to outstanding awards. The three months ended March 31, 2023 included an expense of $0.7 million relating to the group restructure.

Depreciation and amortization

Depreciation and amortization decreased for the three-month period by $0.1 million. This was driven by Gaming reduction of $0.4 million and Leisure reduction of $0.3 million due to assets being fully written down, partly offset by an increase of $0.6 million in Interactives.

Net operating income/(loss) / net loss

During the three-month period ended March 31, 2024, net operating loss was $1.4 million, a decrease of $5.7 million compared to the prior year period. The decrease was attributable to the decrease in gross margin of $2.2 million and an increase in selling, general and administrative expenses of $4.1 million, including the cost of restatement and additional audit and accountancy fees, partially offset by the lower restructuring costs.

For the three-months ended March 31, 2024 net loss was $5.7 million, compared to a net loss of $1.4 million in the prior year period. The $3.8 million decline year-over-year was primarily due to the decline in net operating income of $5.7 million, partially offset by an increase in income tax benefit of $1.9 million.

| 16 |

Deferred Tax

The effective income tax rate for the three months ended March 31, 2024 and 2023 were 27.4% and 13.2%, respectively, resulting in a $2.2 million and $0.2 million income tax benefit respectively.

The effective tax rate reported in any given year will continue to be influenced by a variety of factors including the level of pre-tax income or loss, the income mix between jurisdictions, and any discrete items that may occur.

The Company recorded a valuation allowance against all of our deferred tax assets as of both March 31, 2024 and 2023. We intend to continue maintaining a full valuation allowance on our deferred tax assets until there is sufficient evidence to support the reversal of all or some portion of these allowances. However, given our current earnings and anticipated future earnings, we believe that there is a reasonable possibility that within the next 12 months, sufficient positive evidence may become available to allow us to reach a conclusion that a significant portion of the valuation allowance will no longer be needed. Release of the valuation allowance would result in the recognition of certain deferred tax assets and a decrease to income tax expense for the period the release is recorded. However, the exact timing and amount of the valuation allowance release are subject to change on the basis of the level of profitability that we are able to actually achieve.

Segment Results (for the three months ended March 31, 2024, compared to the three months ended March 31, 2023)

Gaming

We generate revenue from our Gaming segment through the delivery of our gaming terminals preloaded with proprietary gaming software, server-based content, as well as services such as terminal repairs, maintenance, software upgrades and upgrades on a when and if available basis and content development. We receive rental fees for machines, typically in conjunction with long-term contracts, on both a participation and fixed fee basis. Our participation contracts are typically structured to pay us a percentage of net win (defined as net revenue to our operator customers, after deducting player winnings, free bets or plays and any relevant regulatory levies) from gaming terminals placed in our customers’ facilities. Typically, we recognize revenue from these arrangements on a daily basis over the term of the contract.

Revenue growth for our Gaming business is principally driven by changes in (i) the number of operator customers we have, (ii) the number of Gaming machines in operation, (iii) the net win performance of the machines and (iv) the net win percentage that we receive pursuant to our contracts with our customers.

Gaming, Key Performance Indicators

| For the Three-Month Period ended | Variance | |||||||||||||||

| 2024 vs 2023 | ||||||||||||||||

| Gaming | March 31, 2024 | March 31, 2023 | % | |||||||||||||

| End of period installed base (# of terminals) (2) | 34,924 | 34,711 | 213 | 0.6 | % | |||||||||||

| Total Gaming - Average installed base (# of terminals) (2) | 34,783 | 34,778 | 5 | 0.0 | % | |||||||||||

| Participation - Average installed base (# of terminals) (2) | 29,834 | 30,793 | (959 | ) | (3.1 | )% | ||||||||||

| Fixed Rental - Average installed base (# of terminals) | 4,949 | 3,985 | 964 | 24.2 | % | |||||||||||

| Service Only - Average installed base (# of terminals) | 7,848 | 14,160 | (6,312 | ) | (44.6 | )% | ||||||||||

| Customer Gross Win per unit per day (1) (2) | £ | 98.8 | £ | 98.3 | £ | 0.5 | 0.5 | % | ||||||||

| Customer Net Win per unit per day (1) (2) | £ | 72.2 | £ | 71.5 | £ | 0.7 | 1.0 | % | ||||||||

| Inspired Blended Participation Rate | 5.4 | % | 5.8 | % | (0.4 | )% | ||||||||||

| Inspired Fixed Rental Revenue per Gaming Machine per week | £ | 41.5 | £ | 49.6 | £ | (8.1 | ) | (16.3 | )% | |||||||

| Inspired Service Rental Revenue per Gaming Machine per week | £ | 5.1 | £ | 5.1 | £ | - | 0.0 | % | ||||||||

| Gaming Long term license amortization (£’m) | £ | 0.5 | £ | 0.8 | £ | (0.3 | ) | (37.5 | )% | |||||||

| Number of Machine sales | 589 | 688 | (99 | ) | (14.4 | )% | ||||||||||

| Average selling price per terminal | £ | 7,196 | £ | 7,880 | £ | (684 | ) | (8.7 | )% | |||||||

| (1) | Includes all server-based gaming terminals in which the Company takes a participation revenue share across all territories. |

| (2) | Includes approximately 2,500 lottery terminals where the share is on handle instead of net win. |

| 17 |

In the table above:

“End of Period Installed Base” is equal to the number of deployed Gaming terminals at the end of each period that have been placed on a participation or fixed rental basis. Gaming participation revenue, which comprises the majority of Gaming Service revenue, is directly related to the participation terminal installed base. This is the medium by which our customers generate revenue and distribute a revenue share to the Company. To the extent all other key performance indicators (KPIs) and certain other factors remain constant, the larger the installed base, the higher the Company’s revenue would be for a given period. Management gives careful consideration to this KPI in terms of driving growth across the segment. This does not include Service Only terminals.

Revenue is derived from the performance of the installed base as described by the Gross and Net Win KPIs.

If the End of Period Installed Base is materially different from the Average Installed Base (described below), we believe this gives an indication as to potential future performance. We believe the End of Period Installed Base is particularly useful for assessing new customers or markets, to indicate the progress being made with respect to entering new territories or jurisdictions.

“Total Gaming - Average Installed Base” is the average number of deployed Gaming terminals during the period split by participation terminals and Fixed Rental terminals. Therefore, it is more closely aligned to revenue in the period. We believe this measure is particularly useful for assessing existing customers or markets to provide comparisons of historical size and performance. This does not include Service Only terminals.

“Participation - Average Installed Base” is the average number of deployed Gaming terminals that generated revenue on a participation basis.

“Fixed Rental - Average Installed Base” is the average number of deployed Gaming terminals that generated revenue on a fixed rental basis.

“Service Only - Average Installed Base” is the average number of terminals that generated revenue on a Service only basis.

“Customer Gross Win per unit per day” is a KPI used by our management to (i) assess impact on the Company’s revenue, (ii) determine changes in the performance of the overall market and (iii) evaluate the impacts of regulatory change and our new content releases on our customers. Customer Gross Win per unit per day is the average per unit cash generated across all Gaming terminals in which the Company takes a participation revenue share across all territories in the period, defined as the difference between the amounts staked less winnings to players divided by the Average Installed Base in the period, then divided by the number of days in the period.

Gaming revenue accrued in the period is derived from Customer Gross Win accrued in the period after deducting gaming taxes (defined as a regulatory levy paid by the Customer to government bodies) and applying the Company’s contractual revenue share percentage.

Our management believes Customer Gross Win measures are meaningful because they represent a view of customer operating performance that is unaffected by our revenue share percentage and allow management to (1) readily view operating trends, (2) perform analytical comparisons and benchmarking between customers and (3) identify strategies to improve operating performance in the different markets in which we operate.

“Customer Net Win per unit per day” is Customer Gross Win per unit per day after giving effect to the deduction of gaming taxes.

“Inspired Blended Participation Rate” is the Company’s average revenue share percentage across all participation terminals where revenue is earned on a participation basis, weighted by Customer Net Win per unit per day.

| 18 |

“Inspired Fixed Rental Revenue per Gaming Machine per week” is the Company’s average fixed rental amount across all fixed rental terminals where revenue is generated on a fixed fee basis, per unit per week.

“Inspired Service Rental Revenue per Gaming Machine per week” is the Company’s average service rental amount across all service only rental terminals where revenue is generated on a service only fixed fee basis, per unit per week.

“Gaming Long-term license amortization” is the upfront license fee per terminal which is typically spread over the life of the terminal.

Our overall Gaming revenue from terminals placed on a participation basis can therefore be calculated as the product of the Participation - Average Installed Base, the Customer Net Win per unit per day, the number of days in the period, and the Inspired Blended Participation Rate, which is equal to “Participation Revenue”.

“Number of Machine sales” is the number of terminals sold during the period.

“Average selling price per terminal” is the total revenue in GBP of the Gaming terminals sold divided by the “number of Machine sales”.

Gaming, Recurring Revenue

| For the Three-Month Period ended | Variance | |||||||||||||||

| March 31, | March 31, | 2023 vs 2022 | ||||||||||||||

| (In £ millions) | 2024 | 2023 | % | |||||||||||||

| Gaming Recurring Revenue | ||||||||||||||||

| Total Gaming Revenue | £ | 18.9 | £ | 22.3 | £ | (3.4 | ) | (15.3 | )% | |||||||

| Gaming Participation Revenue | £ | 10.5 | £ | 11.5 | £ | (1.0 | ) | (8.7 | )% | |||||||

| Gaming Other Fixed Fee Recurring Revenue | £ | 3.2 | £ | 3.6 | £ | (0.4 | ) | (11.1 | )% | |||||||

| Gaming Project Recurring Revenue | £ | 0.2 | £ | 0.2 | £ | - | 0.0 | % | ||||||||

| Gaming Long-term license amortization | £ | 0.5 | £ | 0.8 | £ | (0.3 | ) | (37.5 | )% | |||||||

| Total Gaming Recurring Revenue | £ | 14.4 | £ | 16.1 | £ | (1.7 | ) | (10.6 | )% | |||||||

| Gaming Recurring Revenue as a % of Total Gaming Revenue | 76.2 | % | 72.2 | % | 4.0 | % | ||||||||||

Set forth below is a breakdown of our Gaming recurring revenue. Gaming recurring revenue principally consists of Gaming participation revenue and fixed rental revenue.

| 19 |

In the table above:

“Gaming Participation Revenue” includes our share of revenue generated from (i) our Gaming terminals placed in gaming and lottery venues; and (ii) licensing of our game content and intellectual property to third parties.

“Gaming Other Fixed Fee Recurring Revenue” includes service revenue in which the Company earns a periodic fixed fee on a contracted basis.

“Gaming Project Recurring Revenue” relates specifically to a single customer for machine estate upgrades and distribution.

“Gaming Long term license amortization” – see the definition provided above.

“Total Gaming Recurring Revenue” is equal to Gaming Participation Revenue plus Gaming Other Fixed Fee Recurring Revenue.

Gaming, Service Revenue by Region

Set forth below is a breakdown of our Gaming service revenue by geographic region. Gaming Service revenue consists principally of Gaming participation revenue, Gaming other fixed fee revenue, Gaming long-term license amortization and Gaming other non-recurring revenue. See “Gaming Segment Revenue” below for a discussion of gaming service revenue between the periods under review.

| For the Three-Month Period ended | Variance | |||||||||||||||||||

| (In millions) | March 31, 2024 | March 31, 2023 | 2024 vs 2023 | Total Functional Currency % | ||||||||||||||||

| Service Revenue: | ||||||||||||||||||||

| UK LBO | $ | 9.2 | $ | 9.7 | $ | (0.5 | ) | (5.2 | )% | (8.2 | )% | |||||||||

| UK Other | 3.5 | 3.4 | 0.1 | 2.9 | % | 23.5 | % | |||||||||||||

| Italy | 0.4 | 0.8 | (0.4 | ) | (50.0 | )% | (62.5 | )% | ||||||||||||

| Greece | 3.9 | 4.3 | (0.4 | ) | (9.3 | )% | (11.6 | )% | ||||||||||||

| Rest of the World | 0.2 | 0.6 | (0.4 | ) | (66.7 | )% | (66.7 | )% | ||||||||||||

| Lotteries | 1.4 | 1.4 | - | 0.0 | % | (7.1 | )% | |||||||||||||

| Total Service revenue | $ | 18.6 | $ | 20.2 | $ | (1.6 | ) | (7.9 | )% | (12.4 | )% | |||||||||

| Exchange Rate - $ to £ | 1.27 | 1.21 | ||||||||||||||||||

Note: Exchange rate in the table is calculated by dividing the USD total service revenue by the GBP total service revenue, therefore this could be slightly different from the average rate during the period depending on timing of transactions.

| 20 |

Gaming, Results of Operations

| For the Three-Month | Variance | |||||||||||||||||||||||

| (In millions) | Period ended | 2024 vs 2023 | ||||||||||||||||||||||

| March 31, 2024 | March 31, 2023 | Variance Attributable to Currency Movement | Variance on a Functional currency basis | Total Functional Currency Variance % | Total Reported Variance % | |||||||||||||||||||

| Revenue: | ||||||||||||||||||||||||

| Service | $ | 18.6 | $ | 20.2 | $ | 0.8 | $ | (2.4 | ) | (12 | )% | (8 | )% | |||||||||||

| Product | 5.4 | 6.9 | 0.2 | (1.7 | ) | (25 | )% | (22 | )% | |||||||||||||||

| Total revenue | 24.0 | 27.1 | 1.0 | (4.1 | ) | (15 | )% | (11 | )% | |||||||||||||||

| Cost of Sales, excluding depreciation and amortization: | ||||||||||||||||||||||||

| Cost of Service | (5.8 | ) | (5.9 | ) | (0.2 | ) | 0.3 | (5 | )% | (2 | )% | |||||||||||||

| Cost of Product | (4.3 | ) | (5.8 | ) | (0.2 | ) | 1.7 | (29 | )% | (26 | )% | |||||||||||||

| Total cost of sales | (10.1 | ) | (11.7 | ) | (0.4 | ) | 2.0 | (17 | )% | (14 | )% | |||||||||||||

| Selling, general and administrative expenses | (6.6 | ) | (5.7 | ) | (0.2 | ) | (0.7 | ) | 12 | % | 16 | % | ||||||||||||

| Stock-based compensation | (0.2 | ) | (0.3 | ) | 0.0 | 0.1 | (33 | )% | (33 | )% | ||||||||||||||

| Depreciation and amortization | (4.3 | ) | (4.5 | ) | (0.2 | ) | 0.4 | 9 | % | 4 | % | |||||||||||||

| Net operating income | $ | 2.8 | $ | 4.9 | $ | 0.2 | $ | (2.3 | ) | (47 | )% | (43 | )% | |||||||||||

| Exchange Rate - $ to £ | 1.27 | 1.21 | ||||||||||||||||||||||

Note: Exchange rate in the table is calculated by dividing the USD total revenue by the GBP total revenue, therefore this could be slightly different from the average rate during the period depending on timing of transactions.

All variances discussed in the Gaming results below are on a functional currency (at constant rate) basis, which excludes the impact of any changes in foreign currency exchange rates.

Gaming Revenue

During the three-month period ended March 31, 2024, Gaming revenue decreased by $4.1 million, or 15%. This was driven by a $2.4 million decrease in Service revenue and a $1.7 million decrease in Product revenue.

The decrease in Gaming Service revenue was mainly driven by the UK market, inclusive of shop closures in UK LBO and the expiry of historical amortized license revenues in Greece.

Product revenue decrease was primarily driven by lower product sales of $0.6 million in each of the UK and mainland Europe markets respectively.

Gaming Operating Income

Operating income decreased for the three-month period by $2.3 million. This was primarily due to the decrease in gross margin of $2.1 million and an increase of $0.7 million in SG&A driven by reduced labor and overhead absorption.

| 21 |

Virtual Sports

We generate revenue from our Virtual Sports segment through the on-premise solution and hosting of our products. We primarily receive fees on a participation basis. Our participation contracts are typically structured to pay us a percentage of net win (defined as net revenue to our operator customers, after deducting player winnings, free bets or plays and other promotional costs and any relevant regulatory levies) from Virtual Sports content placed on our customers’ websites or in our customers’ facilities. Typically, we recognize revenue from these arrangements on a daily basis over the term of the contract.

Revenue growth for our Virtual Sports segment is principally driven by the number of customers we have, the net win performance of the games and the net win percentage that we receive pursuant to our contracts with our customers.

Virtual Sports, Key Performance Indicators

| For the Three-Month Period ended | Variance | |||||||||||||||

| March 31, | March 31, | 2024 vs 2023 | ||||||||||||||

| Virtuals | 2024 | 2023 | % | |||||||||||||

| No. of Live Customers at the end of the period | 55 | 58 | (3 | ) | (5.2 | )% | ||||||||||

| Average No. of Live Customers | 54 | 58 | (4 | ) | (6.9 | )% | ||||||||||

| Total Revenue (£’m) | £ | 9.8 | £ | 12.2 | £ | (2.4 | ) | (19.7 | )% | |||||||

| Total Revenue £’m - Retail | £ | 2.3 | £ | 2.5 | £ | (0.2 | ) | (8.0 | )% | |||||||

| Total Revenue £’m - Online Virtuals | £ | 7.5 | £ | 9.7 | £ | (2.2 | ) | (22.7 | )% | |||||||

In the table above:

“No. of Live Customers at the end of the period” and “Average No. of Live Customers” represent the number of customers from which there is Virtual Sports revenue at the end of the period and the average number of customers from which there is Virtual Sports revenue during the period, respectively.

“Total Revenue (£m)” represents total revenue for the Virtual Sports segment, including recurring and upfront service revenue. Total revenue is also divided between “Total Revenue (£m) – Retail,” which consists of revenue earned through players wagering at Virtual Sports venues, “Total Revenue (£m) – Online Virtuals,” which consists of revenue earned through players wagering on Virtual Sports online.

Virtual Sports, Recurring Revenue

Set forth below is a breakdown of our Virtual Sports recurring revenue, which consists of Retail Virtuals and Online Virtuals recurring revenue as well as long-term license amortization. See “Virtual Sports Segment Revenue” below for a discussion of Virtual Sports Service revenue between the periods under review.

| For the Three-Month Period ended | Variance | |||||||||||||||

| March 31, | March 31, | 2024 vs 2023 | ||||||||||||||

| (In £ millions) | 2024 | 2023 | % | |||||||||||||

| Virtual Sports Recurring Revenue | ||||||||||||||||

| Total Virtual Sports Revenue | £ | 9.8 | £ | 12.2 | £ | (2.4 | ) | (19.7 | )% | |||||||

| Recurring Revenue - Retail Virtuals | £ | 2.3 | £ | 2.5 | £ | (0.2 | ) | (8.0 | )% | |||||||

| Recurring Revenue - Online Virtuals | £ | 7.3 | £ | 9.6 | £ | (2.3 | ) | (24.0 | )% | |||||||

| Total Virtual Sports Long-term license amortization | £ | - | £ | - | £ | - | 0.0 | % | ||||||||

| Total Virtual Sports Recurring Revenue | £ | 9.6 | £ | 12.1 | £ | (2.5 | ) | (20.7 | )% | |||||||

| Virtual Sports Recurring Revenue as a Percentage of Total Virtual Sports Revenue | 98.0 | % | 99.1 | % | (1.1 | )% | ||||||||||

“Recurring Revenue” includes our share of revenue generated from (i) our Virtual Sports products placed with operators; (ii) licensing our game content and intellectual property to third parties; and (iii) our games on third-party online gaming platforms that are interoperable with our game servers.

“Virtual Sports Long term license amortization” is the upfront license fee which is typically spread over the life of the contract.

| 22 |

Virtual Sports, Results of Operations

| For the Three-Month | Variance | |||||||||||||||||||||||

| (In millions) | Period ended | 2024 vs 2023 | ||||||||||||||||||||||

| March 31, 2024 | March 31, 2023 | Variance Attributable to Currency Movement | Variance on a Functional currency basis | Total Functional Currency Variance % | Total Reported Variance % | |||||||||||||||||||

| Service Revenue | $ | 12.4 | $ | 14.8 | $ | 0.5 | $ | (2.9 | ) | (20 | )% | (16 | )% | |||||||||||

| Cost of Service | (0.4 | ) | (0.4 | ) | - | - | 0 | % | 0 | % | ||||||||||||||

| Selling, general and administrative expenses | (1.6 | ) | (1.7 | ) | (0.2 | ) | 0.3 | (18 | )% | (6 | )% | |||||||||||||

| Stock-based compensation | (0.1 | ) | (0.2 | ) | - | 0.1 | (50 | )% | (50 | )% | ||||||||||||||

| Depreciation and amortization | (0.9 | ) | (0.8 | ) | (0.1 | ) | - | 0 | % | 13 | % | |||||||||||||

| Net operating income | $ | 9.4 | $ | 11.7 | $ | 0.2 | $ | (2.5 | ) | (21 | )% | (20 | )% | |||||||||||

| Exchange Rate - $ to £ | 1.27 | 1.21 | ||||||||||||||||||||||

Note: Exchange rate in the table is calculated by dividing the USD service revenue by the GBP service revenue, therefore this could be slightly different from the average rate during the period depending on timing of transactions.

All variances discussed in the Virtual Sports results below are on a functional currency (at constant rate) basis, which excludes the impact of any changes in foreign currency exchange rates.

Virtual Sports revenue

During the three-month period, revenue decreased by $2.9 million, or 20%. This was driven by $2.6 million in Online Virtuals, primarily driven by a major customer optimizing their customer base, as well as decreases in Retail Virtuals of $0.3 million.

Virtual Sports operating income

Operating income decreased by $2.5 million in the three-month period. This was due to the decrease in revenue of $2.9 million, partly offset by a decrease of $0.3 million in SG&A costs.

Interactive

We generate revenue from our Interactive segment through the various games content made available via third party aggregation platforms with Inspired’s remote gaming server or directly on the Company’s remote gaming server platform, and services such as customer support, platform maintenance, updates and upgrades. Typically, we receive fees on a participation basis. Our participation contracts are usually structured to pay us a percentage of net win (defined as net revenue to our operator customers, after deducting player winnings, free bets or plays and other promotional costs and any relevant regulatory levies) from Interactive content placed on our customers’ websites. Typically, we recognize revenue from these arrangements on a daily basis over the term of the contract.

Revenue growth for our Interactive segment is principally driven by the number of customers we have, the number of live games, the net win performance of the games and the net win percentage that we receive pursuant to our contracts with our customers.

| 23 |

Interactive, Key Performance Indicators

| For the Three-Month Period ended | Variance | |||||||||||||||

| March 31, | March 31, | 2024 vs 2023 | ||||||||||||||

| Interactive | 2024 | 2023 | % | |||||||||||||

| No. of Live Customers at the end of the period | 155 | 138 | 17 | 12.3 | % | |||||||||||

| Average No. of Live Customers | 154 | 135 | 19 | 14.1 | % | |||||||||||

| No. of Games available at the end of the period | 298 | 271 | 27 | 10.0 | % | |||||||||||

| Average No. of Games available | 296 | 270 | 26 | 9.6 | % | |||||||||||

| No. of Live Games at the end of the period | 283 | 247 | 36 | 14.6 | % | |||||||||||

| Average No. of Live Games | 275 | 246 | 29 | 11.8 | % | |||||||||||

| Total Revenue (£’m) | £ | 6.3 | £ | 4.9 | £ | 1.4 | 28.6 | % | ||||||||

In the table above:

“No. of Live Customers at the end of the period” and “Average No. of Live Customers” represent the number of customers from which there is Interactive revenue at the end of the period and the average number of customers from which there is Interactive revenue during the period, respectively.

“No. of Games available at the end of the period” and “Average No. of Games available” represents the number of games that are available for operators to deploy at the end of the period (including inactive legacy games still available and inactive new games that are available but have not yet gone live with any operators) and the average number of games that are available for operators to deploy during the period, respectively. This incorporates both live games and inactive games.

“No. of Live Games at the end of the period” and “Average No. of Live Games” represents the number of games from which there is Interactive revenue at the end of the period and the average number of games from which there is Interactive revenue during the period, respectively.

“Total Revenue (£m)” represents total revenue for the Interactive segment, including recurring and upfront service revenue.

Interactive, Results of Operations

| For the Three-Month | Variance | |||||||||||||||||||||||

| (In millions) | Period ended | 2024 vs 2023 | ||||||||||||||||||||||

| March 31, 2024 | March 31, 2023 | Variance Attributable to Currency Movement | Variance on a Functional currency basis | Total Functional Currency Variance % | Total Reported Variance % | |||||||||||||||||||

| Service Revenue | $ | 8.1 | $ | 5.9 | $ | 0.4 | $ | 1.8 | 31 | % | 37 | % | ||||||||||||

| Cost of Service | (0.6 | ) | (0.3 | ) | - | (0.3 | ) | 100 | % | 100 | % | |||||||||||||

| Selling, general and administrative expenses | (3.1 | ) | (2.5 | ) | - | (0.6 | ) | 24 | % | 24 | % | |||||||||||||

| Stock-based compensation | (0.1 | ) | (0.2 | ) | - | 0.1 | (50 | )% | (50 | )% | ||||||||||||||

| Depreciation and amortization | (1.2 | ) | (0.6 | ) | - | (0.6 | ) | 100 | % | 100 | % | |||||||||||||

| Net operating income | $ | 3.1 | $ | 2.3 | $ | 0.4 | $ | 0.4 | 17 | % | 35 | % | ||||||||||||

| Exchange Rate - $ to £ | 1.27 | 1.21 | ||||||||||||||||||||||

Note: Exchange rate in the table is calculated by dividing the USD service revenue by the GBP service revenue, therefore this could be slightly different from the average rate during the period depending on timing of transactions.

All variances discussed in the Interactive results below are on a functional currency (at constant rate) basis, which excludes the impact of any changes in foreign currency exchange rates.

Interactive revenue

During the three-month period ended March 31, 2024, revenue increased by $1.8 million, or 31% as compared to the three-month period ended March 31, 2023, primarily driven by revenue growth in the UK, Europe and Latin America due to the consistent launch of new content across the estate and increased promotional activity.

Interactive operating income

Operating income for the three-month period ended March 31, 2024 increased by $0.4 million. This increase was driven by the increase in revenue, partially offset by a $0.6 million increase in SG&A expenses driven by increased staff and IT costs, and a $0.6 million increase in depreciation and amortization expenses.

| 24 |

Leisure

We typically generate revenue from our Leisure segment through the supply of our gaming and amusement machines. We receive rental fees for machines, typically on a long-term contract basis, on both a participation and fixed fee basis. Our participation contracts are usually structured to pay us a percentage of net win (defined as net revenue to our operator customers, after deducting player winnings, free bets or plays, any relevant regulatory levies and minimum fixed incomes where applicable) from machines placed in our customers’ facilities. We generally recognize revenue from these arrangements on a daily basis over the term of the contract.