UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

For the quarterly period ended

Commission File Number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of |

(I.R.S. Employer |

(Address of principal executive offices) |

(Zip Code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

☒ |

|

Accelerated filer |

|

☐ |

|

Non-accelerated filer |

|

☐ |

|

Smaller reporting company |

|

|

Emerging growth company |

|

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

There were

BROADSTONE NET LEASE, INC.

TABLE OF CONTENTS

|

Page |

|

1 |

||

Item 1. |

1 |

|

|

1 |

|

|

Condensed Consolidated Statements of Income and Comprehensive Income (Unaudited) |

2 |

|

3 |

|

|

4 |

|

|

Notes to the Condensed Consolidated Financial Statements (Unaudited) |

5 |

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 |

|

19 |

|

|

19 |

|

|

20 |

|

|

20 |

|

|

21 |

|

|

27 |

|

|

31 |

|

|

34 |

|

|

34 |

|

|

35 |

|

|

39 |

|

|

39 |

|

Item 3. |

40 |

|

Item 4. |

40 |

|

41 |

||

Item 1. |

41 |

|

Item 1A. |

41 |

|

Item 2. |

41 |

|

Item 3. |

41 |

|

Item 4. |

41 |

|

Item 5. |

41 |

|

Item 6. |

42 |

|

Part I. FINANCIAL INFORMATION

Item 1. Financial Statements

Broadstone Net Lease, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(Unaudited)

(in thousands, except per share amounts)

|

|

March 31, |

|

|

December 31, |

|

||

Assets |

|

|

|

|

|

|

||

Accounted for using the operating method: |

|

|

|

|

|

|

||

Land |

|

$ |

|

|

$ |

|

||

Land improvements |

|

|

|

|

|

|

||

Buildings and improvements |

|

|

|

|

|

|

||

Equipment |

|

|

|

|

|

|

||

Total accounted for using the operating method |

|

|

|

|

|

|

||

Less accumulated depreciation |

|

|

( |

) |

|

|

( |

) |

Accounted for using the operating method, net |

|

|

|

|

|

|

||

Accounted for using the direct financing method |

|

|

|

|

|

|

||

Accounted for using the sales-type method |

|

|

|

|

|

|

||

Property under development |

|

|

|

|

|

|

||

Investment in rental property, net |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

|

|

|

|

|

||

Accrued rental income |

|

|

|

|

|

|

||

Tenant and other receivables, net |

|

|

|

|

|

|

||

Prepaid expenses and other assets |

|

|

|

|

|

|

||

Interest rate swap, assets |

|

|

|

|

|

|

||

Goodwill |

|

|

|

|

|

|

||

Intangible lease assets, net |

|

|

|

|

|

|

||

Total assets |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

Liabilities and equity |

|

|

|

|

|

|

||

Unsecured revolving credit facility |

|

$ |

|

|

$ |

|

||

Mortgages, net |

|

|

|

|

|

|

||

Unsecured term loans, net |

|

|

|

|

|

|

||

Senior unsecured notes, net |

|

|

|

|

|

|

||

Accounts payable and other liabilities |

|

|

|

|

|

|

||

Dividends payable |

|

|

|

|

|

|

||

Accrued interest payable |

|

|

|

|

|

|

||

Intangible lease liabilities, net |

|

|

|

|

|

|

||

Total liabilities |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Commitments and contingencies (Note 16) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Equity |

|

|

|

|

|

|

||

Broadstone Net Lease, Inc. equity: |

|

|

|

|

|

|

||

Preferred stock, $ |

|

|

|

|

|

|

||

Common stock, $ |

|

|

|

|

|

|

||

Additional paid-in capital |

|

|

|

|

|

|

||

Cumulative distributions in excess of retained earnings |

|

|

( |

) |

|

|

( |

) |

Accumulated other comprehensive income |

|

|

|

|

|

|

||

Total Broadstone Net Lease, Inc. equity |

|

|

|

|

|

|

||

Non-controlling interests |

|

|

|

|

|

|

||

Total equity |

|

|

|

|

|

|

||

Total liabilities and equity |

|

$ |

|

|

$ |

|

||

The accompanying notes are an integral part of these condensed consolidated financial statements.

1

Broadstone Net Lease, Inc. and Subsidiaries

Condensed Consolidated Statements of Income and Comprehensive Income

(Unaudited)

(in thousands, except per share amounts)

|

|

For the Three Months Ended |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Revenues |

|

|

|

|

|

|

||

Lease revenues, net |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

Operating expenses |

|

|

|

|

|

|

||

Depreciation and amortization |

|

|

|

|

|

|

||

Property and operating expense |

|

|

|

|

|

|

||

General and administrative |

|

|

|

|

|

|

||

Provision for impairment of investment in rental properties |

|

|

|

|

|

|

||

Total operating expenses |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Other income (expenses) |

|

|

|

|

|

|

||

Interest income |

|

|

|

|

|

|

||

Interest expense |

|

|

( |

) |

|

|

( |

) |

Gain on sale of real estate |

|

|

|

|

|

|

||

Income taxes |

|

|

( |

) |

|

|

( |

) |

Other income (expenses) |

|

|

|

|

|

( |

) |

|

Net income |

|

|

|

|

|

|

||

Net income attributable to non-controlling interests |

|

|

( |

) |

|

|

( |

) |

Net income attributable to Broadstone Net Lease, Inc. |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

Weighted average number of common shares outstanding |

|

|

|

|

|

|

||

Basic |

|

|

|

|

|

|

||

Diluted |

|

|

|

|

|

|

||

Net earnings per share attributable to common stockholders |

|

|

|

|

|

|

||

Basic and Diluted |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

Comprehensive income |

|

|

|

|

|

|

||

Net income |

|

$ |

|

|

$ |

|

||

Other comprehensive income |

|

|

|

|

|

|

||

Change in fair value of interest rate swaps |

|

|

|

|

|

( |

) |

|

Realized loss on interest rate swaps |

|

|

|

|

|

|

||

Comprehensive income |

|

|

|

|

|

|

||

Comprehensive income attributable to non-controlling interests |

|

|

( |

) |

|

|

( |

) |

Comprehensive income attributable to Broadstone Net Lease, Inc. |

|

$ |

|

|

$ |

|

||

The accompanying notes are an integral part of these condensed consolidated financial statements.

2

Broadstone Net Lease, Inc. and Subsidiaries

Condensed Consolidated Statements of Equity

(Unaudited)

(in thousands, except per share amounts)

|

|

Common |

|

|

Additional |

|

|

Cumulative |

|

|

Accumulated |

|

|

Non- |

|

|

Total |

|

||||||

Balance, January 1, 2024 |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

|

|

$ |

|

|||||

Net income |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|||

Issuance of |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Offering costs, discounts, and commissions |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Stock-based compensation, net of |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Retirement of |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Conversion of |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

Distributions declared ($ |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Change in fair value of interest rate swap agreements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|||

Realized loss on interest rate swap agreements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|||

Adjustment to non-controlling interests |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

— |

|

|

Balance, March 31, 2024 |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

|

|

$ |

|

|||||

|

|

Common |

|

|

Additional |

|

|

Cumulative |

|

|

Accumulated |

|

|

Non- |

|

|

Total |

|

||||||

Balance, January 1, 2023 |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

|

|

$ |

|

|||||

Net income |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|||

Issuance of |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Offering costs, discounts, and commissions |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Stock-based compensation, net of |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

||

Retirement of |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

Conversion of |

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

Distributions declared ($ |

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

Change in fair value of interest rate swap agreements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

( |

) |

|

|

( |

) |

|

|

( |

) |

Realized loss on interest rate swap agreements |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|||

Adjustment to non-controlling interests |

|

|

— |

|

|

|

( |

) |

|

|

— |

|

|

|

|

|

|

( |

) |

|

|

— |

|

|

Balance, March 31, 2023 |

|

$ |

|

|

$ |

|

|

$ |

( |

) |

|

$ |

|

|

$ |

|

|

$ |

|

|||||

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

Broadstone Net Lease, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(in thousands)

|

|

For the Three Months Ended |

|

|||||

|

|

2024 |

|

|

2023 |

|

||

Operating activities |

|

|

|

|

|

|

||

Net income |

|

$ |

|

|

$ |

|

||

Adjustments to reconcile net income including non-controlling interests to net cash provided by |

|

|

|

|

|

|

||

Depreciation and amortization including intangibles associated with investment in rental property |

|

|

|

|

|

|

||

Provision for impairment of investment in rental properties |

|

|

|

|

|

|

||

Amortization of debt issuance costs and original issuance discount charged to interest expense |

|

|

|

|

|

|

||

Stock-based compensation expense |

|

|

|

|

|

|

||

Straight-line rent, direct financing and sales-type lease adjustments |

|

|

( |

) |

|

|

( |

) |

Gain on sale of real estate |

|

|

( |

) |

|

|

( |

) |

Other non-cash items |

|

|

( |

) |

|

|

|

|

Changes in assets and liabilities: |

|

|

|

|

|

|

||

Tenant and other receivables |

|

|

|

|

|

|

||

Prepaid expenses and other assets |

|

|

|

|

|

|

||

Accounts payable and other liabilities |

|

|

( |

) |

|

|

( |

) |

Accrued interest payable |

|

|

|

|

|

|

||

Net cash provided by operating activities |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Investing activities |

|

|

|

|

|

|

||

Acquisition of rental property |

|

|

( |

) |

|

|

( |

) |

Investment in property under development including capitalized interest of $ |

|

|

( |

) |

|

|

|

|

Capital expenditures and improvements |

|

|

( |

) |

|

|

( |

) |

Proceeds from disposition of rental property, net |

|

|

|

|

|

|

||

Change in deposits on investments in rental property |

|

|

( |

) |

|

|

|

|

Net cash provided by investing activities |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Financing activities |

|

|

|

|

|

|

||

Offering costs, discounts, and commissions |

|

|

( |

) |

|

|

( |

) |

Principal payments on mortgages and unsecured term loans |

|

|

( |

) |

|

|

( |

) |

Borrowings on unsecured revolving credit facility |

|

|

|

|

|

|

||

Repayments on unsecured revolving credit facility |

|

|

( |

) |

|

|

( |

) |

Cash distributions paid to stockholders |

|

|

( |

) |

|

|

( |

) |

Cash distributions paid to non-controlling interests |

|

|

( |

) |

|

|

( |

) |

Net cash used in financing activities |

|

|

( |

) |

|

|

( |

) |

Net increase (decrease) in cash and cash equivalents and restricted cash |

|

|

|

|

|

( |

) |

|

Cash and cash equivalents and restricted cash at beginning of period |

|

|

|

|

|

|

||

Cash and cash equivalents and restricted cash at end of period |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

Reconciliation of cash and cash equivalents and restricted cash |

|

|

|

|

|

|

||

Cash and cash equivalents at beginning of period |

|

$ |

|

|

$ |

|

||

Restricted cash at beginning of period |

|

|

|

|

|

|

||

Cash and cash equivalents and restricted cash at beginning of period |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

Cash and cash equivalents at end of period |

|

$ |

|

|

$ |

|

||

Restricted cash at end of period |

|

|

|

|

|

|

||

Cash and cash equivalents and restricted cash at end of period |

|

$ |

|

|

$ |

|

||

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

Broadstone Net Lease, Inc. and Subsidiaries

Notes to the Condensed Consolidated Financial Statements (Unaudited)

1. Business Description

Broadstone Net Lease, Inc. (the “Corporation”) is a Maryland corporation formed on October 18, 2007, that elected to be taxed as a real estate investment trust (“REIT”) commencing with the taxable year ended December 31, 2008. Broadstone Net Lease, LLC (the Corporation’s operating company, or the “OP”), is the entity through which the Corporation conducts its business and owns (either directly or through subsidiaries) all of the Corporation’s properties. The Corporation is the sole managing member of the OP. The membership units not owned by the Corporation are referred to as OP Units or non-controlling interests. As the Corporation conducts substantially all of its operations through the OP, it is structured as what is referred to as an umbrella partnership real estate investment trust (“UPREIT”). The Corporation’s common stock is listed on the New York Stock Exchange under the symbol “BNL.” The Corporation, the OP, and its consolidated subsidiaries are collectively referred to as the “Company.”

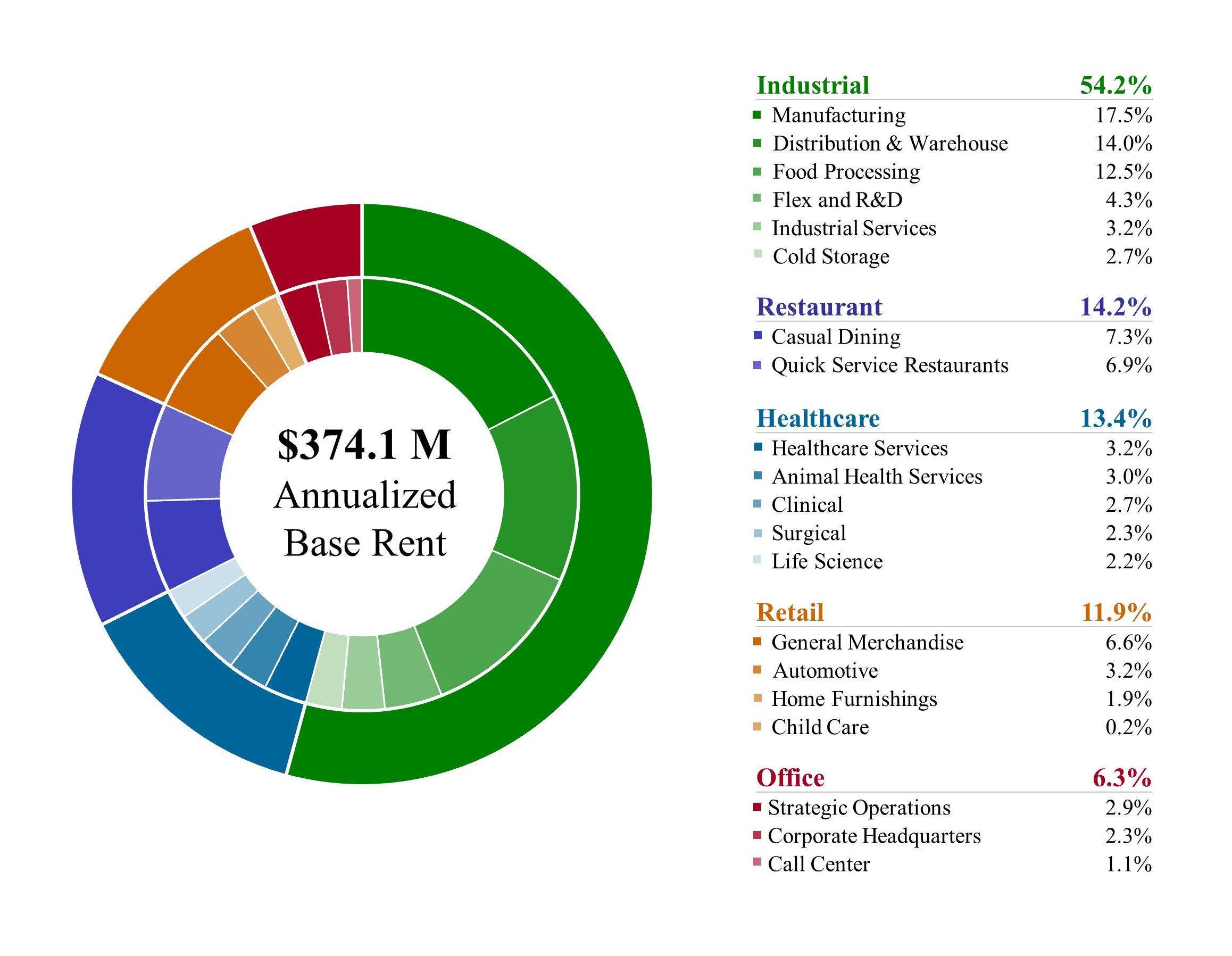

The Company is an industrial-focused, diversified net lease REIT that focuses on investing in income-producing, single-tenant net leased commercial properties, primarily in the United States. The Company leases industrial, restaurant, healthcare, retail, and office commercial properties under long-term lease agreements. At March 31, 2024, the Company owned a diversified portfolio of

The following table summarizes the outstanding equity and economic ownership interest of the Company:

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

||||||||||||||||||

(in thousands) |

|

Shares of |

|

|

OP Units |

|

|

Total Diluted |

|

|

Shares of |

|

|

OP Units |

|

|

Total Diluted |

|

||||||

Ownership interest |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Percent ownership of OP |

|

|

% |

|

|

% |

|

|

% |

|

|

% |

|

|

% |

|

|

% |

||||||

Refer to Note 14 for further discussion regarding the calculation of weighted average shares outstanding.

5

2. Summary of Significant Accounting Policies

Interim Information

Principles of Consolidation

The Condensed Consolidated Financial Statements include the accounts and operations of the Company. All intercompany balances and transactions have been eliminated in consolidation.

To the extent the Corporation has a variable interest in entities that are not evaluated under the variable interest entity (“VIE”) model, the Corporation evaluates its interests using the voting interest entity model. The Corporation has complete responsibility for the day-to-day management of, authority to make decisions for, and control of the OP. Based on consolidation guidance, the Corporation has concluded that the OP is a VIE as the members in the OP do not possess kick-out rights or substantive participating rights. Accordingly, the Corporation consolidates its interest in the OP. However, because the Corporation holds the majority voting interest in the OP and certain other conditions are met, it qualifies for the exemption from providing certain disclosure requirements associated with investments in VIEs.

Basis of Accounting

The Condensed Consolidated Financial Statements have been prepared in accordance with GAAP.

Use of Estimates

Investment in Property Under Development

Land acquired for development and construction and improvement costs incurred in connection with the development of new properties are capitalized and recorded as Property under development in the accompanying Condensed Consolidated Balance Sheets until construction has been completed. Such capitalized costs include all direct and indirect costs related to planning, development, and construction, including interest, real estate taxes, and other miscellaneous costs incurred during the construction period. Once completed, the property under development is placed in service and depreciation commences. For the three months ended March 31, 2024 and 2023, the Company invested $

6

Long-lived Asset Impairment

The Company reviews long-lived assets to be held and used for possible impairment when events or changes in circumstances indicate that their carrying amounts may not be recoverable. If, and when, such events or changes in circumstances are present, an impairment exists to the extent the carrying value of the long-lived asset or asset group exceeds the sum of the undiscounted cash flows expected to result from the use of the long-lived asset or asset group and its eventual disposition. Such cash flows include expected future operating income, as adjusted for trends and prospects, as well as the effects of demand, competition, and other factors. An impairment loss is measured as the amount by which the carrying amount of the long-lived asset or asset group exceeds its fair value. Significant judgment is made to determine if and when impairment should be taken. The Company’s assessment of impairment as of March 31, 2024 and 2023 was based on the most current information available to the Company. Certain of the Company’s properties may have fair values less than their carrying amounts. However, based on the Company’s plans with respect to each of those properties, the Company believes that their carrying amounts are recoverable and therefore,

Inputs used in establishing fair value for impaired real estate assets generally fall within Level 3 of the fair value hierarchy, which are characterized as requiring significant judgment as little or no current market activity may be available for validation. The main indicator used to establish the classification of the inputs is current market conditions, as derived through the use of published commercial real estate market information and information obtained from brokers and other third party sources. The Company determines the valuation of impaired assets using generally accepted valuation techniques including discounted cash flow analysis, income capitalization, analysis of recent comparable sales transactions, actual sales negotiations, and bona fide purchase offers received from third parties. Management may consider a single valuation technique or multiple valuation techniques, as appropriate, when estimating the fair value of its real estate.

The following table summarizes the Company’s impairment charges:

|

|

For the Three Months Ended |

|

|||||

(in thousands, except number of properties) |

|

2024 |

|

|

2023 |

|

||

Number of properties |

|

|

|

|

|

|

||

Impairment charge |

|

$ |

|

|

$ |

|

||

During the three months ended March 31, 2024, the Company recognized impairment of $

Restricted Cash

Restricted cash generally includes escrow funds the Company maintains pursuant to the terms of certain mortgages, lease agreements, and undistributed proceeds from the sale of properties under Section 1031 of the Internal Revenue Code of 1986, as amended (the “Code”), and is reported within Prepaid expenses and other assets in the Condensed Consolidated Balance Sheets.

|

|

March 31, |

|

|

December 31, |

|

||

(in thousands) |

|

2024 |

|

|

2023 |

|

||

Escrow funds and other |

|

$ |

|

|

$ |

|

||

1031 exchange proceeds |

|

|

|

|

|

|

||

|

|

$ |

|

|

$ |

|

||

Rent Received in Advance

Rent received in advance represents tenant rent payments received prior to the contractual due date, and is included in Accounts payable and other liabilities in the Condensed Consolidated Balance Sheets.

(in thousands) |

|

March 31, |

|

|

December 31, |

|

||

Rent received in advance |

|

$ |

|

|

$ |

|

||

7

Fair Value Measurements

Recurring Fair Value Measurements

The balances of financial instruments measured at fair value on a recurring basis are as follows (see Note 9):

|

|

March 31, 2024 |

|

|||||||||||||

(in thousands) |

|

Total |

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

||||

Interest rate swap, assets |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

|

|

December 31, 2023 |

|

|||||||||||||

(in thousands) |

|

Total |

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

||||

Interest rate swap, assets |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

||||

Long-term Debt – The fair value of the Company’s debt was estimated using Level 1, Level 2, and Level 3 inputs based on recent secondary market trades of the Company’s 2031 Senior Unsecured Public Notes (see Note 7), recent comparable financing transactions, recent market risk premiums for loans of comparable quality, applicable Secured Overnight Financing Rate (“SOFR”), Canadian Dollar Offered Rate (“CDOR”), U.S. Treasury obligation interest rates, and discounted estimated future cash payments to be made on such debt. The discount rates estimated reflect the Company’s judgment as to the approximate current lending rates for loans or groups of loans with similar maturities and assumes that the debt is outstanding through maturity. Market information, as available, or present value techniques were utilized to estimate the amounts required to be disclosed. Since such amounts are estimates that are based on limited available market information for similar transactions and do not acknowledge transfer or other repayment restrictions that may exist on specific loans, it is unlikely that the estimated fair value of any such debt could be realized by immediate settlement of the obligation.

The following table summarizes the carrying amount reported in the Condensed Consolidated Balance Sheets and the Company’s estimate of the fair value of the unsecured revolving credit facility, mortgages, unsecured term loans, and senior unsecured notes which reflects the fair value of interest rate swaps:

(in thousands) |

|

March 31, |

|

|

December 31, |

|

||

Carrying amount |

|

$ |

|

|

$ |

|

||

Fair value |

|

|

|

|

|

|

||

Non-recurring Fair Value Measurements

The Company’s non-recurring fair value measurements at March 31, 2024 and December 31, 2023 consisted of the fair value of impaired real estate assets that were determined using Level 3 inputs.

Right-of-Use Assets and Lease Liabilities

The Company is a lessee under non-cancelable operating leases associated with its corporate headquarters and other office spaces as well as with leases of land (“ground leases”). The Company records right-of-use assets and lease liabilities associated with these leases. The lease liability is equal to the net present value of the future payments to be made under the lease, discounted using estimates based on observable market factors. The right-of-use asset is generally equal to the lease liability plus initial direct costs associated with the leases. The Company includes in the recognition of the right-of-use asset and lease liability those renewal periods that are reasonably certain to be exercised, based on the facts and circumstances that exist at lease inception. Amounts associated with percentage rent provisions are considered variable lease costs and are not included in the initial measurement of the right-of-use asset or lease liability. The Company has made an accounting policy election, applicable to all asset types, not to separate lease from nonlease components when allocating contract consideration related to operating leases.

Right-of-use assets and lease liabilities associated with operating leases were included in the accompanying Condensed Consolidated Balance Sheets as follows:

|

|

|

|

March 31, |

|

|

December 31, |

|

||

(in thousands) |

|

Financial Statement Presentation |

|

2024 |

|

|

2023 |

|

||

Right-of-use assets |

|

Prepaid expenses and other assets |

|

$ |

|

|

$ |

|

||

Lease liabilities |

|

Accounts payable and other liabilities |

|

|

|

|

|

|

||

The Company’s right-of-use assets and lease liabilities primarily consist of a ten year lease for the Company’s corporate office space. The lease contains two five-year extension options, exercisable at the Company’s discretion, that are not reasonably certain to be exercised, and are therefore excluded from our calculation of the lease liability.

8

3. Acquisitions of Rental Property

The Company did not close on any acquisitions during the three months ended March 31, 2024.

The Company closed on the following acquisitions during the three months ended March 31, 2023:

(in thousands, except number of properties) |

|

Number of |

|

|

Real Estate |

|

|

||||

Date |

|

Property Type |

|

Properties |

|

|

Acquisition Price |

|

|

||

March 14, 2023 |

|

|

|

|

|

$ |

|

(a) |

|||

The Company allocated the purchase price of these properties to the fair value of the assets acquired and liabilities assumed.

|

|

For the Three Months Ended |

|

|

|||||

(in thousands) |

|

2024 |

|

|

2023 |

|

|

||

Land |

|

$ |

|

|

$ |

|

|

||

Land improvements |

|

|

|

|

|

|

|

||

Buildings and improvements |

|

|

|

|

|

|

|

||

Acquired in-place leases (b) |

|

|

|

|

|

|

|

||

Acquired below-market leases (c) |

|

|

|

|

|

( |

) |

|

|

|

|

$ |

|

|

$ |

|

|

||

The above acquisition was funded using a combination of available cash on hand and unsecured revolving credit facility borrowings and qualified as an asset acquisition. As such, acquisition costs were capitalized.

4. Sale of Real Estate

The Company closed on the following sales of real estate, none of which qualified as discontinued operations:

|

|

For the Three Months Ended |

|

|||||

(in thousands, except number of properties) |

|

2024 |

|

|

2023 |

|

||

Number of properties disposed |

|

|

|

|

|

|

||

Aggregate sale price |

|

$ |

|

|

$ |

|

||

Aggregate carrying value |

|

|

( |

) |

|

|

( |

) |

Additional sales expenses |

|

|

( |

) |

|

|

( |

) |

Gain on sale of real estate |

|

$ |

|

|

$ |

|

||

9

5. Investment in Rental Property and Lease Arrangements

The Company generally leases its investment rental property to established tenants in the industrial, restaurant, healthcare, retail, and office property types. At March 31, 2024, the Company had

Investment in Rental Property – Accounted for Using the Operating Method

Depreciation expense on investment in rental property was as follows:

|

|

For the Three Months Ended |

|

|||||

(in thousands) |

|

2024 |

|

|

2023 |

|

||

Depreciation |

|

$ |

|

|

$ |

|

||

Estimated lease payments to be received under non-cancelable operating leases with tenants at March 31, 2024 are as follows:

(in thousands) |

|

|

|

|

Remainder of 2024 |

|

$ |

|

|

2025 |

|

|

|

|

2026 |

|

|

|

|

2027 |

|

|

|

|

2028 |

|

|

|

|

Thereafter |

|

|

|

|

|

|

$ |

|

|

Since lease renewal periods are exercisable at the option of the tenant, the above amounts only include future lease payments due during the initial lease terms. Such amounts exclude any potential variable rent increases that are based on changes in the CPI or future variable rents which may be received under the leases based on a percentage of the tenant’s gross sales. Additionally, certain of our leases provide tenants with the option to terminate their leases in exchange for termination penalties, or that are contingent upon the occurrence of a future event. Future lease payments within the table above have not been adjusted for these termination rights.

Investment in Rental Property – Direct Financing Leases

The Company’s net investment in direct financing leases was comprised of the following:

(in thousands) |

|

March 31, |

|

|

December 31, |

|

||

Undiscounted estimated lease payments to be received |

|

$ |

|

|

$ |

|

||

Estimated unguaranteed residual values |

|

|

|

|

|

|

||

Unearned revenue |

|

|

( |

) |

|

|

( |

) |

Reserve for credit losses |

|

|

( |

) |

|

|

( |

) |

Net investment in direct financing leases |

|

$ |

|

|

$ |

|

||

Undiscounted estimated lease payments to be received under non-cancelable direct financing leases with tenants at March 31, 2024 are as follows:

(in thousands) |

|

|

|

|

Remainder of 2024 |

|

$ |

|

|

2025 |

|

|

|

|

2026 |

|

|

|

|

2027 |

|

|

|

|

2028 |

|

|

|

|

Thereafter |

|

|

|

|

|

|

$ |

|

|

The above rental receipts do not include future lease payments for renewal periods, potential variable CPI rent increases, or variable percentage rent payments that may become due in future periods.

10

The following table summarizes amounts reported as Lease revenues, net in the Condensed Consolidated Statements of Income and Comprehensive Income:

|

|

For the Three Months Ended |

|

|||||

(in thousands) |

|

2024 |

|

|

2023 |

|

||

Contractual rental amounts billed for operating leases |

|

$ |

|

|

$ |

|

||

Adjustment to recognize contractual operating lease billings on a |

|

|

|

|

|

|

||

Net write-offs of accrued rental income |

|

|

( |

) |

|

|

( |

) |

Variable rental amounts earned |

|

|

|

|

|

|

||

Earned income from direct financing leases |

|

|

|

|

|

|

||

Interest income from sales-type leases |

|

|

|

|

|

|

||

Operating expenses billed to tenants |

|

|

|

|

|

|

||

Other income from real estate transactions (a) |

|

|

|

|

|

|

||

Adjustment to revenue recognized for uncollectible rental |

|

|

( |

) |

|

|

|

|

Total lease revenues, net |

|

$ |

|

|

$ |

|

||

6. Intangible Assets and Liabilities, and Leasing Fees

The following is a summary of intangible assets and liabilities, and leasing fees, and related accumulated amortization:

(in thousands) |

|

March 31, |

|

|

December 31, |

|

||

Lease intangibles: |

|

|

|

|

|

|

||

Acquired above-market leases |

|

$ |

|

|

$ |

|

||

Less accumulated amortization |

|

|

( |

) |

|

|

( |

) |

Acquired above-market leases, net |

|

|

|

|

|

|

||

Acquired in-place leases |

|

|

|

|

|

|

||

Less accumulated amortization |

|

|

( |

) |

|

|

( |

) |

Acquired in-place leases, net |

|

|

|

|

|

|

||

Total intangible lease assets, net |

|

$ |

|

|

$ |

|

||

Acquired below-market leases |

|

$ |

|

|

$ |

|

||

Less accumulated amortization |

|

|

( |

) |

|

|

( |

) |

Intangible lease liabilities, net |

|

$ |

|

|

$ |

|

||

Leasing fees |

|

$ |

|

|

$ |

|

||

Less accumulated amortization |

|

|

( |

) |

|

|

( |

) |

Leasing fees, net |

|

$ |

|

|

$ |

|

||

Amortization of intangible lease assets and liabilities, and leasing fees was as follows:

(in thousands) |

|

|

|

For the Three Months Ended |

|

|||||

Intangible |

|

Financial Statement Presentation |

|

2024 |

|

|

2023 |

|

||

Acquired in-place leases and leasing fees |

|

Depreciation and amortization |

|

$ |

|

|

$ |

|

||

Above-market and below-market leases |

|

Lease revenues, net |

|

|

|

|

|

|

||

There was

Estimated future amortization of intangible assets and liabilities, and leasing fees at March 31, 2024 is as follows:

(in thousands) |

|

|

|

|

Remainder of 2024 |

|

$ |

|

|

2025 |

|

|

|

|

2026 |

|

|

|

|

2027 |

|

|

|

|

2028 |

|

|

|

|

Thereafter |

|

|

|

|

|

|

$ |

|

|

11

7. Unsecured Credit Agreements

The following table summarizes the Company’s unsecured credit agreements:

|

|

Outstanding Balance |

|

|

|

|

|

|||||

(in thousands, except interest rates) |

|

March 31, |

|

|

December 31, |

|

|

Interest Rate |

|

Maturity Date |

||

Unsecured revolving credit facility |

|

$ |

|

|

$ |

|

|

|

||||

Unsecured term loans: |

|

|

|

|

|

|

|

|

|

|

||

2026 Unsecured Term Loan |

|

|

|

|

|

|

|

|

||||

2027 Unsecured Term Loan |

|

|

|

|

|

|

|

|

||||

2029 Unsecured Term Loan |

|

|

|

|

|

|

|

|

||||

Total unsecured term loans |

|

|

|

|

|

|

|

|

|

|

||

Unamortized debt issuance costs, net |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

Total unsecured term loans, net |

|

|

|

|

|

|

|

|

|

|

||

Senior unsecured notes: |

|

|

|

|

|

|

|

|

|

|

||

2027 Senior Unsecured Notes - Series A |

|

|

|

|

|

|

|

|

||||

2028 Senior Unsecured Notes - Series B |

|

|

|

|

|

|

|

|

||||

2030 Senior Unsecured Notes - Series C |

|

|

|

|

|

|

|

|

||||

2031 Senior Unsecured Public Notes |

|

|

|

|

|

|

|

|

||||

Total senior unsecured notes |

|

|

|

|

|

|

|

|

|

|

||

Unamortized debt issuance costs and |

|

|

( |

) |

|

|

( |

) |

|

|

|

|

Total senior unsecured notes, net |

|

|

|

|

|

|

|

|

|

|

||

Total unsecured debt, net |

|

$ |

|

|

$ |

|

|

|

|

|

||

At March 31, 2024, the weighted average interest rate on all outstanding borrowings was

The Company is subject to various financial and operational covenants and financial reporting requirements pursuant to its unsecured credit agreements. These covenants require the Company to maintain certain financial ratios. As of March 31, 2024, and for all periods presented, the Company believes it was in compliance with all of its loan covenants. Failure to comply with the covenants would result in a default which, if the Company were unable to cure or obtain a waiver from the lenders, could accelerate the repayment of the obligations. Further, in the event of default, the Company may be restricted from paying dividends to its stockholders in excess of dividends required to maintain its REIT qualification. Accordingly, an event of default could have a material effect on the Company.

Debt issuance costs and original issuance discounts are amortized as a component of Interest expense in the accompanying Condensed Consolidated Statements of Income and Comprehensive Income.

|

|

For the Three Months Ended |

|

|||||

(in thousands) |

|

2024 |

|

|

2023 |

|

||

Debt issuance costs and original issuance discount amortization |

|

$ |

|

|

$ |

|

||

12

8. Mortgages

The Company’s mortgages consist of the following:

|

|

Origination |

|

Maturity |

|

|

|

|

|

|

|

|

|

|

||

(in thousands, except interest rates) |

|

Date |

|

Date |

|

Interest |

|

March 31, |

|

|

December 31, |

|

|

|

||

Lender |

|

(Month/Year) |

|

(Month/Year) |

|

Rate |

|

2024 |

|

|

2023 |

|

|

|

||

Wilmington Trust National Association |

|

|

|

|

$ |

|

|

$ |

|

|

(a) (b) (c) (d) |

|||||

Wilmington Trust National Association |

|

|

|

|

|

|

|

|

|

|

(a) (b) (c) (d) |

|||||

PNC Bank |

|

|

|

|

|

|

|

|

|

|

(b) (c) |

|||||

Total mortgages |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Debt issuance costs, net |

|

|

|

|

|

|

|

|

( |

) |

|

|

( |

) |

|

|

Mortgages, net |

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

|

||

At March 31, 2024, investment in rental property of $

Estimated future principal payments to be made under the above mortgages and the Company’s unsecured credit agreements (see Note 7) at March 31, 2024 are as follows:

(in thousands) |

|

|

|

|

Remainder of 2024 |

|

$ |

|

|

2025 |

|

|

|

|

2026 |

|

|

|

|

2027 |

|

|

|

|

2028 |

|

|

|

|

Thereafter |

|

|

|

|

|

|

$ |

|

|

Certain of the Company’s mortgages provide for prepayment fees and can be terminated under certain events of default as defined under the related agreements. These prepayment fees are not reflected as part of the table above.

13

9. Interest Rate Swaps

The following is a summary of the Company’s outstanding interest rate swap agreements:

(in thousands, except interest rates) |

|

|

|

|

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

|||||||||||||

Counterparty |

|

Maturity Date |

|

Fixed |

|

|

Variable Rate Index |

|

Notional |

|

|

Fair |

|

|

Notional |

|

|

Fair |

|

|

|||||

Wells Fargo Bank, N.A. |

|

|

|

% |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

|||||||

Capital One, National Association |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Bank of Montreal |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Truist Financial Corporation |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Bank of Montreal |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Truist Financial Corporation |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Truist Financial Corporation |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Bank of Montreal |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Bank of Montreal |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Capital One, National Association |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Truist Financial Corporation |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Capital One, National Association |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Capital One, National Association |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Bank of Montreal |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Bank of Montreal |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Toronto-Dominion Bank |

|

|

|

% |

|

|

|

|

(a) |

|

|

|

|

|

(a) |

|

|

|

|||||||

Wells Fargo Bank, N.A. |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Bank of Montreal |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Capital One, National Association |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Wells Fargo Bank, N.A. |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Bank of Montreal |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Regions Bank |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Regions Bank |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

U.S. Bank National Association |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Regions Bank |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Toronto-Dominion Bank |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

U.S. Bank National Association |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

U.S. Bank National Association |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

U.S. Bank National Association |

|

|

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Regions Bank |

|

|

|

% |

|

|

|

|

(a) |

|

|

|

|

|

(a) |

|

|

|

|||||||

U.S. Bank National Association |

|

|

|

% |

|

|

|

|

(a) |

|

|

|

|

|

(a) |

|

|

|

|||||||

Bank of Montreal |

|

|

|

% |

|

|

|

|

(b) |

|

|

|

|

|

(b) |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

|||||

At March 31, 2024, the weighted average fixed rate on all outstanding interest rate swaps was

The total amounts recognized, and the location in the accompanying Condensed Consolidated Statements of Income and Comprehensive Income, from converting from variable rates to fixed rates under these agreements were as follows:

|

|

Amount of Gain (Loss) |

|

|

Reclassification from |

|

|

Total Interest Expense |

|

|||||

|

|

Recognized in |

|

|

Accumulated Other |

|

|

Presented in the Condensed |

|

|||||

|

|

Accumulated Other |

|

|

Comprehensive Income |

|

|

Consolidated Statements of |

|

|||||

(in thousands) |

|

Comprehensive |

|

|

|

|

Amount of |

|

|

Income and Comprehensive |

|

|||

For the Three Months Ended March 31, |

|

Income |

|

|

Location |

|

Gain |

|

|

Income |

|

|||

2024 |

|

$ |

|

|

|

$ |

|

|

$ |

|

||||

2023 |

|

|

( |

) |

|

|

|

|

|

|

|

|||

Amounts related to the interest rate swaps expected to be reclassified out of Accumulated other comprehensive income to Interest expense during the next twelve months are estimated to be a gain of $

14

10. Non-Controlling Interests

The following table summarizes OP Units exchanged for shares of common stock:

|

|

For the Three Months Ended |

|

|||||

(in thousands) |

|

2024 |

|

|

2023 |

|

||

OP Units exchanged for shares of common stock |

|

|

|

|

|

|

||

Value of units exchanged |

|

$ |

|

|

$ |

|

||

11. Credit Risk Concentrations

The Company maintained bank balances that, at times, exceeded the federally insured limit during the three months ended March 31, 2024. The Company has not experienced losses relating to these deposits and management does not believe that the Company is exposed to any significant credit risk with respect to these amounts based on the financial position and capitalization of the banks.

For the three months ended March 31, 2024 and 2023, the Company had

12. Equity

At-the-Market Program

The Company has an at-the-market common equity offering program (“ATM Program”), through which it may, from time to time, publicly offer and sell shares of common stock having an aggregate gross sales price of up to $

Share Repurchase Program

The Company has a stock repurchase program (the “Repurchase Program”), which authorizes the Company to repurchase up to $

15

13. Stock-Based Compensation

Restricted Stock Awards

During the three months ended March 31, 2024 and 2023, the Company awarded

The following table presents information about the Company’s RSAs:

|

|

For the Three Months Ended |

|

|||||

(in thousands) |

|

2024 |

|

|

2023 |

|

||

Compensation cost |

|

$ |

|

|

$ |

|

||

Dividends declared on unvested RSAs |

|

|

|

|

|

|

||

Fair value of shares vested during the period |

|

|

|

|

|

|

||

As of March 31, 2024, there was $

The following table presents information about the Company’s restricted stock activity:

|

|

For the Three Months Ended March 31, |

|

|||||||||||||

|

|

2024 |

|

|

2023 |

|

||||||||||

(in thousands, except per share amounts) |

|

Number of Shares |

|

|

Weighted Average |

|

|

Number of Shares |

|

|

Weighted Average |

|

||||

Unvested at beginning of period |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

||||

Granted |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Vested |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

|

||

Forfeited |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|||

Unvested at end of period |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Performance-based Restricted Stock Units

During the three months ended March 31, 2024 and 2023, the Company issued target grants of

The following table presents compensation cost recognized on the Company’s performance-based restricted stock units:

|

|

For the Three Months Ended |

|

|

|||||

(in thousands) |

|

2024 |

|

|

2023 |

|

|

||

Compensation cost |

|

$ |

|

|

$ |

|

|

||

16

As of March 31, 2024, there was $

The following table presents information about the Company’s performance-based restricted stock unit activity:

|

|

For the Three Months Ended March 31, |

|

|||||||||||||

|

|

2024 |

|

|

2023 |

|

||||||||||

(in thousands, except per share amounts) |

|

Number of Shares |

|

|

Weighted Average |

|

|

Number of Shares |

|

|

Weighted Average |

|

||||

Unvested at beginning of period |

|

|

|

|

$ |

|

|

|

|

|

$ |

|

||||

Granted |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Vested |

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|||

Forfeited |

|

|

( |

) |

|

|

|

|

|

( |

) |

|

|

|

||

Unvested at end of period |

|

|

|

|

|

|

|

|

|

|

|

|

||||

14. Earnings per Share

The following table summarizes the components used in the calculation of basic and diluted earnings per share (“EPS”):

|

|

For the Three Months Ended |

|

|||||

(in thousands, except per share amounts) |

|

2024 |

|

|

2023 |

|

||

Basic earnings: |

|

|

|

|

|

|

||

Net earnings attributable to Broadstone Net Lease, Inc. common |

|

$ |

|

|

$ |

|

||

Less: earnings allocated to unvested restricted shares |

|

|

( |

) |

|

|

( |

) |

Net earnings used to compute basic earnings per common share |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

Diluted earnings: |

|

|

|

|

|

|

||

Net earnings used to compute basic earnings per common share |

|

$ |

|

|

$ |

|

||

Add: net earnings attributable to non-controlling interests |

|

|

|

|

|

|

||

Add: undistributed earnings allocated to unvested restricted shares |

|

|

|

|

|

|

||

Less: undistributed earnings reallocated to unvested restricted shares |

|

|

( |

) |

|

|

|

|

Net earnings used to compute diluted earnings per common share |

|

$ |

|

|

$ |

|

||

|

|

|

|

|

|

|

||

Weighted average number of common shares outstanding |

|

|

|

|

|

|

||

Less: weighted average unvested restricted shares (a) |

|

|

( |

) |

|

|

( |

) |

Weighted average number of common shares outstanding used in |

|

|

|

|

|

|

||

Add: effects of restricted stock units (b) |

|

|

|

|

|

|

||

Add: effects of convertible membership units (c) |

|

|

|

|

|

|

||

Weighted average number of common shares outstanding used in |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

Basic earnings per share |

|

$ |

|

|

$ |

|

||

Diluted earnings per share |

|

$ |

|

|

$ |

|

||

17

15. Supplemental Cash Flow Disclosures

Cash paid for interest was $

The following are non-cash transactions and have been excluded from the accompanying Condensed Consolidated Statements of Cash Flows:

16. Commitments and Contingencies

Litigation

From time to time, the Company is a party to various litigation matters incidental to the conduct of the Company’s business. While the resolution of such matters cannot be predicted with certainty, based on currently available information, the Company does not believe that the final outcome of any of these matters will have a material effect on its consolidated financial position, results of operations, or liquidity.

Property and Acquisition Related

In connection with ownership and operation of real estate, the Company may potentially be liable for costs and damages related to environmental matters. The Company is not aware of any non-compliance, liability, claim, or other environmental condition that would have a material effect on its consolidated financial position, results of operations, or liquidity.

As of March 31, 2024, the Company has a commitment to fund one build-to-suit transaction with a remaining obligation of $

The Company is a party to two separate tax protection agreements with the contributing members of two distinct UPREIT transactions and a third tax protection agreement entered into in connection with the Company’s internalization. The tax protection agreements require the Company to indemnify the beneficiaries in the event of a sale, exchange, transfer, or other disposal of the contributed property, and in the case of the tax protection agreement entered into in connection with the Company’s internalization, the entire Company, in a taxable transaction that would cause such beneficiaries to recognize a gain that is protected under the agreements, subject to certain exceptions. The Company is required to allocate an amount of nonrecourse liabilities to each beneficiary that is at least equal to the minimum liability amount, as contained in the agreements. The minimum liability amount and the associated allocation of nonrecourse liabilities are calculated in accordance with applicable tax regulations, are completed at the OP level, and are not probable. Therefore, there is no impact to the Condensed Consolidated Financial Statements. Based on values as of March 31, 2024, taxable sales of the applicable properties would trigger liability under the agreements of approximately $

In the normal course of business, the Company enters into various types of commitments to purchase real estate properties. These commitments are generally subject to the Company’s customary due diligence process and, accordingly, a number of specific conditions must be met before the Company is obligated to purchase the properties.

17. Subsequent Events

On April 15, 2024, the Company paid distributions totaling $

On April 25, 2024, the Board of Directors declared a quarterly distribution of $

Subsequent to March 31, 2024, the Company continued to expand its operations through the acquisition of approximately $149

Subsequent to March 31, 2024, the Company sold two properties with an aggregate carrying value of approximately $

18

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Except where the context suggests otherwise, as used in this Quarterly Report on Form 10-Q, the terms “BNL,” “we,” “us,” “our,” and “our company” refer to Broadstone Net Lease, Inc., a Maryland corporation incorporated on October 18, 2007, and, as required by context, Broadstone Net Lease, LLC, a New York limited liability company, which we refer to as the or our "OP,” and to their respective subsidiaries.

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to help the reader understand our results of operations and financial condition. This MD&A is provided as a supplement to, and should be read in conjunction with, our Condensed Consolidated Financial Statements and the accompanying Notes to the Condensed Consolidated Financial Statements appearing elsewhere in this Quarterly Report on Form 10-Q.

Cautionary Note Regarding Forward-Looking Statements

This Quarterly Report on Form 10-Q contains forward-looking statements, which reflect our current views regarding our business, financial performance, growth prospects and strategies, market opportunities, and market trends, that are intended to be made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include all statements that are not historical facts. In some cases, you can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “projects,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of these words or other comparable words. All of the forward-looking statements included in this Quarterly Report on Form 10-Q are subject to various risks and uncertainties. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions, and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond our control. Although we believe that the expectations reflected in such forward-looking statements are based on reasonable assumptions, our actual results, performance, and achievements could differ materially from those expressed in or by the forward-looking statements and may be affected by a variety of risks and other factors. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from such forward-looking statements.