Jones Lang LaSalle Incorporated0001037976December 317,382,022,43247,442,613FY202310-KFALSETRUEDecember 31, 2023TRUEFALSE0.20.30.1313271152300.7—0.77.6—7.60.4—0.46.1—6.100010379762023-01-012023-12-3100010379762023-06-30iso4217:USD00010379762024-02-21xbrli:shares00010379762023-12-3100010379762022-12-310001037976us-gaap:LineOfCreditMember2023-12-310001037976us-gaap:LineOfCreditMember2022-12-310001037976us-gaap:SeniorNotesMember2023-12-310001037976us-gaap:SeniorNotesMember2022-12-31iso4217:USDxbrli:shares00010379762022-01-012022-12-3100010379762021-01-012021-12-310001037976us-gaap:CommonStockMember2020-12-310001037976us-gaap:AdditionalPaidInCapitalMember2020-12-310001037976us-gaap:RetainedEarningsMember2020-12-310001037976jll:SharesHeldInTrustMember2020-12-310001037976us-gaap:TreasuryStockCommonMember2020-12-310001037976us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001037976us-gaap:NoncontrollingInterestMember2020-12-3100010379762020-12-310001037976us-gaap:RetainedEarningsMember2021-01-012021-12-310001037976us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001037976us-gaap:CommonStockMember2021-01-012021-12-310001037976us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001037976us-gaap:TreasuryStockCommonMember2021-01-012021-12-310001037976jll:SharesHeldInTrustMember2021-01-012021-12-310001037976us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001037976us-gaap:CommonStockMember2021-12-310001037976us-gaap:AdditionalPaidInCapitalMember2021-12-310001037976us-gaap:RetainedEarningsMember2021-12-310001037976jll:SharesHeldInTrustMember2021-12-310001037976us-gaap:TreasuryStockCommonMember2021-12-310001037976us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001037976us-gaap:NoncontrollingInterestMember2021-12-3100010379762021-12-310001037976us-gaap:RetainedEarningsMember2022-01-012022-12-310001037976us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001037976us-gaap:CommonStockMember2022-01-012022-12-310001037976us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001037976us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001037976jll:SharesHeldInTrustMember2022-01-012022-12-310001037976us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001037976us-gaap:CommonStockMember2022-12-310001037976us-gaap:AdditionalPaidInCapitalMember2022-12-310001037976us-gaap:RetainedEarningsMember2022-12-310001037976jll:SharesHeldInTrustMember2022-12-310001037976us-gaap:TreasuryStockCommonMember2022-12-310001037976us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001037976us-gaap:NoncontrollingInterestMember2022-12-310001037976us-gaap:RetainedEarningsMember2023-01-012023-12-310001037976us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001037976us-gaap:CommonStockMember2023-01-012023-12-310001037976us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001037976us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001037976jll:SharesHeldInTrustMember2023-01-012023-12-310001037976us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001037976us-gaap:CommonStockMember2023-12-310001037976us-gaap:AdditionalPaidInCapitalMember2023-12-310001037976us-gaap:RetainedEarningsMember2023-12-310001037976jll:SharesHeldInTrustMember2023-12-310001037976us-gaap:TreasuryStockCommonMember2023-12-310001037976us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001037976us-gaap:NoncontrollingInterestMember2023-12-31jll:employeeutr:sqftxbrli:pure0001037976jll:OutofScopeofTopic606RevenueMember2023-01-012023-12-310001037976jll:OutofScopeofTopic606RevenueMember2022-01-012022-12-310001037976jll:OutofScopeofTopic606RevenueMember2021-01-012021-12-310001037976jll:AllowanceForDoubtfulAccountsCurrent.Member2022-12-310001037976jll:ASCTopic326OpeningBalanceAdjustmentMemberjll:AllowanceForDoubtfulAccountsCurrent.Member2021-12-310001037976jll:AllowanceForDoubtfulAccountsCurrent.Member2020-12-310001037976jll:AllowanceForDoubtfulAccountsCurrent.Member2023-01-012023-12-310001037976jll:AllowanceForDoubtfulAccountsCurrent.Member2022-01-012022-12-310001037976jll:AllowanceForDoubtfulAccountsCurrent.Member2021-01-012021-12-310001037976jll:AllowanceForDoubtfulAccountsCurrent.Member2023-12-310001037976jll:AllowanceForDoubtfulAccountsCurrent.Member2021-12-310001037976jll:MortgageservicingrightsMember2023-12-310001037976jll:MortgageservicingrightsMember2022-12-310001037976us-gaap:FurnitureAndFixturesMember2023-12-310001037976us-gaap:FurnitureAndFixturesMember2022-12-310001037976jll:ComputerEquipmentAndSoftwareMember2023-12-310001037976jll:ComputerEquipmentAndSoftwareMember2022-12-310001037976us-gaap:LeaseholdImprovementsMember2023-12-310001037976us-gaap:LeaseholdImprovementsMember2022-12-310001037976us-gaap:PropertyPlantAndEquipmentOtherTypesMember2023-12-310001037976us-gaap:PropertyPlantAndEquipmentOtherTypesMember2022-12-310001037976us-gaap:StockCompensationPlanMember2023-01-012023-12-31utr:Y0001037976srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2023-12-310001037976srt:MaximumMemberus-gaap:FurnitureAndFixturesMember2023-12-310001037976srt:MinimumMemberjll:ComputerEquipmentAndSoftwareMember2023-12-310001037976srt:MaximumMemberjll:ComputerEquipmentAndSoftwareMember2023-12-310001037976srt:MinimumMemberus-gaap:LeaseholdImprovementsMember2023-12-310001037976us-gaap:LeaseholdImprovementsMembersrt:MaximumMember2023-12-310001037976srt:MinimumMemberus-gaap:PropertyPlantAndEquipmentOtherTypesMember2023-12-310001037976us-gaap:PropertyPlantAndEquipmentOtherTypesMembersrt:MaximumMember2023-12-310001037976jll:MarketsAdvisoryMemberjll:LeasingMember2023-01-012023-12-310001037976jll:MarketsAdvisoryMemberjll:LeasingMember2022-01-012022-12-310001037976jll:MarketsAdvisoryMemberjll:LeasingMember2021-01-012021-12-310001037976jll:MarketsAdvisoryMemberjll:PropertyManagementMember2023-01-012023-12-310001037976jll:MarketsAdvisoryMemberjll:PropertyManagementMember2022-01-012022-12-310001037976jll:MarketsAdvisoryMemberjll:PropertyManagementMember2021-01-012021-12-310001037976jll:MarketsAdvisoryMemberjll:AdvisoryConsultingAndOtherMember2023-01-012023-12-310001037976jll:MarketsAdvisoryMemberjll:AdvisoryConsultingAndOtherMember2022-01-012022-12-310001037976jll:MarketsAdvisoryMemberjll:AdvisoryConsultingAndOtherMember2021-01-012021-12-310001037976jll:MarketsAdvisoryMember2023-01-012023-12-310001037976jll:MarketsAdvisoryMember2022-01-012022-12-310001037976jll:MarketsAdvisoryMember2021-01-012021-12-310001037976jll:CapitalMarketsMemberjll:InvestmentSalesDebtEquityAdvisoryAndOtherMember2023-01-012023-12-310001037976jll:CapitalMarketsMemberjll:InvestmentSalesDebtEquityAdvisoryAndOtherMember2022-01-012022-12-310001037976jll:CapitalMarketsMemberjll:InvestmentSalesDebtEquityAdvisoryAndOtherMember2021-01-012021-12-310001037976jll:CapitalMarketsMemberjll:ValuationAndRiskAdvisoryMember2023-01-012023-12-310001037976jll:CapitalMarketsMemberjll:ValuationAndRiskAdvisoryMember2022-01-012022-12-310001037976jll:CapitalMarketsMemberjll:ValuationAndRiskAdvisoryMember2021-01-012021-12-310001037976jll:CapitalMarketsMemberjll:LoanServicingMember2023-01-012023-12-310001037976jll:CapitalMarketsMemberjll:LoanServicingMember2022-01-012022-12-310001037976jll:CapitalMarketsMemberjll:LoanServicingMember2021-01-012021-12-310001037976jll:CapitalMarketsMember2023-01-012023-12-310001037976jll:CapitalMarketsMember2022-01-012022-12-310001037976jll:CapitalMarketsMember2021-01-012021-12-310001037976jll:WorkplaceManagementMemberjll:WorkDynamicsMember2023-01-012023-12-310001037976jll:WorkplaceManagementMemberjll:WorkDynamicsMember2022-01-012022-12-310001037976jll:WorkplaceManagementMemberjll:WorkDynamicsMember2021-01-012021-12-310001037976jll:WorkDynamicsMemberjll:ProjectManagementMember2023-01-012023-12-310001037976jll:WorkDynamicsMemberjll:ProjectManagementMember2022-01-012022-12-310001037976jll:WorkDynamicsMemberjll:ProjectManagementMember2021-01-012021-12-310001037976jll:WorkDynamicsMemberjll:PortfolioServicesAndOtherMember2023-01-012023-12-310001037976jll:WorkDynamicsMemberjll:PortfolioServicesAndOtherMember2022-01-012022-12-310001037976jll:WorkDynamicsMemberjll:PortfolioServicesAndOtherMember2021-01-012021-12-310001037976jll:WorkDynamicsMember2023-01-012023-12-310001037976jll:WorkDynamicsMember2022-01-012022-12-310001037976jll:WorkDynamicsMember2021-01-012021-12-310001037976jll:JLLTechnologiesMember2023-01-012023-12-310001037976jll:JLLTechnologiesMember2022-01-012022-12-310001037976jll:JLLTechnologiesMember2021-01-012021-12-310001037976jll:LasalleInvestmentManagementMemberjll:AdvisoryFeesMember2023-01-012023-12-310001037976jll:LasalleInvestmentManagementMemberjll:AdvisoryFeesMember2022-01-012022-12-310001037976jll:LasalleInvestmentManagementMemberjll:AdvisoryFeesMember2021-01-012021-12-310001037976jll:TransactionFeesOtherMemberjll:LasalleInvestmentManagementMember2023-01-012023-12-310001037976jll:TransactionFeesOtherMemberjll:LasalleInvestmentManagementMember2022-01-012022-12-310001037976jll:TransactionFeesOtherMemberjll:LasalleInvestmentManagementMember2021-01-012021-12-310001037976jll:IncentiveFeesMemberjll:LasalleInvestmentManagementMember2023-01-012023-12-310001037976jll:IncentiveFeesMemberjll:LasalleInvestmentManagementMember2022-01-012022-12-310001037976jll:IncentiveFeesMemberjll:LasalleInvestmentManagementMember2021-01-012021-12-310001037976jll:LasalleInvestmentManagementMember2023-01-012023-12-310001037976jll:LasalleInvestmentManagementMember2022-01-012022-12-310001037976jll:LasalleInvestmentManagementMember2021-01-012021-12-310001037976currency:USD2023-01-012023-12-310001037976currency:USD2022-01-012022-12-310001037976currency:USD2021-01-012021-12-310001037976currency:GBP2023-01-012023-12-310001037976currency:GBP2022-01-012022-12-310001037976currency:GBP2021-01-012021-12-310001037976currency:EUR2023-01-012023-12-310001037976currency:EUR2022-01-012022-12-310001037976currency:EUR2021-01-012021-12-310001037976currency:AUD2023-01-012023-12-310001037976currency:AUD2022-01-012022-12-310001037976currency:AUD2021-01-012021-12-310001037976currency:INR2023-01-012023-12-310001037976currency:INR2022-01-012022-12-310001037976currency:INR2021-01-012021-12-310001037976currency:CAD2023-01-012023-12-310001037976currency:CAD2022-01-012022-12-310001037976currency:CAD2021-01-012021-12-310001037976currency:HKD2023-01-012023-12-310001037976currency:HKD2022-01-012022-12-310001037976currency:HKD2021-01-012021-12-310001037976currency:CNY2023-01-012023-12-310001037976currency:CNY2022-01-012022-12-310001037976currency:CNY2021-01-012021-12-310001037976currency:SGD2023-01-012023-12-310001037976currency:SGD2022-01-012022-12-310001037976currency:SGD2021-01-012021-12-310001037976currency:JPY2023-01-012023-12-310001037976currency:JPY2022-01-012022-12-310001037976currency:JPY2021-01-012021-12-310001037976jll:OtherCurrenciesMember2023-01-012023-12-310001037976jll:OtherCurrenciesMember2022-01-012022-12-310001037976jll:OtherCurrenciesMember2021-01-012021-12-31jll:acquisition0001037976us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001037976us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001037976jll:MarketsAdvisoryMember2021-12-310001037976jll:CapitalMarketsMember2021-12-310001037976jll:WorkDynamicsMember2021-12-310001037976jll:JLLTechnologiesMember2021-12-310001037976jll:LasalleInvestmentManagementMember2021-12-310001037976jll:MarketsAdvisoryMember2022-12-310001037976jll:CapitalMarketsMember2022-12-310001037976jll:WorkDynamicsMember2022-12-310001037976jll:JLLTechnologiesMember2022-12-310001037976jll:LasalleInvestmentManagementMember2022-12-310001037976jll:MarketsAdvisoryMember2023-12-310001037976jll:CapitalMarketsMember2023-12-310001037976jll:WorkDynamicsMember2023-12-310001037976jll:JLLTechnologiesMember2023-12-310001037976jll:LasalleInvestmentManagementMember2023-12-310001037976jll:MortgageservicingrightsMember2021-12-310001037976us-gaap:OtherIntangibleAssetsMember2021-12-310001037976jll:MortgageservicingrightsMember2022-01-012022-12-310001037976us-gaap:OtherIntangibleAssetsMember2022-01-012022-12-310001037976us-gaap:OtherIntangibleAssetsMember2022-12-310001037976jll:MortgageservicingrightsMember2023-01-012023-12-310001037976us-gaap:OtherIntangibleAssetsMember2023-01-012023-12-310001037976us-gaap:OtherIntangibleAssetsMember2023-12-310001037976jll:JLLTechnologiesMember2023-12-310001037976jll:JLLTechnologiesMember2022-12-310001037976jll:LasalleInvestmentManagementMember2023-12-310001037976jll:LasalleInvestmentManagementMember2022-12-310001037976jll:OtherInvestmentsAndAdvanceToAffiliatesSubsidiariesAssociatesAndJointVenturesMember2023-12-310001037976jll:OtherInvestmentsAndAdvanceToAffiliatesSubsidiariesAssociatesAndJointVenturesMember2022-12-31jll:investment0001037976jll:LasalleInvestmentCompanyIiMember2023-12-310001037976jll:ConsolidatedVariableInterestEntitiesMember2023-01-012023-12-310001037976jll:ConsolidatedVariableInterestEntitiesMember2022-01-012022-12-310001037976jll:ConsolidatedVariableInterestEntitiesMember2021-01-012021-12-310001037976jll:JLLTechnologiesMember2022-01-012022-12-310001037976us-gaap:StockCompensationPlanMember2023-12-310001037976us-gaap:EmployeeStockOptionMemberjll:JonesLangLasalleSavingsRelatedShareOptionPlanMember2023-01-012023-12-310001037976us-gaap:EmployeeStockOptionMemberjll:UKSaveAsYouEarnSayePlanMember2023-12-310001037976us-gaap:RestrictedStockUnitsRSUMemberus-gaap:StockCompensationPlanMember2023-01-012023-12-310001037976us-gaap:RestrictedStockUnitsRSUMemberus-gaap:StockCompensationPlanMember2022-01-012022-12-310001037976us-gaap:RestrictedStockUnitsRSUMemberus-gaap:StockCompensationPlanMember2021-01-012021-12-310001037976us-gaap:PerformanceSharesMemberus-gaap:StockCompensationPlanMember2023-01-012023-12-310001037976us-gaap:PerformanceSharesMemberus-gaap:StockCompensationPlanMember2022-01-012022-12-310001037976us-gaap:PerformanceSharesMemberus-gaap:StockCompensationPlanMember2021-01-012021-12-310001037976us-gaap:RestrictedStockUnitsRSUMember2020-12-310001037976us-gaap:PerformanceSharesMember2020-12-310001037976us-gaap:StockCompensationPlanMember2020-12-310001037976us-gaap:StockCompensationPlanMember2020-01-012020-12-310001037976us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001037976us-gaap:PerformanceSharesMember2021-01-012021-12-310001037976us-gaap:StockCompensationPlanMember2021-01-012021-12-310001037976us-gaap:RestrictedStockUnitsRSUMember2021-12-310001037976us-gaap:PerformanceSharesMember2021-12-310001037976us-gaap:StockCompensationPlanMember2021-12-310001037976us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001037976us-gaap:PerformanceSharesMember2022-01-012022-12-310001037976us-gaap:StockCompensationPlanMember2022-01-012022-12-310001037976us-gaap:RestrictedStockUnitsRSUMember2022-12-310001037976us-gaap:PerformanceSharesMember2022-12-310001037976us-gaap:StockCompensationPlanMember2022-12-310001037976us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001037976us-gaap:PerformanceSharesMember2023-01-012023-12-310001037976us-gaap:RestrictedStockUnitsRSUMember2023-12-310001037976us-gaap:PerformanceSharesMember2023-12-310001037976jll:UnitedStatesRetirementPlansOfUsEntityDefinedContributionMember2023-01-012023-12-310001037976jll:UnitedStatesRetirementPlansOfUsEntityDefinedContributionMember2022-01-012022-12-310001037976jll:UnitedStatesRetirementPlansOfUsEntityDefinedContributionMember2021-01-012021-12-310001037976jll:ForeignRetirementPlansDefinedContributionMember2023-01-012023-12-310001037976jll:ForeignRetirementPlansDefinedContributionMember2022-01-012022-12-310001037976jll:ForeignRetirementPlansDefinedContributionMember2021-01-012021-12-31jll:plan0001037976us-gaap:ForeignPlanMember2023-12-310001037976us-gaap:ForeignPlanMember2022-12-310001037976us-gaap:ForeignPlanMember2023-12-310001037976us-gaap:ForeignPlanMember2022-12-31jll:country0001037976country:HK2023-01-012023-12-310001037976country:SG2023-01-012023-12-310001037976country:IL2023-01-012023-12-310001037976us-gaap:DomesticCountryMember2023-12-310001037976us-gaap:StateAndLocalJurisdictionMember2023-12-310001037976us-gaap:ForeignCountryMember2023-12-310001037976jll:DeferredTaxAssetsOperatingLossCarryforwardsUtilizedOrExpiredMember2023-01-012023-12-310001037976jll:DeferredTaxAssetsOperatingLossCarryforwardsEstablishedOrContinuedMember2023-01-012023-12-31jll:statejll:city0001037976jll:ConclusionOfExaminationByTaxAuthoritiesMember2023-12-310001037976us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001037976us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001037976us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001037976us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001037976us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001037976us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001037976us-gaap:ForeignExchangeContractMember2023-12-310001037976us-gaap:ForeignExchangeContractMember2022-12-310001037976us-gaap:FairValueInputsLevel3Memberus-gaap:InvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2023-01-012023-12-310001037976us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeMemberus-gaap:FairValueMeasurementsRecurringMember2023-01-012023-12-310001037976us-gaap:FairValueInputsLevel3Memberjll:EarnoutLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-01-012023-12-310001037976us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001037976us-gaap:FairValueInputsLevel3Memberus-gaap:InvestmentsMemberus-gaap:FairValueMeasurementsRecurringMember2022-01-012022-12-310001037976us-gaap:FairValueInputsLevel3Memberus-gaap:DerivativeMemberus-gaap:FairValueMeasurementsRecurringMember2022-01-012022-12-310001037976us-gaap:FairValueInputsLevel3Memberjll:EarnoutLiabilitiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-01-012022-12-310001037976jll:LongtermseniornotesEuronotes1.96dueJune2027Member2023-12-31iso4217:EUR0001037976jll:LongtermseniornotesEuronotes1.96dueJune2027Member2022-12-310001037976jll:LongTermSeniorNotes6.875DueDecember2028Member2023-12-310001037976jll:LongTermSeniorNotes6.875DueDecember2028Member2022-12-310001037976jll:LongtermseniornotesEuronotes2.21dueJune2029Member2023-12-310001037976jll:LongtermseniornotesEuronotes2.21dueJune2029Member2022-12-310001037976us-gaap:LineOfCreditMember2023-01-012023-12-310001037976us-gaap:LineOfCreditMember2022-01-012022-12-310001037976jll:LongTermSeniorNotes6.875DueDecember2028Member2023-01-012023-12-310001037976jll:Longtermseniornotes4.4dueNovember2022Member2022-12-310001037976jll:AgreementExpiresSeptember162024ExtensionMember2023-01-012023-12-310001037976jll:AgreementExpiresSeptember162024ExtensionMember2023-12-310001037976jll:AgreementExpiresSeptember162024ExtensionMember2022-12-310001037976jll:AgreementExpiresSeptember142024ExtensionMember2023-01-012023-12-310001037976jll:AgreementExpiresSeptember142024ExtensionMember2023-12-310001037976jll:AgreementExpiresSeptember142024ExtensionMember2022-12-310001037976jll:AgreementExpiresJuly262024ExtensionMember2023-01-012023-12-310001037976jll:AgreementExpiresJuly262024ExtensionMember2023-12-310001037976jll:AgreementExpiresJuly262024ExtensionMember2022-12-310001037976jll:FannieMaeASAPprogramMember2023-01-012023-12-310001037976jll:FannieMaeASAPprogramMember2023-12-310001037976jll:FannieMaeASAPprogramMember2022-12-310001037976jll:LineofCreditGrossMember2023-12-310001037976jll:LineofCreditGrossMember2022-12-310001037976us-gaap:WarehouseAgreementBorrowingsMember2023-12-310001037976us-gaap:WarehouseAgreementBorrowingsMember2022-12-310001037976us-gaap:EquityMethodInvesteeMember2023-01-012023-12-310001037976us-gaap:EquityMethodInvesteeMember2022-01-012022-12-310001037976us-gaap:EquityMethodInvesteeMember2021-01-012021-12-310001037976us-gaap:EquityMethodInvesteeMember2023-12-310001037976us-gaap:EquityMethodInvesteeMember2022-12-310001037976jll:EmployeesMemberjll:LoansRelatedToCoInvestmentsMember2023-12-310001037976jll:EmployeesMemberjll:LoansRelatedToCoInvestmentsMember2022-12-310001037976jll:TravelRelocationAndOtherMiscellaneousAdvancesMemberjll:EmployeesMember2023-12-310001037976jll:TravelRelocationAndOtherMiscellaneousAdvancesMemberjll:EmployeesMember2022-12-310001037976jll:EmployeesMember2023-12-310001037976jll:EmployeesMember2022-12-310001037976us-gaap:InsuranceClaimsMember2020-12-310001037976us-gaap:InsuranceClaimsMember2021-01-012021-12-310001037976us-gaap:InsuranceClaimsMember2021-12-310001037976us-gaap:InsuranceClaimsMember2022-01-012022-12-310001037976us-gaap:InsuranceClaimsMember2022-12-310001037976us-gaap:InsuranceClaimsMember2023-01-012023-12-310001037976us-gaap:InsuranceClaimsMember2023-12-310001037976us-gaap:EmployeeSeveranceMember2023-01-012023-12-310001037976us-gaap:EmployeeSeveranceMember2022-01-012022-12-310001037976us-gaap:EmployeeSeveranceMember2021-01-012021-12-310001037976jll:ContractTerminationAndOtherChargesMember2023-01-012023-12-310001037976jll:ContractTerminationAndOtherChargesMember2022-01-012022-12-310001037976jll:ContractTerminationAndOtherChargesMember2021-01-012021-12-310001037976us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001037976us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001037976us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310001037976us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310001037976us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001037976us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001037976us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310001037976us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310001037976us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001037976us-gaap:AccumulatedTranslationAdjustmentMember2023-12-3100010379762023-10-012023-12-31

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 10-K

Annual Report Pursuant to Section 13 or 15(d) of the Securities Act of 1934

| | | | | | | | | | | |

| For the fiscal year ended | December 31, 2023 | Commission File Number | 1-13145 |

Jones Lang LaSalle Incorporated

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Maryland | 36-4150422 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

| 200 East Randolph Drive | Chicago, | IL | | | 60601 | |

| (Address of principal executive offices) | | (Zip Code) | |

| Registrant's telephone number, including area code: | | (312) | 782-5800 | | | | |

| | | | | | | | | | | | | | |

| |

| | |

| | |

| |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.01 | | JLL | | The New York Stock Exchange |

| Securities registered pursuant to Section 12(g) of the Act: None |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such period that the registrant was required to submit such files). Yes x No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth corporation (as defined in Rule 12b-2 of the Exchange Act).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The aggregate market value of the voting stock (common stock) held by non-affiliates of the registrant as of the close of business on June 30, 2023 was $7,382,022,432.

The number of shares outstanding of the registrant's common stock (par value $0.01) as of the close of business on February 21, 2024 was 47,442,613.

Portions of the Registrant's Proxy Statement for its 2024 Annual Meeting of Shareholders are incorporated by reference in Part III of this report.

JONES LANG LASALLE INCORPORATED

ANNUAL REPORT ON FORM 10-K

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| Item 15. | | |

| Item 16. | | |

| | |

| | |

| | |

| | |

PART I

ITEM 1. BUSINESS

COMPANY OVERVIEW

Jones Lang LaSalle Incorporated, incorporated in 1997, is a Maryland corporation. References to “JLL,” “the Company,” “we,” “us” and “our” refer to Jones Lang LaSalle Incorporated and include all of its consolidated subsidiaries, unless otherwise indicated or the context requires otherwise. Our common stock is listed on The New York Stock Exchange ("NYSE") under the symbol “JLL.”

For over 200 years, JLL, a leading global commercial real estate and investment management company, has helped clients buy, build, occupy, manage and invest in a variety of commercial, industrial, hotel, residential and retail properties. Driven by our purpose to shape the future of real estate for a better world, we help our clients, people and communities SEE A BRIGHTER WAYSM by using the most advanced technology to create rewarding opportunities, amazing spaces and sustainable real estate solutions. JLL is a Fortune 500® company with annual revenue of $20.8 billion, operations in over 80 countries and a global workforce of more than 106,000 as of December 31, 2023. We provide services for a broad range of clients who represent a wide variety of industries and are based in markets throughout the world. Our clients vary greatly in size and include for-profit and not-for-profit entities, public-private partnerships and governmental ("public sector") entities. Through LaSalle Investment Management, we invest for clients on a global basis in both private assets and publicly-traded real estate securities.

Our global platform and diverse service and product offerings position us to take advantage of the opportunities in a consolidating industry and to successfully navigate the dynamic and challenging markets in which we compete worldwide.

We use JLL as our principal trading name. Jones Lang LaSalle Incorporated remains our legal name. JLL is a registered trademark in the countries in which we do business, as is our logo. In addition, LaSalle Investment Management, which uses LaSalle as its principal trading name, is a wholly-owned subsidiary of Jones Lang LaSalle Incorporated. LaSalle is also a registered trademark in the countries in which we conduct business, as is our logo.

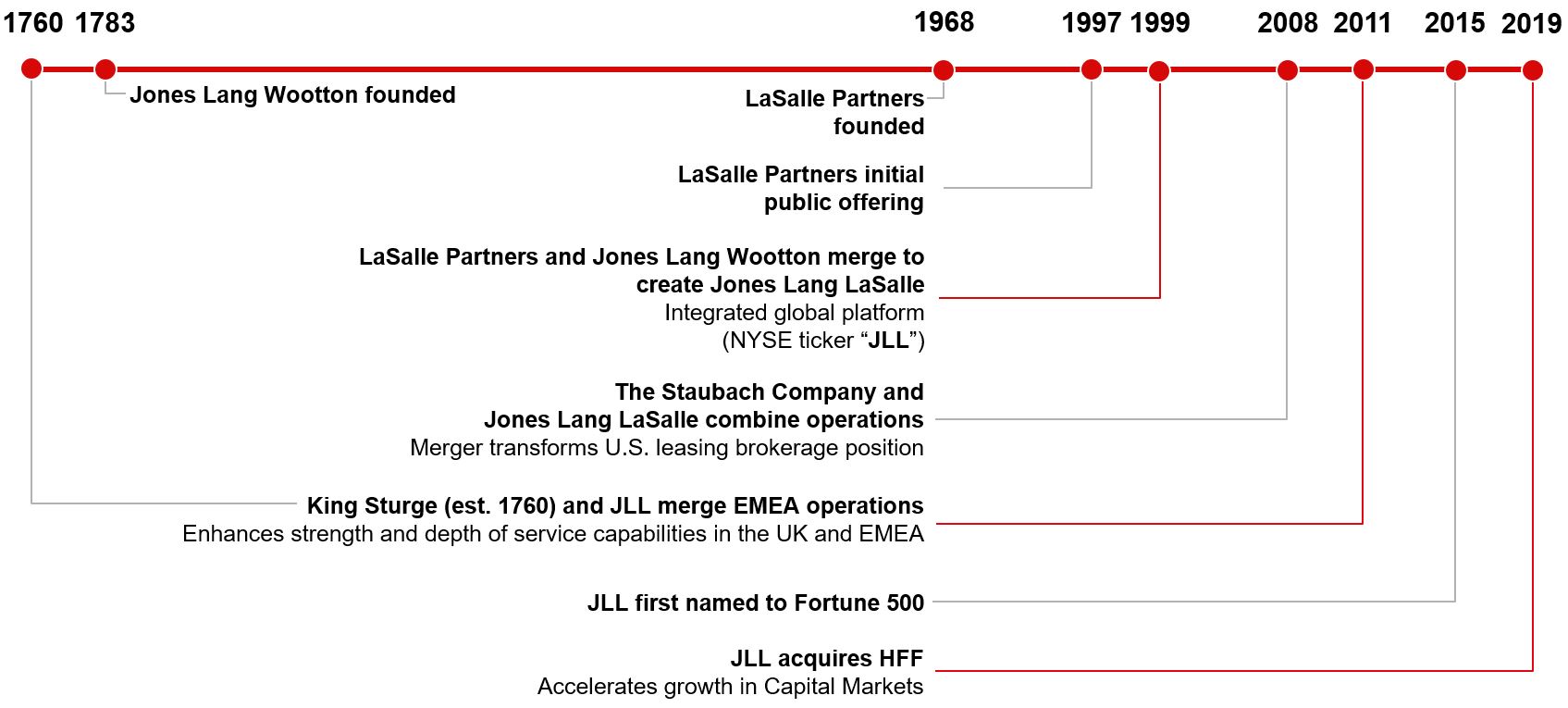

OUR HISTORY

We began to establish our global services platform through the 1999 merger of the Jones Lang Wootton companies ("JLW," founded in England in 1783) with LaSalle Partners Incorporated ("LaSalle Partners," founded in the United States in 1968 and incorporated in 1997). We have grown our business by expanding our client base as well as service and product offerings, both organically and through a series of mergers and acquisitions. Our extensive global reach and in-depth knowledge of local real estate markets enable us to serve as a single-source provider of solutions for the full spectrum of our clients' real estate needs. These mergers and acquisitions have given us additional share and scale in key geographical markets, expanded our capabilities in certain service offerings and further broadened the global platform we make available to our clients.

For information on recent acquisitions, refer to Note 4, Business Combinations, Goodwill and Other Intangible Assets, of the Notes to the Consolidated Financial Statements, included in Item 8.

A timeline of notable milestones in our history is illustrated below.

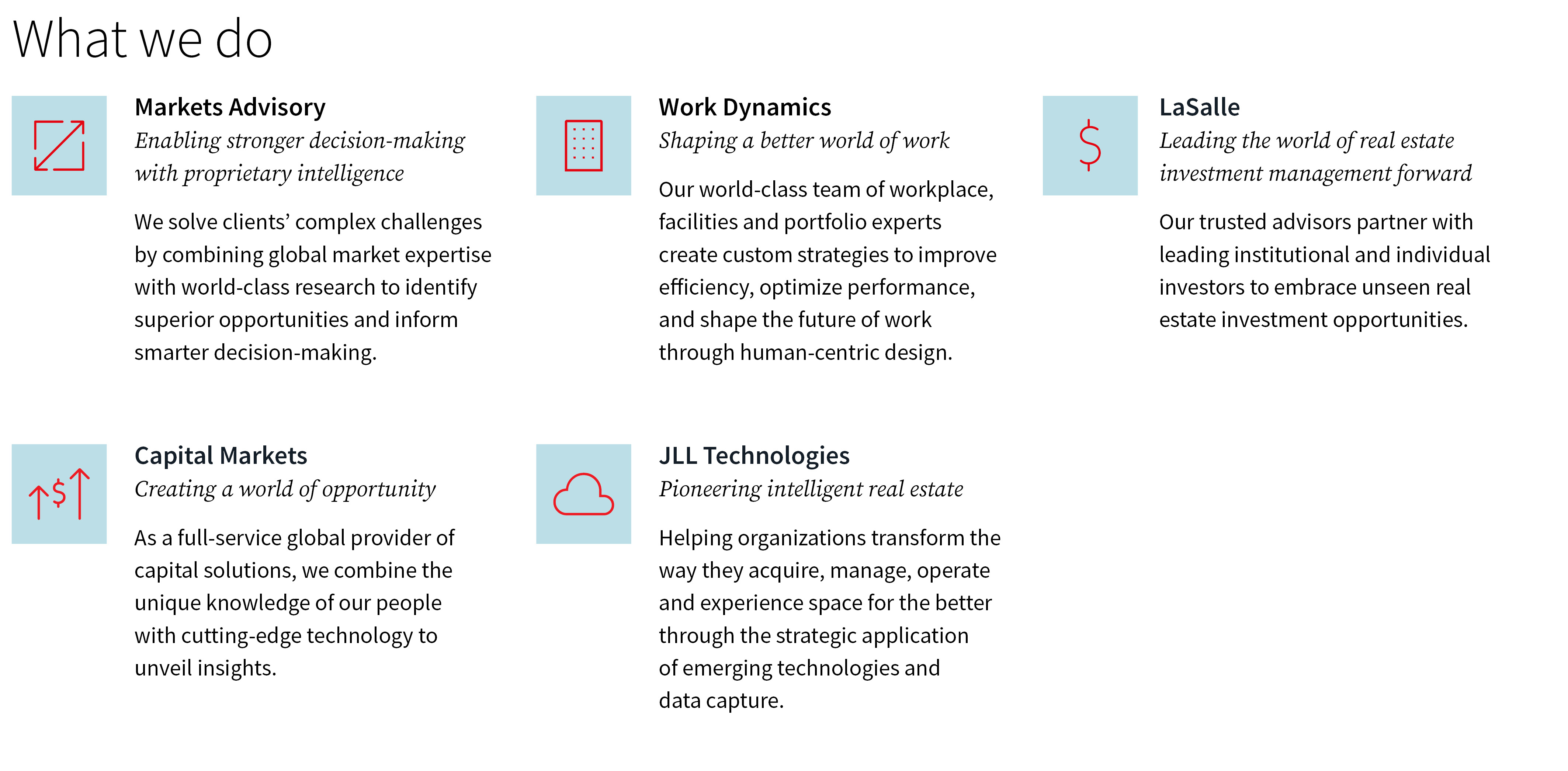

OUR SERVICES AND BUSINESS SEGMENTS

We are driven to shape the future of real estate for a better world. We do this by addressing the needs of real estate owners, occupiers and investors, leveraging our deep real estate expertise and experience to provide clients with a full range of services on a local, regional and global scale. For detail on the range of services provided by each of the five segments outlined in the following graphic, refer to the narrative starting on page 6.

We offer our real estate services locally, regionally and globally to real estate owners, occupiers, investors and developers for a variety of property types, including (ordered alphabetically):

| | | | | | | | |

| • Critical Environments and Data Centers | • Hotels and Hospitality Facilities | • Office (including Flex Space) |

| • Cultural Facilities | • Industrial and Warehouse | • Residential (Individual and Multifamily) |

| • Educational Facilities | • Infrastructure Projects | • Retail and Shopping Malls |

| • Government Facilities | • Logistics (Sort and Fulfillment) | • Sports Facilities |

| • Healthcare and Laboratory Facilities | • Military Housing | • Transportation Centers |

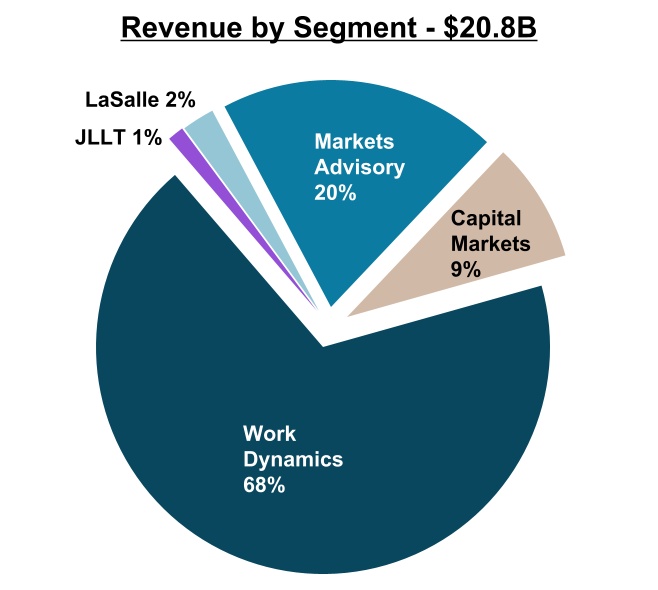

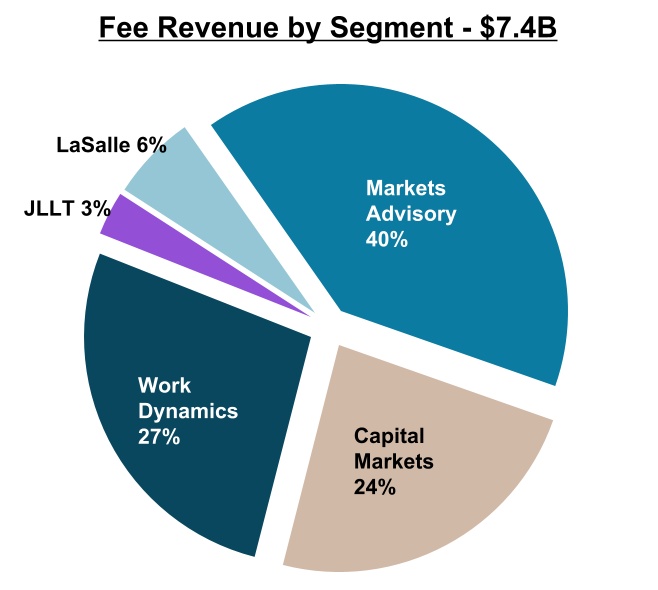

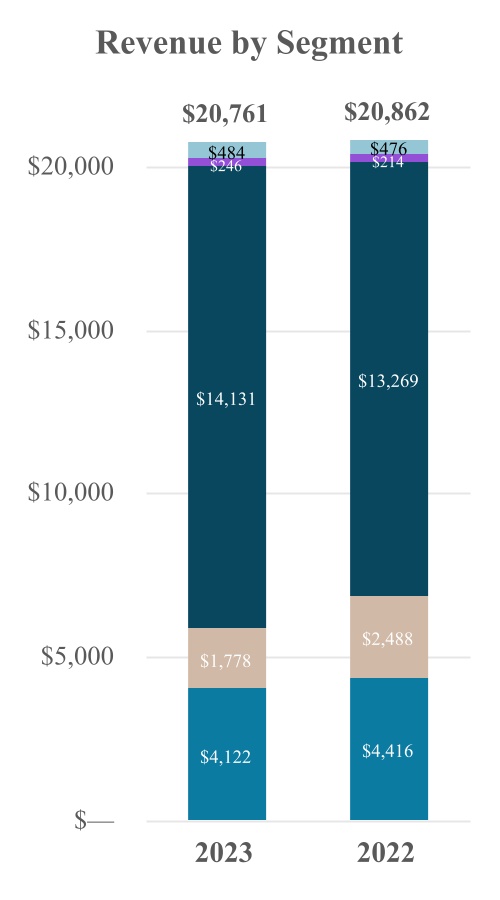

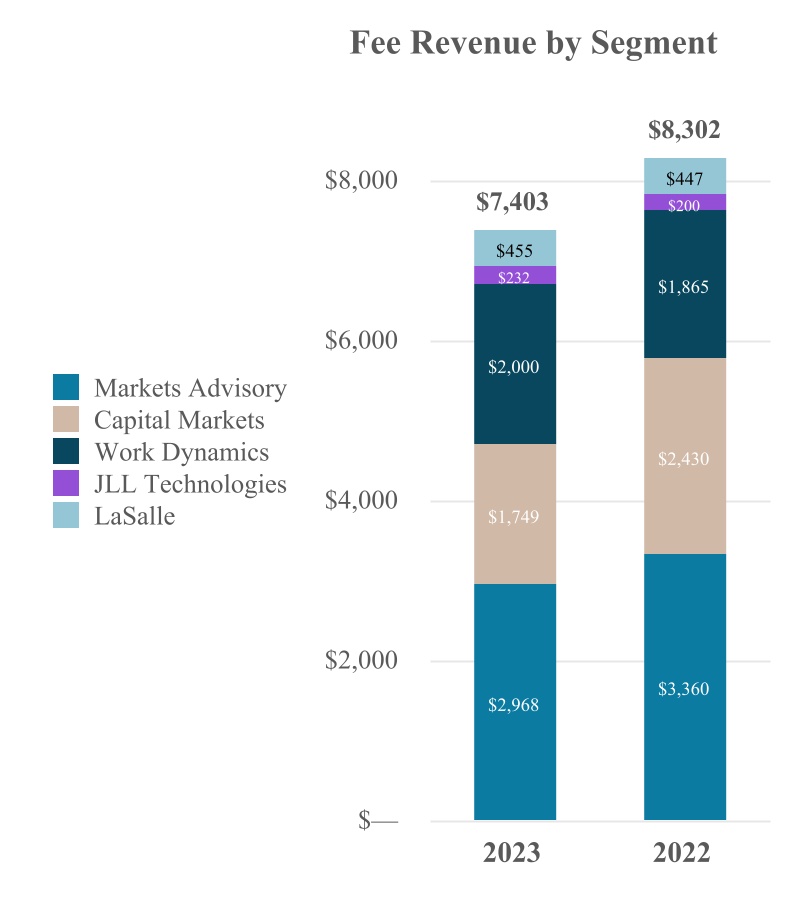

The following reflects our revenue and fee revenue by segment for the year ended December 31, 2023:

To calculate fee revenue, we exclude (i) net non-cash mortgage servicing rights and mortgage banking derivative activity and (ii) gross contract costs associated with client-dedicated labor, and third-party vendors and subcontractors. Refer to Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations for additional discussion of fee revenue, a non-GAAP measure, and reconciliation from the most comparable U.S. GAAP measure, Revenue.

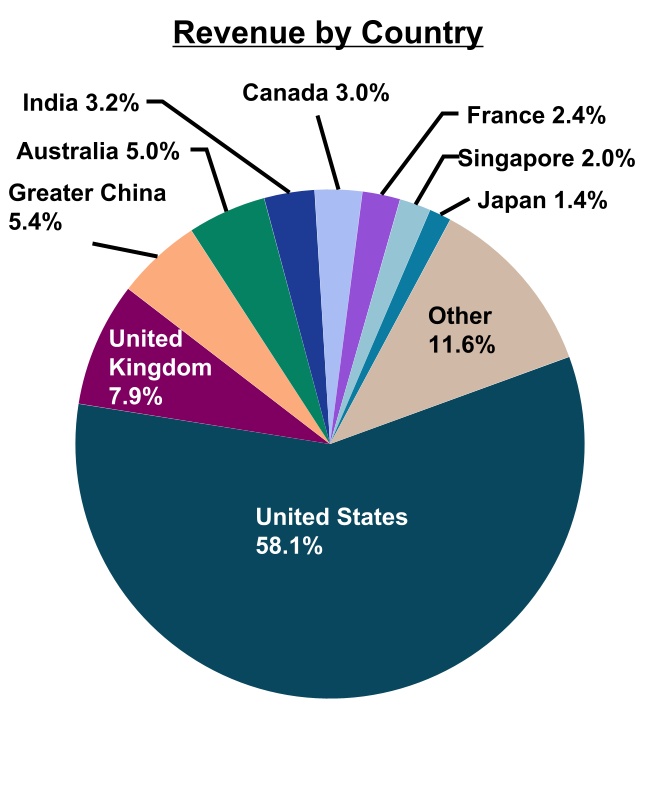

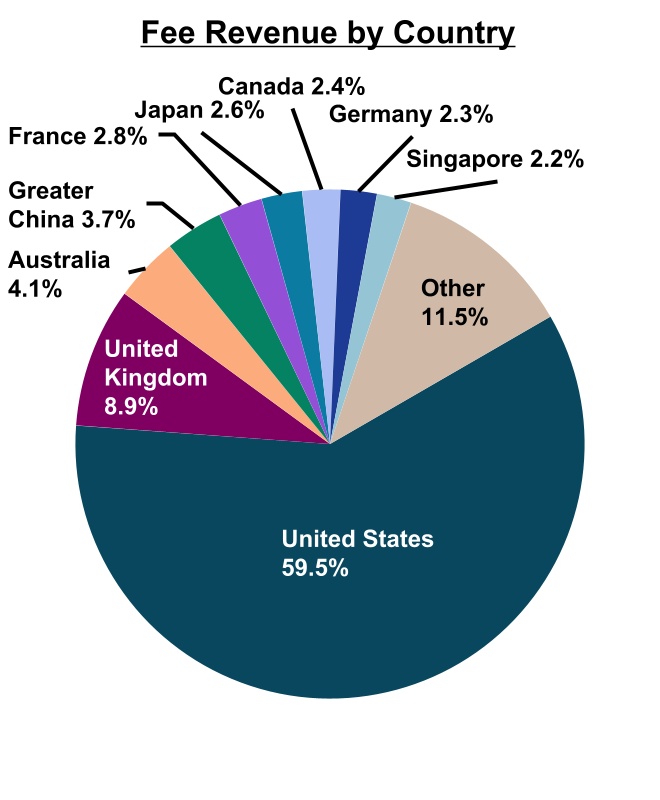

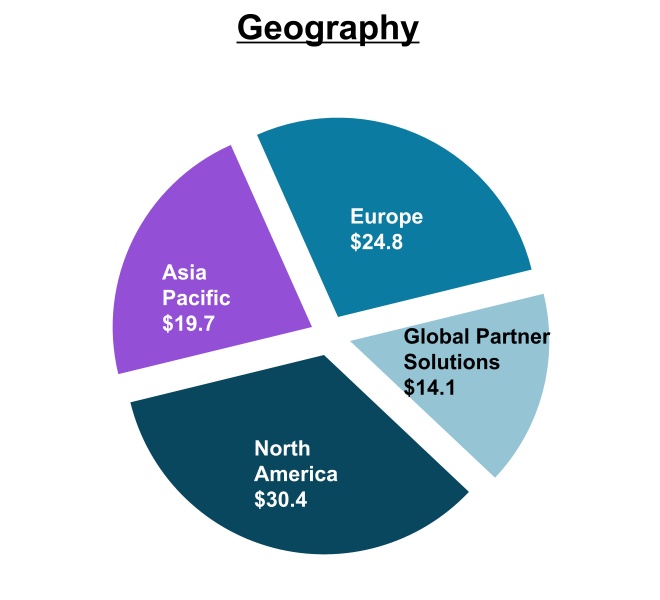

Our revenue was $20.8 billion and fee revenue was $7.4 billion for 2023, earned geographically as follows:

Note: Greater China is defined as China, Hong Kong, Macau and Taiwan.

Our five segments, and the services we provide within them, include:

1. Markets Advisory

Markets Advisory offers local expertise across the globe covering a comprehensive range of services across asset types. We aggregate such services into three categories: Leasing, Property Management and Advisory, Consulting and Other.

Leasing

Agency Leasing executes marketing and leasing programs on behalf of property owners (including investors, developers, property-owning companies and public entities), including product positioning, target tenant identification and competitor analysis through to securing tenants and negotiating leases with terms that reflect our clients' best interests. In 2023, we completed approximately 16,500 agency leasing transactions representing 303 million square feet of space.

Tenant Representation establishes strategic alliances with occupier clients to define space requirements, identify suitable alternatives, recommend appropriate occupancy solutions, and negotiate lease and ownership terms with landlords. Our involvement helps our clients reduce real estate costs, minimize occupancy risk, improve occupancy control and flexibility, and create more productive office environments. In 2023, we completed approximately 21,600 tenant representation transactions representing 539 million square feet of space.

Our agency leasing and tenant representation advisory anchors to the workplace of the future and helps owners and occupiers realize their sustainability commitments and goals. Both our agency leasing and tenant representation fees are typically based on a percentage of the value of the lease revenue commitment for executed leases, although in some cases they are based on a monetary amount per square foot leased.

Property Management

Property Management provides services to real estate owners for office, industrial and logistics, retail, multi-housing and specialty properties. We typically provide property management services through local teams, which are generally on-site for office and multi-housing properties, supported by regional supervisory teams and central resources in such areas as technology, training, environmental services, accounting, marketing, lease administration and human resources. We leverage our market share and buying power to deliver superior service and value to our clients, and our extended delivery team increasingly uses new technology and digital capabilities we deploy at the property. This allows clients to drive value, optimize operations, gain insights and elevate the tenant experience. Our work with clients also includes advisory, tenancy management and services focused strategically on reducing energy usage and carbon impact.

As of December 31, 2023, we provided property management services for properties totaling approximately 3.0 billion square feet.

We are generally compensated by either directly agreeing to a fixed fee or a cost plus fee model, or a fee based upon a percentage of cash collections we make on behalf of our clients, or based on square footage managed; in some cases, management agreements provide for incentive compensation relating to operating expense reductions, gross revenue or occupancy objectives, or tenant satisfaction levels. Consistent with industry norms, management contract terms typically range from one to three years, although some contracts can be terminated at will at any time following a short notice period, usually 30 to 120 days.

Advisory, Consulting and Other

Advisory and Consulting provides clients with specialized, value-add real estate consulting services in such areas as occupier portfolio strategy, workplace solutions, location advisory, mergers and acquisitions advisory, asset management, development advisory and master planning activities.

We typically negotiate compensation for Advisory and Consulting based on developed work plans that vary based on the scope and complexity of projects.

2. Capital Markets

Capital Markets is a full-service global provider of capital solutions creating a world of opportunity for investors and owners of real estate. As a leading provider of property sales, debt, value and risk advisory services, and hedging and derivatives, we combine the unique knowledge of our people with the power of collective insight and technology made possible by our fully-integrated capital markets platform. Our broad array of services includes (ordered alphabetically):

| | | | | | | | |

| ● Debt advisory | | | | ● Loan sales |

| ● Equity advisory (Equity and funds placement, M&A and corporate advisory) | | | | ● Loan servicing |

| ● Investment sales and advisory | | | | ● Value and risk advisory |

Investment Sales, Debt/Equity Advisory and Other

We provide brokerage and other services for real estate transactions, such as sales or loan originations and refinancing. M&A and corporate advisory services include sourcing capital, both equity and debt, and other traditional investment banking services designed to assist investor and corporate clients to maximize the value of their real estate interests. To meet client demands for selling and acquiring real estate assets domestically and internationally, our Capital Markets teams combine local market knowledge with our access to global capital sources to provide superior execution in raising capital for real estate transactions. By originating, developing and introducing innovative new financial products and strategies, Capital Markets is integral to the business development efforts of our other businesses. Most of our revenues are in the form of fees, derived from the value of transactions we complete or securities we place. In certain circumstances, we receive retainer fees for portfolio advisory or consulting services. For the year ended December 31, 2023, we provided capital markets services for approximately $157 billion of client transactions.

Value and Risk Advisory

Our Value and Risk Advisory professionals provide several services, including valuation, secured lending advisory, transaction support, data and analytics, development advisory, asset and infrastructure advisory, business valuation, property tax advisory, and restructuring. Our specialist risk advisory team provides environmental risk assessments to help asset owners reduce the carbon footprint of an asset. Our risk analytics services use artificial intelligence ("AI") and machine learning to identify risks from cash flow stability, climate change, location, regulatory and health and safety risks. Working closely with investors and lenders, we usually negotiate compensation for value and risk advisory services based on the scale and complexity of each assignment, and our fees typically relate in part to the value of the underlying assets.

Loan Servicing

In the U.S., we are a commercial multifamily lender and loan servicer approved by Freddie Mac, Fannie Mae and Housing and Urban Development/Ginnie Mae (the “Agencies”). In addition, we are one of only 25 Fannie Mae Delegated Underwriting and Servicing ("DUS") lenders. We service substantially all the loans we originate and sell to the Agencies, and service loans we did not originate but subsequently acquire the rights to service. We obtain a periodic fee for each loan we service based on a proportion of the cash collections. As of December 31, 2023, we serviced a loan portfolio of approximately $136 billion.

| | | | | |

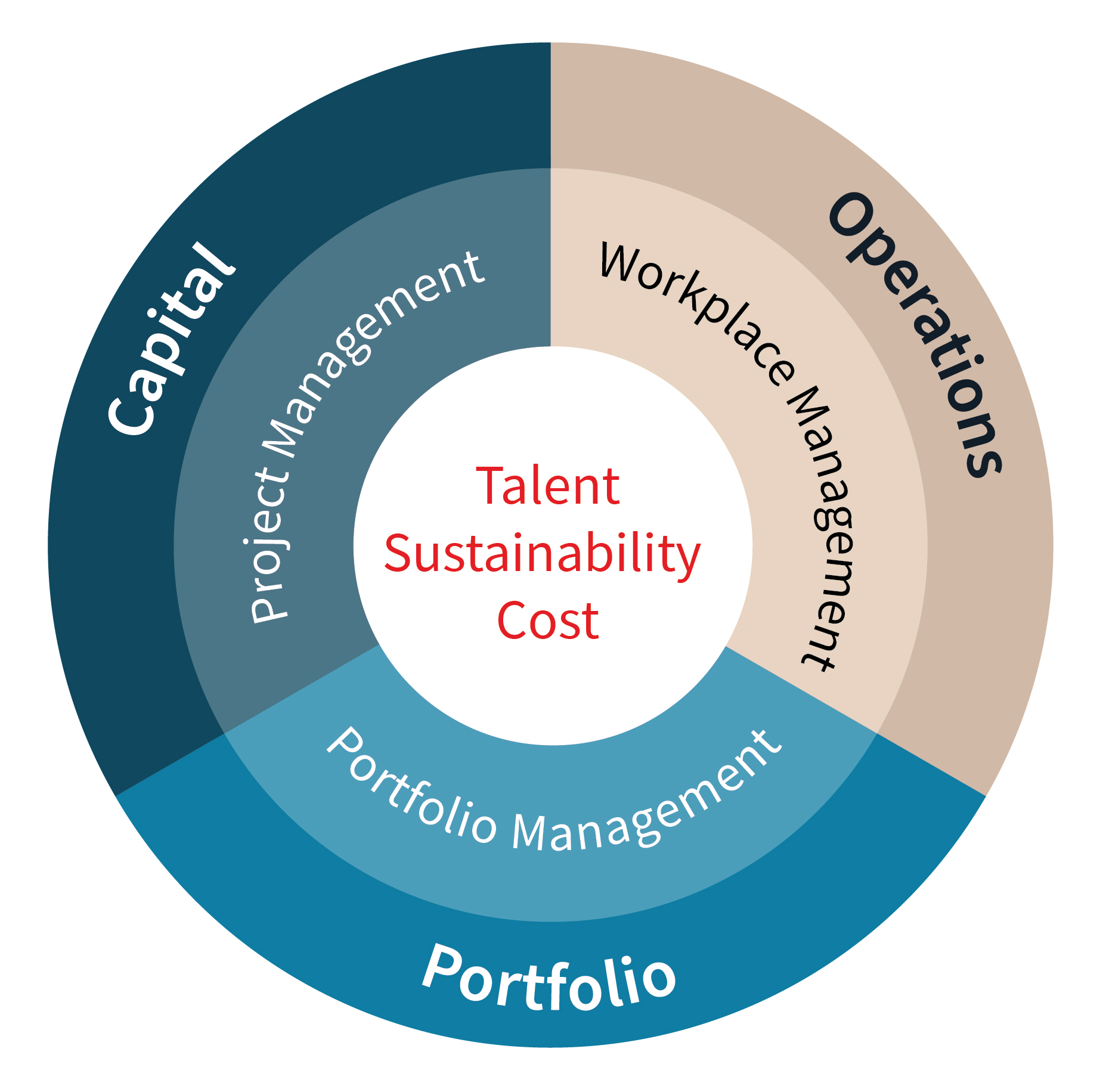

3. Work Dynamics Workplace Management ("WPM") As a strategic partner of clients with a multinational footprint, Work Dynamics offers a single, cohesive service-delivery team focused on three key value levers: (i) making informed, data-driven decisions and digital transformation, (ii) achieving operational excellence through improved productivity and financial performance and (iii) attracting and retaining key talent through an enhanced user experience. WPM provides comprehensive facility management services globally to corporations and institutions that outsource the management of the real estate they occupy, typically those with large multi-market portfolios of over one million square feet. Our WPM offering leverages tech-enabled solutions and focuses on the work, worker and workplace to help clients manage costs, achieve sustainability goals, improve workplace service delivery and enhance end-user experience and performance. | |

Our globally-integrated delivery team includes our own personnel as well as third-party vendors and subcontractors who meet clients' requirements by providing consistent service delivery worldwide and a single point of contact for their real estate service needs. WPM solutions offered to clients range from mobile engineering at a single location to a full-service outsourcing, where we execute day-to-day operations management of client site locations, delivered through a globally-integrated platform with standardized processes. Facilities under management cover all real estate asset classes, including corporate headquarters, distribution facilities, hospitals, research and development facilities, data centers and industrial complexes. As of December 31, 2023, WPM managed approximately 1.8 billion square feet of real estate for our clients. WPM contracts are generally structured on a principal basis (a fixed fee, guaranteed maximum, or reimbursement-based pricing model) but may also be on an agency basis. Typically, our structures include a direct or indirect reimbursement for costs of client-dedicated personnel and third-party vendors and subcontractors in addition to a base fee and performance-based fees. Performance-based fees result from achieving quantitative and qualitative performance measures and/or target scores on recurring client satisfaction surveys. WPM agreements are typically three to seven years in duration and, although most contracts can be terminated at will by the client upon a short notice period (usually 30 to 60 days), a transition period of six to twelve-months is more common in our industry. We typically experience a high renewal rate, with most clients renewing their contracts at least once; many of our largest contracts have been in place for more than a decade. |

Project Management Project Management provides consulting, design, management and build services to tenants of leased space, owners in self-occupied buildings and owners of real estate investments, leveraging technology to drive outstanding service delivery. We also provide services to public-sector clients, notably military and government entities, and educational institutions, primarily in the U.S. and to a growing extent in other countries. We bring a "life cycle" perspective to our clients, from consulting and capital management through design, construction and occupancy via our JLL brand, while we also provide fit-out, refurbishment and design services under the Tétris brand, predominantly in Europe. Our Project Management business is generally compensated on the basis of negotiated fees as well as reimbursement of costs when we are principal to a contract (or client). Individual projects are generally completed in less than one year, but client contracts may extend multiple years in duration and govern a number of discrete projects. |

|

|

Portfolio Services

Through the suite of services our Work Dynamics business provides to clients via our "One JLL" approach, we gain deep knowledge and extensive data about their corporate real estate footprints, business strategies and organizational priorities. This knowledge enables our consulting practice to effectively advise clients on how to optimize their workplace strategies and occupancy planning to improve utilization and ultimately enhance the productivity and well-being of those who use the space. More broadly, this advice may extend to our clients’ portfolio strategies, including location advisory, transaction management, lease administration, technology implementation and optimization, and options to add and integrate flexible space solutions. Our fee structures vary and are based on the point-in-time or over-time nature of services and deliverables provided to our clients.

4. JLL Technologies

JLL Technologies leverages its comprehensive technology portfolio of software platforms, apps, hardware and technology services, as well as innovations from venture-backed companies, to help organizations maximize their real estate experience.

Services and Software Solutions

We offer professional services including program and project management, implementation and support, managed services, and advisory/consulting services. We recognize the associated revenue at the time our performance obligation is satisfied, sometimes over the course of multiple years.

In addition, our cloud-based software solutions enable higher-quality insight and decision-making through improved data and analytics, creating opportunities to improve clients' financial performance. These solutions are typically sold via subscription offerings and we recognize revenue over time, commensurate with the length and terms of the contract. Examples include:

•Building Engines, a comprehensive system that unites the technology and applications used to manage a building with simplified upstream and downstream user interactions;

•Corrigo, a mobile and desktop-integrated product that enables facility managers to efficiently manage work orders, centralize repairs and maintenance, and automate tasks, all on a scalable level; and

•Hank, a technology which uses machine learning and artificial intelligence to optimize building energy efficiency, maintenance costs and tenant comfort, facilitating improved property operating income.

An additional product offering is JLL Marketplace, which enables one-stop shopping for facility product needs and supports ordering, billing and order tracking. We generate revenue by taking a share from gross market value of all goods and services sold via this platform.

JLL Spark - Investments in Proptech

We incubate and drive property technology (proptech) innovation across the real estate spectrum, supporting the development of an array of products and data analytics tools. One way we achieve this goal is through strategic investments in proptech funds and early to mid-stage proptech companies, including through our JLL Spark Global Ventures Funds.

We generally report these investments at fair value and include fair value adjustments in our Consolidated Statements of Comprehensive Income within Equity earnings. As of December 31, 2023, the fair value of such investments was $397.6 million.

5. LaSalle

LaSalle is a global real estate investment management firm that invests institutional and individual capital in real estate assets and securities with a strategic priority to meet client objectives and deliver superior risk-adjusted returns over market cycles.

LaSalle launched its first institutional investment fund in 1979, making us one of the most experienced real estate focused investment managers in the industry. We have invested, on behalf of our clients and ourselves, in real estate assets located in 28 countries around the globe, as well as in public real estate companies traded on all major stock exchanges. LaSalle provides clients with a broad range of real estate investment products and services, designed to meet the differing strategic, asset allocation, risk/return and liquidity requirements of our clients. The range of investment solutions are offered either through commingled or single investor strategies and include private and public equity investments and real estate debt strategies structured as private or public open-ended funds or private closed-end funds (commingled funds), separate accounts, joint ventures or co-investments.

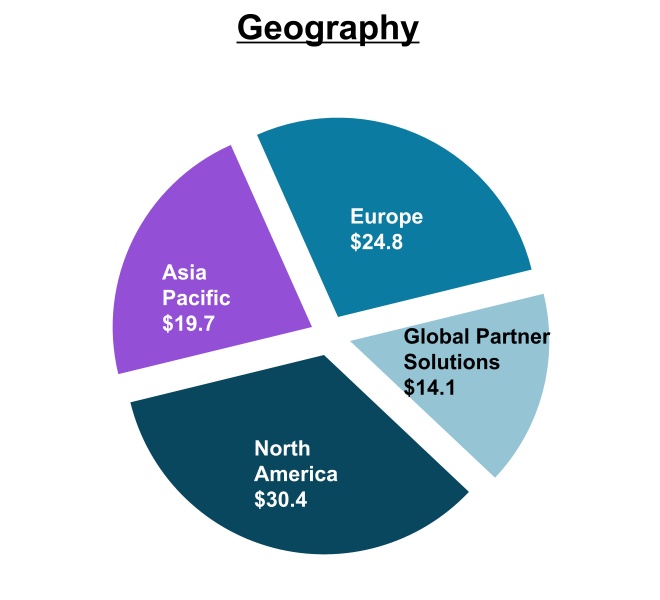

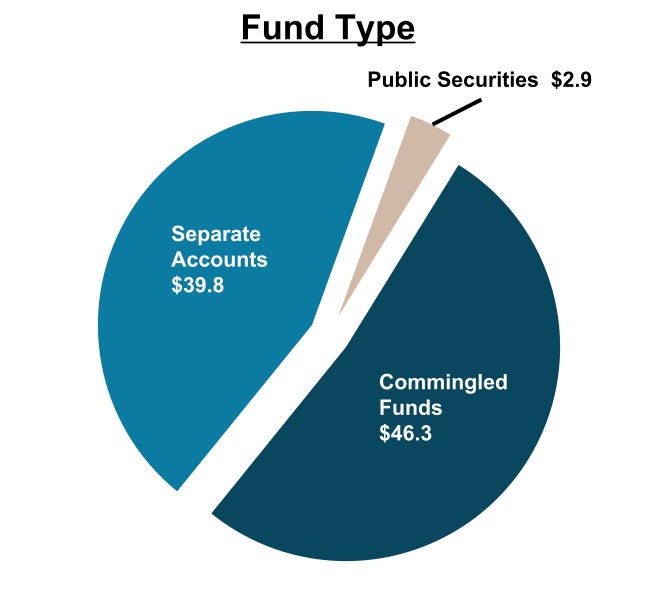

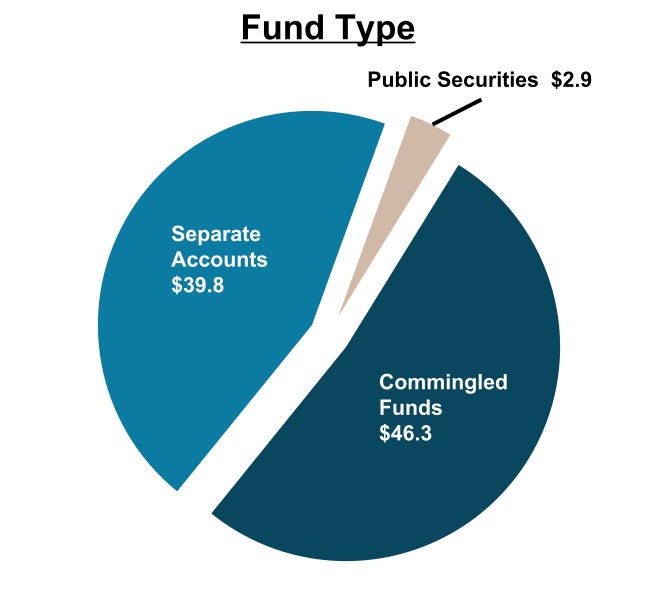

LaSalle's assets under management ("AUM") were $73.9 billion as of December 31, 2023. To more closely conform with the methodology of similarly titled metrics provided by other industry participants, the calculation of AUM will be refined in 2024 to include uncalled committed capital and cash held on behalf of clients based on a new standard industry definition developed by industry groups NCREIF, INREV and ANREV. Under the new methodology, AUM was $89.0 billion as of December 31, 2023. AUM by geographic distribution and fund type under the updated definition as of December 31, 2023 is detailed in the following graphics ($ in billions).

We believe our ability to co-invest alongside our clients' funds aligns our interests and will continue to be an important differentiating factor in maintaining and improving our investment performance and attracting new capital to manage. As of December 31, 2023, we had a total of $388.3 million of co-investments, alongside our clients, in real estate ventures included in total AUM.

LaSalle is compensated for investment management services for private equity investments based on capital committed, capital deployed and managed (advisory fees), with additional fees tied to investment performance above specific hurdles (incentive fees). In some cases, LaSalle also receives fees tied to acquisitions, financings, and dispositions (transaction fees).

Our investment funds have various life spans, typically ranging between five and nine years, but in some cases are open ended. In 2023, open-ended funds represented approximately 30% of AUM as of December 31, 2023. Separate account advisory agreements generally have specific terms with "at will" termination provisions and include fee arrangements calculated on the mark to market value of the assets, plus, in some cases, incentive fees.

ORGANIZATIONAL PURPOSE

JLL’s organizational purpose is to shape the future of real estate for a better world. Staying true to this purpose in all that we do enables us to fully align with the best interests and ambitions of our clients and all our stakeholders. It exemplifies our commitment to the highest standards of environmental, social and corporate governance ("ESG"), and to a more sustainable, diverse and inclusive future.

This core organizational purpose is fully aligned with our "One JLL" philosophy which supports our corporate values of teamwork, ethics and excellence. This philosophy formalizes how our teams engage with each other and enables us to deliver the best capabilities to our clients. Ultimate responsibility for promoting awareness and ensuring adherence to our values and purpose across the enterprise is held by the JLL Global Executive Board ("GEB") and is endorsed by our Board of Directors. Our purpose guides our strategic growth vision and informs our response to the long-term macro trends which maintain prevalence in the real estate industry at all points in the economic cycle. These trends and our strategic framework are summarized below.

INDUSTRY TRENDS

Informing our long-term growth strategy, we have identified five macro trends we see as major guiding influences on the continued expansion and evolution of the real estate sector. Each of these trends has a multi-year lifespan, and while the COVID-19 pandemic and subsequent economic volatility has slowed some and accelerated others, we expect all five trends to maintain their long-term trajectory and relevance over the next decade. These macro trends are:

1 Urban Development Update - World Bank, April 2023.

Growth in corporate outsourcing

The steady long-term trend towards outsourcing of real estate services, which began in the early 1990s, originally with U.S.-based corporations, is now a global trend with a strong growth trajectory. By focusing their own resources on core competencies and partnering with dedicated service providers like JLL to manage real estate strategy and activities, organizations are better positioned to advance their goals of financial and operational performance, talent attraction, customer experience, employee productivity and environmental sustainability.

In corporate boardrooms around the world, the pandemic has significantly enhanced the growing focus on reimagining workplaces and concepts for the future of work. These are areas in which JLL holds deep expertise and specialist experience and resources. Across different industries, we are positioned to provide highly adaptive and relevant solutions that promote organizational culture and prioritize health and well-being, flexible working models and technology enablement. We see further growth in the strong and sustained trend for organizations to outsource real estate services as our clients increasingly seek strategic advice on reimagining their workspaces and workstyles to reinforce culture, attract talent and drive cost efficiencies.

Rising investment allocations and globalization of capital flows to real estate

In the years following the 2008 Global Financial Crisis, as investors reassessed investment allocations and priorities, real estate emerged from its previous "alternative investment" classification to become a major defined asset class of its own. This began a sustained long-term trend of rising investment allocations to the real estate sector with allocations increasing approximately 200 basis points over the last 10 years, according to Cornell University's Baker Program in Real Estate and Hodes Weill & Associates, LP. While major global and market events can have significant near-term impacts on real estate investment transaction volumes, this deeply engrained long-term trend remains prevalent. As we move into 2024, capital will be focused on the distinct opportunities to access real estate's attractive returns and distinctive investment characteristics.

Complementing this, when we see investment volumes return, we anticipate increased capital flows across borders and between continents, creating new opportunities for advisors and investment managers equipped to source and facilitate these capital flows and execute cross-border transactions. Our real estate investment expertise, linking seamlessly across the world's major markets, is ideally placed to support our clients' investment ambitions.

Urbanization

The concentration of culture, diversity, opportunity, facilities and creative expression supports the long-term global trend of migration into the world's major cities. While work patterns and preferences will continue to evolve, driven in part by new possibilities created by technology and the widespread adoption of flexible working, cities will thrive as they deliver on people's lifestyle and economic ambitions, characterized by vibrant and reimagined office, cultural, retail and residential profiles.

According to the World Bank's Urban Development update in April 2023, over 80% of global GDP is generated from cities, with the population in cities expected to increase 1.5 times by 2045. These trends support increasing demand for global real estate services and advice. JLL has well-established global research exploring this and associated trends in more depth, including related dynamics in the way the world’s major cities are growing, adapting and evolving.

Fourth Industrial Revolution

The World Economic Forum defines the Fourth Industrial Revolution as the wave of change being driven through advances in technology, data and artificial intelligence. The real estate industry is affected in many ways including, for example, (1) the transition to flexible and hybrid office working models, (2) new data-driven understanding of how all forms of real estate can be more efficient, sustainable and productive, (3) the rise of experiential and online retail, (4) new asset management technologies and (5) the growth of the logistics sector.

While there is currently no single technology disruptor positioned to dominate the real estate industry, there are thousands of start-ups, applications and concepts vying to transform the marketplace, collectively known as proptech. The challenge to innovate and maximize the current and future benefits of proptech is constant. At the heart of our Beyond strategy (discussed below), supported by major ongoing investments and innovations, we continue to accelerate progress toward our goal of becoming the widely-recognized leading user of technology and data in real estate.

Sustainability

Addressing and managing climate change and the finite nature of global resources are defining issues for our time. According to the International Energy Agency, real estate and the built environment account for nearly 40% of total global direct and indirect CO₂ emissions. At the same time, stakeholders are demanding greater focus on ESG from businesses and organizations in all areas of society. These and other factors, including heightened awareness of the importance of promoting health and well-being, coalesce into strong rising demand for sustainability services and advice across the real estate industry. JLL has identified meeting this demand as a major growth opportunity and priority, aligning with our purpose to shape the future of real estate for a better world.

Refer to our annual ESG Performance Report, available on our website, for further information.

STRATEGIC FRAMEWORK

Our GEB has set out the Beyond strategic vision and framework to deliver long-term sustainable and profitable global growth. This framework comprises broad strategic priorities grouped into five pillars – Clients, Brand, Technology, People & Values, and Sustainability – which collectively support and drive our ambitious long-term growth trajectory.

Beyond: Our Strategic Vision for Long-Term Sustainable and Profitable Growth

Since initiating our Beyond strategic plan in 2017, we successfully completed a multi-year transformation program building a fully integrated global organizational and enabling our "One JLL" philosophy across our business lines and functions. As a result, we are now even better positioned to provide seamless and highly consistent services to our clients across the world, as well as smoothly and rapidly deploy innovations, best practices and new technologies.

Clients

Our “One JLL” philosophy formalizes how our teams engage with each other and enables us to deliver the best capabilities to our clients. Under “One JLL” our teams go to market together, which allows us to seamlessly serve clients across business lines and geographies. We also focus on attracting clients in growth industries who value our global scale and data capabilities.

We continue to enhance our comprehensive service offerings to create real value for our clients. Guided by our Beyond strategy, we are making continued investments in advanced client relationship management processes and tools, ensuring we can quickly assemble the best multidisciplinary teams and expertise tailored to meet each client's requirements.

Brand

Our extensive annual global client relationship survey for 2023, and ongoing monitoring of net promoter scores, show that more than 80% of our clients express positive sentiment when discussing the JLL brand. Our strong reputation and broad market coverage forges greater client loyalty. This recognition complements our recent brand refresh. Clients turn to us for solutions and insights to optimize their real estate strategies and support their operational needs and growth strategies. Our industry-leading research capabilities and data analytics equip JLL's people to enable clients to SEE A BRIGHTER WAY.

Our clients perceive the JLL brand to be trustworthy and ethical, in line with our recent recognition by Ethisphere as one of the World's Most Ethical Companies for the 16th consecutive year. They continue to value our professionalism, responsiveness, competency and how we listen to their needs to deliver a personalized service.

JLL is a world leader in real estate services with a unique blend of global presence and local expertise. We have won numerous awards and recognition that reflect the service quality we provide to our clients, the integrity of our people and our desirability as a place to work. In February 2023, Fortune magazine named JLL amongst the World’s Most Admired Companies for the 7th consecutive year. Further, JLL was included in the Bloomberg Gender Equality index (every year since 2020) and awarded the Energy Star Partner of the Year – Sustained Excellence Award by the U.S. Environmental Protection Agency (12th consecutive year). Refer to the Distinguishing Attributes and Competitive Differentiators section below for additional awards and recognition during the past year.

We continue to strengthen and expand awareness of our brand beyond the traditional real estate sector, with a focused goal in our Beyond strategic vision to reach more CEOs and other senior decision makers. Supporting this goal, we are a long-standing and active strategic partner of the World Economic Forum, playing a key role in its Real Estate and Investment industry groups and its Alliance of CEO Climate Leaders, among other areas of engagement.

Technology

JLL embraces technology to deliver value for our clients, people and shareholders. Technology is core to our growth strategy as reflected in our significant investments in JLL Technologies. With a comprehensive portfolio of purpose-built solutions, unparalleled industry expertise and leading-edge, venture-backed companies, JLL Technologies enables organizations to achieve exceptional building performance, accelerate the path to net zero and optimize spaces for the future of work.

JLL Technologies is a global leader in proptech, expanding and refining our technology capabilities to deliver significant competitive advantages and value for our company and our clients, across all business lines. The technology and data solutions we provide include multiple cloud-based software products and AI-powered platforms. These technologies generate value for occupiers and investors by leveraging data and analytics to improve the quality of decision making, deliver unique insights and reduce operating costs.

Additionally, we continue to be committed to the JLL Spark Global Ventures Funds, the offerings of which are further discussed in Our Services and Business Segments. Visit our websites at www.jll.com and www.jllt.com to see the full portfolio of technology services.

The substantial platform technology investments we made in the early phases of our Beyond journey are benefiting all areas within our enterprise by improving efficiency of our producers, increasing margins, growing market share of our existing businesses and enabling entry into adjacent markets with new business models.

People & Values

People are at the heart of our business. We are dedicated to helping our people SEE A BRIGHTER WAY by enabling them to explore new opportunities, build expertise, create long-term careers, and draw inspiration through working with talented colleagues and clients. Our commitment to promoting and achieving true diversity and inclusion is exemplified by achieving 30% female representation amongst our top 100 leaders.

In the world's major markets across most industries, declining working-age populations and long-term economic growth continue to drive competition for talent, resulting in highly fluid and competitive recruitment markets. A successful enterprise-wide people strategy is central to our company's success and complements our promise to our people where we commit to empowering them to shape a brighter way forward. This promise ensures JLL is positioned as an employer of choice for top talent, achieving and sustaining a diverse, inclusive and collaborative culture that strongly appeals to our people and our clients alike.

Sustainability

Our sustainability program is rooted in our purpose to shape the future of real estate for a better world. Staying true to this purpose enables us to align with the interests and ambitions of our clients and stakeholders. It exemplifies our commitment to the highest standards of ESG, and to a more sustainable, diverse and inclusive future.

With 40% of global carbon emissions emanating from the built environment according to the International Energy Agency, the real estate sector has a collective responsibility to set and achieve transformational sustainability targets. JLL is a leader in addressing this challenge - from setting aggressive sustainability targets for our own operations, through providing industry-leading sustainability services, products and advice for our corporate and investor clients, to partnering with civil society and industry bodies.

In 2021, we became the first real estate services company to align its climate ambitions with climate science when our net zero target was certified by the Science Based Targets initiative (SBTi) to its Net-Zero Standard. Within this overall target, JLL has committed to:

1.A near-term target to reduce absolute Scope 1, 2 and 3 emissions by 51% by 2030 from a 2018 baseline (including 100% of Scope 1 and 2 emissions from JLL-occupied buildings)

2.A long-term target to reduce absolute Scope 1, 2 and 3 emissions by 95% by 2040 from a 2018 baseline

We further discuss our ESG and sustainability focus areas in the next section, Sustaining Our Enterprise: A Business Model That Considers All Aspects of Stakeholder Value.

Growth

Our Beyond priorities combined with the macro trends we discussed above provide a platform for long-term growth. Our strategic vision positions us to capitalize on these trends while enhancing productivity, optimizing sustainable and profitable long-term growth, and creating value for all our stakeholders. We embrace our opportunity to play a leading role in understanding and guiding the future of work, workplaces and cities, while enabling clients and communities to deliver on their sustainability targets and ambitions. JLL recognizes the vital role innovations in data and technology will play in the real estate sector and continue to strategically invest in products and data-driven insights to lead this wave of change.

The commercial real estate industry is consolidating with the large players gaining market share both organically and through mergers and acquisitions. Our strong investment grade balance sheet provides flexibility to selectively pursue merger and acquisition opportunities that will augment our organic growth.

Our growth strategy and strategic vision places a central focus on diversity, equity and inclusion, ensuring we attract and retain a truly diverse, inclusive and talented global workforce.

SUSTAINING OUR ENTERPRISE: A BUSINESS MODEL THAT CONSIDERS ALL ASPECTS OF STAKEHOLDER VALUE

As referenced above, the built environment is estimated to account for over one-third of global final energy consumption and nearly 40% of total direct and indirect CO2 emissions, meaning JLL can have a significant impact through the work we do with our clients, as well as efforts in our own workplaces and communities. | | | | | |

| Our Global Sustainability Program | |

Our sustainability program focuses on three issue areas that directly align to our purpose and JLL's corporate strategy. Each area is supported by targets and delivered by global business lines and corporate functions. •Climate action for sustainable real estate: We support action that accelerates the transition to net zero, enhances performance and mitigates risks. •Healthy spaces for all people: We create safe and healthy spaces that promote productivity, well-being and sustainability. •Inclusive places for thriving communities: We provide fair and inclusive places that support equal opportunities and thriving communities. |

Four principles underpin our program and demonstrate how we deliver a positive impact for our stakeholders and lead our sector on sustainability.

1.Being a responsible business and leading by example, giving us the credibility to talk to our clients and advance industry action on sustainability

2.Harnessing the power of our people, giving them the opportunity, knowledge and tools to own their success and valuing what makes them unique

3.Driving change through client solutions to maximize impact, collaborating to transform and transition toward more sustainable outcomes

4.Advocating for a better real estate sector by driving demand for sustainability, demonstrating thought leadership and engaging the industry, governments and society on the issues that matter most

Our approach is informed by a periodic assessment of ESG topics to ensure our program and targets address the key issues for our business. In 2023 this included a "double materiality" review aligned with the European Sustainability Reporting Standards (ESRS). Through a process of market evaluation and direct stakeholder input, we have identified the most important ESG impacts, risks and opportunities to inform our decision making for impact and value creation beyond our already ambitious net zero commitment.

A description of these issues, along with an account of our approach and performance in 2023, is covered in our annual ESG Performance Report, due for publication in the second quarter of 2024, available on our website.

Creating Sustainable Value for Clients, Shareholders and Employees

We have designed our business model to (i) create value for all our stakeholders, (ii) establish high-quality relationships with the suppliers we engage and the communities in which we operate and (iii) respond to macroeconomic trends impacting the real estate sector.

We strive to create a healthy and dynamic balance between activities that will produce short-term value and returns for our stakeholders through effective management of current transactions and business activities, and investments in people (such as new hires), acquisitions, technologies and systems designed to produce sustainable returns over the long term.

Increasingly, our clients require innovative and consistent sustainability solutions across all geographies in which they operate. Through industry-leading sustainability services powered by a suite of sustainability technology solutions, we deliver an end-to-end approach that enables clients to achieve their goals.

We have over 1,000 sustainability professionals located around the world who are responsible for developing industry-leading sustainability and decarbonization solutions. Partnering for an end-to-end journey, we ensure clients have a clear plan, take the necessary action, and manage critical data to disclose against sustainability goals and deliver a return through risk mitigation and value creation.

We provide a programmatic approach to drive outcomes and deliver value across all types of real estate portfolios:

•Plan - to help clients develop carbon baselines and actionable sustainability strategies;

•Act - to execute sustainability initiatives that drive outcomes on goals; and

•Manage - to optimize implemented projects and programs, and measure and monitor critical data to support continued progress in reducing emissions and compliance reporting powered by JLL's Canopy technology, our proprietary sustainability tech platform that enables users to collect, measure, and report on their GHG emissions and sustainability performance.

JLL's sustainability program is aligned with our purpose to shape the future of real estate for a better world and our corporate strategy to create long-term value for our stakeholders, including shareholders, clients, employees and communities. Through this, we help our clients manage their real estate more effectively and efficiently, promote employment and create value for our shareholders and employees.

COMPETITION

We operate across a wide variety of highly-competitive business lines within the commercial real estate industry globally. Our significant growth over the last decade, and our ability to take advantage of the consolidation which has taken place in our industry, have made us one of the largest commercial real estate services and investment management providers on a global basis, though the industry remains fragmented.

As we provide a broad range of commercial real estate and investment management services across many geographies, we face competition at international, regional and local levels. Increasingly, we also see companies who may not traditionally be considered real estate service providers, including investment banking firms, investment managers, accounting firms, technology firms, software-as-a-service companies, firms providing co-working space, firms providing outsourcing services of various types (including technology, food service and building products) and companies that self-perform their real estate services with in-house capabilities, entering the market. Some of our primary competitors include large national or global firms including CBRE Group Inc., Cushman & Wakefield plc, Colliers International Group Inc., Savills plc and Newmark Group Inc.

DISTINGUISHING ATTRIBUTES AND COMPETITIVE DIFFERENTIATORS

We deliver exceptional strategic, fully-integrated services, best practices and innovative solutions for real estate owners, occupiers, investors and developers worldwide through an integrated global platform. We invest in technology and data capabilities that provide our people and our clients with the best insights, driving productivity and client results. These characteristics, among others, distinguish us from our competitors, drive service excellence and customer loyalty, and demonstrate our commitment to a sustainable future.

While we face formidable competition in individual markets, the following are key attributes differentiating JLL for clients seeking real estate and investment management services across the globe.

| | | | | | | | |

Client Relationship Management Our client-driven focus enables us to develop, sustain and grow long-term client relationships that generate repeat business and create repeat revenue opportunities. Our clients are the center of our business model, and we enable superior service delivery through ongoing investments in the people, processes and tools that support client relationship management. Our client experience management platform allows us to gather, understand and act on our clients' feedback. Our goal is to provide a holistic understanding of our clients' needs across our business, curate a customized experience and identify the right management approach for our clients to drive accountability and bring the best of JLL. We achieve superior client service through best practices in client relationship management, seeking and acting on regular client feedback, and recognizing each client's own specific definition of excellence. We also invest in developing the highest caliber talent dedicated to managing our client relationships through an employee compensation and evaluation system aligned with our global career framework and designed to reward client relationship building, teamwork and quality performance. | |

| Globally Integrated Business Model and "One JLL" Through the combination of a wide range of high-quality, complementary services, we develop and implement real estate strategies that meet the increasingly complex and far-reaching needs of our clients. With operations spanning the globe, our in-depth knowledge of local, regional and international markets along with our "One JLL" approach - leveraging the ability and connectivity of our people - can provide services which address the entire life cycle of real estate around the world. "One JLL" enables cross-selling opportunities across geographies and service offerings that we expect will continue to develop new revenue sources and growth. |

| | | | | | | | |

Technology Leadership Technology is transforming commercial real estate and CRE technology strategy is top of mind for our clients. JLL’s technology strategy is to build, buy, partner and invest to curate an industry-leading technology portfolio that extends seamlessly into the generative AI era. By building our own solutions and partnering with, investing in, or selectively acquiring market-leading proptech companies, we empower our clients and create material differentiation for our company while leading the digital transformation of our industry. Examples of this include: •A proprietary technology solution that drives higher productivity for our leasing brokers within Markets Advisory. •A proprietary technology platform that generates leads and insights for advisors in our Capital Markets business and helps us identify and win new business. •A proprietary generative AI platform purpose-built for CRE that provides JLL’s workforce with relevant and reliable outputs to increase their efficiency and to provide CRE insights to clients in a new way. Through our JLL Technologies business, we offer a comprehensive set of products along with services for investor and occupier clients. Corrigo, for example, helps improve client outcomes and drive cost efficiency for our Work Dynamics business. Hank AI enables faster energy savings and ROI for properties. JLL Spark Global Ventures has invested in more than 50 proptech start-ups focused on technology such as IoT sensors, AI space planning and visualization, AI analytics for builders, investment platforms and more. Our globally-coordinated investments in research, technology, data and analytics, people, quality control and innovation provide a foundation for us to develop, share and continually evaluate best practices across our global organization. Our investments are focused on both platform and client-facing technology. Further, we will continue to develop and deploy technology to support our marketing and client development activities and to make our products and services increasingly accessible. | |