Liquidity and Capital Resources

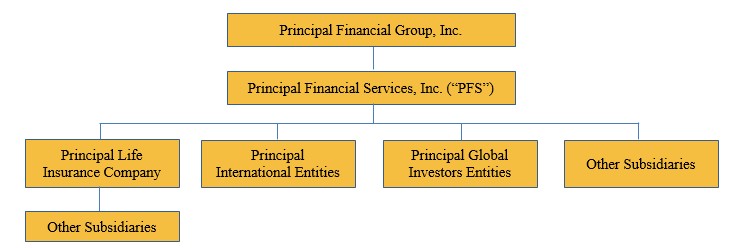

Liquidity and capital resources represent the overall strength of a company and its ability to generate strong cash flows, borrow funds at a competitive rate and raise new capital to meet operating and growth needs. We are monitoring our liquidity closely and feel confident in our ability to meet all long-term obligations to customers, policyholders and debt holders. Our sources of strength include our laddered long-term debt maturities with the next maturity occurring in 2025, access to revolving credit facility and contingent funding arrangements, a strong risk-based capital position and our available cash and liquid assets. Our legal entity structure has an impact on our ability to meet cash flow needs as an organization. Following is a simplified organizational structure.

Liquidity

Our liquidity requirements have been and will continue to be met by funds from consolidated operations as well as the issuance of commercial paper, common stock, debt or other capital securities and borrowings from credit facilities. We believe the cash flows from these sources are sufficient to satisfy the current liquidity requirements of our operations, including reasonably foreseeable contingencies.

We maintain a level of cash and securities which, combined with expected cash inflows from investments and operations, we believe to be adequate to meet anticipated short-term and long-term payment obligations. We will continue our prudent capital management practice of regularly exploring options available to us to maximize capital flexibility, including accessing the capital markets and careful attention to and management of expenses.

We perform rigorous liquidity stress testing to ensure our asset portfolio includes sufficient high quality liquid assets that could be utilized to bolster our liquidity position under increasingly stressed market conditions. These assets could be utilized as collateral for secured borrowing transactions with various third parties or by selling the securities in the open market if needed.

We also manage liquidity risk by limiting the sales of liabilities with features such as puts or other options that can be exercised at inopportune times. For example, as of December 31, 2023, approximately $14.8 billion, or 99%, of our institutional guaranteed investment contracts and funding agreements cannot be redeemed by contractholders prior to maturity. Our individual annuity liabilities also contain surrender charges and other provisions limiting early surrenders.

The following table summarizes the withdrawal characteristics of our domestic general account investment contracts as of December 31, 2023.

| Contractholder funds, |

|

| |||

net of reinsurance | Percentage | |||||

(in millions) |

| |||||

Not subject to discretionary withdrawal | $ | 15,746.6 |

| 57.2 | % | |

Subject to discretionary withdrawal with adjustments: |

|

|

| |||

Specified surrender charges |

| 7,084.7 |

| 25.8 | ||

Market value adjustments |

| 4,666.1 |

| 17.0 | ||

Subject to discretionary withdrawal without adjustments |

| 0.7 |

| — | ||

Total domestic investment contracts | $ | 27,498.1 |

| 100.0 | % | |

58