falseFY2023000035069812/31P3Y3333122P1Yhttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrent http://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrent http://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationsCurrent http://www.autonation.com/20231231#VehicleFloorplanPayablehttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationsCurrent http://www.autonation.com/20231231#VehicleFloorplanPayablehttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationshttp://fasb.org/us-gaap/2023#LongTermDebtAndCapitalLeaseObligationsP3Yhttp://fasb.org/us-gaap/2023#OtherOperatingIncomeExpenseNethttp://fasb.org/us-gaap/2023#OtherOperatingIncomeExpenseNethttp://fasb.org/us-gaap/2023#OtherOperatingIncomeExpenseNethttp://fasb.org/us-gaap/2023#OtherOperatingIncomeExpenseNethttp://fasb.org/us-gaap/2023#OtherOperatingIncomeExpenseNethttp://fasb.org/us-gaap/2023#OtherOperatingIncomeExpenseNethttp://fasb.org/us-gaap/2023#OtherOperatingIncomeExpenseNet00003506982023-01-012023-12-3100003506982023-06-30iso4217:USD00003506982024-02-14xbrli:shares00003506982023-12-3100003506982022-12-310000350698an:TradeMember2023-12-310000350698an:TradeMember2022-12-310000350698an:NonTradeMember2023-12-310000350698an:NonTradeMember2022-12-31iso4217:USDxbrli:shares0000350698an:NewVehicleMember2023-01-012023-12-310000350698an:NewVehicleMember2022-01-012022-12-310000350698an:NewVehicleMember2021-01-012021-12-310000350698an:UsedVehicleMember2023-01-012023-12-310000350698an:UsedVehicleMember2022-01-012022-12-310000350698an:UsedVehicleMember2021-01-012021-12-310000350698an:PartsAndServiceMember2023-01-012023-12-310000350698an:PartsAndServiceMember2022-01-012022-12-310000350698an:PartsAndServiceMember2021-01-012021-12-310000350698an:FinanceAndInsuranceNetMember2023-01-012023-12-310000350698an:FinanceAndInsuranceNetMember2022-01-012022-12-310000350698an:FinanceAndInsuranceNetMember2021-01-012021-12-310000350698us-gaap:ProductAndServiceOtherMember2023-01-012023-12-310000350698us-gaap:ProductAndServiceOtherMember2022-01-012022-12-310000350698us-gaap:ProductAndServiceOtherMember2021-01-012021-12-3100003506982022-01-012022-12-3100003506982021-01-012021-12-3100003506982021-12-310000350698us-gaap:CommonStockMember2020-12-310000350698us-gaap:AdditionalPaidInCapitalMember2020-12-310000350698us-gaap:RetainedEarningsMember2020-12-310000350698us-gaap:TreasuryStockCommonMember2020-12-3100003506982020-12-310000350698us-gaap:RetainedEarningsMember2021-01-012021-12-310000350698us-gaap:TreasuryStockCommonMember2021-01-012021-12-310000350698us-gaap:CommonStockMember2021-01-012021-12-310000350698us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310000350698us-gaap:CommonStockMember2021-12-310000350698us-gaap:AdditionalPaidInCapitalMember2021-12-310000350698us-gaap:RetainedEarningsMember2021-12-310000350698us-gaap:TreasuryStockCommonMember2021-12-310000350698us-gaap:RetainedEarningsMember2022-01-012022-12-310000350698us-gaap:TreasuryStockCommonMember2022-01-012022-12-310000350698us-gaap:CommonStockMember2022-01-012022-12-310000350698us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310000350698us-gaap:CommonStockMember2022-12-310000350698us-gaap:AdditionalPaidInCapitalMember2022-12-310000350698us-gaap:RetainedEarningsMember2022-12-310000350698us-gaap:TreasuryStockCommonMember2022-12-310000350698us-gaap:RetainedEarningsMember2023-01-012023-12-310000350698us-gaap:TreasuryStockCommonMember2023-01-012023-12-310000350698us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310000350698us-gaap:CommonStockMember2023-12-310000350698us-gaap:AdditionalPaidInCapitalMember2023-12-310000350698us-gaap:RetainedEarningsMember2023-12-310000350698us-gaap:TreasuryStockCommonMember2023-12-310000350698an:SeniorNotesAtThreePointEightFivePercentDue2032Member2023-01-012023-12-310000350698an:SeniorNotesAtThreePointEightFivePercentDue2032Member2022-01-012022-12-310000350698an:SeniorNotesAtThreePointEightFivePercentDue2032Member2021-01-012021-12-310000350698an:SeniorNotesAtOnePointNineFivePercentDue2028Member2023-01-012023-12-310000350698an:SeniorNotesAtOnePointNineFivePercentDue2028Member2022-01-012022-12-310000350698an:SeniorNotesAtOnePointNineFivePercentDue2028Member2021-01-012021-12-310000350698an:SeniorNotesAtTwoPointFourPercentDue2031Member2023-01-012023-12-310000350698an:SeniorNotesAtTwoPointFourPercentDue2031Member2022-01-012022-12-310000350698an:SeniorNotesAtTwoPointFourPercentDue2031Member2021-01-012021-12-310000350698an:SeniorNotesatThreePointThreeFivePercentDue2021Member2023-01-012023-12-310000350698an:SeniorNotesatThreePointThreeFivePercentDue2021Member2022-01-012022-12-310000350698an:SeniorNotesatThreePointThreeFivePercentDue2021Member2021-01-012021-12-31an:franchises0000350698an:DealershipsMember2023-12-31an:storean:brandxbrli:pure0000350698an:CollisionCenterMember2023-12-310000350698an:AutoNationUSAStoresMember2023-12-310000350698an:AutomotiveAuctionOperationsMember2023-12-310000350698an:PartsDistributionCentersMember2023-12-310000350698srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310000350698srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-12-310000350698srt:MinimumMemberan:FurnitureFixturesAndEquipmentMember2023-12-310000350698an:FurnitureFixturesAndEquipmentMembersrt:MaximumMember2023-12-310000350698us-gaap:SegmentContinuingOperationsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000350698us-gaap:SegmentContinuingOperationsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000350698us-gaap:SegmentDiscontinuedOperationsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000350698us-gaap:SegmentDiscontinuedOperationsMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000350698srt:MinimumMember2023-12-310000350698srt:MaximumMember2023-12-310000350698us-gaap:DeferredCompensationArrangementWithIndividualByTypeOfCompensationPensionAndOtherPostretirementBenefitsMember2023-01-012023-12-310000350698us-gaap:DeferredCompensationArrangementWithIndividualByTypeOfCompensationPensionAndOtherPostretirementBenefitsMember2022-01-012022-12-310000350698us-gaap:DeferredCompensationArrangementWithIndividualByTypeOfCompensationPensionAndOtherPostretirementBenefitsMember2023-12-310000350698us-gaap:DeferredCompensationArrangementWithIndividualByTypeOfCompensationPensionAndOtherPostretirementBenefitsMember2022-12-310000350698an:ANReportableSegmentDomesticMemberan:NewVehicleMember2023-01-012023-12-310000350698an:ANReportableSegmentImportMemberan:NewVehicleMember2023-01-012023-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberan:NewVehicleMember2023-01-012023-12-310000350698us-gaap:CorporateAndOtherMemberan:NewVehicleMember2023-01-012023-12-310000350698an:ANReportableSegmentDomesticMemberan:UsedVehicleMember2023-01-012023-12-310000350698an:ANReportableSegmentImportMemberan:UsedVehicleMember2023-01-012023-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberan:UsedVehicleMember2023-01-012023-12-310000350698us-gaap:CorporateAndOtherMemberan:UsedVehicleMember2023-01-012023-12-310000350698an:ANReportableSegmentDomesticMemberan:PartsAndServiceMember2023-01-012023-12-310000350698an:ANReportableSegmentImportMemberan:PartsAndServiceMember2023-01-012023-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberan:PartsAndServiceMember2023-01-012023-12-310000350698us-gaap:CorporateAndOtherMemberan:PartsAndServiceMember2023-01-012023-12-310000350698an:FinanceAndInsuranceNetMemberan:ANReportableSegmentDomesticMember2023-01-012023-12-310000350698an:FinanceAndInsuranceNetMemberan:ANReportableSegmentImportMember2023-01-012023-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberan:FinanceAndInsuranceNetMember2023-01-012023-12-310000350698an:FinanceAndInsuranceNetMemberus-gaap:CorporateAndOtherMember2023-01-012023-12-310000350698an:ANReportableSegmentDomesticMemberus-gaap:ProductAndServiceOtherMember2023-01-012023-12-310000350698an:ANReportableSegmentImportMemberus-gaap:ProductAndServiceOtherMember2023-01-012023-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberus-gaap:ProductAndServiceOtherMember2023-01-012023-12-310000350698us-gaap:CorporateAndOtherMemberus-gaap:ProductAndServiceOtherMember2023-01-012023-12-310000350698an:ANReportableSegmentDomesticMember2023-01-012023-12-310000350698an:ANReportableSegmentImportMember2023-01-012023-12-310000350698an:ANReportableSegmentPremiumLuxuryMember2023-01-012023-12-310000350698us-gaap:CorporateAndOtherMember2023-01-012023-12-310000350698an:ANReportableSegmentDomesticMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310000350698an:ANReportableSegmentImportMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310000350698us-gaap:CorporateAndOtherMemberus-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310000350698us-gaap:TransferredAtPointInTimeMember2023-01-012023-12-310000350698an:ANReportableSegmentDomesticMemberus-gaap:TransferredOverTimeMember2023-01-012023-12-310000350698an:ANReportableSegmentImportMemberus-gaap:TransferredOverTimeMember2023-01-012023-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberus-gaap:TransferredOverTimeMember2023-01-012023-12-310000350698us-gaap:CorporateAndOtherMemberus-gaap:TransferredOverTimeMember2023-01-012023-12-310000350698us-gaap:TransferredOverTimeMember2023-01-012023-12-310000350698an:ANReportableSegmentDomesticMemberan:NewVehicleMember2022-01-012022-12-310000350698an:ANReportableSegmentImportMemberan:NewVehicleMember2022-01-012022-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberan:NewVehicleMember2022-01-012022-12-310000350698us-gaap:CorporateAndOtherMemberan:NewVehicleMember2022-01-012022-12-310000350698an:ANReportableSegmentDomesticMemberan:UsedVehicleMember2022-01-012022-12-310000350698an:ANReportableSegmentImportMemberan:UsedVehicleMember2022-01-012022-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberan:UsedVehicleMember2022-01-012022-12-310000350698us-gaap:CorporateAndOtherMemberan:UsedVehicleMember2022-01-012022-12-310000350698an:ANReportableSegmentDomesticMemberan:PartsAndServiceMember2022-01-012022-12-310000350698an:ANReportableSegmentImportMemberan:PartsAndServiceMember2022-01-012022-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberan:PartsAndServiceMember2022-01-012022-12-310000350698us-gaap:CorporateAndOtherMemberan:PartsAndServiceMember2022-01-012022-12-310000350698an:FinanceAndInsuranceNetMemberan:ANReportableSegmentDomesticMember2022-01-012022-12-310000350698an:FinanceAndInsuranceNetMemberan:ANReportableSegmentImportMember2022-01-012022-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberan:FinanceAndInsuranceNetMember2022-01-012022-12-310000350698an:FinanceAndInsuranceNetMemberus-gaap:CorporateAndOtherMember2022-01-012022-12-310000350698an:ANReportableSegmentDomesticMemberus-gaap:ProductAndServiceOtherMember2022-01-012022-12-310000350698an:ANReportableSegmentImportMemberus-gaap:ProductAndServiceOtherMember2022-01-012022-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberus-gaap:ProductAndServiceOtherMember2022-01-012022-12-310000350698us-gaap:CorporateAndOtherMemberus-gaap:ProductAndServiceOtherMember2022-01-012022-12-310000350698an:ANReportableSegmentDomesticMember2022-01-012022-12-310000350698an:ANReportableSegmentImportMember2022-01-012022-12-310000350698an:ANReportableSegmentPremiumLuxuryMember2022-01-012022-12-310000350698us-gaap:CorporateAndOtherMember2022-01-012022-12-310000350698an:ANReportableSegmentDomesticMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310000350698an:ANReportableSegmentImportMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310000350698us-gaap:CorporateAndOtherMemberus-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310000350698us-gaap:TransferredAtPointInTimeMember2022-01-012022-12-310000350698an:ANReportableSegmentDomesticMemberus-gaap:TransferredOverTimeMember2022-01-012022-12-310000350698an:ANReportableSegmentImportMemberus-gaap:TransferredOverTimeMember2022-01-012022-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberus-gaap:TransferredOverTimeMember2022-01-012022-12-310000350698us-gaap:CorporateAndOtherMemberus-gaap:TransferredOverTimeMember2022-01-012022-12-310000350698us-gaap:TransferredOverTimeMember2022-01-012022-12-310000350698an:ANReportableSegmentDomesticMemberan:NewVehicleMember2021-01-012021-12-310000350698an:ANReportableSegmentImportMemberan:NewVehicleMember2021-01-012021-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberan:NewVehicleMember2021-01-012021-12-310000350698us-gaap:CorporateAndOtherMemberan:NewVehicleMember2021-01-012021-12-310000350698an:ANReportableSegmentDomesticMemberan:UsedVehicleMember2021-01-012021-12-310000350698an:ANReportableSegmentImportMemberan:UsedVehicleMember2021-01-012021-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberan:UsedVehicleMember2021-01-012021-12-310000350698us-gaap:CorporateAndOtherMemberan:UsedVehicleMember2021-01-012021-12-310000350698an:ANReportableSegmentDomesticMemberan:PartsAndServiceMember2021-01-012021-12-310000350698an:ANReportableSegmentImportMemberan:PartsAndServiceMember2021-01-012021-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberan:PartsAndServiceMember2021-01-012021-12-310000350698us-gaap:CorporateAndOtherMemberan:PartsAndServiceMember2021-01-012021-12-310000350698an:FinanceAndInsuranceNetMemberan:ANReportableSegmentDomesticMember2021-01-012021-12-310000350698an:FinanceAndInsuranceNetMemberan:ANReportableSegmentImportMember2021-01-012021-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberan:FinanceAndInsuranceNetMember2021-01-012021-12-310000350698an:FinanceAndInsuranceNetMemberus-gaap:CorporateAndOtherMember2021-01-012021-12-310000350698an:ANReportableSegmentDomesticMemberus-gaap:ProductAndServiceOtherMember2021-01-012021-12-310000350698an:ANReportableSegmentImportMemberus-gaap:ProductAndServiceOtherMember2021-01-012021-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberus-gaap:ProductAndServiceOtherMember2021-01-012021-12-310000350698us-gaap:CorporateAndOtherMemberus-gaap:ProductAndServiceOtherMember2021-01-012021-12-310000350698an:ANReportableSegmentDomesticMember2021-01-012021-12-310000350698an:ANReportableSegmentImportMember2021-01-012021-12-310000350698an:ANReportableSegmentPremiumLuxuryMember2021-01-012021-12-310000350698us-gaap:CorporateAndOtherMember2021-01-012021-12-310000350698an:ANReportableSegmentDomesticMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310000350698an:ANReportableSegmentImportMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310000350698us-gaap:CorporateAndOtherMemberus-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310000350698us-gaap:TransferredAtPointInTimeMember2021-01-012021-12-310000350698an:ANReportableSegmentDomesticMemberus-gaap:TransferredOverTimeMember2021-01-012021-12-310000350698an:ANReportableSegmentImportMemberus-gaap:TransferredOverTimeMember2021-01-012021-12-310000350698an:ANReportableSegmentPremiumLuxuryMemberus-gaap:TransferredOverTimeMember2021-01-012021-12-310000350698us-gaap:CorporateAndOtherMemberus-gaap:TransferredOverTimeMember2021-01-012021-12-310000350698us-gaap:TransferredOverTimeMember2021-01-012021-12-3100003506982024-01-012023-12-3100003506982025-01-012023-12-3100003506982027-01-012023-12-310000350698an:CreditProgramTierPlatinumMember2023-12-310000350698an:CreditProgramTierGoldMember2023-12-310000350698an:CreditProgramTierSilverMember2023-12-310000350698an:CreditProgramTierBronzeMember2023-12-310000350698an:CreditProgramTierCopperMember2023-12-310000350698an:CreditProgramTierPlatinumMember2022-12-310000350698an:CreditProgramTierGoldMember2022-12-310000350698an:CreditProgramTierSilverMember2022-12-310000350698an:CreditProgramTierBronzeMember2022-12-310000350698an:CreditProgramTierCopperMember2022-12-310000350698an:CIGFinancialAcquisitionMember2022-10-012022-10-010000350698an:ThirtyOneToSixtyDaysPastDueMember2023-12-310000350698an:ThirtyOneToSixtyDaysPastDueMember2022-12-310000350698an:SixtyOneToNinetyDaysPastDueMember2023-12-310000350698an:SixtyOneToNinetyDaysPastDueMember2022-12-310000350698an:GreaterThanNinetyDaysPastDueMember2023-12-310000350698an:GreaterThanNinetyDaysPastDueMember2022-12-310000350698us-gaap:FinancialAssetPastDueMember2023-12-310000350698us-gaap:FinancialAssetPastDueMember2022-12-310000350698us-gaap:FinancialAssetNotPastDueMember2023-12-310000350698us-gaap:FinancialAssetNotPastDueMember2022-12-310000350698an:NewVehicleMember2023-12-310000350698an:NewVehicleMember2022-12-310000350698an:UsedVehicleMember2023-12-310000350698an:UsedVehicleMember2022-12-310000350698an:PartsAndServiceMember2023-12-310000350698an:PartsAndServiceMember2022-12-310000350698an:NewVehicleFloorplanFacilitiesMember2023-12-310000350698an:NewVehicleFloorplanFacilitiesMember2022-12-310000350698an:UsedVehicleFloorplanFacilitiesMember2023-12-310000350698an:UsedVehicleFloorplanFacilitiesMember2022-12-310000350698us-gaap:LandMember2023-12-310000350698us-gaap:LandMember2022-12-310000350698us-gaap:BuildingAndBuildingImprovementsMember2023-12-310000350698us-gaap:BuildingAndBuildingImprovementsMember2022-12-310000350698an:FurnitureFixturesAndEquipmentMember2023-12-310000350698an:FurnitureFixturesAndEquipmentMember2022-12-310000350698an:ReportingUnitDomesticMember2021-12-310000350698an:ReportingUnitImportMember2021-12-310000350698an:ReportingUnitPremiumLuxuryMember2021-12-310000350698an:ReportingUnitOtherMember2021-12-310000350698an:ReportingUnitDomesticMember2022-01-012022-12-310000350698an:ReportingUnitImportMember2022-01-012022-12-310000350698an:ReportingUnitPremiumLuxuryMember2022-01-012022-12-310000350698an:ReportingUnitOtherMember2022-01-012022-12-310000350698an:ReportingUnitDomesticMember2022-12-310000350698an:ReportingUnitImportMember2022-12-310000350698an:ReportingUnitPremiumLuxuryMember2022-12-310000350698an:ReportingUnitOtherMember2022-12-310000350698an:ReportingUnitDomesticMember2023-01-012023-12-310000350698an:ReportingUnitImportMember2023-01-012023-12-310000350698an:ReportingUnitPremiumLuxuryMember2023-01-012023-12-310000350698an:ReportingUnitOtherMember2023-01-012023-12-310000350698an:ReportingUnitDomesticMember2023-12-310000350698an:ReportingUnitImportMember2023-12-310000350698an:ReportingUnitPremiumLuxuryMember2023-12-310000350698an:ReportingUnitOtherMember2023-12-310000350698an:SingleReportingUnitBeforeChangeInReportingUnitsMember2021-12-310000350698an:SingleReportingUnitBeforeChangeInReportingUnitsMember2022-12-310000350698an:SingleReportingUnitBeforeChangeInReportingUnitsMember2023-12-310000350698an:ANReportableSegmentDomesticMember2023-12-310000350698an:ANReportableSegmentImportMember2023-12-310000350698an:ANReportableSegmentPremiumLuxuryMember2023-12-310000350698srt:MinimumMemberus-gaap:LandAndBuildingMember2023-01-012023-12-310000350698us-gaap:LandAndBuildingMembersrt:MaximumMember2023-01-012023-12-310000350698srt:MinimumMemberus-gaap:EquipmentMember2023-01-012023-12-310000350698us-gaap:EquipmentMembersrt:MaximumMember2023-01-012023-12-310000350698srt:MinimumMemberan:ServiceLoanerVehiclesMember2023-12-310000350698srt:MaximumMemberan:ServiceLoanerVehiclesMember2023-12-310000350698srt:MinimumMember2023-01-012023-12-310000350698srt:MaximumMember2023-01-012023-12-310000350698us-gaap:SeniorNotesMemberus-gaap:RecourseMemberan:SeniorNotesatThreePointFivePercentDue2024Member2023-12-310000350698us-gaap:SeniorNotesMemberus-gaap:RecourseMemberan:SeniorNotesatThreePointFivePercentDue2024Member2023-01-012023-12-310000350698us-gaap:SeniorNotesMemberus-gaap:RecourseMemberan:SeniorNotesatThreePointFivePercentDue2024Member2022-12-310000350698an:SeniorNotesatFourPointFivePercentDue2025Memberus-gaap:SeniorNotesMemberus-gaap:RecourseMember2023-12-310000350698an:SeniorNotesatFourPointFivePercentDue2025Memberus-gaap:SeniorNotesMemberus-gaap:RecourseMember2023-01-012023-12-310000350698an:SeniorNotesatFourPointFivePercentDue2025Memberus-gaap:SeniorNotesMemberus-gaap:RecourseMember2022-12-310000350698us-gaap:SeniorNotesMemberus-gaap:RecourseMemberan:SeniorNotesatThreePointEightPercentDue2027Member2023-12-310000350698us-gaap:SeniorNotesMemberus-gaap:RecourseMemberan:SeniorNotesatThreePointEightPercentDue2027Member2023-01-012023-12-310000350698us-gaap:SeniorNotesMemberus-gaap:RecourseMemberan:SeniorNotesatThreePointEightPercentDue2027Member2022-12-310000350698an:SeniorNotesAtOnePointNineFivePercentDue2028Memberus-gaap:SeniorNotesMemberus-gaap:RecourseMember2023-12-310000350698an:SeniorNotesAtOnePointNineFivePercentDue2028Memberus-gaap:SeniorNotesMemberus-gaap:RecourseMember2023-01-012023-12-310000350698an:SeniorNotesAtOnePointNineFivePercentDue2028Memberus-gaap:SeniorNotesMemberus-gaap:RecourseMember2022-12-310000350698us-gaap:SeniorNotesMemberus-gaap:RecourseMemberan:SeniorNotesatFourPointSevenFivePercentDue2030MemberMember2023-12-310000350698us-gaap:SeniorNotesMemberus-gaap:RecourseMemberan:SeniorNotesatFourPointSevenFivePercentDue2030MemberMember2023-01-012023-12-310000350698us-gaap:SeniorNotesMemberus-gaap:RecourseMemberan:SeniorNotesatFourPointSevenFivePercentDue2030MemberMember2022-12-310000350698an:SeniorNotesAtTwoPointFourPercentDue2031Memberus-gaap:SeniorNotesMemberus-gaap:RecourseMember2023-12-310000350698an:SeniorNotesAtTwoPointFourPercentDue2031Memberus-gaap:SeniorNotesMemberus-gaap:RecourseMember2023-01-012023-12-310000350698an:SeniorNotesAtTwoPointFourPercentDue2031Memberus-gaap:SeniorNotesMemberus-gaap:RecourseMember2022-12-310000350698an:SeniorNotesAtThreePointEightFivePercentDue2032Memberus-gaap:SeniorNotesMemberus-gaap:RecourseMember2023-12-310000350698an:SeniorNotesAtThreePointEightFivePercentDue2032Memberus-gaap:SeniorNotesMemberus-gaap:RecourseMember2023-01-012023-12-310000350698an:SeniorNotesAtThreePointEightFivePercentDue2032Memberus-gaap:SeniorNotesMemberus-gaap:RecourseMember2022-12-310000350698an:RevolvingCreditFacilityDue2028Memberus-gaap:LineOfCreditMemberus-gaap:RecourseMember2023-01-012023-12-310000350698an:RevolvingCreditFacilityDue2028Memberus-gaap:RecourseMember2023-12-310000350698us-gaap:RecourseMemberan:RevolvingCreditFacilityDue2025Member2022-12-310000350698us-gaap:RecourseMemberan:OtherDebtMember2023-12-310000350698us-gaap:RecourseMemberan:OtherDebtMember2022-12-310000350698us-gaap:RecourseMember2023-12-310000350698us-gaap:RecourseMember2022-12-310000350698an:RevolvingCreditFacilityDue2025Member2023-07-180000350698an:RevolvingCreditFacilityDue2028Member2023-12-310000350698an:RevolvingCreditFacilityDue2028Memberus-gaap:LineOfCreditMemberus-gaap:RecourseMember2023-07-182023-12-310000350698srt:MinimumMemberan:RevolvingCreditFacilityDue2028Member2023-01-012023-12-310000350698an:RevolvingCreditFacilityDue2028Membersrt:MaximumMember2023-01-012023-12-310000350698an:RevolvingCreditFacilityDue2028Memberus-gaap:LineOfCreditMemberan:SecuredOvernightFinancingRateSOFRMember2023-01-012023-12-310000350698srt:MinimumMemberan:RevolvingCreditFacilityDue2028Memberus-gaap:LineOfCreditMemberan:SecuredOvernightFinancingRateSOFRMember2023-01-012023-12-310000350698an:RevolvingCreditFacilityDue2028Memberus-gaap:LineOfCreditMemberan:SecuredOvernightFinancingRateSOFRMembersrt:MaximumMember2023-01-012023-12-310000350698srt:MinimumMemberan:RevolvingCreditFacilityDue2028Memberus-gaap:LineOfCreditMemberus-gaap:BaseRateMember2023-01-012023-12-310000350698an:RevolvingCreditFacilityDue2028Memberus-gaap:LineOfCreditMemberus-gaap:BaseRateMembersrt:MaximumMember2023-01-012023-12-3100003506982023-08-160000350698srt:MaximumMemberus-gaap:CommercialPaperMember2023-01-012023-12-310000350698us-gaap:CommercialPaperMember2023-12-310000350698us-gaap:CommercialPaperMembersrt:WeightedAverageMember2023-01-012023-12-310000350698us-gaap:CommercialPaperMember2022-12-310000350698us-gaap:CommercialPaperMembersrt:WeightedAverageMember2022-01-012022-12-310000350698us-gaap:NonrecourseMemberan:WarehouseFacilitiesMember2023-12-310000350698us-gaap:NonrecourseMemberan:WarehouseFacilitiesMember2022-12-310000350698us-gaap:NonrecourseMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMemberan:TermSecuritizationDebtMember2023-12-310000350698us-gaap:NonrecourseMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMemberan:TermSecuritizationDebtMember2022-12-310000350698us-gaap:NonrecourseMember2023-12-310000350698us-gaap:NonrecourseMember2022-12-310000350698us-gaap:NonrecourseMemberan:WarehouseFacilityOneMember2023-01-012023-12-310000350698an:WarehouseFacilityTwoMemberus-gaap:NonrecourseMemberus-gaap:SubsequentEventMember2024-02-012024-02-160000350698us-gaap:NonrecourseMemberus-gaap:SubsequentEventMemberan:WarehouseFacilitiesMember2024-02-160000350698srt:MinimumMemberus-gaap:NonrecourseMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMemberan:TermSecuritizationDebtMember2023-12-310000350698us-gaap:NonrecourseMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMembersrt:MaximumMemberan:TermSecuritizationDebtMember2023-12-310000350698us-gaap:AssetPledgedAsCollateralMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-12-310000350698us-gaap:AssetPledgedAsCollateralMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2022-12-310000350698an:ChargebacksReservesMember2022-12-310000350698an:ChargebacksReservesMember2021-12-310000350698an:ChargebacksReservesMember2020-12-310000350698an:ChargebacksReservesMember2023-01-012023-12-310000350698an:ChargebacksReservesMember2022-01-012022-12-310000350698an:ChargebacksReservesMember2021-01-012021-12-310000350698an:ChargebacksReservesMember2023-12-310000350698us-gaap:OtherCurrentLiabilitiesMember2023-12-310000350698us-gaap:OtherCurrentLiabilitiesMember2022-12-310000350698us-gaap:OtherNoncurrentLiabilitiesMember2023-12-310000350698us-gaap:OtherNoncurrentLiabilitiesMember2022-12-310000350698us-gaap:DomesticCountryMember2023-12-310000350698us-gaap:StateAndLocalJurisdictionMember2023-12-310000350698an:DeferredTaxAssetLossCarryForwardsMember2023-12-310000350698an:StockRepurchaseProgramBoardAuthorizedRepurchasesMember2023-01-012023-12-310000350698an:StockRepurchaseProgramBoardAuthorizedRepurchasesMember2022-01-012022-12-310000350698an:StockRepurchaseProgramBoardAuthorizedRepurchasesMember2021-01-012021-12-310000350698an:StockRepurchaseProgramBoardAuthorizedRepurchasesMember2023-12-310000350698us-gaap:CommonStockMember2022-11-012022-11-300000350698us-gaap:CommonStockMember2021-04-012021-04-300000350698us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310000350698us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310000350698us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310000350698an:EmployeeMemberan:EmployeeEquityandIncentivePlan2017Member2023-12-310000350698an:NonEmployeeDirectorEquityPlan2014Membersrt:DirectorMember2023-12-310000350698an:NonEmployeeDirectorEquityPlan2014Membersrt:DirectorMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-030000350698an:EmployeeMemberan:EmployeeEquityandIncentivePlan2017Memberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310000350698srt:MinimumMemberan:EmployeeMemberan:EmployeeEquityandIncentivePlan2017Memberan:TimeBasedRSUsMember2023-01-012023-12-310000350698an:EmployeeMemberan:EmployeeEquityandIncentivePlan2017Membersrt:MaximumMemberan:TimeBasedRSUsMember2023-01-012023-12-310000350698an:EmployeeMemberan:EmployeeEquityandIncentivePlan2017Memberan:PerformanceBasedRSUsMember2023-01-012023-12-310000350698an:EmployeeMemberan:MarketBasedRSUsMemberan:EmployeeEquityandIncentivePlan2017Member2023-01-012023-12-310000350698us-gaap:RestrictedStockUnitsRSUMember2022-12-310000350698us-gaap:RestrictedStockUnitsRSUMember2023-12-310000350698us-gaap:EmployeeStockOptionMember2023-01-012023-12-310000350698us-gaap:EmployeeStockOptionMember2022-01-012022-12-310000350698us-gaap:EmployeeStockOptionMember2021-01-012021-12-310000350698us-gaap:EmployeeStockOptionMember2023-12-310000350698an:DealershipsMember2023-01-012023-12-310000350698an:DealershipsMember2022-10-012022-12-310000350698an:DealershipsMember2021-01-012021-12-310000350698an:CollisionCenterMember2021-01-012021-12-310000350698us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2021-01-012021-12-310000350698an:DealershipsDivestedMember2023-01-012023-12-310000350698an:DealershipsDivestedMember2022-01-012022-12-310000350698an:DealershipsDivestedMember2021-01-012021-12-310000350698an:CollisionCentersDivestedMember2021-01-012021-12-310000350698us-gaap:FairValueMeasurementsNonrecurringMember2023-12-310000350698an:FixedRateDebtMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310000350698an:FixedRateDebtMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310000350698an:FixedRateDebtMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310000350698an:FixedRateDebtMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310000350698us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2023-12-310000350698us-gaap:SegmentContinuingOperationsMemberus-gaap:FairValueMeasurementsNonrecurringMember2023-01-012023-12-310000350698us-gaap:FairValueMeasurementsNonrecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310000350698us-gaap:SegmentContinuingOperationsMemberus-gaap:FairValueMeasurementsNonrecurringMember2022-01-012022-12-310000350698us-gaap:SegmentContinuingOperationsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2023-12-310000350698us-gaap:SegmentContinuingOperationsMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2022-12-310000350698us-gaap:FairValueMeasurementsNonrecurringMember2023-01-012023-12-31an:segments0000350698us-gaap:CorporateAndOtherMember2023-12-310000350698an:ANReportableSegmentDomesticMember2022-12-310000350698an:ANReportableSegmentImportMember2022-12-310000350698an:ANReportableSegmentPremiumLuxuryMember2022-12-310000350698us-gaap:CorporateAndOtherMember2022-12-310000350698an:ANReportableSegmentDomesticMember2021-12-310000350698an:ANReportableSegmentImportMember2021-12-310000350698an:ANReportableSegmentPremiumLuxuryMember2021-12-310000350698us-gaap:CorporateAndOtherMember2021-12-310000350698an:ANReportableSegmentsMember2023-01-012023-12-310000350698an:ANReportableSegmentsMember2022-01-012022-12-310000350698an:ANReportableSegmentsMember2021-01-012021-12-310000350698an:DealershipsMemberus-gaap:PensionPlansDefinedBenefitMember2023-12-310000350698an:AutomotiveIndustriesPensionPlanMember2023-01-012023-12-310000350698an:AutomotiveIndustriesPensionPlanMember2022-01-012022-12-310000350698an:AutomotiveIndustriesPensionPlanMember2021-01-012021-12-310000350698an:IAMNationalPensionPlanMember2023-01-012023-12-310000350698an:IAMNationalPensionPlanMember2022-01-012022-12-310000350698an:IAMNationalPensionPlanMember2021-01-012021-12-310000350698an:AutomotiveIndustriesPensionPlanMember2023-12-31an:agreements0000350698an:IAMNationalPensionPlanMember2023-12-3100003506982023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☑ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission File Number:1-13107

AUTONATION, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 73-1105145 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| 200 SW 1st Ave | | |

| Fort Lauderdale | , | Florida | | 33301 |

| (Address of principal executive offices) | | (Zip Code) |

(954) 769-6000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, Par Value $0.01 Per Share | AN | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the new registrant was required to submit such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

Large accelerated filer | þ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ¨

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

As of June 30, 2023, the last business day of the registrant’s most recently completed second fiscal quarter, the aggregate market value of the common stock of the registrant held by non-affiliates was approximately $4.7 billion based on the closing price of the common stock on the New York Stock Exchange on such date (for the purpose of this calculation, the registrant assumed that each of its directors, executive officers, and greater than 10% stockholders was an affiliate of the registrant as of June 30, 2023).

As of February 14, 2024, the registrant had 41,660,637 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement relating to its 2024 Annual Meeting of Stockholders to be filed with the SEC within 120 days after the end of the fiscal year ended December 31, 2023, are incorporated herein by reference in Part III.

AUTONATION, INC.

FORM 10-K

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023

INDEX

| | | | | | | | |

|

| | | Page |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

|

| Item 5. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

|

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

|

| Item 15. | | |

| Item 16. | | |

PART I

ITEM 1. BUSINESS

General

AutoNation, Inc., through its subsidiaries, is one of the largest automotive retailers in the United States. As of December 31, 2023, we owned and operated 349 new vehicle franchises from 252 stores located in the United States, predominantly in major metropolitan markets in the Sunbelt region. Our stores, which we believe include some of the most recognizable and well-known in our key markets, sell 34 different new vehicle brands. The core brands of new vehicles that we sell, representing approximately 88% of the new vehicles that we sold in 2023, are manufactured by Toyota (including Lexus), Honda, Ford, General Motors, BMW, Mercedes-Benz, Stellantis, and Volkswagen (including Audi and Porsche). As of December 31, 2023, we also owned and operated 53 AutoNation-branded collision centers, 19 AutoNation USA used vehicle stores, 4 AutoNation-branded automotive auction operations, 3 parts distribution centers, a mobile automotive repair and maintenance business, and an auto finance company.

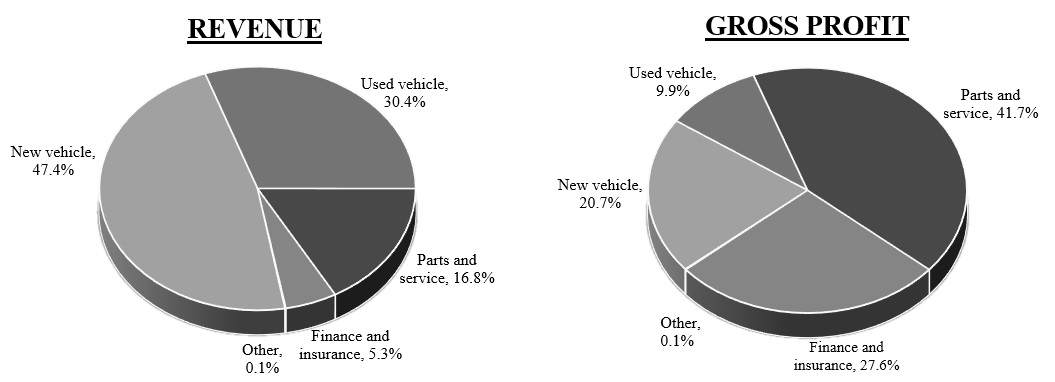

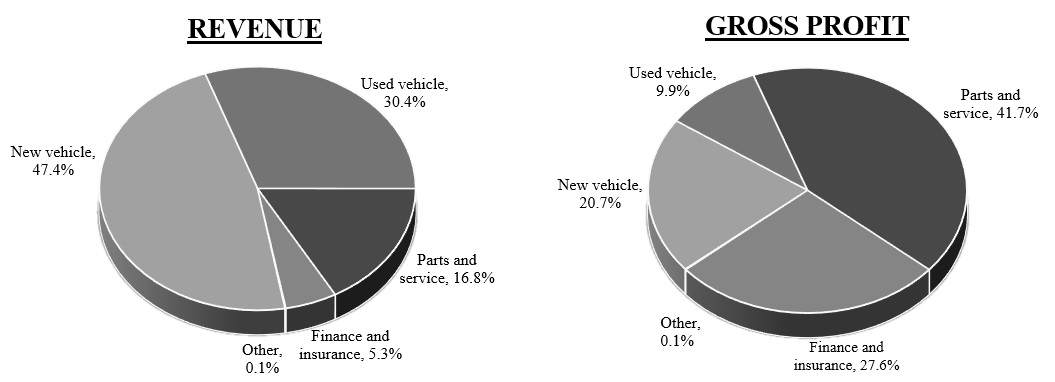

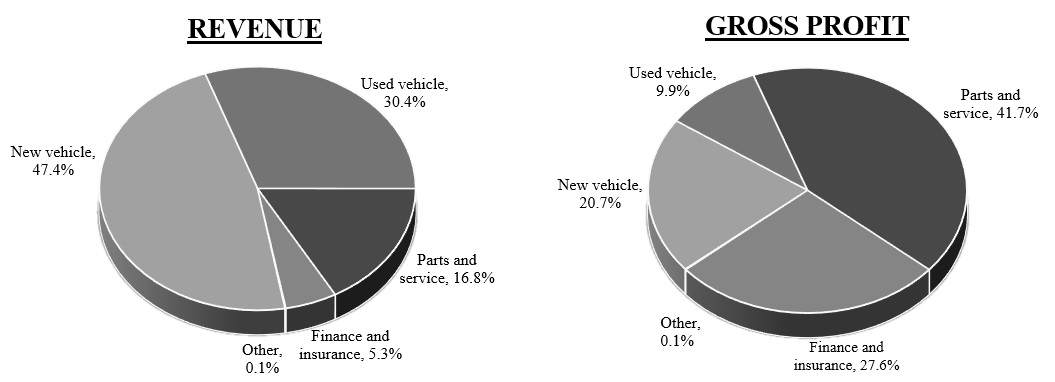

We offer a diversified range of automotive products and services, including new vehicles, used vehicles, “parts and service” (also referred to as “After-Sales”), which includes automotive repair and maintenance services as well as wholesale parts and collision businesses, and automotive “finance and insurance” products (also referred to as “Customer Financial Services”), which include vehicle service and other protection products, as well as the arranging of financing for vehicle purchases through third-party finance sources. We also offer indirect financing on certain vehicles we sell through our captive finance company. The following charts present the contribution to total revenue and gross profit by each of new vehicle, used vehicle, parts and service, and finance and insurance sales in 2023.

For convenience, the terms “AutoNation,” “Company,” and “we” are used to refer collectively to AutoNation, Inc. and its subsidiaries, unless otherwise required by the context. Our store and other operations are conducted by our subsidiaries.

Reportable Segments

As of December 31, 2023, we had three reportable segments: Domestic, Import, and Premium Luxury. These segments are comprised of retail automotive franchises that sell the following new vehicle brands:

| | | | | | | | | | | | | | | | | | | | | | | |

| Domestic | | Import | | Premium Luxury |

| Buick | Ford | | Acura | Mazda | | Alfa Romeo | Land Rover |

| Cadillac | GMC | | Fiat | Nissan | | Aston Martin | Lexus |

| Chevrolet | Jeep | | Genesis | Subaru | | Audi | Maserati |

| Chrysler | Lincoln | | Honda | Toyota | | Bentley | Mercedes-Benz |

| Dodge | Ram | | Hyundai | Volkswagen | | BMW | MINI |

| | | Infiniti | Volvo | | Jaguar | Porsche |

The following table sets forth information regarding our new vehicle revenues and retail new vehicle unit sales for the year ended, and the number of franchises owned as of, December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | New Vehicle

Revenues

(in millions) | | Retail

New Vehicle

Unit Sales | | % of Total

Retail New

Vehicle

Units Sold | | Franchises Owned |

| Domestic: | | | | | | | | |

| Ford, Lincoln | | $ | 1,367.7 | | | 25,859 | | | 10.6 | | | 35 | |

| Chevrolet, Buick, Cadillac, GMC | | 1,200.0 | | | 24,794 | | | 10.1 | | | 40 | |

| Chrysler, Dodge, Jeep, Ram | | 957.3 | | | 16,818 | | | 6.9 | | | 80 | |

| Domestic Total | | 3,525.0 | | | 67,471 | | | 27.6 | | | 155 | |

| Import: | | | | | | | | |

| Toyota | | 1,819.0 | | | 47,467 | | | 19.4 | | | 19 | |

| Honda | | 1,085.0 | | | 30,968 | | | 12.7 | | | 24 | |

| Nissan | | 165.8 | | | 5,111 | | | 2.1 | | | 7 | |

| Hyundai | | 291.3 | | | 8,218 | | | 3.4 | | | 11 | |

| Subaru | | 305.6 | | | 8,810 | | | 3.6 | | | 8 | |

| Other Import | | 329.3 | | | 7,494 | | | 3.0 | | | 21 | |

| Import Total | | 3,996.0 | | | 108,068 | | | 44.2 | | | 90 | |

| Premium Luxury: | | | | | | | | |

| Mercedes-Benz | | 1,848.1 | | | 22,485 | | | 9.2 | | | 38 | |

| BMW | | 1,663.2 | | | 22,928 | | | 9.4 | | | 16 | |

| Lexus | | 415.2 | | | 7,792 | | | 3.2 | | | 3 | |

| Audi | | 417.3 | | | 6,680 | | | 2.7 | | | 9 | |

| Jaguar Land Rover | | 413.6 | | | 4,278 | | | 1.7 | | | 22 | |

| Other Premium Luxury | | 489.0 | | | 4,844 | | | 2.0 | | | 16 | |

| Premium Luxury Total | | 5,246.4 | | | 69,007 | | | 28.2 | | | 104 | |

| | $ | 12,767.4 | | | 244,546 | | | 100.0 | | | 349 | |

The franchises in each segment also sell used vehicles, parts and automotive repair and maintenance services, and automotive finance and insurance products. For the year ended December 31, 2023, Premium Luxury revenue represented 38% of total revenue, Import revenue represented 29% of total revenue, and Domestic revenue represented 28% of total revenue. For additional financial information regarding our three reportable segments, refer to Note 22 of the Notes to Consolidated Financial Statements set forth in Part II, Item 8 of this Form 10-K.

Except to the extent that differences among reportable segments are material to an understanding of our business taken as a whole, the description of our business in this report is presented on a consolidated basis.

Business Strategy

We seek to create long-term value for our stockholders and to be the best-run, most profitable automotive retailer and provider of personalized transportation services in the United States. We believe that the significant scale of our operations, our digital customer experience, and the quality of our managerial talent allow us to achieve efficiencies in our key markets. To achieve and sustain operational excellence, we are pursuing the following strategies:

•We strive to be the nation’s most comprehensive provider of transportation solutions to meet the mobility needs of our current and future customers through a comprehensive, unique suite of transportation solutions.

We seek to maximize the performance and utilization of our assets through operational excellence and expand through the development and/or acquisition of key capabilities, products, and resources. We achieve this by both optimizing our existing business and capturing new and developing opportunities. We continue to invest in strategic partnerships and broaden our offerings to evolve with the changing automotive retail industry and to

widen our access to new and expanding sales channels for vehicles, parts and service, financing, and personal transportation services.

AutoNation Finance, our captive auto finance company, provides financing to qualified retail customers on certain new and used vehicles we sell. Through AutoNation Finance, we have further extended our relationship with our customers beyond the car-buying experience. In September 2023, we discontinued acquiring installment contracts from third-party independent dealers and are now exclusively focused on increasing finance penetration in our stores.

We also pursue opportunities to penetrate the extensive After-Sales service market and respond to our customers’ needs by broadening the reach of our existing After-Sales network. AutoNation Mobile Service, our mobile solution for automotive repair and maintenance services, offers customers the convenience of services and repairs at their home, workplace, or on-site for fleet vehicles. In 2023, we launched AutoNationParts.com, a new e-commerce website enabling customers to purchase high-quality automotive parts and accessories at competitive prices, shipped directly to their homes.

Additionally, we have minority ownership stakes in Waymo, the self-driving technology company of Alphabet Inc., and TrueCar, Inc., a leading automotive digital marketplace that lets auto buyers and sellers connect to its nationwide network of certified dealers. These investments signal our continued commitment to emerging technologies that impact the automotive industry.

We also continue to actively pursue acquisitions and new store opportunities that meet our strategic and financial objectives. We expect that these offerings, initiatives, partnerships, and acquisitions will continue to expand and strengthen the AutoNation retail brand, improve the customer experience, provide new growth opportunities, and enable us to expand our footprint in our core and other markets.

•Hire, train, and retain the best talent available to build dynamic teams to serve our customers.

At AutoNation, nothing drives our success more than how we hire, train, and retain great people. We value the dignity of all employees and are committed to maintaining a work environment where all associates are valued and treated with respect. Our associates are at the core of our performance, by driving innovation and meeting the needs of our more than 11 million customers while protecting and enhancing AutoNation’s brand and reputation. See “Human Capital Resources” and “Corporate Social Responsibility – Our Workplace” below for more information about how we invest in our associates to help us prepare leaders with the vision, integrity, and expertise that enhance our operational excellence every day, drive store profitability, and create both positive employee and customer experiences.

•Continue to provide an industry-leading automotive retail customer experience in our stores and through our digital channels.

We seek to deliver a consistently superior customer experience by offering a broad selection of inventory, customer-friendly, transparent sales and service processes, vehicle financing, and competitive pricing. We believe that this will benefit us by increasing customer loyalty and will encourage our customers to bring their vehicles to our stores for all of their vehicle service, maintenance, and collision repair needs and also by driving repeat and referral vehicle sales business.

We continue to make significant investments to provide a seamless, end-to-end customer experience in our stores and through our digital channels, and to improve our ability to generate business through those channels. We have enhanced the AutoNation Express experience - our integrated retailing solution that provides customers with a seamless and intuitive omnichannel vehicle shopping and purchase experience - by continuing to build omnichannel digital capabilities that provide a personalized digital customer experience online and in-store. Our customers are able to complete key automotive retail- and service-related transactions online through our digital channels such as selecting a vehicle with a guaranteed price, scheduling a test drive, calculating payment options, receiving a certified trade-in or purchase offer for a vehicle that a customer wants to sell, applying for financing, selecting vehicle protection products, scheduling in-store pick up or home delivery, arranging service appointments, receiving service updates, paying for maintenance and repair services, and signing paperwork

electronically. We also utilize proprietary tools that leverage real-time customer data to guide and personalize the customer experience.

•Continue to invest in the AutoNation retail brand to enhance our strong customer satisfaction and expand our market share.

AutoNation is a brand that connects people and places. We continue to invest in the AutoNation retail brand, promoting personal transportation for America’s drivers, leading the charge to make transformational change in the automotive industry, and driving out cancer coast to coast. We are committed to delivering easy, transparent, and customer-centric services for our customers’ personal transportation needs.

The AutoNation retail brand includes our AutoNation USA used vehicle stores. We continue to expand our AutoNation USA used vehicle store footprint throughout the country. These stores play an integral part of both our long-term growth plans and the achievement of scale, scope, and density in markets to better serve and meet the needs of customers. AutoNation USA stores continue to leverage the AutoNation brand, scale, exceptional used vehicle sourcing capabilities, and proven customer-centric processes to differentiate our Company and capture a larger share of the used vehicle market.

The AutoNation retail brand extends to other products and services, as well. We offer AutoNation-branded Customer Financial Services products (including extended service and maintenance contracts and other vehicle protection products), parts and accessories, and vehicle financing, as well as collision repair services at AutoNation-branded collision centers, and auction services at AutoNation-branded automotive auctions. We also offer our One Price used vehicle centralized pricing and appraisal strategy, and our “We’ll Buy Your Car” program under which customers receive a guaranteed trade-in offer honored for 7 days or 500 miles at any of our locations.

•Leverage our significant scale and cost structure to improve our operating efficiency.

As one of the largest automotive retailers in the United States, we are uniquely positioned to leverage our significant scale so that we are able to achieve competitive operating margins by centralizing and streamlining various business processes. We strive to manage our new and used vehicle inventories so that our stores’ supply and mix of vehicles are in line with seasonal sales trends and also minimize our carrying costs. We are able to self-source a significant portion of our used vehicle inventory through our “We’ll Buy Your Car” program, and quickly make available such used vehicles through optimization of our reconditioning capabilities at our parts and service departments. Additionally, we are able to improve financial controls and lower servicing costs by maintaining many key store-level accounting and administrative activities in our shared service center located in Irving, Texas. We also leverage our digital capabilities to drive cost reductions and increased efficiency for the long-term success of our business. Finally, we leverage our scale to reduce costs related to purchasing certain equipment, supplies, and services through national vendor relationships.

Our business benefits from a well-diversified portfolio of automotive retail franchises. In 2023, approximately 44% of our segment income for reportable segments was generated by Premium Luxury franchises, approximately 34% by Import franchises, and approximately 22% by Domestic franchises. We believe that our business also benefits from diverse revenue streams generated by our new and used vehicle sales, parts and service business, and finance and insurance sales. Our higher-margin parts and service business has historically been less sensitive to macroeconomic conditions as compared to new and used vehicle sales. In addition, we have been able to attain industry-leading finance and insurance gross profit per vehicle retailed as we have increased the penetration of products sold per vehicle.

Our capital allocation strategy is focused on growing long-term value per share. We invest capital in our business to maintain and upgrade our existing facilities and to build new facilities for existing franchises and new AutoNation USA used vehicle stores, as well as for other strategic and technology initiatives. We also deploy capital opportunistically to complete acquisitions or investments, build facilities for newly awarded franchises, and/or repurchase our common stock and/or debt. Our capital allocation decisions are based on factors such as the expected rate of return on our investment, the market price of our common stock versus our view of its intrinsic value, the market price of our debt, the potential impact on our capital structure, our ability to complete acquisitions that meet our strategic objectives, market and vehicle brand criteria and/or return on investment threshold, and limitations set forth in our debt agreements. For additional information

regarding our capital allocation, refer to “Liquidity and Capital Resources – Capital Allocation” in Part II, Item 7 of this Form 10-K.

Operations

Each of our stores acquires new vehicles for retail sale either directly from the applicable automotive manufacturer or distributor or through dealer trades with other stores of the same brand franchise. We generally acquire used vehicles from customers, primarily through trade-ins and our “We’ll Buy Your Car” program, as well as through auctions, lease terminations, and other sources, and we generally recondition used vehicles acquired for retail sale in our parts and service departments. Used vehicles that we do not sell at our stores generally are sold at wholesale prices through auctions. See also “Inventory Management” in Part II, Item 7 of this Form 10-K.

Our stores provide a wide range of vehicle maintenance, repair, and collision repair services, including manufacturer recall repairs and other warranty work that can be performed only at franchised dealerships and customer-pay service work. Our parts and service departments also recondition used vehicles acquired by our used vehicle departments and perform preparatory work and accessory installation on new vehicles acquired by our new vehicle departments. We also offer product and accessory lines that are integrated into our parts and service operations. In 2023, we launched AutoNationParts.com, a new e-commerce website enabling customers to purchase high-quality automotive parts and accessories at competitive prices, shipped directly to their homes. In addition to our retail business, we also have wholesale parts operations, which sell automotive parts to both collision repair shops and independent vehicle repair providers.

We offer a wide variety of automotive finance and insurance products to our customers. We primarily arrange for our customers to finance vehicles through installment loans or leases with third-party lenders, including the vehicle manufacturers’ and distributors’ captive finance subsidiaries, and receive a commission payable to us from the lender. Our exposure to loss in connection with financing arrangements with third-party lenders generally is limited to the commissions that we receive. We also originate and service consumer auto finance loans through our captive finance company. See the risk factor “We are subject to various risks associated with originating and servicing auto finance loans through indirect lending to customers, any of which could have an adverse effect on our business” in Part I, Item 1A of this Form 10-K for additional information.

We also offer our customers various vehicle protection products, including extended service contracts, maintenance programs, guaranteed auto protection (known as “GAP,” this protection covers the shortfall between a customer’s loan balance and insurance payoff in the event of a casualty), “tire and wheel” protection, and theft protection products, many of which are AutoNation-branded. These products are underwritten and administered by independent third parties, including the vehicle manufacturers’ and distributors’ captive finance subsidiaries. We sell the products on a commission basis, and we also participate in future underwriting profit for certain products pursuant to retrospective commission arrangements with the issuers of those products.

As of December 31, 2023, we operated stores in the following states:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| State | | Number of Retail Stores (1) | | Number of

Franchises | | Number of Other Locations (2) | | % of Total Revenue |

| Florida | | 49 | | | 59 | | | 19 | | | 25 | |

| Texas | | 46 | | | 62 | | | 17 | | | 19 | |

| California | | 42 | | | 59 | | | 2 | | | 19 | |

| Colorado | | 20 | | | 31 | | | 1 | | | 6 | |

| Arizona | | 16 | | | 18 | | | 4 | | | 6 | |

| Washington | | 14 | | | 19 | | | 3 | | | 5 | |

| Georgia | | 17 | | | 24 | | | 4 | | | 4 | |

| Nevada | | 12 | | | 13 | | | 1 | | | 4 | |

| Maryland | | 14 | | | 16 | | | 3 | | | 3 | |

| Illinois | | 7 | | | 8 | | | 1 | | | 2 | |

| Tennessee | | 7 | | | 7 | | | 1 | | | 2 | |

| South Carolina | | 10 | | | 13 | | | 1 | | | 1 | |

| Ohio | | 4 | | | 4 | | | 3 | | | 1 | |

| North Carolina | | 1 | | | — | | | — | | | 1 | |

| Virginia | | 2 | | | 2 | | | — | | | 1 | |

| Alabama | | 3 | | | 6 | | | — | | | 1 | |

Minnesota (3) | | 1 | | | 1 | | | — | | | — | |

New York (3) | | 3 | | | 6 | | | — | | | — | |

New Mexico (3) | | 1 | | | — | | | — | | | — | |

Missouri (3) | | 1 | | | — | | | — | | | — | |

New Jersey (3) | | 1 | | | 1 | | | — | | | — | |

| Total | | 271 | | 349 | | 60 | | 100 | |

(1)Includes franchised dealerships and AutoNation USA used vehicle stores.

(2)Includes collision centers, automotive auction operations, and parts distribution centers.

(3)Revenue represented less than 1% of total revenue.

Agreements with Vehicle Manufacturers

Framework Agreements

We have entered into framework and related agreements with most major vehicle manufacturers and distributors. These agreements, which are in addition to the franchise agreements described below, contain provisions relating to our management, operation, advertising and marketing, and acquisition and ownership structure of automotive stores franchised by such manufacturers. These agreements contain certain requirements pertaining to our operating performance (with respect to matters such as sales volume, sales effectiveness, and customer satisfaction or loyalty), which, if we do not satisfy, adversely impact our ability to make further acquisitions of such manufacturers’ stores or could result in us being compelled to take certain actions, such as divesting a significantly underperforming store, subject to applicable state franchise laws. Additionally, these agreements set limits (nationally, regionally, and in local markets) on the number of stores that we may acquire of the particular manufacturer and contain certain restrictions on our ability to name and brand our stores. Some of these framework agreements give the manufacturer or distributor the right to acquire at fair market value, or the right to compel us to sell, the automotive stores franchised by that manufacturer or distributor under specified circumstances in the event of a change in control of our Company (generally including certain material changes in the composition of our Board of Directors during a specified time period, the acquisition of 20% or more of the voting stock of our Company by another vehicle manufacturer or distributor, or the acquisition of 50% or more of our voting stock by a person, entity, or group not affiliated with a vehicle manufacturer or distributor) or other extraordinary corporate transactions such as a merger or sale of all or substantially all of our assets. In addition, we have granted certain manufacturers the right to acquire, at fair market value, our automotive dealerships franchised by such manufacturers in specified circumstances in the event of our default under certain of our debt agreements.

Franchise Agreements

We operate each of our new vehicle stores under a franchise agreement with a vehicle manufacturer or distributor. The franchise agreements grant the franchised automotive store a non-exclusive right to sell the manufacturer’s or distributor’s brand of vehicles and offer related parts and service within a specified market area. These franchise agreements grant our stores the right to use the relevant manufacturer’s or distributor’s trademarks in connection with their operations, and they also impose numerous operational requirements and restrictions relating to inventory levels, working capital levels, the sales process, marketing and branding, showroom and service facilities, signage, personnel, changes in management, and monthly financial reporting, among other things. The contractual terms of our stores’ franchise agreements provide for various durations, ranging from one year to no expiration date, and in certain cases manufacturers have undertaken to renew such franchises upon expiration so long as the store is in compliance with the terms of the agreement. We generally expect our franchise agreements to survive for the foreseeable future and, when the agreements do not have indefinite terms, anticipate routine renewals of the agreements without substantial cost or modification. Our stores’ franchise agreements provide for termination of the agreement by the manufacturer or non-renewal for a variety of causes (including performance deficiencies in such areas as sales volume, sales effectiveness, and customer satisfaction or loyalty). However, in general, the states in which we operate have automotive dealership franchise laws that provide that, notwithstanding the terms of any franchise agreement, it is unlawful for a manufacturer to terminate or not renew a franchise unless “good cause” exists. It generally is difficult, outside of bankruptcy, for a manufacturer to terminate, or not renew, a franchise under these laws, which were designed to protect dealers. In addition, in our experience and historically in the automotive retail industry, dealership franchise agreements are rarely involuntarily terminated or not renewed by the manufacturer outside of bankruptcy. From time to time, certain manufacturers assert sales and customer satisfaction performance deficiencies under the terms of our framework and franchise agreements. We generally work with these manufacturers to address the asserted performance issues. For additional information, please refer to the risk factor captioned “We are subject to restrictions imposed by, and significant influence from, vehicle manufacturers that may adversely impact our business, financial condition, results of operations, cash flows, and prospects, including our ability to acquire additional stores” in Part I, Item 1A of this Form 10-K.

Regulations

We operate in a highly regulated industry. A number of state and federal laws and regulations affect our business. In every state in which we operate, we must obtain various licenses in order to operate our businesses, including dealer, sales and finance, and insurance licenses issued by state regulatory authorities. Numerous laws and regulations govern how we conduct our business, including those relating to our sales, operations, finance and insurance, advertising, indirect auto financing, origination and servicing of consumer auto finance loans, and employment practices. These laws and regulations include state franchise laws and regulations, federal and state consumer protection laws and regulations, privacy laws, escheatment laws, anti-money laundering laws, and other extensive laws and regulations applicable to new and used motor vehicle dealers and auto finance companies, as well as a variety of other laws and regulations. These laws also include federal and state wage and hour, anti-discrimination, and other employment practices laws. See the risk factor “Our operations are subject to extensive governmental laws and regulations. If we are found to be in purported violation of or subject to liabilities under any of these laws or regulations, or if new laws or regulations are enacted that adversely affect our operations, our business, operating results, and prospects could suffer” in Part I, Item 1A of this Form 10-K.

Automotive and Other Laws and Regulations

Our operations are subject to the National Traffic and Motor Vehicle Safety Act, Federal Motor Vehicle Safety Standards promulgated by the United States Department of Transportation, and the rules and regulations of various state motor vehicle regulatory agencies. In addition, automotive dealers are subject to regulation by the Federal Trade Commission (the “FTC”). The imported automobiles, parts, and accessories we purchase are subject to United States customs duties and, in the ordinary course of our business we may, from time to time, be subject to claims for duties, penalties, liquidated damages, or other charges. Further, our captive finance company operations are subject to regulations and supervision by the Consumer Financial Protection Bureau (the “CFPB”). Among other things, the CFPB is authorized to take action to prevent auto finance companies from engaging in unfair, deceptive, or abusive acts and practices and to issue rules requiring enhanced disclosures concerning consumer financial products and services. In addition, state attorneys general have authority under their respective laws and regulations, and under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), enacted in 2010, to investigate and/or regulate certain aspects of our operations.

Our financing activities with customers, including our origination and servicing activities through our captive finance company, are subject to the federal Truth-in-Lending Act, Consumer Leasing Act, Equal Credit Opportunity Act, Fair Credit Reporting Act, federal and state prohibitions against unfair, deceptive, and abusive acts and practices, and various other federal laws and regulations, as well as state and local motor vehicle finance laws, leasing laws, collection, repossession, and installment finance laws, usury laws, and other installment sales and leasing laws and regulations. Among other things, these laws and regulations regulate finance and other fees and charges that may be imposed or received in connection with motor vehicle retail installment sales and leasing, require specific disclosures to consumers, define the rights to collect payments and repossess and sell collateral, and govern the sale and terms of ancillary products. Claims arising out of actual or alleged violations of law or regulation may be asserted against us by individuals, a class of individuals, or governmental entities and may expose us to significant damages or other penalties, including fines and revocation or suspension of our licenses to conduct our operations. See the risk factor “Our operations are subject to extensive governmental laws and regulations. If we are found to be in purported violation of or subject to liabilities under any of these laws or regulations, or if new laws or regulations are enacted that adversely affect our operations, our business, operating results, and prospects could suffer” in Part I, Item 1A of this Form 10-K for additional information.

Environmental, Health, and Safety Laws and Regulations

Our operations involve the use, handling, storage, and contracting for recycling and/or disposal of materials such as motor oil and filters, transmission fluids, antifreeze, refrigerants, paints, thinners, batteries, cleaning products, lubricants, degreasing agents, tires, and fuel. Consequently, our business is subject to a complex variety of federal, state, and local requirements that regulate the environment and public health and safety.

Most of our stores utilize aboveground storage tanks and, to a lesser extent, underground storage tanks, primarily for petroleum-based products. Storage tanks are subject to periodic testing, containment, upgrading, and removal under the Resource Conservation and Recovery Act and its state law counterparts. Clean-up or other remedial action may be necessary in the event of leaks or other discharges from storage tanks or other sources. In addition, water quality protection programs under the federal Water Pollution Control Act (commonly known as the Clean Water Act), the Safe Drinking Water Act, and comparable state and local programs govern certain discharges from some of our operations. Similarly, certain air emissions from operations, such as auto body painting, may be subject to the federal Clean Air Act and related state and local laws. Certain health and safety standards promulgated by the Occupational Safety and Health Administration of the United States Department of Labor and related state agencies also apply.

Some of our stores are parties to proceedings under the Comprehensive Environmental Response, Compensation, and Liability Act, or CERCLA, typically in connection with materials that were sent to former recycling, treatment, and/or disposal facilities owned and operated by independent businesses. The remediation or clean-up of facilities where the release of a regulated hazardous substance occurred is required under CERCLA and other laws.

We have a proactive strategy related to environmental, health, and safety laws and regulations, which includes contracting with third-party vendors to inspect our facilities routinely in an effort to ensure compliance. We incur significant costs to comply with applicable environmental, health, and safety laws and regulations in the ordinary course of our business. We do not anticipate, however, that the costs of such compliance will have a material adverse effect on our business, results of operations, cash flows, or financial condition, although such outcome is possible given the nature of our operations and the extensive environmental, health, and safety regulatory framework. We do not have any material known environmental commitments or contingencies.

Markets and Competition

We operate in a highly competitive industry. We believe that the principal competitive factors in the automotive retail business are location, service, price, selection, and online and mobile offerings. Each of our markets includes a large number of well-capitalized competitors that have extensive automotive retail managerial experience and strong retail locations and facilities.

New vehicle unit volume benefited from increases in new vehicle inventory levels due to higher levels of manufacturer vehicle production. The increasing supply and availability of new vehicle inventory has adversely impacted market demand for used vehicles, particularly for higher-priced used vehicles. According to industry sources, as of December 31, 2023, there were approximately 16,800 franchised automotive dealerships, which sell both new and used vehicles, in the United

States. In addition, we estimate that there were approximately twice as many independent used vehicle dealers in the United States. We continue to expand our footprint and increase scope and scale through both the acquisition of new dealerships and franchises and through the expansion of our AutoNation USA used vehicle stores. We face competition from (i) several public companies that operate numerous automotive retail stores or collision centers on a regional or national basis, including franchised dealers that sell new and used vehicles, non-franchised dealers that sell only used vehicles, and manufacturers that sell directly to customers, (ii) private companies that operate automotive retail stores or collision centers in our markets, (iii) electric vehicle manufacturers who sell directly to consumers, and (iv) online and mobile sales platforms. We compete with dealers that sell the same vehicle brands that we sell, as well as dealers and certain manufacturers that sell other vehicle brands that we do not represent in a particular market. Our new vehicle store competitors have franchise agreements with the various vehicle manufacturers and, as such, generally have access to new vehicles on the same terms as we have. We also compete with other dealers for qualified employees, including general managers and sales and service personnel.

In general, the vehicle manufacturers have designated marketing and sales areas within which only one franchised dealer of a given vehicle brand may operate. Under most framework agreements with vehicle manufacturers, the ability to acquire multiple dealers of a given vehicle brand within a particular market is limited. Dealers are also restricted by various state franchise laws from relocating stores or establishing new stores of a particular vehicle brand within any area that is served by another dealer of the same vehicle brand, and generally need the manufacturer to approve any relocation or the grant of a new franchise. However, to the extent that a market has multiple dealers of a particular vehicle brand, as most of our key markets do with respect to most vehicle brands we sell, we face significant intra-brand competition.

We also compete with independent automobile service shops, service center chains, collision service operations, and wholesale parts outlets. We believe that the principal competitive factors in the parts and service business are price, location, expertise with the particular vehicle lines, and customer service. We also compete with a broad range of financial institutions in our finance and insurance business. We believe that the principal competitive factors in the finance and insurance business are product selection, convenience, price, contract terms, and the ability to finance vehicle protection and aftermarket products.

We also operate in the auto finance sector of the consumer finance market. This sector is primarily comprised of banks, captive finance divisions of new car manufacturers, credit unions, and independent finance companies. According to industry sources, this sector represented more than $1 trillion in outstanding receivables as of December 31, 2023. Our primary competitors in this sector are banks and credit unions that offer direct and indirect financing to customers purchasing vehicles.

Insurance and Bonding

Our business exposes us to the risk of liabilities arising out of our operations. For example, liabilities may arise out of claims of employees, customers, or other third parties for personal injury or property damage occurring in the course of our operations. We could also be subject to fines and civil and criminal penalties in connection with alleged violations of federal and state laws or regulatory requirements.

The automotive retail business is also subject to substantial risk of property loss due to the significant concentration of property values at store locations. In our case in particular, our operations are concentrated in states and regions in which natural disasters and severe weather events (such as hailstorms, hurricanes, earthquakes, fires, tornadoes, snowstorms, and landslides) may subject us to substantial risk of property loss and operational disruption. Under self-insurance programs, we retain various levels of aggregate loss limits, per claim deductibles, and claims-handling expenses as part of our various insurance programs, including property and casualty, automobile, workers’ compensation, and employee medical benefits. Costs in excess of this retained risk per claim may be insured under various contracts with third-party insurance carriers. We estimate the ultimate costs of these retained insurance risks based on actuarial evaluations and historical claims experience, adjusted for current trends and changes in claims-handling procedures. The level of risk we retain may change in the future as insurance market conditions or other factors affecting the economics of our insurance purchasing change. Although we have, subject to certain limitations and exclusions, substantial insurance, we cannot assure you that we will not be exposed to uninsured or underinsured losses that could have a material adverse effect on our business, financial condition, results of operations, or cash flows.

Provisions for retained losses and deductibles are made by charges to expense based upon periodic evaluations of the estimated ultimate liabilities on reported and unreported claims. The insurance companies that underwrite our insurance require that we secure certain of our obligations for deductible reimbursements with collateral. Our collateral requirements are set by the insurance companies and, to date, have been satisfied by posting surety bonds, letters of credit, and/or cash deposits. Our collateral requirements may change from time to time based on, among other things, our claims experience.

Seasonality

In a stable environment, our operations generally experience higher volumes of vehicle unit sales in the second and third quarters of each year due in part to consumer buying trends and the introduction of new vehicle models. Also, demand for vehicles and light trucks is generally lower during the winter months than in other seasons, particularly in regions of the United States where stores may be subject to adverse winter conditions. However, we typically experience higher sales of Premium Luxury vehicles, which have higher average selling prices and gross profit per vehicle retailed, in the fourth quarter. Revenue and operating results may be impacted significantly from quarter to quarter by changing economic conditions, vehicle manufacturer incentive programs, and actual or threatened severe weather events.

Trademarks

We own a number of registered service marks and trademarks, including, among other marks, AutoNation® and AutoNation USA®. Pursuant to agreements with vehicle manufacturers, we have the right to use and display manufacturers’ trademarks, logos, and designs at our stores and in our advertising and promotional materials, subject to certain restrictions. We also have licenses pursuant to various agreements with third parties authorizing the use and display of the marks and/or logos of such third parties, subject to certain restrictions. The current registrations of our service marks and trademarks are effective for varying periods of time, which we may renew periodically, provided that we comply with all applicable laws.

Human Capital Resources

Purpose and Culture