false2023Q30001682852December 31http://fasb.org/us-gaap/2023#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2023#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrent72327700016828522023-01-012023-09-3000016828522023-10-27xbrli:shares00016828522023-09-30iso4217:USD00016828522022-12-31iso4217:USDxbrli:shares0001682852mrna:ProductSalesMember2023-07-012023-09-300001682852mrna:ProductSalesMember2022-07-012022-09-300001682852mrna:ProductSalesMember2023-01-012023-09-300001682852mrna:ProductSalesMember2022-01-012022-09-300001682852us-gaap:ProductAndServiceOtherMember2023-07-012023-09-300001682852us-gaap:ProductAndServiceOtherMember2022-07-012022-09-300001682852us-gaap:ProductAndServiceOtherMember2023-01-012023-09-300001682852us-gaap:ProductAndServiceOtherMember2022-01-012022-09-3000016828522023-07-012023-09-3000016828522022-07-012022-09-3000016828522022-01-012022-09-300001682852us-gaap:CommonStockMember2023-06-300001682852us-gaap:AdditionalPaidInCapitalMember2023-06-300001682852us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001682852us-gaap:RetainedEarningsMember2023-06-3000016828522023-06-300001682852us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001682852us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001682852us-gaap:RetainedEarningsMember2023-07-012023-09-300001682852us-gaap:CommonStockMember2023-09-300001682852us-gaap:AdditionalPaidInCapitalMember2023-09-300001682852us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001682852us-gaap:RetainedEarningsMember2023-09-300001682852us-gaap:CommonStockMember2022-06-300001682852us-gaap:AdditionalPaidInCapitalMember2022-06-300001682852us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001682852us-gaap:RetainedEarningsMember2022-06-3000016828522022-06-300001682852us-gaap:CommonStockMember2022-07-012022-09-300001682852us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001682852us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300001682852us-gaap:RetainedEarningsMember2022-07-012022-09-300001682852us-gaap:CommonStockMember2022-09-300001682852us-gaap:AdditionalPaidInCapitalMember2022-09-300001682852us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001682852us-gaap:RetainedEarningsMember2022-09-3000016828522022-09-300001682852us-gaap:CommonStockMember2022-12-310001682852us-gaap:AdditionalPaidInCapitalMember2022-12-310001682852us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001682852us-gaap:RetainedEarningsMember2022-12-310001682852us-gaap:CommonStockMember2023-01-012023-09-300001682852us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300001682852us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300001682852us-gaap:RetainedEarningsMember2023-01-012023-09-300001682852us-gaap:CommonStockMember2021-12-310001682852us-gaap:AdditionalPaidInCapitalMember2021-12-310001682852us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001682852us-gaap:RetainedEarningsMember2021-12-3100016828522021-12-310001682852us-gaap:CommonStockMember2022-01-012022-09-300001682852us-gaap:AdditionalPaidInCapitalMember2022-01-012022-09-300001682852us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300001682852us-gaap:RetainedEarningsMember2022-01-012022-09-30mrna:candidatemrna:developmentProgram0001682852us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2022-12-310001682852us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001682852us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-01-012023-03-310001682852us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-03-3100016828522023-01-012023-03-310001682852us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-03-310001682852us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-03-310001682852us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001682852us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-04-012023-06-300001682852us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-04-012023-06-3000016828522023-04-012023-06-300001682852us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-06-300001682852us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-06-300001682852us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-07-012023-09-300001682852us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-07-012023-09-300001682852us-gaap:AccumulatedNetUnrealizedInvestmentGainLossMember2023-09-300001682852us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-09-300001682852mrna:ProductSalesMembercountry:US2023-07-012023-09-300001682852mrna:ProductSalesMembercountry:US2022-07-012022-09-300001682852mrna:ProductSalesMembercountry:US2023-01-012023-09-300001682852mrna:ProductSalesMembercountry:US2022-01-012022-09-300001682852mrna:ProductSalesMembersrt:EuropeMember2023-07-012023-09-300001682852mrna:ProductSalesMembersrt:EuropeMember2022-07-012022-09-300001682852mrna:ProductSalesMembersrt:EuropeMember2023-01-012023-09-300001682852mrna:ProductSalesMembersrt:EuropeMember2022-01-012022-09-300001682852mrna:ProductSalesMembermrna:RestOfTheWorldMember2023-07-012023-09-300001682852mrna:ProductSalesMembermrna:RestOfTheWorldMember2022-07-012022-09-300001682852mrna:ProductSalesMembermrna:RestOfTheWorldMember2023-01-012023-09-300001682852mrna:ProductSalesMembermrna:RestOfTheWorldMember2022-01-012022-09-300001682852mrna:ProductSalesMember2023-09-300001682852mrna:ProductSalesMember2022-12-310001682852us-gaap:GrantMember2023-07-012023-09-300001682852us-gaap:GrantMember2022-07-012022-09-300001682852us-gaap:GrantMember2023-01-012023-09-300001682852us-gaap:GrantMember2022-01-012022-09-300001682852mrna:CollaborationArrangementIncludingArrangementsWithAffiliateMember2023-07-012023-09-300001682852mrna:CollaborationArrangementIncludingArrangementsWithAffiliateMember2022-07-012022-09-300001682852mrna:CollaborationArrangementIncludingArrangementsWithAffiliateMember2023-01-012023-09-300001682852mrna:CollaborationArrangementIncludingArrangementsWithAffiliateMember2022-01-012022-09-300001682852mrna:BiomedicalAdvancedResearchAndDevelopmentAuthorityMember2020-04-012020-04-3000016828522020-04-30mrna:participant0001682852mrna:BiomedicalAdvancedResearchAndDevelopmentAuthorityMember2020-04-012023-09-300001682852mrna:BiomedicalAdvancedResearchAndDevelopmentAuthorityMember2023-09-300001682852mrna:DefenseAdvancedResearchProjectsAgencyMember2020-09-012020-09-300001682852mrna:DefenseAdvancedResearchProjectsAgencyMembermrna:ContractOptionsMember2023-09-300001682852mrna:TheBillAndMelindaGatesFoundationMembermrna:InitialProjectMember2023-09-300001682852us-gaap:GrantMembermrna:BiomedicalAdvancedResearchAndDevelopmentAuthorityMember2023-07-012023-09-300001682852us-gaap:GrantMembermrna:BiomedicalAdvancedResearchAndDevelopmentAuthorityMember2022-07-012022-09-300001682852us-gaap:GrantMembermrna:BiomedicalAdvancedResearchAndDevelopmentAuthorityMember2023-01-012023-09-300001682852us-gaap:GrantMembermrna:BiomedicalAdvancedResearchAndDevelopmentAuthorityMember2022-01-012022-09-300001682852us-gaap:GrantMembermrna:OtherGrantRevenueMember2023-07-012023-09-300001682852us-gaap:GrantMembermrna:OtherGrantRevenueMember2022-07-012022-09-300001682852us-gaap:GrantMembermrna:OtherGrantRevenueMember2023-01-012023-09-300001682852us-gaap:GrantMembermrna:OtherGrantRevenueMember2022-01-012022-09-300001682852mrna:CollaborationArrangementIncludingArrangementsWithAffiliateMembermrna:VertexMember2023-07-012023-09-300001682852mrna:CollaborationArrangementIncludingArrangementsWithAffiliateMembermrna:VertexMember2022-07-012022-09-300001682852mrna:CollaborationArrangementIncludingArrangementsWithAffiliateMembermrna:VertexMember2023-01-012023-09-300001682852mrna:CollaborationArrangementIncludingArrangementsWithAffiliateMembermrna:VertexMember2022-01-012022-09-300001682852mrna:CollaborationArrangementIncludingArrangementsWithAffiliateMembermrna:MerckMember2023-07-012023-09-300001682852mrna:CollaborationArrangementIncludingArrangementsWithAffiliateMembermrna:MerckMember2022-07-012022-09-300001682852mrna:CollaborationArrangementIncludingArrangementsWithAffiliateMembermrna:MerckMember2023-01-012023-09-300001682852mrna:CollaborationArrangementIncludingArrangementsWithAffiliateMembermrna:MerckMember2022-01-012022-09-300001682852mrna:AstraZenecaMembermrna:CollaborationArrangementIncludingArrangementsWithAffiliateMember2023-07-012023-09-300001682852mrna:AstraZenecaMembermrna:CollaborationArrangementIncludingArrangementsWithAffiliateMember2022-07-012022-09-300001682852mrna:AstraZenecaMembermrna:CollaborationArrangementIncludingArrangementsWithAffiliateMember2023-01-012023-09-300001682852mrna:AstraZenecaMembermrna:CollaborationArrangementIncludingArrangementsWithAffiliateMember2022-01-012022-09-300001682852mrna:CollaborationArrangementIncludingArrangementsWithAffiliateMembermrna:OtherCollaborativePartiesMember2023-07-012023-09-300001682852mrna:CollaborationArrangementIncludingArrangementsWithAffiliateMembermrna:OtherCollaborativePartiesMember2022-07-012022-09-300001682852mrna:CollaborationArrangementIncludingArrangementsWithAffiliateMembermrna:OtherCollaborativePartiesMember2023-01-012023-09-300001682852mrna:CollaborationArrangementIncludingArrangementsWithAffiliateMembermrna:OtherCollaborativePartiesMember2022-01-012022-09-300001682852us-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMembermrna:MerckMember2022-10-310001682852us-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMembermrna:MerckMember2023-07-012023-09-300001682852us-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMembermrna:MerckMember2023-01-012023-09-300001682852mrna:GenerationBioCoGBIOMemberus-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMember2023-03-310001682852mrna:GenerationBioCoGBIOMemberus-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMember2023-03-012023-03-310001682852mrna:OriCiroGenomicsKKMember2023-01-312023-01-310001682852us-gaap:DevelopedTechnologyRightsMembermrna:OriCiroGenomicsKKMember2023-01-310001682852mrna:OriCiroGenomicsKKMember2023-01-310001682852us-gaap:DevelopedTechnologyRightsMembermrna:OriCiroGenomicsKKMember2023-01-312023-01-310001682852us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2023-09-300001682852us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2023-09-300001682852mrna:CurrentMarketableSecuritiesMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2023-09-300001682852us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Membermrna:NoncurrentMarketableSecuritiesMember2023-09-300001682852us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-09-300001682852us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2023-09-300001682852us-gaap:USTreasurySecuritiesMembermrna:CurrentMarketableSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-09-300001682852us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Membermrna:NoncurrentMarketableSecuritiesMember2023-09-300001682852us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-09-300001682852us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2023-09-300001682852us-gaap:USGovernmentAgenciesDebtSecuritiesMembermrna:CurrentMarketableSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-09-300001682852us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Membermrna:NoncurrentMarketableSecuritiesMember2023-09-300001682852us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2023-09-300001682852us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300001682852mrna:CurrentMarketableSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2023-09-300001682852us-gaap:FairValueInputsLevel2Membermrna:NoncurrentMarketableSecuritiesMemberus-gaap:CorporateDebtSecuritiesMember2023-09-300001682852us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentDebtSecuritiesMember2023-09-300001682852us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:USGovernmentDebtSecuritiesMember2023-09-300001682852mrna:CurrentMarketableSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentDebtSecuritiesMember2023-09-300001682852us-gaap:FairValueInputsLevel2Membermrna:NoncurrentMarketableSecuritiesMemberus-gaap:USGovernmentDebtSecuritiesMember2023-09-300001682852us-gaap:FairValueInputsLevel2Member2023-09-300001682852us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2023-09-300001682852mrna:CurrentMarketableSecuritiesMemberus-gaap:FairValueInputsLevel2Member2023-09-300001682852us-gaap:FairValueInputsLevel2Membermrna:NoncurrentMarketableSecuritiesMember2023-09-300001682852us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001682852us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:CashAndCashEquivalentsMember2022-12-310001682852mrna:CurrentMarketableSecuritiesMemberus-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001682852us-gaap:CashAndCashEquivalentsMemberus-gaap:FairValueInputsLevel1Membermrna:NoncurrentMarketableSecuritiesMember2022-12-310001682852us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2022-12-310001682852us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMemberus-gaap:CashAndCashEquivalentsMember2022-12-310001682852mrna:CurrentMarketableSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2022-12-310001682852us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMembermrna:NoncurrentMarketableSecuritiesMember2022-12-310001682852us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001682852us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2022-12-310001682852us-gaap:USTreasurySecuritiesMembermrna:CurrentMarketableSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001682852us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Membermrna:NoncurrentMarketableSecuritiesMember2022-12-310001682852us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001682852us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2022-12-310001682852us-gaap:USGovernmentAgenciesDebtSecuritiesMembermrna:CurrentMarketableSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001682852us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Membermrna:NoncurrentMarketableSecuritiesMember2022-12-310001682852us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001682852us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001682852mrna:CurrentMarketableSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2022-12-310001682852us-gaap:FairValueInputsLevel2Membermrna:NoncurrentMarketableSecuritiesMemberus-gaap:CorporateDebtSecuritiesMember2022-12-310001682852us-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentDebtSecuritiesMember2022-12-310001682852us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMemberus-gaap:USGovernmentDebtSecuritiesMember2022-12-310001682852mrna:CurrentMarketableSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentDebtSecuritiesMember2022-12-310001682852us-gaap:FairValueInputsLevel2Membermrna:NoncurrentMarketableSecuritiesMemberus-gaap:USGovernmentDebtSecuritiesMember2022-12-310001682852us-gaap:FairValueInputsLevel2Member2022-12-310001682852us-gaap:FairValueInputsLevel2Memberus-gaap:CashAndCashEquivalentsMember2022-12-310001682852mrna:CurrentMarketableSecuritiesMemberus-gaap:FairValueInputsLevel2Member2022-12-310001682852us-gaap:FairValueInputsLevel2Membermrna:NoncurrentMarketableSecuritiesMember2022-12-310001682852us-gaap:USTreasuryBillSecuritiesMember2023-09-300001682852us-gaap:USTreasuryNotesSecuritiesMember2023-09-300001682852us-gaap:CorporateDebtSecuritiesMember2023-09-300001682852us-gaap:USGovernmentDebtSecuritiesMember2023-09-300001682852us-gaap:USTreasuryBillSecuritiesMember2022-12-310001682852us-gaap:USTreasuryNotesSecuritiesMember2022-12-310001682852us-gaap:CorporateDebtSecuritiesMember2022-12-310001682852us-gaap:USGovernmentDebtSecuritiesMember2022-12-31mrna:security0001682852us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:FairValueInputsLevel1Memberus-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentDebtSecuritiesMember2023-09-300001682852us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentDebtSecuritiesMember2023-09-300001682852us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentDebtSecuritiesMember2023-09-300001682852us-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:FairValueInputsLevel1Memberus-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:FairValueInputsLevel2Memberus-gaap:EquitySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001682852us-gaap:MoneyMarketFundsMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:FairValueInputsLevel1Memberus-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:USTreasurySecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:FairValueInputsLevel1Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentDebtSecuritiesMember2022-12-310001682852us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentDebtSecuritiesMember2022-12-310001682852us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:USGovernmentDebtSecuritiesMember2022-12-310001682852us-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001682852us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2023-09-300001682852us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeContractMember2022-12-310001682852us-gaap:NondesignatedMemberus-gaap:ForeignExchangeContractMember2022-12-310001682852us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2023-07-012023-09-300001682852us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2022-07-012022-09-300001682852us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2023-01-012023-09-300001682852us-gaap:SalesMemberus-gaap:ForeignExchangeContractMember2022-01-012022-09-300001682852us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2023-07-012023-09-300001682852us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2022-07-012022-09-300001682852us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2023-01-012023-09-300001682852us-gaap:ForeignExchangeContractMemberus-gaap:OtherNonoperatingIncomeExpenseMember2022-01-012022-09-300001682852us-gaap:PublicUtilitiesInventoryRawMaterialsMember2023-01-012023-09-300001682852us-gaap:LandMember2023-09-300001682852us-gaap:LandMember2022-12-310001682852us-gaap:EquipmentMember2023-09-300001682852us-gaap:EquipmentMember2022-12-310001682852us-gaap:LeaseholdImprovementsMember2023-09-300001682852us-gaap:LeaseholdImprovementsMember2022-12-310001682852us-gaap:PropertyPlantAndEquipmentOtherTypesMember2023-09-300001682852us-gaap:PropertyPlantAndEquipmentOtherTypesMember2022-12-310001682852us-gaap:ComputerEquipmentMember2023-09-300001682852us-gaap:ComputerEquipmentMember2022-12-310001682852us-gaap:ConstructionInProgressMember2023-09-300001682852us-gaap:ConstructionInProgressMember2022-12-310001682852mrna:FinancingRightOfUseAssetMember2023-09-300001682852mrna:FinancingRightOfUseAssetMember2022-12-310001682852us-gaap:GrantMember2022-12-310001682852us-gaap:GrantMember2023-09-300001682852mrna:CollaborationArrangementMember2022-12-310001682852mrna:CollaborationArrangementMember2023-01-012023-09-300001682852mrna:CollaborationArrangementMember2023-09-30mrna:campus0001682852mrna:CambridgeMassachusettsMember2023-09-30utr:sqft0001682852mrna:CambridgeMassachusettsMember2021-09-300001682852mrna:CambridgeMassachusettsMember2021-09-012021-09-30mrna:numberOfExtensionPeriod0001682852mrna:MTCSouthMTCNorthAndMTCEastMember2023-09-30mrna:numberOfBuilding0001682852mrna:EmbeddedLeasesMember2023-07-012023-09-300001682852mrna:EmbeddedLeasesMember2023-09-300001682852mrna:EmbeddedLeasesMember2022-12-310001682852mrna:MTCSouthMTCNorthAndMTCEastMembermrna:NorwoodMassachusettsMember2023-09-300001682852us-gaap:IndemnificationGuaranteeMember2023-07-012023-09-300001682852us-gaap:IndemnificationGuaranteeMember2023-01-012023-09-300001682852us-gaap:IndemnificationGuaranteeMember2022-01-012022-12-310001682852us-gaap:IndemnificationGuaranteeMember2023-09-30mrna:claim0001682852us-gaap:IndemnificationGuaranteeMember2022-12-310001682852mrna:SupplyAndManufacturingAgreementsMember2023-09-300001682852mrna:ClinicalServicesMember2023-09-300001682852mrna:ClinicalOperationsAndSupportCommitmentMember2023-09-300001682852us-gaap:EmployeeStockOptionMember2023-07-012023-09-300001682852us-gaap:EmployeeStockOptionMember2022-07-012022-09-300001682852us-gaap:EmployeeStockOptionMember2023-01-012023-09-300001682852us-gaap:EmployeeStockOptionMember2022-01-012022-09-300001682852mrna:RestrictedStockAndRestrictedStockUnitsRSUMember2023-07-012023-09-300001682852mrna:RestrictedStockAndRestrictedStockUnitsRSUMember2022-07-012022-09-300001682852mrna:RestrictedStockAndRestrictedStockUnitsRSUMember2023-01-012023-09-300001682852mrna:RestrictedStockAndRestrictedStockUnitsRSUMember2022-01-012022-09-300001682852us-gaap:EmployeeStockMember2023-07-012023-09-300001682852us-gaap:EmployeeStockMember2022-07-012022-09-300001682852us-gaap:EmployeeStockMember2023-01-012023-09-300001682852us-gaap:EmployeeStockMember2022-01-012022-09-300001682852us-gaap:CostOfSalesMember2023-07-012023-09-300001682852us-gaap:CostOfSalesMember2022-07-012022-09-300001682852us-gaap:CostOfSalesMember2023-01-012023-09-300001682852us-gaap:CostOfSalesMember2022-01-012022-09-300001682852us-gaap:ResearchAndDevelopmentExpenseMember2023-07-012023-09-300001682852us-gaap:ResearchAndDevelopmentExpenseMember2022-07-012022-09-300001682852us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-09-300001682852us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-09-300001682852us-gaap:GeneralAndAdministrativeExpenseMember2023-07-012023-09-300001682852us-gaap:GeneralAndAdministrativeExpenseMember2022-07-012022-09-300001682852us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-09-300001682852us-gaap:GeneralAndAdministrativeExpenseMember2022-01-012022-09-300001682852mrna:A2022RepurchaseProgramMember2023-09-30xbrli:pure0001682852us-gaap:StateAndLocalJurisdictionMember2022-12-310001682852mrna:ImmaticsMemberus-gaap:CollaborativeArrangementTransactionWithPartyToCollaborativeArrangementMemberus-gaap:SubsequentEventMember2023-10-310001682852mrna:StephaneBancelMember2023-01-012023-09-300001682852mrna:StephaneBancelMember2023-07-012023-09-300001682852mrna:StephaneBancelMember2023-09-300001682852mrna:ArpaGarayMember2023-01-012023-09-300001682852mrna:ArpaGarayMember2023-07-012023-09-300001682852mrna:ArpaGarayMembermrna:ArpaGaraySaleOfCommonStockMember2023-09-300001682852mrna:ArpaGarayMembermrna:ArpaGarayExceriseOfVestStockOptionsMember2023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _ to _

Commission File Number: 001-38753

Moderna, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | |

| Delaware | | 81-3467528 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (IRS Employer Identification No.) |

| | | |

| 200 Technology Square | | |

| Cambridge, | Massachusetts | | 02139 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(617) 714-6500

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | MRNA | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer o | | Non-accelerated filer o | | Smaller reporting company | ☐ |

| | | | | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of October 27, 2023, there were 381,283,996 shares of the registrant’s common stock, par value $0.0001 per share, outstanding.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q (Form 10-Q) contains express or implied forward-looking statements. All statements other than those of historical facts contained in this Form 10-Q are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking statements in this Form 10-Q include, but are not limited to, statements about:

•our activities with respect to our COVID-19 vaccine, and our plans and expectations regarding future generations of our COVID-19 vaccine, including boosters, that we may develop in response to variants of the SARS-CoV-2 virus, ongoing clinical development, manufacturing and supply, pricing, commercialization, regulatory matters (including authorization or approval for boosters), demand for COVID-19 vaccines, our provisions for product returns, and third-party and governmental arrangements and potential arrangements;

•our expectations regarding the endemic and seasonal commercial market for COVID-19 vaccines and our preparations for and ability to effectively compete in such a market, as well as the impact that the evolving market will have on our financial returns;

•expected sales and delivery of our COVID-19 vaccine in future periods, and expected seasonality for sales;

•our global regulatory submissions for our RSV vaccine candidate, mRNA-1345, and plans for commercialization of this product;

•our ability to successfully contract with third-party suppliers, distributors and manufacturers;

•our ability and the ability of third parties with whom we contract to successfully manufacture, supply and distribute our COVID-19 vaccine and boosters, and any future commercial products at scale as well as drug substances, delivery vehicles, development candidates, and investigational medicines for preclinical and clinical use;

•internal and external costs associated with manufacturing for our products, including our COVID-19 vaccine, and the impact on our cost of sales for the current year and future periods, and the impact of resizing initiatives on our cost of sales;

•the scope of protection we are able to establish and maintain for intellectual property rights covering our commercial products, development candidates, investigational medicines and technology, including our ability to enter into license agreements, and our expectations regarding pending legal proceedings related to our intellectual property;

•our plans with respect to our individualized neoantigen therapy (INT), including our plan to expand the development program to additional tumor types, including non-small cell lung cancer;

•the timing of initiation, progress, completion, results and cost of our clinical trials, preclinical studies and research and development programs, as well as those of our collaborators, including Merck and Vertex Pharmaceuticals;

•participant enrollment in our clinical trials, including enrollment demographics and timing;

•potential advantages of mRNA as compared to traditional medicine;

•our ability to obtain and maintain regulatory approval of our investigational medicines;

•the implementation of our business model and strategic plans for our business, investigational medicines and technology;

•potential product launches, including the timing of launches;

•our ability to successfully commercialize our products, if approved;

•the pricing and reimbursement of our medicines, if approved;

•the build out of our manufacturing and commercial operations;

•estimates of our future expenses, revenues and capital requirements;

•our operation and funding requirements, including our forecast of the period of time through which our financial resources will be adequate to support our operations;

•the potential benefits of strategic collaboration agreements and our ability to enter into strategic collaborations or other agreements with collaborators with development, regulatory and commercialization expertise;

•our financial performance;

•our tax provision and related tax liabilities;

•legal and regulatory developments in the United States and foreign countries;

•our ability to produce our products or investigational medicines with advantages in turnaround times or manufacturing cost; and

•developments relating to our competitors and our industry.

Forward-looking statements often contain words such as “will,” “may,” “should,” “could,” “expects,” “intends,” “plans,” “aims,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” “continue,” or the negative of these terms or other comparable terminology, although not all forward-looking statements contain these words. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our operational or financial performance, and involve risks, uncertainties, and other factors that may cause our actual results to differ materially from any future results expressed or implied by these forward-looking statements. Accordingly, you should not place undue reliance on these forward-looking statements. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under the section entitled “Risk Factors” and elsewhere in this Form 10-Q and under Part I, Item 1A. “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual results could differ materially from those expressed or implied by the forward-looking statements.

The forward-looking statements in this Form 10-Q represent our views as of the date of this Form 10-Q. We undertake no obligation to update any forward-looking statements, except as required by applicable securities law. You should therefore not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this Form 10-Q. However, any further disclosures made on related subjects in our subsequent reports filed with the Securities and Exchange Commission should be consulted.

TRADEMARKS

This Form 10-Q contains references to our trademarks and to trademarks belonging to other entities. Solely for convenience, trademarks and trade names referred to may appear without the ® or ™ symbols, but such references are not intended to indicate that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend our reference to other companies’ trade names or trademarks to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

NOTE REGARDING COMPANY REFERENCES

Unless the context otherwise requires, the terms “Moderna,” the “Company,” “we,” “us” and “our” in this Form 10-Q refer to Moderna, Inc. and its consolidated subsidiaries.

ADDITIONAL INFORMATION

Our website, www.modernatx.com, including the Investor Relations section, www.investors.modernatx.com; and corporate blog www.modernatx.com/moderna-blog; as well as our social media channels: Facebook, www.facebook.com/modernatx; Twitter, www.twitter.com/moderna_tx (@moderna_tx); LinkedIn, www.linkedin.com/company/modernatx; Instagram (@moderna_tx); and Threads (@moderna_tx) contain a significant amount of information about us, including financial and other information for investors. We encourage investors to visit these websites and social media channels as information is frequently updated and new information is shared. Information contained on our website, corporate blog and social media channels shall not be deemed incorporated into, or be a part of, this Form 10-Q.

Table of Contents

| | | | | | | | |

PART I. | | Page |

| Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

PART II. | | |

Item 1. | | |

Item 1A. | | |

Item 2. | | |

Item 5. | | |

| Item 6. | | |

| | |

Item 1. Financial Statements

MODERNA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited, in millions, except per share data)

| | | | | | | | | | | |

| September 30, | | December 31, |

| 2023 | | 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 2,932 | | | $ | 3,205 | |

| Investments | 4,641 | | | 6,697 | |

| Accounts receivable, net | 1,866 | | | 1,385 | |

| Inventory | 487 | | | 949 | |

| Prepaid expenses and other current assets | 873 | | | 1,195 | |

| Total current assets | 10,799 | | | 13,431 | |

| Investments, non-current | 5,273 | | | 8,318 | |

| Property, plant and equipment, net | 1,952 | | | 2,018 | |

| Right-of-use assets, operating leases | 765 | | | 121 | |

| | | |

| Deferred tax assets | — | | | 982 | |

| Other non-current assets | 661 | | | 988 | |

| Total assets | $ | 19,450 | | | $ | 25,858 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 494 | | | $ | 487 | |

| Accrued liabilities | 2,224 | | | 2,101 | |

| Deferred revenue | 1,372 | | | 2,038 | |

| Income taxes payable | 56 | | | 48 | |

| Other current liabilities | 239 | | | 249 | |

| Total current liabilities | 4,385 | | | 4,923 | |

| Deferred revenue, non-current | 166 | | | 673 | |

| Operating lease liabilities, non-current | 697 | | | 92 | |

| Financing lease liabilities, non-current | 575 | | | 912 | |

| Other non-current liabilities | 172 | | | 135 | |

| Total liabilities | 5,995 | | | 6,735 | |

Commitments and contingencies (Note 13) | | | |

| Stockholders’ equity: | | | |

Preferred stock, par value $0.0001; 162 shares authorized as of September 30, 2023 and December 31, 2022; no shares issued or outstanding at September 30, 2023 and December 31, 2022 | — | | | — | |

Common stock, par value $0.0001; 1,600 shares authorized as of September 30, 2023 and December 31, 2022; 381 and 385 shares issued and outstanding as of September 30, 2023 and December 31, 2022, respectively | — | | | — | |

| Additional paid-in capital | 277 | | | 1,173 | |

| Accumulated other comprehensive loss | (211) | | | (370) | |

| Retained earnings | 13,389 | | | 18,320 | |

| Total stockholders’ equity | 13,455 | | | 19,123 | |

| Total liabilities and stockholders’ equity | $ | 19,450 | | | $ | 25,858 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

MODERNA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in millions, except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | | |

| Net product sales | | $ | 1,757 | | | $ | 3,120 | | | $ | 3,878 | | | $ | 13,576 | |

| Other revenue | | 74 | | | 244 | | | 159 | | | 603 | |

| | | | | | | | |

| | | | | | | | |

| Total revenue | | 1,831 | | | 3,364 | | | 4,037 | | | 14,179 | |

| Operating expenses: | | | | | | | | |

| Cost of sales | | 2,241 | | | 1,100 | | | 3,764 | | | 3,498 | |

| Research and development | | 1,160 | | | 820 | | | 3,439 | | | 2,084 | |

| Selling, general and administrative | | 442 | | | 278 | | | 1,079 | | | 757 | |

| Total operating expenses | | 3,843 | | | 2,198 | | | 8,282 | | | 6,339 | |

| (Loss) income from operations | | (2,012) | | | 1,166 | | | (4,245) | | | 7,840 | |

| Interest income | | 105 | | | 58 | | | 318 | | | 113 | |

| Other expense, net | | (51) | | | (7) | | | (85) | | | (33) | |

| (Loss) income before income taxes | | (1,958) | | | 1,217 | | | (4,012) | | | 7,920 | |

| Provision for income taxes | | 1,672 | | | 174 | | | 919 | | | 1,023 | |

| Net (loss) income | | $ | (3,630) | | | $ | 1,043 | | | $ | (4,931) | | | $ | 6,897 | |

| | | | | | | | |

| (Loss) earnings per share: | | | | | | | | |

| Basic | | $ | (9.53) | | | $ | 2.67 | | | $ | (12.89) | | | $ | 17.41 | |

| Diluted | | $ | (9.53) | | | $ | 2.53 | | | $ | (12.89) | | | $ | 16.46 | |

| | | | | | | | |

Weighted average common shares used in calculation of (loss) earnings per share: | | | | | | | | |

| Basic | | 381 | | | 390 | | | 382 | | | 396 | |

| Diluted | | 381 | | | 412 | | | 382 | | | 419 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

MODERNA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, | |

| | 2023 | | 2022 | | 2023 | | 2022 | |

| Net (loss) income | | $ | (3,630) | | | $ | 1,043 | | | $ | (4,931) | | | $ | 6,897 | | |

| Other comprehensive income (loss), net of tax: | | | | | | | | | |

| Available-for-sale securities: | | | | | | | | | |

| Unrealized gains (losses) on available-for-sale debt securities | | 46 | | | (126) | | | 115 | | | (384) | | |

| Less: net realized losses on available-for-sale securities reclassified in net (loss) income | | 6 | | | 3 | | | 36 | | | 18 | | |

| Net increase (decrease) from available-for-sale debt securities | | 52 | | | (123) | | | 151 | | | (366) | | |

| Cash flow hedges: | | | | | | | | | |

| Unrealized gains on derivative instruments | | — | | | 62 | | | — | | | 133 | | |

| Less: net realized (gains) losses on derivative instruments reclassified in net (loss) income | | — | | | (50) | | | 8 | | | (94) | | |

| Net increase from derivatives designated as hedging instruments | | — | | | 12 | | | 8 | | | 39 | | |

| Total other comprehensive income (loss) | | 52 | | | (111) | | | 159 | | | (327) | | |

| Comprehensive (loss) income | | $ | (3,578) | | | $ | 932 | | | $ | (4,772) | | | $ | 6,570 | | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

MODERNA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(Unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-In

Capital | | Accumulated Other Comprehensive Loss | | Retained Earnings | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | |

| Balance at June 30, 2023 | 381 | | | $ | — | | | $ | 193 | | | $ | (263) | | | $ | 17,019 | | | $ | 16,949 | |

| | | | | | | | | | | |

| Exercise of options to purchase common stock | — | | | — | | | 6 | | | — | | | — | | | 6 | |

| | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 77 | | | — | | | — | | | 77 | |

| Other comprehensive income, net of tax | — | | | — | | | — | | | 52 | | | — | | | 52 | |

| Repurchase of common stock, including excise tax | — | | | — | | | 1 | | | — | | | — | | | 1 | |

| Net loss | — | | | — | | | — | | | — | | | (3,630) | | | (3,630) | |

| Balance at September 30, 2023 | 381 | | | $ | — | | | $ | 277 | | | $ | (211) | | | $ | 13,389 | | | $ | 13,455 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-In

Capital | | Accumulated

Other

Comprehensive

Loss | | Retained Earnings | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | |

| Balance at June 30, 2022 | 392 | | | $ | — | | | $ | 2,413 | | | $ | (240) | | | $ | 15,812 | | | $ | 17,985 | |

| | | | | | | | | | | |

| Vesting of restricted common stock | 1 | | | — | | | — | | | — | | | — | | | — | |

| Exercise of options to purchase common stock | 1 | | | — | | | 11 | | | — | | | — | | | 11 | |

| | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 70 | | | — | | | — | | | 70 | |

| Other comprehensive loss, net of tax | — | | | — | | | — | | | (111) | | | — | | | (111) | |

| Repurchase of common stock | (7) | | | — | | | (1,006) | | | — | | | — | | | (1,006) | |

| Net income | — | | | — | | | — | | | — | | | 1,043 | | | 1,043 | |

| Balance at September 30, 2022 | 387 | | | $ | — | | | $ | 1,488 | | | $ | (351) | | | $ | 16,855 | | | $ | 17,992 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-In

Capital | | Accumulated Other Comprehensive Loss | | Retained Earnings | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | |

| Balance at December 31, 2022 | 385 | | | $ | — | | | $ | 1,173 | | | $ | (370) | | | $ | 18,320 | | | $ | 19,123 | |

| Vesting of restricted common stock | 1 | | | — | | | — | | | — | | | — | | | — | |

| Exercise of options to purchase common stock | 3 | | | — | | | 19 | | | — | | | — | | | 19 | |

| Purchase of common stock under employee stock purchase plan | — | | | — | | | 12 | | | — | | | — | | | 12 | |

| Stock-based compensation | — | | | — | | | 226 | | | — | | | — | | | 226 | |

| Other comprehensive income, net of tax | — | | | — | | | — | | | 159 | | | — | | | 159 | |

| Repurchase of common stock, including excise tax | (8) | | | — | | | (1,153) | | | — | | | — | | | (1,153) | |

| Net loss | — | | | — | | | — | | | — | | | (4,931) | | | (4,931) | |

| Balance at September 30, 2023 | 381 | | | $ | — | | | $ | 277 | | | $ | (211) | | | $ | 13,389 | | | $ | 13,455 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock | | Additional

Paid-In

Capital | | Accumulated

Other

Comprehensive

Loss | | Retained Earnings | | Total

Stockholders’

Equity |

| Shares | | Amount | | | | |

| Balance at December 31, 2021 | 403 | | | $ | — | | | $ | 4,211 | | | $ | (24) | | | $ | 9,958 | | | $ | 14,145 | |

| | | | | | | | | | | |

| Vesting of restricted common stock | 1 | | | — | | | — | | | — | | | — | | | — | |

| Exercise of options to purchase common stock | 3 | | | — | | | 31 | | | — | | | — | | | 31 | |

| Purchase of common stock under employee stock purchase plan | — | | | — | | | 9 | | | — | | | — | | | 9 | |

| Stock-based compensation | — | | | — | | | 164 | | | — | | | — | | | 164 | |

| Other comprehensive loss, net of tax | — | | | — | | | — | | | (327) | | | — | | | (327) | |

| Repurchase of common stock | (20) | | | — | | | (2,927) | | | — | | | — | | | (2,927) | |

| Net income | — | | | — | | | — | | | — | | | 6,897 | | | 6,897 | |

| Balance at September 30, 2022 | 387 | | | $ | — | | | $ | 1,488 | | | $ | (351) | | | $ | 16,855 | | | $ | 17,992 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

MODERNA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in millions)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Operating activities | | | |

| Net (loss) income | $ | (4,931) | | | $ | 6,897 | |

| Adjustments to reconcile net (loss) income to net cash (used in) provided by operating activities: | | | |

| Stock-based compensation | 226 | | | 164 | |

| Depreciation and amortization | 419 | | | 268 | |

| Amortization/accretion of investments | (41) | | | 35 | |

| Loss on equity investments, net | 16 | | | — | |

| Deferred income taxes | 934 | | | (473) | |

| Other non-cash items | 25 | | | 36 | |

| Changes in assets and liabilities, net of acquisition of business: | | | |

| Accounts receivable, net | (481) | | | 480 | |

| Prepaid expenses and other assets | 772 | | | (669) | |

| Inventory | 462 | | | (636) | |

| Right-of-use assets, operating leases | (657) | | | 29 | |

| Accounts payable | (8) | | | 89 | |

| Accrued liabilities | 63 | | | 354 | |

| Deferred revenue | (1,173) | | | (2,691) | |

| Income taxes payable | 8 | | | (810) | |

| Operating lease liabilities | 605 | | | (27) | |

| Other liabilities | 21 | | | 273 | |

| Net cash (used in) provided by operating activities | (3,740) | | | 3,319 | |

| Investing activities | | | |

| Purchases of marketable securities | (2,097) | | | (8,925) | |

| Proceeds from maturities of marketable securities | 4,711 | | | 2,222 | |

| Proceeds from sales of marketable securities | 2,725 | | | 2,918 | |

| Purchases of property, plant and equipment | (487) | | | (308) | |

| Acquisition of business, net of cash acquired | (85) | | | — | |

| Investment in convertible notes and equity securities | (23) | | | (35) | |

| Net cash provided by (used in) investing activities | 4,744 | | | (4,128) | |

| Financing activities | | | |

| | | |

| Proceeds from issuance of common stock through equity plans | 31 | | | 40 | |

| | | |

| Repurchase of common stock, including excise tax | (1,153) | | | (2,927) | |

| Changes in financing lease liabilities | (146) | | | (123) | |

| Net cash used in financing activities | (1,268) | | | (3,010) | |

| Net decrease in cash, cash equivalents and restricted cash | (264) | | | (3,819) | |

| Cash, cash equivalents and restricted cash, beginning of year | 3,217 | | | 6,860 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 2,953 | | | $ | 3,041 | |

| Non-cash investing and financing activities | | | |

| Purchases of property and equipment included in accounts payable and accrued liabilities | $ | 148 | | | $ | 80 | |

| Right-of-use assets obtained through finance lease modifications and reassessments | $ | 213 | | | $ | — | |

| Right-of-use assets obtained in exchange for financing lease liabilities | $ | — | | | $ | 781 | |

The accompanying notes are an integral part of these unaudited condensed consolidated financial statements.

MODERNA, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

1. Description of the Business

Moderna, Inc. (collectively, with its consolidated subsidiaries, any of Moderna, we, us, our or the Company) is a biotechnology company advancing a new class of medicines made of messenger RNA (mRNA). mRNA medicines are designed to direct the body’s cells to produce intracellular, membrane or secreted proteins that have a therapeutic or preventive benefit with the potential to address a broad spectrum of diseases. Our platform builds on continuous advances in basic and applied mRNA science, delivery technology and manufacturing, providing us the capability to pursue in parallel a robust pipeline of new development candidates. We are developing therapeutics and vaccines for infectious diseases, immuno-oncology, rare diseases, autoimmune diseases and cardiovascular diseases, independently and with our strategic collaborators.

Our COVID-19 vaccine is our first commercial product and is marketed, where approved, under the name Spikevax®. Our original vaccine, mRNA-1273, targeted the SARS-CoV-2 ancestral strain, and we have leveraged our mRNA platform to rapidly adapt our vaccine to emerging SARS-CoV-2 strains to provide protection as the virus evolves and regulatory guidance is updated.

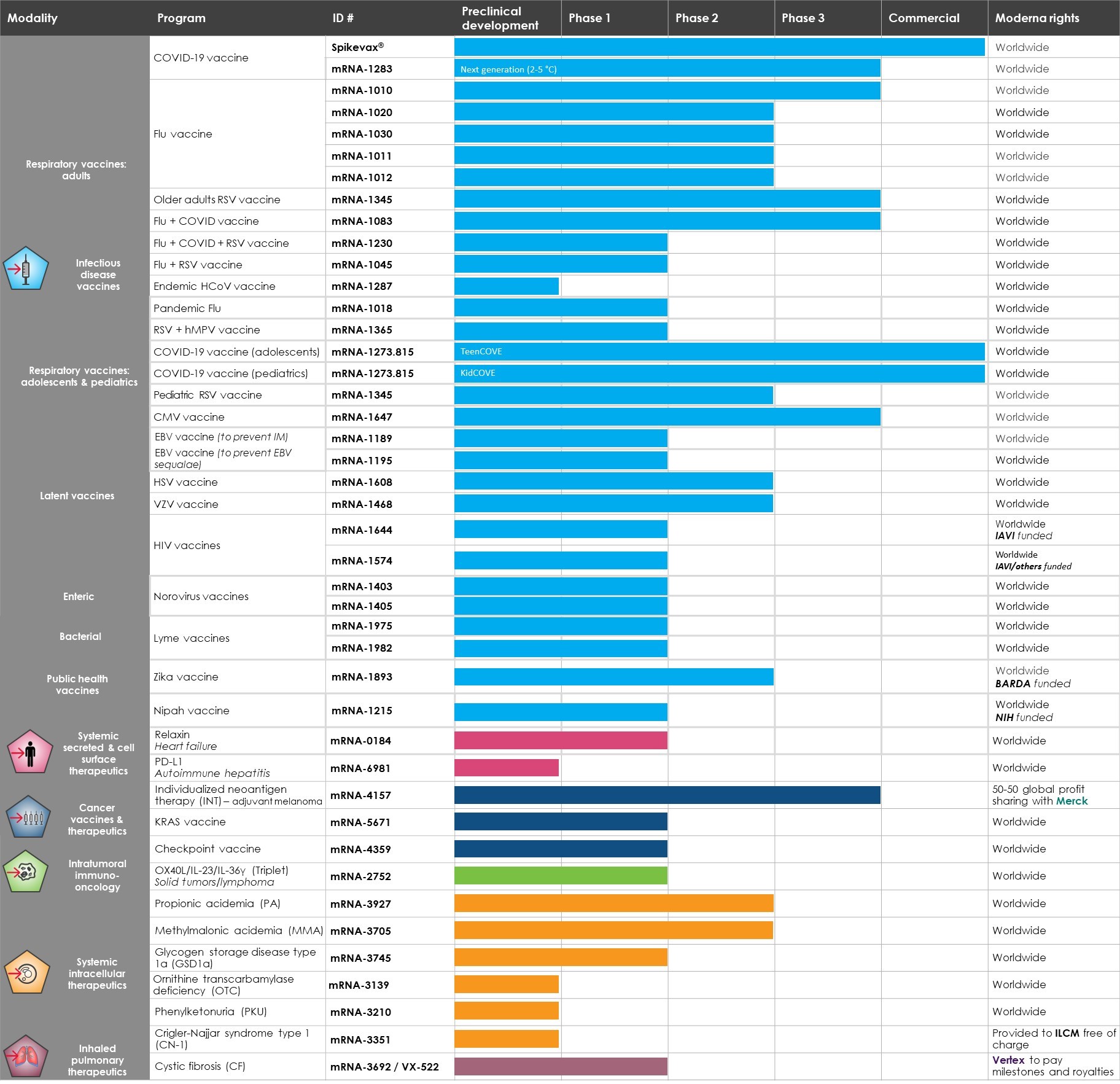

We have a diverse and extensive development pipeline of 41 development candidates across our 43 development programs, of which 38 are in clinical studies currently.

2. Summary of Basis of Presentation and Recent Accounting Standards

Basis of Presentation and Principles of Consolidation

The accompanying unaudited condensed consolidated financial statements that accompany these notes have been prepared in accordance with U.S. generally accepted accounting principles (GAAP) and applicable rules and regulations of the Securities and Exchange Commission (SEC) for interim financial reporting, consistent in all material respects with those applied in our Annual Report on Form 10-K for the year ended December 31, 2022 (2022 Form 10-K). Any reference in these notes to applicable guidance is meant to refer to the authoritative accounting principles generally accepted in the United States as found in the Accounting Standard Codification (ASC) and Accounting Standards Update (ASU) of the Financial Accounting Standards Board (FASB). This report should be read in conjunction with the audited consolidated financial statements in our 2022 Form 10-K.

The condensed consolidated financial statements include Moderna, Inc. and its subsidiaries. All intercompany transactions and balances have been eliminated in consolidation. The significant accounting policies used in preparation of these condensed consolidated financial statements for the three and nine months ended September 30, 2023 are consistent with those described in our 2022 Form 10-K. The only exception pertains to the policy related to net product sales in the U.S. In the third quarter of 2023, we initiated sales of our COVID-19 vaccine in the U.S. commercial market. Please refer to Note 3 for further details regarding the policy. The results of operations for the three and nine months ended September 30, 2023 are not necessarily indicative of the operating results to be expected for the full fiscal year or future operating periods. Other revenue in the condensed consolidated statements of operations comprises grant revenue and collaboration revenue that were previously presented as separate line items in our consolidated statements of operations in our 2022 Form 10-K. The associated prior period amounts in the condensed consolidated financial statements, as well as in the notes thereto, have been reclassified to conform to the current presentation.

Use of Estimates

We have made estimates and judgments affecting the amounts reported in our condensed consolidated financial statements and the accompanying notes. We base our estimates on historical experience and various relevant assumptions that we believe to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods that are not readily apparent from other sources. Significant estimates relied upon in preparing these financial statements include, but are not limited to, critical accounting policies or estimates related to revenue recognition, product sales provisions, income taxes, valuation allowance of deferred tax assets, inventory valuation, firm purchase commitment liabilities, pre-launch inventory, leases, fair value of financial instruments, derivative financial instruments, useful lives of property and equipment, research and development expenses, stock-based compensation, intangible assets, goodwill, credit loss and impairment reviews. The actual results that we experience may differ materially from our estimates.

Comprehensive Income (Loss)

Comprehensive income (loss) includes net income (loss) and other comprehensive income/loss for the period. Other comprehensive income/loss consists of unrealized gains/losses on our investments and derivatives designated as hedging instruments. Total comprehensive income (loss) for all periods presented has been disclosed in the condensed consolidated statements of comprehensive income (loss).

The components of accumulated other comprehensive loss for the three and nine months ended September 30, 2023 were as follows (in millions):

| | | | | | | | | | | | | | | | | |

| Unrealized Gains on Available-for-Sale Debt Securities | | Net Unrealized Gains on Derivatives Designated As Hedging Instruments | | Total |

| Accumulated other comprehensive loss, balance at December 31, 2022 | $ | (362) | | | $ | (8) | | | $ | (370) | |

| Other comprehensive income | 95 | | | 8 | | | 103 | |

| Accumulated other comprehensive loss, balance at March 31, 2023 | (267) | | | — | | | (267) | |

| Other comprehensive income | 4 | | | — | | | 4 | |

| Accumulated other comprehensive loss, balance at June 30, 2023 | (263) | | | — | | | (263) | |

Other comprehensive income | 52 | | | — | | | 52 | |

| Accumulated other comprehensive loss, balance at September 30, 2023 | $ | (211) | | | $ | — | | | $ | (211) | |

| | | | | |

Restricted Cash

We include our restricted cash balance in the cash, cash equivalents and restricted cash reconciliation of operating, investing and financing activities in the condensed consolidated statements of cash flows.

The following table provides a reconciliation of cash, cash equivalents and restricted cash in the condensed consolidated balance sheets that sum to the total of the same such amounts shown in the condensed consolidated statements of cash flows (in millions):

| | | | | | | | | | | | | | |

| | September 30, |

| | 2023 | | 2022 |

| Cash and cash equivalents | | $ | 2,932 | | | $ | 3,027 | |

Restricted cash(1) | | 17 | | | — | |

Restricted cash, non-current(2) | | 4 | | | 14 | |

Total cash, cash equivalents and restricted cash shown in the condensed consolidated

statements of cash flows | | $ | 2,953 | | | $ | 3,041 | |

_______

(1)Included in prepaid expenses and other current assets in the condensed consolidated balance sheets.

(2)Included in other non-current assets in the condensed consolidated balance sheets.

Recently Issued Accounting Standards Not Yet Adopted

From time to time, new accounting pronouncements are issued by the FASB or other standard setting bodies and adopted by us as of the specified effective date. Unless otherwise discussed, we believe that the impact of recently issued standards that are not yet effective will not have a material impact on our condensed consolidated financial statements and disclosures.

3. Net Product Sales

Net product sales by customer geographic location were as follows (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| United States | | $ | 913 | | | $ | 985 | | | $ | 916 | | | $ | 3,380 | |

| Europe | | 103 | | | 1,045 | | | 739 | | | 4,511 | |

| Rest of world | | 741 | | | 1,090 | | | 2,223 | | | 5,685 | |

| Total | | $ | 1,757 | | | $ | 3,120 | | | $ | 3,878 | | | $ | 13,576 | |

As of September 30, 2023, our COVID-19 vaccine was our only commercial product authorized for use.

Prior to the third quarter of 2023, we sold our COVID-19 vaccine to the U.S. Government, other international governments and organizations. The agreements and related amendments with these entities generally do not include variable consideration, such as discounts, rebates or returns. Certain of these agreements entitle us to upfront deposits for our COVID-19 vaccine supply, initially recorded as deferred revenue.

As of September 30, 2023 and December 31, 2022, we had deferred revenue of $1.5 billion and $2.6 billion, respectively, related to customer deposits for our COVID-19 vaccine. We expect $1.4 billion of our deferred revenue related to customer deposits as of September 30, 2023 to be realized in less than one year. Timing of product delivery and manufacturing, and receipt of marketing approval for the applicable COVID-19 vaccine will determine the period in which product sales are recognized.

In the third quarter of 2023, we commenced sales of our latest COVID-19 vaccine to the U.S. commercial market, in addition to continuing sales to international governments and organizations. In the U.S., our COVID-19 vaccine is sold primarily to wholesalers and distributors, and to a lesser extent, directly to retailers and healthcare providers. Wholesalers and distributors typically do not make upfront payments to us.

We recognize net product sales when control of the product transfers to the customer, typically upon delivery. Payment terms generally range from 30 to 60 days, in line with customary practices in each country. Net product sales are recognized net of estimated wholesaler chargebacks, invoice discounts for prompt payments and pre-orders, provisions for sales returns, and other related deductions. These provisions are recorded based on contractual terms and our estimate of returns for product sold during the period, using the expected value method or the most likely amount method. We update our estimates quarterly and record necessary adjustments in the period when we identify the adjustments. Product sales, net of provisions, are recorded only to the extent a significant reversal in the amount of cumulative revenue recognized is not probable when the uncertainty associated with the provisions is subsequently resolved. Shipping and handling activities are considered fulfillment activities and not a separate performance obligation. Taxes assessed by governmental authorities that are imposed on and collected from our product sales are excluded from net product sales.

Wholesaler chargebacks, discounts and fees

We contract with retailers, healthcare providers, and group purchasing organizations (GPO) to broaden our customer reach and offer contractual discounts. The chargeback represents the difference between the invoice price billed to the wholesaler and the negotiated price charged to the retailers, healthcare providers and GPO members. For distribution and related services, such as stocking and cold chain storage, we provide compensation to our wholesalers and distributors. We typically offer our customers invoice discounts on product sales for prompt payments and pre-orders. The estimation of these discounts and fees is based on contractual terms and our expectations regarding future customer payment behaviors. Wholesaler fees and invoice discounts are deducted from our gross product sales and accounts receivable at the time such product sales are recognized.

Product returns

We typically offer customers in the U.S. the right to return products, up to a certain limit as stipulated in our contracts. Estimated returns for our COVID-19 vaccine are determined considering available return rates for similar products, estimated levels of inventory in the distribution channel, projected market demand, and estimated product shelf life. The estimated amount for product returns is presented within accrued liabilities on our condensed consolidated balance sheets and is deducted from our gross product sales in the period the related product sales are recognized.

Other fees

Fees payable to third party payers and healthcare providers, along with fees to our direct customers that are settled via cash payments, including certain patient assistance programs, are recorded as accrued liabilities on our condensed consolidated balance sheets.

Determining the amount of variable consideration to recognize necessitates substantial judgment, especially when assessing factors outside our direct control such as lack of pertinent historical data and limited third-party information. Among all variables, estimating returns presents the most significant judgment due to the broad range of potential outcomes. As we receive more historical data on our product returns, we will incorporate this information into our estimates to improve accuracy. The actual results could differ from our estimates, and such differences could have a material impact to our financial statements.

The following table summarizes product sales provision for the periods presented (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Gross product sales | | $ | 2,420 | | | $ | 3,120 | | | $ | 4,541 | | | $ | 13,576 | |

Product sales provision: | | | | | | | | |

Wholesaler chargebacks, discounts and fees | | (479) | | | — | | | (479) | | | — | |

| Returns and other fees | | (184) | | | — | | | (184) | | | — | |

Total product sales provision | | $ | (663) | | | $ | — | | | $ | (663) | | | $ | — | |

| Net product sales | | $ | 1,757 | | | $ | 3,120 | | | $ | 3,878 | | | $ | 13,576 | |

The following table summarizes the activities related to product sales provision recorded as accrued liabilities for the nine months ended September 30, 2023 (in millions):

| | | | | | | | |

| | Returns and other fees |

| Balance at December 31, 2022 | | $ | — | |

| Provision related to sales made in current period | | (184) | |

| | |

| | |

| | |

| Balance at September 30, 2023 | | $ | (184) | |

4. Other Revenue

The following table summarizes other revenue for the periods presented (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Grant revenue | | $ | 44 | | | $ | 144 | | | $ | 96 | | | $ | 453 | |

| Collaboration revenue | | 30 | | | 100 | | | 63 | | | 150 | |

| Total other revenue | | $ | 74 | | | $ | 244 | | | $ | 159 | | | $ | 603 | |

Grant Revenue

In April 2020, we entered into an agreement with the Biomedical Advanced Research and Development Authority (BARDA), a division of the Office of the Assistant Secretary for Preparedness and Response within the U.S. Department of Health and Human Services (HHS), for an award of up to $483 million to accelerate development of mRNA-1273. The agreement has been subsequently amended to provide for additional commitments to support various late-stage clinical development efforts of our original COVID-19

vaccine, mRNA-1273, including a 30,000 participant Phase 3 study, pediatric clinical trials, adolescent clinical trials and pharmacovigilance studies. The maximum award from BARDA, inclusive of all amendments, was approximately $1.8 billion. All contract options have been exercised. As of September 30, 2023, the remaining available funding, net of revenue earned was $97 million.

In September 2020, we entered into an agreement with the Defense Advanced Research Projects Agency (DARPA) for an award of up to $56 million to fund development of a mobile manufacturing prototype leveraging our existing manufacturing technology that is capable of rapidly producing vaccines and therapeutics. As of September 30, 2023, we had earned the committed funding of $32 million. An additional $24 million of funding will be available if DARPA exercises additional contract options.

In January 2016, we entered a global health project framework agreement with the Bill & Melinda Gates Foundation (Gates Foundation) to advance mRNA development projects for various infectious diseases, including human immunodeficiency virus (HIV). As of September 30, 2023, the available funding, net of revenue earned was $4 million, with up to an additional $80 million available if additional follow-on projects are approved.

The following table summarizes grant revenue for the periods presented (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| BARDA | $ | 44 | | | $ | 141 | | | $ | 88 | | | $ | 442 | |

| Other grant revenue | — | | | 3 | | | 8 | | | 11 | |

| Total grant revenue | $ | 44 | | | $ | 144 | | | $ | 96 | | | $ | 453 | |

Collaboration Revenue

We have entered into collaboration agreements with strategic collaborators to accelerate the discovery and advancement of potential mRNA medicines across therapeutic areas. As of September 30, 2023 and December 31, 2022, we had collaboration agreements with Merck & Co., Inc (Merck), Vertex Pharmaceuticals Incorporated and Vertex Pharmaceuticals (Europe) Limited (together, Vertex), AstraZeneca plc (AstraZeneca) and others. Please refer to our 2022 Form 10-K under the heading “Third-Party Strategic Alliances” and Note 5 to our consolidated financial statements for further description of these collaboration agreements.

The following table summarizes our total collaboration revenue from our strategic collaborators for the periods presented (in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| Collaboration Revenue by Strategic Collaborator: | 2023 | | 2022 | | 2023 | | 2022 |

| Vertex | $ | 30 | | | $ | 4 | | | $ | 62 | | | $ | 33 | |

| Merck | — | | | 20 | | | — | | | 35 | |

| AstraZeneca | — | | | 76 | | | — | | | 80 | |

| Other | — | | | — | | | 1 | | | 2 | |

| Total collaboration revenue | $ | 30 | | | $ | 100 | | | $ | 63 | | | $ | 150 | |

5. Collaboration Agreements

Merck

In June 2016, we entered into a Collaboration and License Agreement for the development and commercialization of personalized mRNA cancer vaccines (also known as individualized neoantigen therapy, or INT) with Merck. This agreement was subsequently amended and restated in 2018. Our role in this strategic alliance involves identifying genetic mutations in a particular patient’s tumor cells, synthesizing mRNA for these mutations, encapsulating the mRNA in one of our proprietary lipid nanoparticles (LNPs), and administering a unique mRNA INT to each patient. Each INT is designed to specifically activate the patient’s immune system against her or his own cancer cells.

In September 2022, Merck exercised its option for INT, including mRNA-4157, pursuant to the terms of the agreement and in October 2022 paid us an option exercise fee of $250 million. Pursuant to the agreement, we and Merck have agreed to collaborate on further development and commercialization of INT, with costs and any profits or losses to be shared equally on a worldwide basis.

For the three and nine months ended September 30, 2023, we recognized expenses of $53 million and $122 million, respectively, related to the INT collaboration.

Generation Bio Co.

In March 2023, we entered into a strategic collaboration and license agreement with Generation Bio Co. (GBIO). The collaboration aims to expand the application of each company’s platform by developing novel nucleic acid therapeutics, including those capable of reaching immune cells, to accelerate our respective pipelines of non-viral genetic medicines. Under the agreement, we have the option to license GBIO’s proprietary cell-targeted lipid nanoparticle (ctLNP) and closed-ended DNA (ceDNA) technology for two immune cell programs and two liver programs, with an additional option for either a third immune cell or liver program. We made an upfront payment to GBIO of $40 million, a prepayment of research funding of $8 million, plus a $36 million equity investment. We will fund all research and development activities under the research plans. We expensed, as research and development expense, the upfront payment of $40 million and the equity premium of $13 million, representing the difference between the equity investment of $36 million paid to GBIO and the fair value of the equity instrument acquired in the first quarter of 2023. Additionally, we recorded an equity investment of $23 million, representing the fair value at the closing date, as other non-current assets in our condensed consolidated balance sheet as of March 31, 2023. The equity investment in GBIO is subsequently remeasured and recorded at the quoted market price of GBIO common stock at the end of each reporting period.

We have other collaborative and licensing arrangements that we do not consider to be individually significant to our business at this time. Pursuant to these agreements, we may be required to make upfront payments and payments upon achievement of various development, regulatory and commercial milestones, which in the aggregate could be significant. Future milestone payments, if any, will be reflected in our consolidated financial statements when the corresponding events have occurred. In addition, we may be required to pay significant royalties on future sales if products related to these arrangements are commercialized.

6. Acquisition

On January 31, 2023, we acquired all outstanding shares of OriCiro Genomics K.K., a Japan-based, privately held biotech company primarily focused on cell-free DNA synthesis and amplification technologies, for $86 million in cash. With this acquisition, we obtained tools for cell-free synthesis and amplification of plasmid DNA, a key building block in mRNA manufacturing. OriCiro’s technology strategically complements our manufacturing process and further accelerates our research and development efforts. The acquisition was accounted for as a business combination requiring all assets acquired and liabilities assumed to be recognized at their fair value as of the acquisition date. Following the acquisition, OriCiro was renamed as Moderna Enzymatics.

The following table summarizes the estimated fair values of assets acquired and liabilities assumed as of the acquisition date (in millions):

| | | | | | | | |

| | January 31, 2023 |

| Finite-lived intangible asset | | |

| Developed technology | | $ | 48 | |

| Deferred tax liabilities | | (15) |

| Other assets and liabilities, net | | 1 |

| Total identifiable net assets | | 34 |

| Goodwill | | 52 |

| Total consideration | | $ | 86 | |

The developed technology of $48 million represents the estimated fair value of the cell-free DNA synthesis and amplification technologies, as of the acquisition date. The fair value was determined by applying the cost saving method under the income approach, which is a valuation technique that provides an estimate of the fair value of an asset based on market participant expectations of the cash flows an asset would generate over its remaining useful life. To estimate the expected cash flows attributable to the development technology, it requires the use of Level 3 fair value measurements and inputs, including estimated expense savings and a discount rate that is based on the estimated weighted-average cost of capital for companies with profiles similar to ours and represents the estimated rate that market participants would use to value this intangible asset. The developed technology is being amortized on a straight-line basis over an estimated useful life of 12 years.

The excess of the consideration over the fair values assigned to the assets acquired and the liabilities assumed of $52 million was recorded as goodwill, which is not deductible for tax purposes. The goodwill is primarily attributable to the expected synergies from the acquired technologies combining with our existing platform technologies and manufacturing capabilities. Our accounting for this acquisition is preliminary and will be finalized upon completion of our analysis to determine the acquisition date fair values of certain assets acquired, liabilities assumed and tax-related items as we obtain additional information during the measurement period of up to one year from the acquisition date.

7. Financial Instruments

Cash and Cash Equivalents and Investments

The following tables summarize our cash and available-for-sale securities by significant investment category as of September 30, 2023 and December 31, 2022 (in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 |

| | Amortized

Cost | | Unrealized

Gains | | Unrealized

Losses | | Estimated Fair Value | | Cash and